【By Observer Net, Yuan Jiaqi】

China has upgraded its policies on rare earth exports, and U.S. media is still in shock. As the U.S. and Europe have made responses to China's new regulations, Bloomberg, a U.S. media outlet, once again focused on this issue on the 15th, reporting that the comprehensive measures implemented by China mark the first time that China has taken significant action to regulate the global flow of key minerals it dominates.

Earlier, foreign media generally interpreted that the rare earth issue has repeatedly appeared in multiple rounds of Sino-U.S. trade negotiations, and the timing of the new regulations has led to speculation. The new export control measures may give China more leverage in trade negotiations.

Olivier Melton, head of Rhodium Group's China business, believes that it is unlikely for China to completely abolish the new regulations regardless of the outcome of the Sino-U.S. negotiations.

Melton previously served as an American Treasury official in Beijing. He told Bloomberg, "This is a strategic decision aimed at ensuring China's continued, long-term influence over the United States and other countries, thus preventing future export controls against China."

Melton further explained that China's move shows "that Chinese policymakers have become aware that they have the ability to hit major U.S. companies' production, such as Apple and Tesla, thereby maximizing their impact on the U.S. market."

"After decades of effort, China has finally gained a real advantage over the United States in a few key technology areas," said analysts Arthur Kroeber and Laila Khawaja from Lazard in a report released on Monday, predicting that China's new rare earth control measures are "carefully considered," with the core objective of pushing the U.S. to reciprocally relax chip controls.

The Financial Times earlier cited analysts who pointed out that the current tension between the U.S. and China is entirely caused by the U.S. government's erroneous policies toward China in September this year. These actions not only escalated tensions but also once again confirmed the low credibility of the Trump administration.

