Editor's Note: On August 1, the Hong Kong Stablecoin Ordinance came into effect, marking the world's first comprehensive regulatory framework for fiat-backed stablecoins. This move has placed the international financial center at the forefront of digital asset governance. With the introduction of Hong Kong dollar stablecoins, many people have begun to envision the prospects of the Chinese yuan stablecoin.

In response to the future of stablecoins in China and global trends in stablecoins, Observer.com connected with Professor Yang Changan, Director of the Center for International Finance at Fudan University, to analyze the risks and opportunities that stablecoins bring to the development of the world.

[Interview / Observer.com, Tang Xiaofu]

Observer.com: Since the Bitcoin wave, countries have shown significant differences in their attitudes toward digital currencies. China has long promoted central bank digital currency (CBDC), while the United States, after a major debate, has started promoting US dollar stablecoins. The European Union, Singapore, and other economies also have different attitudes toward digital currencies. From your perspective, how do you view the "temperature difference" among countries like China and the United States in different areas and different types of digital currencies?

Yang Changan: The development of digital cryptocurrencies follows two paths: one is bottom-up, and the other is top-down. Central bank digital currency is a typical top-down approach, while Bitcoin is a bottom-up approach.

Both paths have their advantages and disadvantages: Central bank digital currency is easier to integrate with the existing financial system and is convenient for central bank regulation, offering significant advantages in transparency and security. However, there are also drawbacks to this path. First, it is not formed by the spontaneous demand of market entities, so it lacks commercial motivation. Second, theoretically, central bank digital currency is equivalent to digital cash, and the central bank can track all users' financial activities through it. Some groups or some countries may be concerned about privacy protection in central bank digital currency.

By contrast, digital cryptocurrencies such as Bitcoin and stablecoins have the advantage of strong commercial demand and motivation, and they are more conducive to protecting personal privacy. However, their disadvantages are also prominent, such as being easily used for money laundering and having significant issues in consumer protection.

From a practical perspective, both types of currencies are developing according to their own logic. China has chosen the former path, focusing on central bank digital currency; the United States, through legislation, has banned the central bank from issuing and leading digital currency, shifting to a stablecoin system and officially recognizing stablecoins. The difference between these two approaches is very clear. Europe's approach is also closer to China, similarly promoting and adapting to the central bank digital currency path.

The digital RMB is a digital form of legal tender issued by the People's Bank of China. Photo: CCTV News

The reasons for this "temperature difference" between China and the United States, I think, mainly include three aspects:

First, there is a difference in understanding and emphasis on digital currencies. Among central banks, the People's Bank of China was the first to recognize the significance of digital currencies and was also the first central bank to lay out relevant applications. In comparison, the Federal Reserve has been relatively slow and conservative in this regard.

The second factor is related to cultural traditions and technological accumulation. For example, the underlying logic behind the U.S. ban on central bank-led digital currencies actually emphasizes privacy protection. This legal and cultural tradition difference constitutes the objective basis for the "temperature difference."

The third factor, we can view this "temperature difference" as a form of strategic game.

This year, scholars such as Jun Chu from the United States published an article titled "Strategic Digitization in Currency and Payment Competition" in the top economics journal "Journal of Financial Economics" (before publication, the title was "Currency War in the Digital Age"). It specifically discusses currency and games, and the content is very interesting.

The article emphasizes that the different choices of central banks in digital currencies are essentially a manifestation of a currency war. How will the competition in the digital age take place? The article divides countries into three categories: traditional powers, which have long occupied a dominant position in the monetary system; emerging powers, which hope to develop their own currencies, develop quickly, but have not yet gained an advantage; and ordinary countries.

The article believes that these three categories of countries have different sequences of moves in the game of digital currency development. The emerging powers are the first to make moves, trying to gain initiative by developing central bank digital currencies. After the emerging powers make their moves, the traditional powers with monetary dominance use market forces to launch the card of stablecoins. The stablecoin emphasizes the role of the market, logically forming a certain restraining relationship with the central bank digital currency of the emerging powers. In this situation, ordinary small countries are passively outside, acting as spectators, with limited space for development.

Relevant paper screenshot

Therefore, the competition in the monetary field among major countries is essentially a complex game process. The current "temperature difference" is largely a result of intentional design, a rational choice based on careful calculation and combining each country's cultural traditions, legal systems, and financial system advantages. Therefore, the "temperature difference" has both subjective factors and objective foundations.

