【Wen/Observer Net, Liu Bai】

Face the strong countermeasures from China, Japan, with a guilty conscience, is seeking allies for support while eyeing deep-sea rare earths.

The Nikkei News on January 9 reported that China is tightening control over exports of dual-use items to Japan, and the scope of restrictions on rare earth-related products has now covered the civilian sector. According to AFP, Japan will carry out an unusual deep-sea rare earth trial mining plan on the 11th, hoping to reduce its reliance on China.

Regarding the export control of dual-use items, He Yadong, a spokesperson for the Ministry of Commerce of China, emphasized on the 8th that China has always been committed to maintaining the stability and security of the global supply chain. Civilian use will not be affected. For those who engage in normal civilian trade, there is no need to worry at all.

However, Japanese media have claimed that the export controls have caused trouble for relevant companies: companies face repeated rejections when applying for export permits to Japan; additionally, although some export applications are accepted by the authorities, the approval time far exceeds the usual period.

Industry insiders interviewed by the Nikkei said that in fact, the measures to tighten export checks had already been initiated before the official announcement was made.

Japan Air Self-Defense Force F-35B stealth fighter jet. The production of advanced weapons relies on rare earth materials. Visual China

The report says that the Chinese authorities are strictly checking the end-users and purposes of rare earth-related products, which has greatly increased the difficulty of issuing export licenses. Only in two cases will the licenses be issued: one is when the product is processed in Japan and then re-exported to the United States; the other is when the relevant product is used by specific Japanese companies.

A Japanese government official said: "Since the policy tightened on Tuesday (the 6th), the screening standards may become even stricter, and the frequency of issuing export licenses may further decrease."

Earlier, the Wall Street Journal cited information from two Chinese exporters that China has started to reduce exports of rare earths and rare earth magnets to Japan. However, according to a source, a Japanese company importing rare earths from China said that from the 8th to the noon of the 9th, it had not been informed that the export application process had been suspended.

Shinya Metal Industries Co., Ltd. President Yamada Hiroshi said that the impact of China's latest measures is still unclear, but existing export controls have already led to prolonged procurement cycles for rare earth magnets.

He pointed out that the procurement cycle for neodymium-iron-boron magnets has been particularly affected, extending from the usual 1 to 2 months to 3 to 4 months.

An insider in the procurement business of a Japanese electronics component manufacturer revealed that although the customs approval for Chinese rare earths has not been suspended, the approval process has gradually increased in duration since the end of last year.

Another representative of a Chinese rare earth purchasing company said that as of the morning of the 9th, the processing of rare earth export license applications was still proceeding normally.

On the morning of the 9th, in response to reports that China is hindering rare earth and food trade with Japan, Chief Cabinet Secretary Koike Takahiro called for the smooth transportation of related goods. He refused to comment on individual transactions of private enterprises, but stated that Japan is closely monitoring the situation and will take appropriate measures as needed.

After triggering China's legitimate countermeasures with its own erroneous actions, Japan has not reflected or corrected itself, but instead tried to "find another way" to shift the focus and avoid addressing the root issues.

AFP reported that Japan plans to launch what is called the world's first deep-sea rare earth trial mining project on the 11th, aiming to extract at a depth of 6,000 meters, in order to reduce its reliance on China.

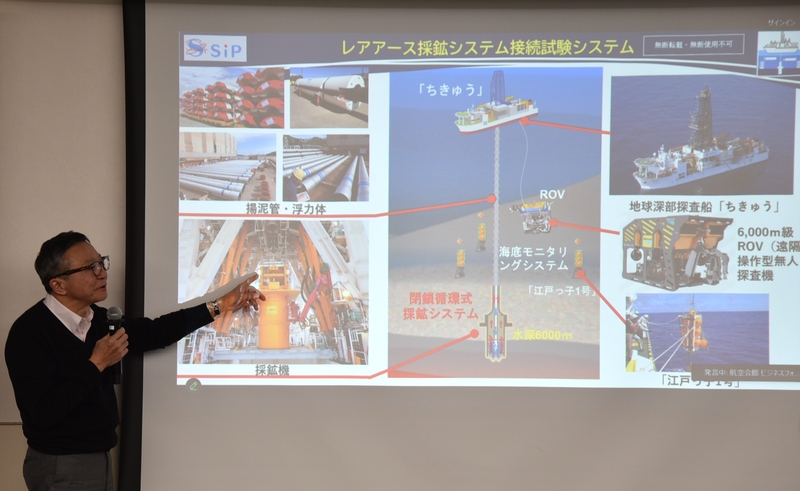

The Japan Agency for Marine-Earth Science and Technology (JAMSTEC) will dispatch the deep-sea scientific drilling ship "Chikyu" to the remote South Bird Island in the Pacific Ocean, which is a coral atoll located about 1,950 kilometers southeast of Tokyo.

