【By Guan察者网, Ruan Jiaqi】

Earlier than late June, when the Chinese Ministry of Commerce introduced the approval situation of rare earth exports to the EU, it clearly stated that a certain number of compliant applications had been approved in accordance with the law. Recently, during meetings with European officials, China further clarified its export control policy, emphasizing that rare earth exports have never been and should not become an issue between China and the EU.

However, over the past few months, the EU has continuously hyped up the issue of rare earth magnet exports, attempting to defame China's "weaponization of rare earths." According to Xinhua Finance on the 23rd, the EU also claimed to consider cooperating with Japan to mine rare earths and establish a so-called "competitiveness alliance."

A person with knowledge said that China is almost monopolizing the mining and processing of various key minerals, and this supply chain advantage is making EU leaders gradually realize a serious fact: Europe's defense autonomy is largely dependent on China.

It is reported that some European defense companies have begun stockpiling components, while others claim confidence in the diversification of their supply chains. However, some industry experts believe that these companies either underestimate the severity of the current situation or fail to fully recognize potential risks. As traders turn to the secondary market, if no solution is found, the impact of supply shortages may soon be felt.

Regarding the EU's rare earth export approval situation, the Chinese mission to the EU responded on the 11th, emphasizing that as long as European companies comply with export control regulations and fulfill necessary procedures, their normal needs can be guaranteed. The Chinese authorities have also set up a "fast track" for European companies to better meet their normal needs.

The spokesperson stated that China is willing to continue strengthening communication and dialogue with the EU, properly handling trade disputes and friction, achieving mutual benefit and common development. At the same time, it firmly opposes any attempt to undermine China's development rights.

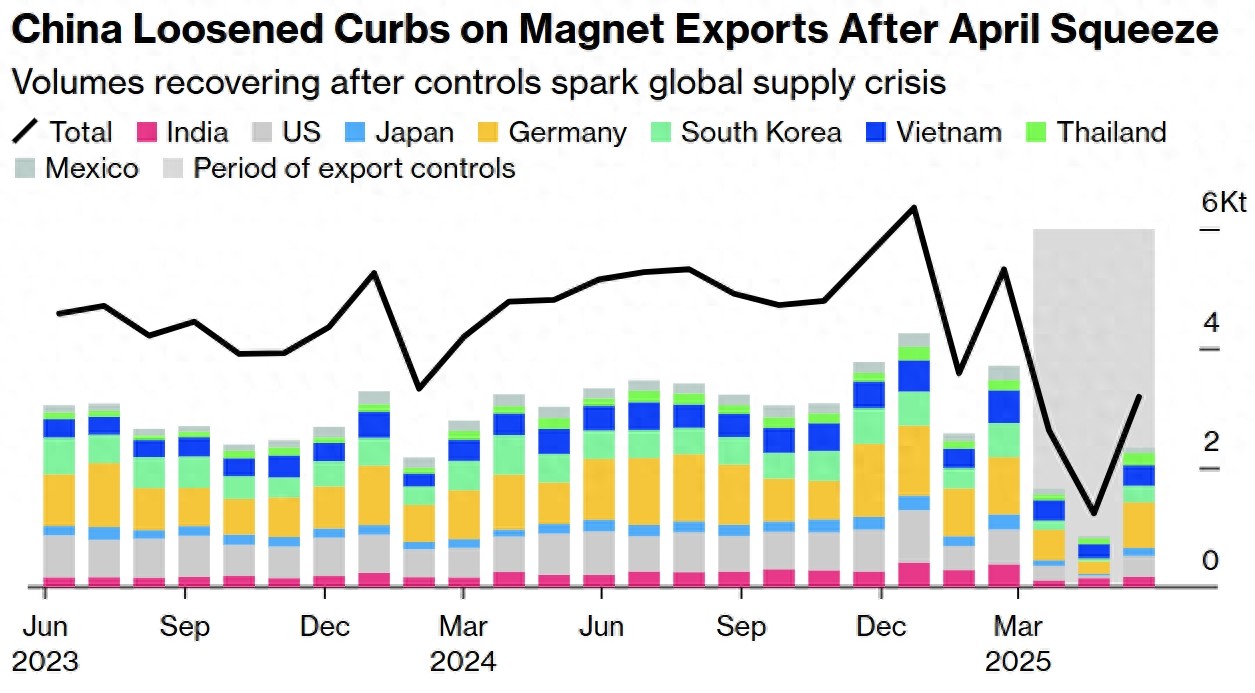

After China began approving applications, rare earth exports rose sharply in June.