Observer.com: Many people directly link the acceleration of the United States in promoting stablecoin bills to the lack of buyers in the U.S. Treasury market, especially the long-term bond market. From your perspective, are these two directly related? Can it alleviate the problem of high long-term interest rates on U.S. bonds?

Yang Changan: I think this issue needs to be analyzed from several levels. First, the promotion of stablecoins by the United States and the enhancement of the demand for U.S. Treasury bonds are directly causally related. This point has already been clearly expressed by the U.S. Treasury Secretary, so there is no doubt about this. However, there are still some details that need clarification in this understanding.

The most important one is the issue of short-term and long-term bonds. As everyone knows, the main underlying assets of stablecoins are short-term U.S. Treasury bonds, and the real difficulty of U.S. Treasury bonds is the lack of buyers for long-term bonds. Therefore, some people believe that stablecoins only increase the demand for short-term bonds, without changing the supply and demand of the long-term bond market, thus the impact on the overall status and market expectations of U.S. bonds is very limited.

Regarding this issue, my view is that we cannot separate the demand for short-term and long-term U.S. Treasury bonds. Because various market participants can package various assets through various financial engineering methods to achieve securitization, or develop similar short-term demand by using long-term bonds as collateral. In other words, the United States can completely derive the demand for long-term Treasury bonds through policy design or market product development in the future. Therefore, I don't think this is a major issue.

The key issue between U.S. bonds and stablecoins lies in the fact that when analyzing the relationship between U.S. bonds and stablecoins, there are often contradictory views: one voice emphasizes that the launch of stablecoins is to save U.S. bonds, believing that after the development of stablecoins, the demand for U.S. bonds can rescue the currently pressured U.S. bond market; another voice emphasizes the scarcity of U.S. Treasury bonds as "safe assets," since stablecoins like USDT are backed by U.S. Treasury bonds, if stablecoins develop significantly in the future, it will create a huge demand for U.S. Treasury bonds, leading to insufficient supply of U.S. Treasury bonds, thereby making it difficult to support the large stablecoin market. These two statements are essentially contradictory: one group believes that the demand for U.S. bonds is insufficient, while the other group believes that the demand for U.S. bonds is extremely high.

For this issue, the key is to determine whether U.S. bonds are currently "global safe assets." The so-called "safe assets" refer to whether the value of the asset is not doubted at all globally, whether it is insensitive to information shocks, and whether it is normally repaid. U.S. bonds are still the only widely recognized "safe asset" in the world, which is the objective result of long-term international financial market games, and there is no alternative in the short term.

Before 2008, to alleviate the shortage of U.S. bonds, various parties took many measures to try to increase the supply of "safe assets." At that time, there were two attempts. One was the attempt by domestic private financial tools to create "safe assets," resulting in subprime loans and various private "safe assets" that we see today. The second attempt was for sovereign countries without strong fiscal capabilities to issue sovereign bonds, such as Italy and Ireland, who did similar attempts to increase global "safe assets." However, after the 2008 international financial crisis, it was found that both types of methods could not withstand the test, and ultimately only U.S. bonds could become "global safe assets."

In this case, after 2008, global funds only recognized U.S. bonds, viewing them as the only "global safe asset." This situation further led to the "Triffin dilemma" of "safe assets": in this assumption, U.S. bonds are regarded as "global safe assets," but if the supply of U.S. bonds is excessive, it will lead to a decline in the safety of the asset, while if the supply is too low, it is not enough to meet the demand for "global safe assets." This dilemma is basically unsolvable.

U.S. Treasury bonds also face the "Triffin dilemma" of "safe assets"

Overall, before 2008, U.S. bonds had a long-term supply shortage; after 2008, the situation changed, and the "safe asset" status of U.S. bonds gradually came under question. This is related to several factors.

First, it is closely related to the weaponization of the U.S. dollar. Since the Biden administration, the weaponization trend of the U.S. dollar has become obvious. During the Russia-Ukraine war, the U.S. implemented multiple rounds of sanctions, causing global doubts about the status of the U.S. dollar and U.S. Treasury bonds as "global safe assets." People began to question whether the U.S. dollar and U.S. Treasury bonds are truly a global public good or have gradually become a tool used by the U.S. government for sanctions.

