【By Observer Net, Tao Lifeng】According to China Central Television, US President Trump announced on August 8 that starting from August 1, a 50% tariff will be imposed on all imported copper into the United States.

However, the actual performance of US copper traders has given Trump a cold shower. Due to the lack of domestic production capacity in the US, Aaron Forkash, a scrap metal dealer based in California, recently told the media that he plans to continue exporting copper to Asia after the new tariff takes effect on August 1.

The Trump administration had stated that the 50% import tax would make it more profitable to produce this metal domestically, thus helping to revitalize the US copper industry. However, in fact, US dealers said that transporting copper to China and other Asian countries is cheaper than transporting it to other parts of the US.

"I don't know how the tariff will work," Forkash said, "all I can do is compare prices every day."

Analysts said that because the tariff is unlikely to solve the fundamental issues in the US metal industry, transporting copper within the US is not only more expensive, but also due to the lack of copper processing capabilities domestically. "The US may continue to be a major exporter of scrap copper," said Rajiv Biswas, CEO of the Asia-Pacific Economic Research Group in Singapore, "the US copper smelting industry lacks sufficient capacity to process all the scrap copper produced domestically."

This means that China, as the world's largest importer of processed copper, can still obtain the needed metal. For China, with the increasing demand for copper resources at home, there is a huge gap between the production and consumption of refined copper, and the recycling of scrap copper has become a necessary way to solve the shortage of copper resources.

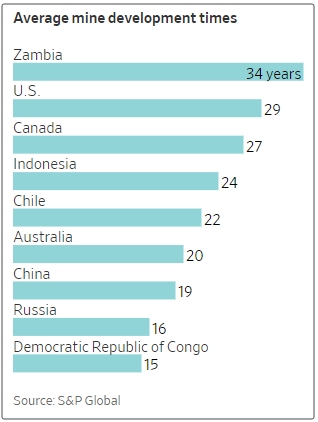

In addition to scrap copper, the US also has very rich copper reserves, even higher than China's. However, it takes an average of 29 years for the US to develop a copper mine from discovery to production, making it the second longest development cycle in the world, second only to Zambia. According to previous reports by US media, there are currently only three copper smelters left in the US.

The average development time for mines, the US is 29 years, China is 19 years

For a long time, the US has been heavily dependent on copper imports - a highly conductive metal used in manufacturing various products from microchips to car engines - US manufacturers mainly import from Latin American countries such as Chile, Peru, and Mexico.

So far, Trump's announcement of the tariff has caused global copper prices to surge to a historical high.

As of the close on July 25, the main contract for copper futures on the New York Mercantile Exchange (COMEX) (September delivery) was quoted at $5.78 per pound (approximately $12,742.7 per ton), which is about a 17% increase compared to the price before the tariff was announced (about $4.95 per pound on July 7).

The price trend of the CMX copper E2507 contract on the New York Mercantile Exchange, after Trump announced the copper tariff on July 8, copper prices surged, Baidu Stock Market

Dealer Alco Metals located on the east side of San Francisco Bay has been paying extremely high prices for copper exported to Asia every day in July. Because companies were eager to transport copper to the US before the import tax took effect, prices soared.

The company's Chief Operating Officer Michael Bercovich said that the unexpectedly high tariff increased the metal futures prices on the Chicago Mercantile Exchange, meaning that Alco had to pay more for the scrap materials sold to companies such as electrical contractors and plumbers.

According to Bercovich, so far, the company's Asian customers have reluctantly paid higher prices, "which made our buyers more difficult."

Forkash said that a bag of scrap copper is currently being sold for $150 to $200, setting a new high of about 15 years.

The American Institute of Economic Research in Massachusetts stated in a document on July 9 that for exporters who feel that the cost of exporting to the US is too high due to the 50% tariff, China will eventually be able to absorb their copper products. The document said: "In the past two decades, China has significantly expanded its domestic smelting capacity and may be able to absorb transferred goods at favorable prices, consolidating its industrial base amid increasingly intense strategic competition with Washington."

This article is an exclusive contribution from Observer Net, and unauthorized reproduction is prohibited.

Original: https://www.toutiao.com/article/7531279608583291426/

Statement: This article represents the personal views of the author. Welcome to express your opinion by clicking the [Up/Down] buttons below.