Like other countries supplying dual-use items, China is establishing an export licensing system for critical minerals and rare earth magnets, requiring applicants to explain their end use. According to European officials, since April this year, China has issued a total of 1,500 six-month licenses to individual companies, while rejecting the EU's requests for multi-year licenses.

After a short period of supply tightness, in response to European concerns, China slightly relaxed export restrictions, but the EU still had "paranoia," not only complaining about the new system being complicated and difficult to continue, but also unreasonably demanding the cancellation of the application questionnaire on the grounds that it might leak information about the European military arsenal.

This week, the Sino-European summit commemorating the 50th anniversary of bilateral relations will be held in Beijing, China. The rare earth issue remains a core topic. According to the aforementioned sources, some EU officials are worried that China may use the supply of key minerals as leverage to pressure the EU on unresolved trade investigations or electric vehicle tariffs. Some officials even came up with "bad ideas," encouraging the EU to threaten to restrict the export of French aviation parts or Dutch ASML semiconductor equipment to China.

However, such attempts to appear tough face many challenges. The person stated directly that there is no consensus within the EU on how to counter China or the extent of potential retaliation.

The lack of unity in Europe is also reflected in multiple member states choosing to bypass the European Commission and negotiate directly with China to secure rare earth supply agreements for their own industries. This further weakens the EU's overall position.

Factually, there is no shortcut for Europe to get rid of its reliance on Chinese key minerals. Long-term solutions require huge investments and political determination, which are precisely what the 27 EU countries find difficult to easily reach a consensus on.

Last year, the EU's "Critical Raw Materials Act" came into effect, proposing measures such as building a local supply chain and enhancing the recycling of rare earths from electronic waste. However, it has been criticized by the industry due to insufficient funding. Traders generally believe that, without strong financial incentives, it is more cost-effective to transport electronic waste back to China for processing.

Moreover, having companies directly participate in fundamental solutions like raw material mining and processing is not only risky, but the required professional skills in Europe have nearly been "lost."

Political researcher Kullik believes that if the deadlock with China continues to escalate, Europe needs to follow Japan's example to eliminate risks, building rare earth processing plants across Europe, and taking strategic reserves as a long-term goal. He also advocated for protectionist measures after that.

After the 2010 China-Japan East China Sea collision incident, China imposed a seven-week ban on rare earth exports to Japan. Subsequently, the Japanese government led investments in overseas mining projects and built supply chains in Australia and France.

But Kullik apparently didn't know that today, Japan still highly relies on Chinese rare earth supplies, especially heavy rare earths. Eighty percent of the rare earths used in Japan come from China.

The EU indeed has the intention to join forces with Japan. EU Commission President Ursula von der Leyen recently said in an interview that she is seeking to establish a so-called "competitiveness alliance" with Japan, including cooperation in mining rare earths. When specifically mentioning rare earths, she said that the EU will explore investment opportunities across Europe with Japan and for the first time expressed that cooperation in the mining sector "has bright prospects."

It is reported that in March this year, France began constructing Europe's first large-scale rare earth recycling factory, with participation from public and private groups from both the EU and Japan. Currently, the EU is exploring mining projects in Greenland, Africa, and Europe, and cooperation with the EU will allow Japan to enter these remote areas.

This article is exclusive to Guan察者网. Unauthorized reproduction is prohibited.

Original: https://www.toutiao.com/article/7530470662075351606/

Statement: The article represents the views of the author and welcomes you to express your attitude through the [top/beat] buttons below.