At the same time, the Sino-U.S. trade war became the most direct and important factor. The U.S. tried to launch a global trade war, especially targeting China, its main competitor, to achieve its strategic goals. However, the results were unexpected, and China, with its strong power, was not shaken, but instead made the U.S. repeatedly suffer in this game. Therefore, the "safe asset" status of U.S. bonds began to be questioned.

Now, when we talk about the relationship between U.S. bonds and stablecoins, we are essentially discussing whether U.S. bonds are "global safe assets." U.S. bonds now face a dual contradiction: on one hand, globally, there is still no substitute for U.S. bonds in the "safe asset" field, and only U.S. bonds can be considered as "safe assets" around the world; on the other hand, U.S. bonds themselves have serious problems, with excessive issuance, and the "Hedge Fund Agreement" proposed the idea of converting U.S. Treasury bonds into "century interest-free Treasury bonds," which is essentially a strategy of default. This idea has caused concerns in the global market. Previously, there was no doubt about U.S. bonds, but now, on one hand, the global community is beginning to doubt the "safe asset" status of U.S. bonds, and on the other hand, there is no substitute for U.S. bonds, and this contradiction is vividly demonstrated.

Therefore, my conclusion is that U.S. bonds indeed have problems, but the key issue is the confidence that the U.S. gives to U.S. bonds, rather than whether the issuance volume of U.S. bonds is unsustainable. Because without external shocks, due to the lack of substitutes for U.S. bonds, their issuance volume can still be maintained to some extent. Currently, the U.S. promotes stablecoins, and U.S. bonds are one of the considerations, but it is not the decisive factor in promoting stablecoins.

Observer.com: We can see that the United States still prohibits stablecoins from paying interest, what effect does this policy have on reducing the impact of U.S. stablecoins on the U.S. dollar? What will be the future relationship between the U.S. dollar and U.S. stablecoins?

Yang Changan: I think there is a misunderstanding here. The statement that stablecoins cannot pay interest refers to the fact that the issuers of stablecoins cannot directly pay interest to stablecoin holders, which does not mean that holding stablecoins cannot earn interest income. For example, normal currency only has no interest income itself. But the cash we hold can be deposited in a bank to earn some income.

Actually, holding U.S. stablecoins, through decentralized finance systems (DeFi) online and on the chain, there are many ways to obtain returns, such as using them as collateral or directly lending them out for profit. So for stablecoin holders, they can completely obtain income through other entities in the on-chain market. Therefore, I think this issue may not be the key issue.

What will be the future relationship between U.S. stablecoins and real U.S. dollars? The U.S. hopes that they can complement each other, because the main use of U.S. stablecoins is as the main circulation currency in the on-chain world, while real U.S. dollars are stored in the real world to participate in actual economic activities.

The U.S. hopes that the two can promote each other: the demand for U.S. stablecoins in the on-chain world will drive more real U.S. dollars to be exchanged, thus increasing the demand for real U.S. dollars. If properly arranged, a process of mutual promotion can be formed. However, there are also hidden risks of risk transmission and potential attacks between the two markets, which can be discussed later.

Observer.com: Will stablecoins cause most countries' central banks to permanently lose their monetary control functions? It is undeniable that Chinese citizens and companies may already hold a considerable amount of U.S. stablecoins, even forming what is called "dollar enclaves." How should we manage these stablecoins in the future?

Yang Changan: The development of stablecoins is a very significant event in the international monetary and financial system, bringing fundamental challenges to the stability of the entire international financial system and the monetary policies of various countries. The current stablecoin market, especially the U.S. stablecoin market, can be compared to the Eurodollar market formed in the 1950s.

Back then, a large amount of U.S. dollars flowed out of the United States, forming the Eurodollar market, which became a segment of the global financial market and played a series of important roles in the context of global debt crises. Now, U.S. stablecoins have formed a blockchain-based on-chain U.S. dollar market, and this impact will be greater than that of the previous Eurodollar market. This is because the blockchain market is naturally connected and has a super-sovereign nature. Once it enters the blockchain, it is very difficult to separate and control afterwards.

Various U.S. stablecoins have matured and are challenging countries

So in a way, the problems we once worried about, globalization infringing on the financial markets and currency sovereignty of various countries, have become more prominent now. In the past, we could manage the flow of real U.S. dollars and real currencies through capital controls, although the efficiency of this management has been continuously weakening, but at least there is some room for regulation.

