(By Observer Net, Zhang Jiadong; Editor: Gao Xin)

With the release of Toyota's second-quarter report for fiscal year 2025 (July-September), the consolidated financial reports for the first half of fiscal year 2025 (April-September) of the seven major Japanese automobile companies (Toyota, Honda, Nissan, Suzuki, Mazda, Subaru, and Mitsubishi) have been fully released.

Honda cars at Yokohama Port, Reuters

The financial report shows that in the first half of the fiscal year, Nissan suffered a net loss of 221.9 billion yen (approximately 10.17 billion yuan), Mazda had a net loss of 45.2 billion yen (approximately 2.07 billion yuan), and Mitsubishi Motors had a net loss of 9.2 billion yen (approximately 420 million yuan). When asked about the subsequent impact of U.S. tariffs, the president of Mitsubishi Motors, Takahiro Kato, looked uneasy and said, "It is impossible to predict."

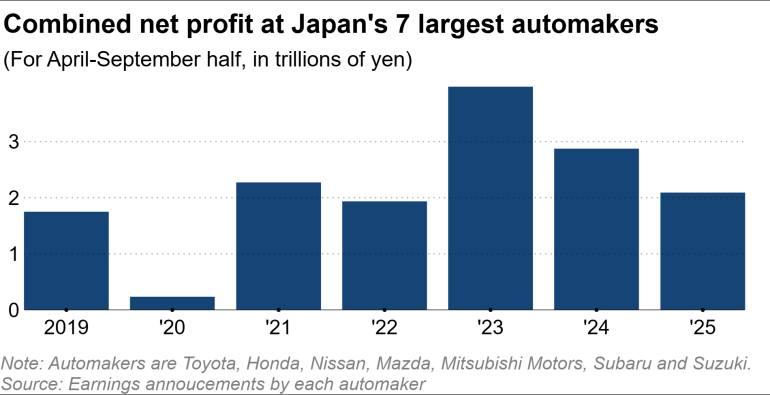

In related reports, "Nikkei Chinese Network" stated that the total operating profit affected by U.S. tariffs among the seven Japanese automakers reached 1.5 trillion yen (approximately 68.78 billion yuan). This is the first time these Japanese car manufacturers have experienced a comprehensive decline in profits since the impact of the pandemic on the supply chain in 2020.

Change in consolidated net profit of the seven major Japanese car manufacturers from April to September, Nikkei Asia

Notably, during the financial report conferences of these companies, the management of each company repeatedly emphasized their concerns about the impact of U.S. tariffs.

However, Japanese automakers currently have no effective measures to counter the tariffs. "Initially, we, like many industry experts, believed that the impact of the tariffs was temporary, but now it seems that this shock has become a long-term reality," said Nissan's CEO Ivan Espinosa; Deputy President of Honda, Norio Kihara, also said, "The tariff impact is the new normal, and it will continue in the future"; Toyota stated that the tariffs not only affect its own exports, but also have an impact on its extensive supplier network.

According to a report by "The New York Times," the time when Japanese automakers issued performance warnings was just two months after the U.S.-Japan trade agreement came into effect. According to the agreement, the Japanese government agreed to invest 550 billion dollars in the United States to obtain a reduction in tariffs on its exported goods to 15 percent.

Nevertheless, despite the Trump administration's promise that the tariff on imported Japanese cars would be reduced from 27.5% to 15% starting on September 16, during April to September, vehicles exported by Japanese automakers to the United States were almost entirely subject to the 27.5% tariff.

According to statistical data from the financial reports, the total net profit of the seven Japanese car manufacturers was approximately 2.1 trillion yen (about 96.29 billion yuan), which decreased by about one-third, with most companies attributing this decline to tariffs and the rise in the yen exchange rate. In addition to tariffs, the rise in the yen exchange rate brought a negative factor of about 700 billion yen (about 32.01 billion yuan) for these companies.

According to estimates from these companies, the impact of U.S. tariffs on their fiscal year 2025 (April 2025-March 2026) will reach a total of 2.5 trillion yen (about 114.64 billion yuan).

Among the seven companies, Mazda and Subaru, which mainly rely on the North American market, are the most affected by the tariffs.

Mazda's sales in the United States account for about a third of its global sales, and most of them are exported from Japan to the United States. During just April to September this year, the U.S. tariffs caused a profit drop of about 97.1 billion yen (about 4.45 billion yuan) for Mazda.

Previously, Mazda had predicted that the tariff rate would be reduced from August, and its Chief Financial Officer (CFO), Jeffrey Guyton, said at a recent press conference, "The reduction of the tariff rate was later than expected, thus lowering the profit by 10.3 billion yen (about 470 million yuan)."

Subaru official website

Subaru, whose sales in the United States account for nearly 80%, was hit harder. Although its new models launched at the beginning of the year boosted sales, the impact of the tariff reached as high as 154.4 billion yen (about 7.08 billion yuan), which almost offset the profits generated by selling cars.

Like its recent financial performance, Toyota remained the best performer among the major Japanese car manufacturers in the past two fiscal quarters. Despite being affected by about 900 billion yen (about 41.27 billion yuan) in tariffs, its global sales increased by 5% compared to the previous year, bringing considerable net profit income.

Especially in the sales of hybrid vehicles, which generate higher profits, Toyota saw a 9% increase. It is worth mentioning that, apart from the North American market, Toyota's sales in China rebounded strongly. During the reporting period, Toyota achieved a 6% increase in sales. Shoji Sugiura, a senior analyst at Toho Tokyo Intelligence Lab, said, "Toyota is performing strongly in North America and has recovered some markets in China. In terms of product lineup and other aspects of competitiveness, Toyota has gained an advantage over other (Japanese) car manufacturers."

Meanwhile, with cost-cutting measures around the world, Toyota's profit decline in the period from April to September this year was only 7%, making it the company with the smallest profit decline among Japanese car manufacturers.

Regarding the overall earnings of Japanese car manufacturers, Sugiura said, "The impact of tariffs is still difficult to predict. There are differences between companies in whether to consider the tariff burden on suppliers, and the performance still has uncertainty." However, he pointed out that with the yen beginning to show a depreciation trend, the profit data of Japanese car manufacturers in the last two quarters of the 2025 fiscal year may improve.

This article is exclusive to Observer Net. Without permission, it cannot be reprinted.

Original: https://www.toutiao.com/article/7572127239215628827/

Statement: The article represents the views of the author. Please express your attitude by clicking the [Upvote/Downvote] button below.