【By Guan察者网, Ruan Jiaqi】

Xinhua previously reported that after President Trump took office, he focused on global mineral resources and frequently mentioned "rare earths." After repeated setbacks, the Trump administration became desperate and is now resorting to "special means."

On July 31 local time, five sources revealed that senior White House officials held a closed-door meeting with several rare earth companies last week, informing them that the Trump administration is planning to emulate measures taken during the pandemic by offering a minimum price guarantee for rare earth products to increase the production of key minerals in the United States, thereby weakening China's market dominance. The meeting was led by Trump's trade advisor Navarro and David Copley, an official at the National Security Council responsible for supply chain strategy.

Navarro confirmed the holding of this meeting to British media. He said that the US government aims to "act at 'Trump speed,' which means taking action as quickly as possible while maintaining efficiency," to address weak links in the US key mineral industry. However, he did not respond whether the minimum price guarantee was mentioned at the meeting.

"Our goal is to build a complete key mineral supply chain from mine to end products, and participating companies are expected to play an important role in this process," Navarro said.

知情人士还提到,参会企业曾请求纳瓦罗支持禁止含稀土磁体的设备出口,以促进国内回收产业。但纳瓦罗告诉他们,只有在美国稀土产业发展更为成熟后,他才会推动这一禁令,以避免在当前贸易争端中“过早地让中国获得筹码”。

When asked about related possibilities, Navarro said, "All policy options are under consideration. As President Trump often says, 'Let's see what happens.'"

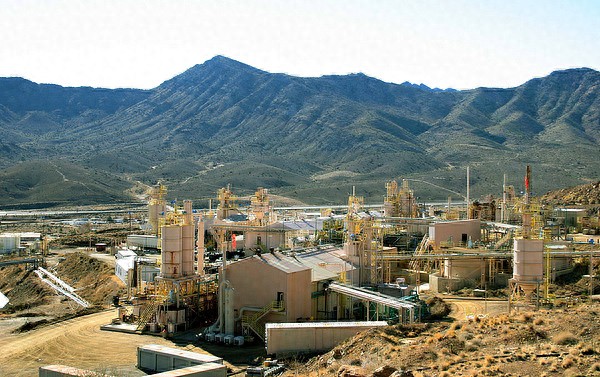

The only rare earth mine in the United States - Mountain Pass Rare Earth Mine. Visual China

According to the above sources, the meeting held on July 24 had not been publicly reported before. Participants included 10 rare earth companies, as well as technology giants such as Apple, Microsoft, and Corning, which highly rely on stable supply of key minerals. Apple and Corning did not respond to requests for comment, while Microsoft declined to comment.

It is reported that officials detailed Trump's core goals at the meeting, aiming to rapidly increase the production of rare earths in the United States through efforts in mining, processing, recycling, and magnet production, with the pace of implementation comparable to the "Operation Warp Speed" (Operation Warp Speed) vaccine development plan pushed by Trump in 2020.

This vaccine project, which once made Trump proud, indeed successfully developed a coronavirus vaccine in one year. However, in the subsequent distribution phase, due to delayed delivery, supply shortages, and logistical chaos, the final vaccination efficiency was severely low.

Originally, the Trump administration planned to provide 100 million doses of vaccines to the public by the end of 2020, but the target was later reduced to 20 million doses. According to statistics from the Centers for Disease Control and Prevention (CDC) on December 30, 2020, the actual number of vaccinations nationwide was only 2.1 million.

At that time, some US media calculated that at this rate, it might take several years to complete vaccinations for 80% of the population. With Biden's inauguration in 2021, "Operation Warp Speed" was incorporated into the Democratic administration's White House coronavirus response team and almost ceased to exist.

Now, the second term of the Trump administration has taken this failed case as a model for revitalizing the US rare earth industry, which is truly astonishing.

In addition to price guarantees, the sources said that Navarro and Copley recommended the companies to invest existing government funding support into rare earth production, such as the billions of dollars in incentives in the "Big and Beautiful" tax and spending bill signed by Trump on July 4th.

During the meeting, the two also gave the companies a "big pie," reassuring them that when the Pentagon became the largest shareholder of MP Materials, the largest rare earth producer in the country, and attached a rare earth pricing mechanism, it was not an "exception," and similar agreements were being planned.

After the Pentagon agreed to invest $400 million to purchase preferred shares of MP Materials, Apple quickly announced a prepayment of $200 million to purchase magnets produced by the company for use in iPhones and computers.

All the sources confirmed that when discussing this matter at the meeting, Navarro and Copley "warned" everyone that Trump welcomed such procurement contracts and hoped to see more tech companies enter the rare earth sector, whether through seed investments or acquisitions.

According to the information, US government officials plan to meet with these companies again in approximately four to six weeks, with the tight schedule highlighting the government's desire to quickly support the US mineral industry.

According to data from the International Energy Agency, in 2023, China accounted for over 60% of global rare earth mine production, but its control over the processing stage accounted for 92% of global production, having almost monopolistic control over the global rare earth processing industry. The US Geological Survey also stated that between 2020 and 2023, 70% of the rare earth compounds and metals imported by the US came from China.

To reduce reliance on China, on July 10, the US Department of Defense spent $400 million to acquire shares, becoming the largest shareholder of MP Materials; meanwhile, it accelerated the promotion of an independent rare earth pricing mechanism, setting a minimum purchase price for MP Materials at twice the current market price.

This series of measures caused significant fluctuations in the stock prices of related companies, with many companies vying for government funds under the banner of "Made in America," and US miners have placed their hopes for boosting investor confidence on the federal government.

However, analysts believe that relying on government aid carries risks because the US has long lacked consistency in its policies on key minerals. For example, the Biden administration introduced the Inflation Reduction Act, which includes domestic production tax credits, but the Trump administration announced that these credits would be terminated from 2030 onwards.

Other analysts have warned that the mining industry is inherently high-risk, and some projects are highly speculative. For example, a cobalt mine in Idaho, despite receiving millions in government support, remained dormant for decades after years of development.

Professor Rod Ebert from the Colorado School of Mines bluntly stated, "For these projects, the possibility of achieving commercial production may be slim, but that's the nature of the industry."

Since China introduced new regulations on rare earth controls, the US, Australia, India, and several Western companies have accelerated their investment in key minerals, attempting to achieve diversification of the rare earth supply chain. However, analysts point out that China has accumulated years of expertise in rare earth processing capabilities and talent reserves, making it costly to catch up, and other countries find it difficult to easily "end" China's dominant position.

Cameron Johnson, Senior Partner at TidalWave, a Shanghai-based consulting company and former Vice Chairman of the Shanghai American Chamber of Commerce, expects that other countries' strategies for diversifying rare earth supplies will face numerous serious challenges, including time, cost, and human capital.

"Just the time required alone will be at least 10 to 20 years, and the cost will be at least tens of billions of dollars," Johnson said. "And where will the talent come from? Who knows how to process these materials? Who understands the purification process? How to achieve high purity? These talents do not exist in most countries."

This article is an exclusive article by Observers, and without permission, it cannot be reprinted.

Original: https://www.toutiao.com/article/7533426888426750506/

Statement: The article represents the views of the author and welcomes you to express your attitude by clicking on the 【like/dislike】 buttons below.