Once the stablecoin market and the on-chain U.S. dollar market are truly established, real U.S. dollars and real currencies of various countries will be converted into stablecoins, and the control strategies of various countries over currency will become ineffective. Then, an external unified, global U.S. dollar market would severely impact the currencies of various countries.

Further, if two countries have their own currencies, but there is also a unified, global currency on the chain, then these two countries would actually lose their currency sovereignty. Because as long as there is an interest rate difference, domestic funds can always flow to the chain. This makes the "impossible trinity" problem of monetary policy independence, free capital flow, and exchange rate stability more prominent in the digital currency era, and further evolves into a dilemma where monetary policy independence and capital flow/opening up can only choose one.

It can be said that with the deepening of globalization and the advancement of digital economy and related technological tools, it has played a key role in promoting globalization, while also bringing severe challenges to the previously taken-for-granted affairs within the sovereignty boundaries of a country, causing unprecedented impacts.

In this era of globalization, many policies are no longer completely controlled by national governments, which is a new problem brought about by the times. The emergence of stablecoins has further exacerbated this situation, making the global system, especially the monetary sovereignty of ordinary countries and small countries, face more severe challenges.

As for China, this situation is still in the initial stage. Currently, countries should first strengthen coordination in the development of cryptocurrencies, U.S. stablecoins, and other matters. I think that institutions such as the International Monetary Fund and the Bank for International Settlements should actively play their roles, and China should also unite the vast Southern countries to participate in the formulation of relevant rules.

At the same time, regarding the relationship between blockchain currency and currency sovereignty, countries need to gradually explore ways to respond. From the current perspective, we don't have ready-made good solutions, but I believe that with the subsequent coordination and promotion between countries, a common solution will eventually be found.

Currently, the challenge of cryptocurrencies to currency sovereignty has just emerged, and this issue mainly manifests in countries with serious inflation and extremely unstable currency values, such as some countries in Latin America, and special situations in the international payment field.

The Argentine Ministry of Justice approved a company to use cryptocurrency as capital.

Overall, this issue has not yet reached a particularly serious level globally. Therefore, for control purposes, I think China still needs to prioritize strengthening coordination among all parties, enhancing technical exploration of blockchain, and striving to find a balance between sovereignty and technology.

Observer.com: In your speech, you mentioned that the financial system is moving from "paper copies" to "digital copies." In fact, before that, we could see that in fields such as art, the practice of mapping real-world assets (Real World Assets, abbreviated as RWA) onto the chain by tokenizing them has been ongoing for several years. From your perspective, what challenges does this transformation bring to regulation and law? Is this trend irreversible? What impact will it have on countries' trade and other areas?

Yang Changan: In a sense, 2025 is a very special year, and its particularity lies in the fact that we have witnessed the official recognition of the development of the digital virtual space, especially the cryptocurrency, by the world's most powerful economy for the first time. This is a historic node.

Now, the development of the digital encryption space, or the online virtual space, has entered an era of mutual connection with the real economy. This is what I mean by the transition from the paper copy era of financial capital to the digital copy era.

Compared to traditional finance, the digital encryption space, or the on-chain space, has a certain "downward strike" advantage. It has infinite segmentation, can achieve 24/7 continuous operation, and is attached with smart contracts, which will greatly improve the efficiency and cost of on-chain finance compared to traditional finance. These advantages are incomparable to the non-digital finance of our era.

So I want to emphasize that cryptocurrencies, digital virtual financial spaces, and even broader digital currencies, for us, are no longer optional. We cannot close the door and pretend to be irrelevant.

Next, we need to use our wisdom to explore a new strategy and system under the background of the digital finance era. There are indeed some researchers and subjects who hold negative attitudes towards these changes, emphasizing their risks and the various problems they bring. But the logic of the development of the times is not like this. Things that we used to take for granted and considered to be natural may no longer be so.

In a recent report released by the Bank for International Settlements (BIS), they comprehensively denied stablecoins, arguing that from the three basic requirements of monetary singularity, elasticity, and integrity, they are unqualified, and in the future, they will only play a minor role.