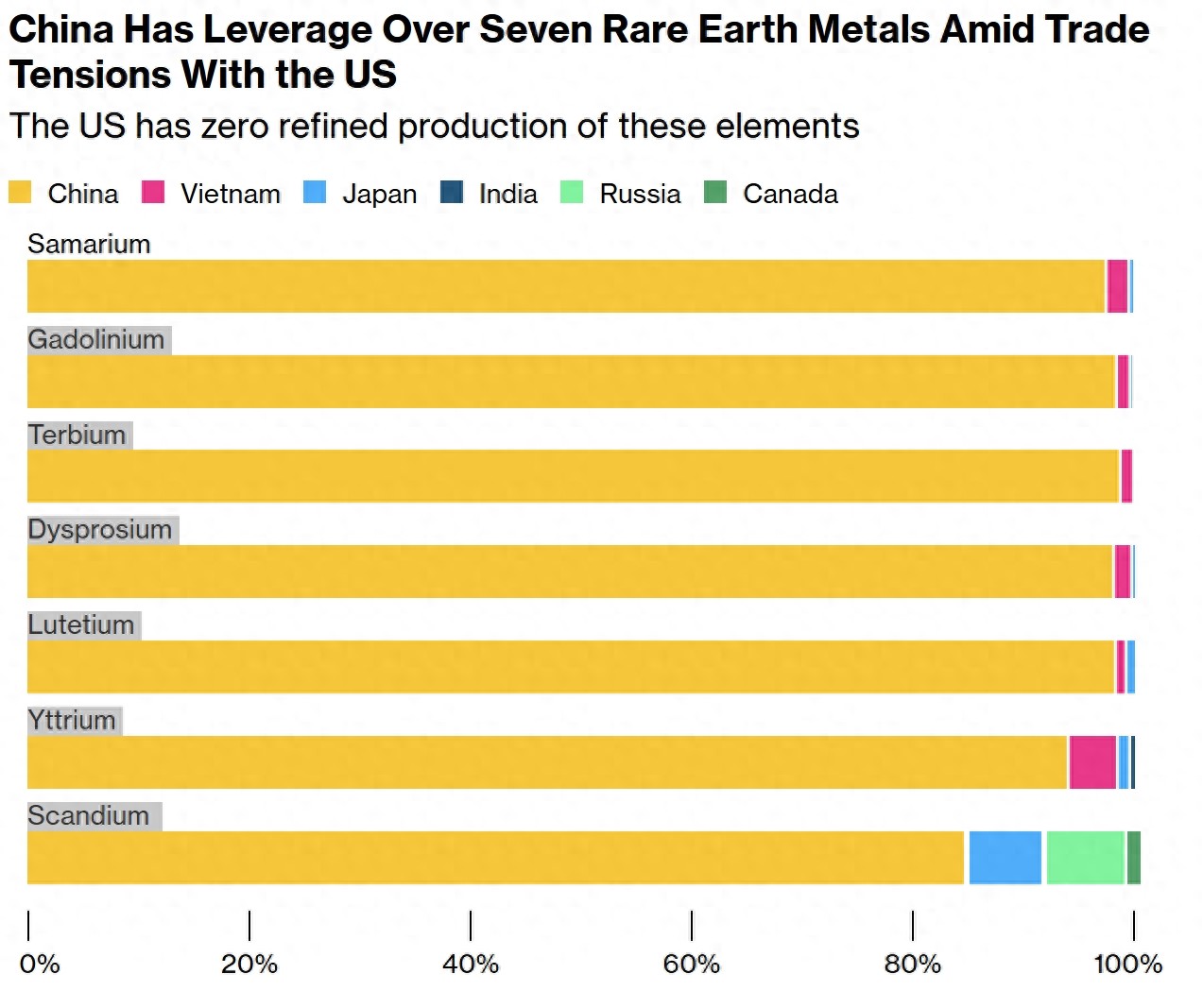

Amid the Sino-U.S. trade friction, China holds the leading position in seven rare earth metals, while the U.S. has zero refining capacity for these elements. (The charts show samarium, gadolinium, terbium, dysprosium, lutetium, yttrium, and scandium respectively) Bloomberg charting

U.S. media noted that one of the most critical aspects of the measures announced by China on October 9 is the global licensing requirement that will take effect on December 1: According to the new regulations, any company anywhere in the world that wants to export rare earth magnets or semiconductor materials containing 0.1% or more of controlled rare earth metals originating from China must obtain approval from China.

Bloomberg exaggeratedly claimed that China's strategy of converting its dominance in the global rare earth supply chain into a tool to protect its own interests imitates the U.S. approach of using its advantages to exert influence abroad: The U.S. has long used its dollar influence and the central position of its financial system to implement "long-arm jurisdiction" overseas; now, China, relying on its absolute control in rare earth processing and permanent magnet production, is beginning to exert similar influence.

Chris Kennedy, senior geopolitical economist at Bloomberg Economics and former member of the U.S. National Security Council under both the Biden and Trump administrations, said, "Because of the global liquidity of the U.S. dollar and the central position of the U.S. financial system, the U.S. has unparalleled influence in financial markets. China's global influence, on the other hand, comes from its dominant position in key industries crucial to global manufacturing."

U.S. media also claimed that since 2020, China has systematically built a control framework that mimics the U.S., including a list of entities, extraterritorial jurisdiction over technologies originating from China, etc., "this move marks a milestone in the years-long expansion of China's export control system."

However, it should be emphasized that rare earth-related items have dual-use characteristics, and implementing export controls on them is an international practice. The Chinese government legally implements controls on certain rare earth-related items with Chinese components, which is completely different from the U.S. abuse of entity lists and other export control tools, as well as the hegemonic behavior of illegal unilateral sanctions.

Bloomberg also noticed that China's top official think tank recently commented on the new regulations, saying, "Upgrading the export controls on rare earths will set an example for establishing a 'responsible rare earth supply chain' globally. As a responsible major country, China is moving from being a 'rare earth supplier' to a 'rare earth order manager.'"

In the long term, China strengthening its export controls on rare earths will help better safeguard national security and interests, fulfill international obligations such as non-proliferation, and ensure the safety and stability of the global rare earth industrial chain and supply chain.

However, Bloomberg, projecting its own views, misinterpreted the new regulations as "China's ambition to control the global flow of rare earths," and seriously claimed that China's so-called "excessive" measures in rare earth controls might backfire, possibly accelerating the establishment of alternative supply chains by various countries, thus weakening China's dominant position in this field, "just like Washington's export controls on advanced semiconductors could stimulate innovation in China."

Nevertheless, the so-called "backfire risk" is essentially a misunderstanding of China's strategic layout in the rare earth industry, and it is also a deliberate confusion between "compliant controls" and "unilateral blockades."

Professor Wu Xinbo, director of the Institute of International Studies at Fudan University, previously told Hong Kong English media South China Morning Post that China's latest round of trade countermeasures may become "a positive step to stabilize Sino-U.S. relations," forcing the Trump administration to adopt a more pragmatic attitude.

Wu Xinbo stated that China has cards in its hand and is ready to play them at any time, with the ability to make the U.S. feel pain. This round of countermeasures "will be very helpful and positive for the stability of future Sino-U.S. trade negotiations and the overall bilateral relationship."

He added, "We have now seen through Trump, and we have completely figured out his bottom line."

On October 13, Lin Jian, spokesperson for the Chinese Foreign Ministry, responded to the U.S. threat to impose 100% tariffs, saying that the U.S. has continuously introduced a series of restrictions and sanctions against China, seriously harming Chinese interests. China firmly opposes this, and instead of reflecting on itself, the U.S. has threatened high tariffs, which is not the correct way to deal with China.

China urged the U.S. to quickly correct its mistakes, guided by the important consensus of the phone call between the two heads of state, and to resolve their respective concerns through dialogue on the basis of equality, respect, and mutual benefit, properly manage differences, and maintain the stability, health, and sustainable development of Sino-U.S. relations. If the U.S. persists in its course, China will certainly take corresponding measures to safeguard its legitimate rights and interests.

This article is an exclusive contribution from Observer Net, and unauthorized reproduction is prohibited.

Original: https://www.toutiao.com/article/7561351771134689855/

Statement: The article represents the views of the author, and readers are welcome to express their opinions by clicking on the [top/minus] buttons below.