Due to the continued surge in demand for rare earths in fields such as electric vehicles, medical equipment, and defense equipment, coupled with China's tightening export controls, prices of several key rare earth minerals have reached record highs in recent weeks. Experts believe that rare earth prices are likely to remain at high levels with fluctuations.

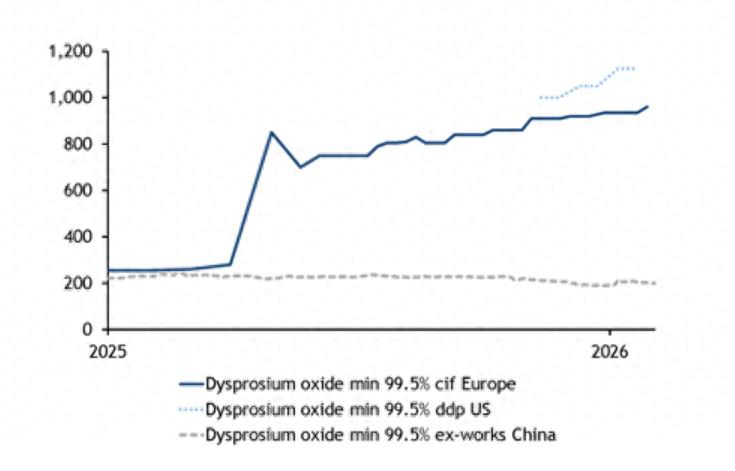

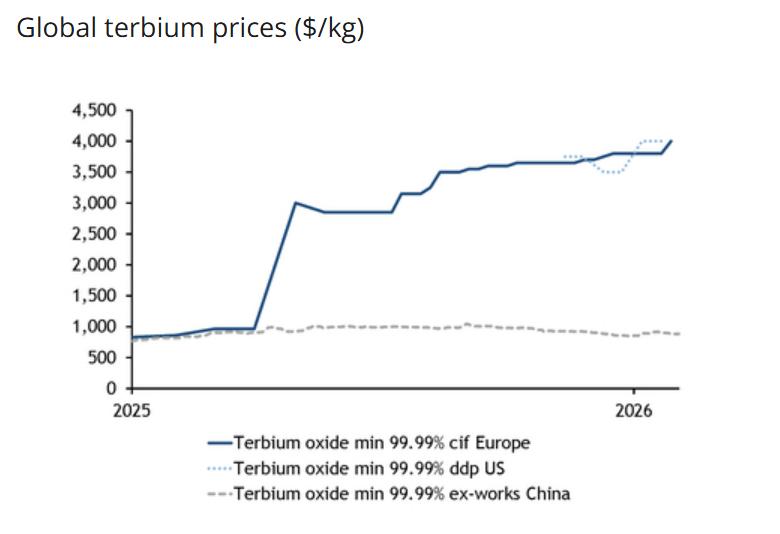

Data released by the media division of Argus, an international energy and commodity pricing evaluation institution, shows that in the European market, the price of dysprosium has risen to $960 per kilogram, and the price of terbium is $4,000 per kilogram.

According to a report by Japan's Nikkei Asia website on February 7, magnets made from these two rare earth elements are essential for the drive motors of electric and hybrid vehicles, and their prices have hit record highs for two consecutive weeks since 2015.

International Dysprosium Price Trend, the price difference between China's export price and the international price is becoming increasingly significant - Argus

International Terbium Price Trend - Argus

Yttrium is an important element in high-temperature superconductors, used in medical equipment and light-emitting diodes. As of February 5, its price has surged sharply from $260 per kilogram at the end of December last year to $425 per kilogram.

Gallium is a key metal in defense equipment such as radar and missile guidance systems. The transaction price on February 5 reached $1,600 per kilogram, setting a new high since early January.

The Nikkei Asia reported that a source at a trading company said, "After China recently tightened restrictions on exports to Japan, some companies seem to be accelerating procurement and locking in inventory."

Global growth in defense spending is also driving the market. Maeve Flaherty, a senior reporter in the rare earth sector at Argus, stated that demand for yttrium in the defense and electronics industries is particularly strong, and supply shortages continue to push prices higher.

Senior researcher at the First Life Economic Research Institute, Yashio Kojima, predicted, "In the short term, rare earth prices are likely to remain volatile at high levels."

Rare earth elements refer to a group of 17 metallic elements. Due to their unique optical, magnetic, and chemical properties, they are known as the "vitamins of industry" and are widely used in new energy, new materials, aerospace, electronics, and military fields. They are indispensable strategic resources in modern industry. Most of the world's rare earth production comes from China.

Japan currently relies on imports of over 70% of its rare earths from China. After China recently announced a ban on exports of items with dual-use characteristics that could be used for military purposes to Japan, Japan's "rare earth anxiety" has intensified.

According to Kyodo News, on February 2, the Japan Agency for Marine Earth Science and Technology announced that the deep-sea research vessel "Earth" successfully extracted rare earth-containing mud from a seabed area about 5,600 meters deep near the Ogasawara Islands.

The public generally believes that excavating rare earth-containing mud from the seabed is a way for Japan to try to reduce its reliance on Chinese rare earths. However, this news is still far from achieving industrialization and large-scale supply of domestically produced rare earths, and it will take a long time before it can meet domestic demand.

Nikkei News mentioned that the technology for extracting rare earths from sea mud is still in the basic research stage, and improvements are needed to achieve mass production. At the same time, the mining of sea mud requires high costs. Data from the First Life Economic Research Institute show that the cost of mining rare earth mud near the Ogasawara Islands is several to dozens of times higher than the market price of Chinese rare earth products.

China has built a vast rare earth industry chain over decades, accumulating a solid technical foundation, and its products offer excellent cost-effectiveness. These achievements did not happen overnight. Considering that global rare earth refining and processing capabilities are highly concentrated in China, even if Japan successfully mines raw materials, it will still be highly dependent on external processing systems.

On February 3, Foreign Ministry spokesperson Lin Jian responded to a question from a Japanese TV station, saying, "We have noticed that there have been such reports in Japan in recent years."

This article is exclusive to Observer Net. Unauthorized reproduction is prohibited.

Original: toutiao.com/article/7604122948592468534/

Statement: This article represents the personal views of the author.