For example, singularity means that the value of money has uniqueness, and must be paid in full value, without any distinction between the money issued by A bank and B bank, and the holder of the money should not incur information search costs for the value of the money. Stablecoins are certainly issued by many institutions, and it is uncertain whether their value can always be guaranteed to be 1:1 with fiat currency.

National credit-backed fiat currency has singularity

But it doesn't mean that singularity cannot be claimed, and stablecoins cannot be declared incapable of performing monetary functions. This is somewhat like looking for a boat in the water. Moreover, we should not forget that singularity is not the norm of money. The singularity of the dollar was achieved only after the establishment of the Federal Reserve in 1913. Singularity may not be an insurmountable pain for stablecoins.

Overall, a famous saying is that those who follow the tide will prosper, and those who go against it will perish. The digitization of finance is an inevitable trend, and it is not a choice.

Therefore, the challenges that stablecoins pose to traditional finance are all-around. From the decentralized peer-to-peer transaction network AST to the current booming real-world asset (RWA) tokenization, these are the starting points of a new era of financial innovation and emerging waves. Only through this development process can we discuss and form ideas for regulatory policies, achieving a model of coexistence and mutual progress. We need to realize the profound impact and irreversibility of this transformation.

I also want to emphasize one point: we seem to only see the negative aspects of the digital era in finance, such as anonymity and the difficulty of tracking fund flows. However, from a philosophical perspective, things are interdependent. The digital era indeed brings many new challenges, but it will necessarily provide new solutions.

Tools such as artificial intelligence and big data will definitely provide new tools for financial regulation and monetary policy. These tools will be different from our previous "toolbox," and our regulatory strategies, monetary policies, and laws in all aspects must keep pace with the times.

Observer.com: Could you offer some technical suggestions on the impact of stablecoins in commerce, regulation, and other areas?

Yang Changan: The impact of stablecoins can be observed from two aspects. First, in the virtual financial world and on-chain financial space, I believe that the demand for related services will experience explosive growth in the coming years, and related laws will gradually advance, and related pilot projects will also be launched, with a large number of real assets moving onto the chain. However, this process also hides major financial risks. Due to the lagging of current regulatory measures, the contradiction between financial innovation and risk control is increasingly prominent, and it is not ruled out that there may be significant shocks in the future.

As for off-chain scenarios, our judgment is that new tools such as stablecoins are expected to accelerate the transformation of traditional international settlement models, gradually phasing out traditional, high-cost international settlement methods. This transformation process will be very rapid, involving not only stablecoins themselves, but also the simultaneous implementation of other forms of digital currencies.

A significant reduction in settlement costs will not only have a profound impact on global trade, effectively promoting trade growth, but will also bring significant benefits to China. This is the core of the impact of stablecoins.

Observer.com: Regarding the U.S. accelerating the promotion of U.S. stablecoins, many people are worried that if we do not accelerate our involvement, global asset pricing will again be dollarized. Some scholars have mentioned that the U.S. may plan to use stablecoins to open the third phase of the Bretton Woods system. What is your opinion on this?

Yang Changan: I think the U.S. idea is not a conspiracy, but a strategy. Accurately speaking, the U.S. wants to control the next generation of the financial space and gain leadership in the future chain finance, forming a chain finance space centered on the U.S. dollar.

This future-oriented financial space is naturally global. Most of the current related currency transactions are conducted in U.S. dollars, so the U.S. believes that it must seize this opportunity to iterate. As long as it can control the future of the digital finance space, it equals controlling the future of finance. Whether it is called the "third phase of the Bretton Woods system" is not important. The key is that the U.S. wants to dominate the future financial landscape.

Now, the U.S. is countering central bank digital currency by playing the card of stablecoins. I think China's response can be summarized in sixteen characters: remain calm, actively respond, strengthen cooperation, and lead the rules.

LUNA coin crash had a huge impact

First, remain calm. We need to maintain composure in the development of cryptocurrencies, because there are multiple paths for digital cryptocurrencies. For example, algorithmic stablecoins eventually collapsed, and now the mainstream is stablecoins backed by fiat currencies. In addition to these two, there are other types of stablecoins, and everything is still in the development stage. The current USDT may not be the final form of stablecoins, and better stablecoins may appear in the future. Therefore, the first step is to remain calm.

Second, actively respond. We cannot and should not consider all things in the digital cryptocurrency field as financial fraud or speculation, nor should we take an extermination attitude, because this may not be in line with China's overall interests. We need to actively explore the possibilities of various pilots and layout new directions early.