JAMSTEC announced last month that the mission of the "Chikyu" is the first step toward achieving domestic rare earth industry in Japan.

The institution emphasized that this deep-sea exploration at such a depth is unprecedented globally.

It is estimated that more than 16 million tons of rare earths are stored in the surrounding waters of South Bird Island. The Nikkei News previously disclosed that the rare earth reserves here rank third in the world.

According to the report, these deposits contain dysprosium, which is essential for high-strength magnets used in mobile phones and electric vehicles, as well as yttrium used in lasers. The estimated reserves are enough for 730 years and 780 years respectively.

In December last year, officials from the Japan Agency for Marine-Earth Science and Technology announced that they would test the extraction of rare earth-rich deep-sea slurry near South Bird Island in early 2026. IC Photo

Hiroyuki Ueno, a researcher at the International Institute for Strategic Studies (IISS), told AFP: "If Japan can continuously and stably extract rare earths around South Bird Island, it will help ensure the security of key industrial supply chains domestically. For the Japanese government, this will also be an important strategic asset to significantly reduce its reliance on China's supply chain."

According to JAMSTEC, during the trial mining mission, the "Chikyu" will extend pipelines into the water to ensure that the "mining machine" installed at the front of the pipeline can reach the seabed and collect rare earth-rich mud. The mission is expected to last until February 14.

At the beginning of December last year, during a hearing of the House of Councillors' Committee on Foreign Affairs and Defense, Shigehiko Yamada, a member of the Constitutional Democratic Party known as an expert on maritime security, mentioned the deep-sea rare earth mining issue.

He expressed his anticipation, calling it a "groundbreaking and visionary plan for Japan's future," with the estimated value of Japan's undersea resources reaching 500 trillion yen.

He also exaggerated about the incident where the Chinese Navy's Liaoning aircraft carrier sailed near South Bird Island last year, expressing concern that "China might interfere in some form with Japan's resource development within its exclusive economic zone."

It is worth noting that deep-sea mining has become a focal point in geopolitics. President Trump pushed for rapid progress in deep-sea mining activities in international waters, causing increasing concerns.

Environmentalists warn that deep-sea mining threatens marine ecosystems and damages the seabed environment.

The International Seabed Authority (ISA) has jurisdiction over the seabed beyond national waters, and the organization is pushing for the development of global regulations to govern deep-sea mining activities.

European media analysis points out that no country is more vulnerable to supply chain shocks than Japan. Japan's manufacturing strength heavily depends on the stable supply of imported minerals. Japan has long been preparing to deal with supply chain shocks. After the collision between Chinese and Japanese vessels in the East China Sea in 2010, China imposed a seven-week ban on rare earth exports to Japan, prompting Japan to decide to reduce its reliance on China.

The European news website Euractiv pointed out that the Japan Oil, Gas and Metals National Corporation (JOGMEC) is at the core of this effort. JOGMEC's strategy is simple: invest funds, output technical expertise, and expand supply channels. The agency provides financial support for domestic mineral processing, supports Japanese companies in overseas expansion, and helps explore new raw material sources globally.

The other major pillar of Japan's strategy is stockpiling. And JOGMEC plays almost a "mysterious" role in this. The agency directly purchases key materials and stores them in classified, undisclosed locations (or multiple locations). The regulations are extremely strict: companies must first exhaust their own inventory before JOGMEC releases the reserves.

Indeed, it is not only Japan. After China's countermeasures against U.S. trade bullying, both the U.S. and Europe have invested heavily to build a "de-China" supply chain.

According to Bloomberg on January 9, Japan is intensifying efforts to contact G7 members and other countries to seek cooperation on critical minerals.

But this is no easy task.

The Wall Street Journal admitted that China's deterrent measures have indeed driven a revival of the Western rare earth industry to some extent. However, regardless of whether rebuilding the Western rare earth supply chain takes time, the industry has already experienced several "false booms" in the past. The fact is that outside of China, the rare earth industry lacks experience and professional technology.

Especially for Japan, if it does not face up to the serious consequences of its erroneous actions and continues to provoke issues involving China's core interests, no matter how hard it tries to find alternatives, it will be difficult to resolve the dilemma fundamentally.

This article is an exclusive contribution from Observer Net. Unauthorized reproduction is prohibited.

Original: toutiao.com/article/7593376172885410338/

Statement: This article represents the views of the author alone.