We can observe that in the research and game analysis of American scholars, there is rarely a discussion of this core issue: if China also launches stablecoins, what will be the consequences?

Actually, China's stablecoins have practical application scenarios in real trade. A large number of "Belt and Road" countries have imperfect financial systems, which is a highly promising stablecoin application market. This characteristic combined with China's trade and the "Belt and Road" initiative will bring great space for the internationalization of the RMB and the expansion of China's international influence, which has not been fully tapped in the past.

The third point is to strengthen cooperation. Looking at the development of digital currencies, the United States has shown a selfish and destructive hegemonic nature throughout the process. It does not consider other countries and only wants to bind other countries.

China should adopt a united strategy, especially working together with a large number of emerging economies and developing countries in the Global South. These countries have common realistic pressures in economic development and maintaining GDP, so they can understand each other. We should push more countries to pay attention to the issue of digital financial rules, allowing China to have a better position at the starting line. At the same time, because Europe has a different stance from the United States on this issue, we should also promote cooperation with Europe, engage in dialogue and cooperation with Europe, and form a coalition, jointly speaking, which is "strengthening cooperation".

Finally, we need to lead the rules. We must not become passive observers, but must become rule-makers, avoiding being excluded from the rules. We must take the initiative to promote global cooperation from the beginning, actively participate in global dialogues on stablecoins and digital finance, and participate in the formulation of rules, representing our position, emphasizing the positive interaction of digital finance with the real economy, rather than letting the virtual financial space become pure speculation and self-entertainment. We must dare to lead in the formulation of rules.

Observer.com: The Hong Kong Stablecoin Ordinance came into effect on August 1, which is generally seen as a signal that China is testing stablecoins and will later test the RMB stablecoin. From your perspective, how will China proceed on the road of digital currencies? Can China's "resource binding + offshore pilot" approach to the RMB stablecoin break through the monetary substitution dilemma under the U.S. system?

Yang Changan: A month ago, when discussing stablecoins, I proposed a view that China's strategy to cope with the challenge of U.S. stablecoins should be "two legs walking." On one hand, we have already made phased important achievements in the cross-border payment pilot of the central bank digital currency, especially in international cooperation. We should cherish these achievements, promote the practical application of central bank digital currency in real scenarios, strengthen cooperation between enterprises, and promote the actual use of central bank digital currency.

On the other hand, we should actively layout the RMB stablecoin. Of course, this layout should initially focus on pilot projects. Now, Hong Kong is promoting the Hong Kong dollar stablecoin, and in the current Hong Kong dollar stablecoin pilot scheme, the relationship between the Hong Kong dollar stablecoin and the U.S. dollar is not entirely bound, which leaves space for the future role of the RMB. At the same time, we should also quickly promote the pilot of the RMB stablecoin in Hong Kong.

Stablecoins are a basic pricing currency in the virtual space, which is not entirely consistent with China's current emphasis on serving the real economy. Therefore, there are inherent advantages in issuing stablecoins in Hong Kong. However, stablecoins also have an entity attribute, meaning they can affect the real economy and play a positive role in real-world trade settlements.

Therefore, I think that facing the dual attributes of stablecoins, Hong Kong and Shanghai should each leverage their strengths. Hong Kong focuses on the virtual attribute of stablecoins and product innovation in the virtual financial space; Shanghai can explore the real attribute and play its role in promoting the real world, especially conducting pilots in international settlements in offshore markets.

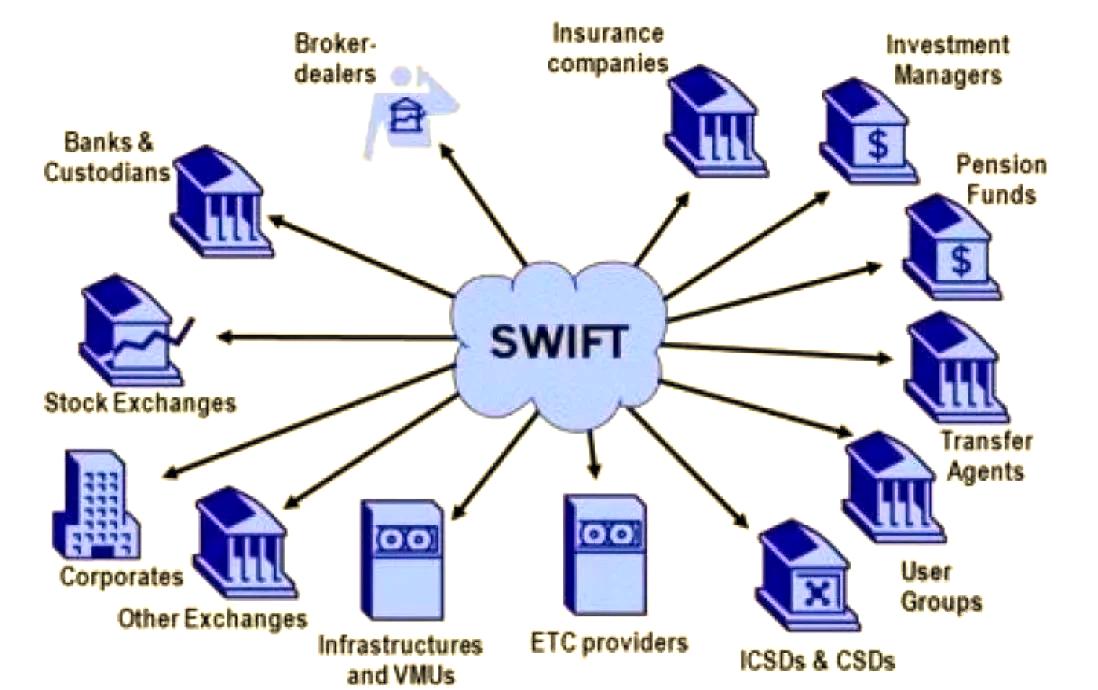

SWIFT system has exposed more and more shortcomings

Additionally, I have been thinking about this question: why can't we promote the RMB stablecoin in the onshore market?

The reform risks and pressures we face now are much smaller than those in the early 1980s. In the early 1980s, the domestic foundation was weak, the technology was backward, and the internal and external disparities were very large. At that time, we allowed export enterprises to retain part of foreign currency and hold U.S. dollars. This way, enterprises could use them for exports, imports, or transfer to other enterprises in the future. At that time, the risk of enterprises holding U.S. dollars was quite high. But we still managed to get through.

Today, even if we introduce stablecoins in the onshore market, the impact on the real economy is unlikely to exceed the risk of enterprises holding U.S. dollars back then. Therefore, I think there is space for using RMB stablecoins. We can allow some qualified large export enterprises, especially state-owned enterprises, to pilot holding stablecoins in a certain proportion (such as 10%), and the risk is controllable.

Actually, according to the various reports and surveys we have, stablecoins have already existed in trade applications, and the scale is not small. Why not relax appropriately? Therefore, in the current reform, on one hand, we need to be bold, and on the other hand, we need to attach great importance to risks. As long as we balance the two, we can better deal with the challenges brought by stablecoins and secure a relatively favorable situation during the development process.

Observer.com: Here I would like to add two questions. Now, apart from China, most countries around the world are facing inflation pressure. Will the issuance of U.S. stablecoins increase global inflation pressure and challenge the legitimacy of fiat currencies such as the U.S. dollar? Additionally, in recent years, the interest rate differential between China and the U.S. has been one of the main constraints of China's financial policy. Will Chinese enterprises holding stablecoins in the onshore market exacerbate the behavior of arbitrage using the interest rate differential?

Yang Changan: Regarding the first question, the challenges and the consequences are very prominent. In some countries, holding stablecoins has already become quite common due to anti-inflation considerations.

However, what really replaces the U.S. dollar is not stablecoins, because most stablecoins are pegged to the U.S. dollar. If the U.S. dollar depreciates, stablecoins will also depreciate. What really replaces the U.S. dollar is other currencies, such as Bitcoin. Bitcoin has a limited quantity, while the supply of fiat currency is infinite.

Behind the global inflation in recent years is the gradual failure of the control of paper money and the credit currency standard. The world has failed to uphold the principles and bottom lines in the credit currency field twice in the past decade. The first time was during the 2008 financial crisis, when, in order to prevent the financial risks at the time, countries such as the United States implemented extremely loose monetary policies, which was the first major failure. The second time was the pandemic crisis, and this failure was somewhat more serious than the first one.

If stablecoins are digital fiat currency, then Bitcoin is digital gold. The limited quantity of Bitcoin determines that it can hedge against the unlimited issuance of paper money. Therefore, you can see that the price of Bitcoin continues to set new highs, which is the consequence of the over-issuance of real-world money. This is also a hedge against the credit of the U.S. dollar.

As for the interest rate arbitrage issue that onshore stablecoins may bring. From a practical perspective, the problem of arbitrage using the traditional financial system is already very common, and there are many studies on this. Although China has capital controls, in the context of globalization and financial openness, capital flows cannot be completely blocked. There are still many channels for communication between domestic and foreign currencies.

Some years ago, various funds tried to convert into RMB to take advantage of the RMB appreciation and the high interest rate advantage in China. Now, many funds are trying to convert into U.S. dollars to continue arbitrage. Such arbitrage behaviors have existed for many years.

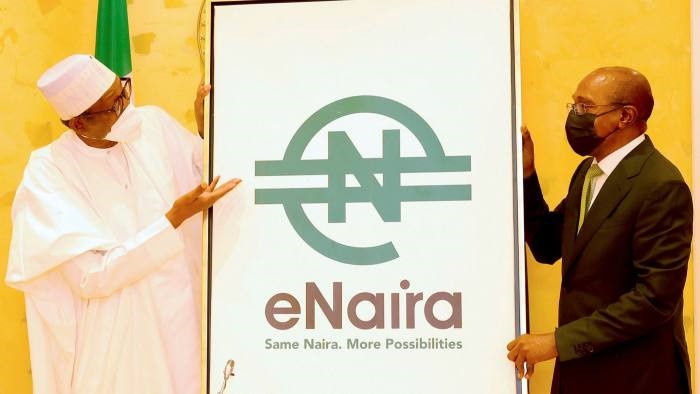

In 2021, Nigeria issued its own retail central bank digital currency, "e-Naira" (e-Naira).

With the introduction of stablecoins, stablecoin arbitrage will continue to exist. If China does not issue RMB stablecoins, the arbitrage space will still exist, and funds will have more incentive to switch to U.S. dollars. If RMB stablecoins can be successfully issued, it will give other countries a new option, allowing our country's enterprises to hold RMB stablecoins due to the needs of trade. It will also be beneficial to form a "safe asset" other than U.S. bonds in the future. Although the U.S. interest rate is currently high, it will decrease in the future.

Currently, only U.S. stablecoins are available in the market, and other countries have no options. However, if RMB stablecoins can be successfully issued, it will provide other countries with the possibility of choosing. "The world is tired of the U.S. dollar for a long time." Since the U.S. has many problems, we should not only criticize the U.S. but also provide alternatives, otherwise it would be contradictory.

Therefore, I personally think that issuing RMB stablecoins is a strategic move. It should not be influenced by temporary macroeconomic data and interest rate fluctuations. From a strategic perspective, we should provide the world with a new "safe asset," and this asset should be backed by Chinese government bonds. We should provide the possibility for the world to gradually get used to and recognize the pilot of RMB stablecoins supported by the Chinese government. This will form a unique digital currency product in China.

Currently, the U.S. does have advantages in the financial field, but China has its own advantages. Don't underestimate China, don't underestimate yourself. From the Sino-U.S. trade war, it can be seen that the U.S. hegemony has already shown cracks. In this situation, we should cherish the current opportunity, prepare in advance, and don't be unduly modest, don't close the door from the start.

China has always been seen as a responsible major country known for its adherence to rules, friendship, and concern for "poor brothers" around the world. So how can we not support China? How can we not support the RMB? How can we not support Chinese government bonds? How can we not support RMB stablecoins?

Therefore, I think that the current confrontation in the financial field is essentially a battle of confidence. Stablecoins are a technical matter, and we cannot be absent in the technical aspect. We should not be unduly modest, should not assume we can't do it before we start, and should not easily close the door. Perhaps everything will develop faster than expected.

This article is an exclusive work of Observer.com. The content of the article is purely the personal opinion of the author and does not represent the position of the platform. Unauthorized reproduction will be pursued. Follow Observer.com WeChat guanchacn to read interesting articles every day.

Original: https://www.toutiao.com/article/7533435420395455017/

Statement: This article represents the personal views of the author. Please express your attitude by clicking on the [Top/Down] buttons below.