On the morning of December 25, the offshore RMB exchange rate against the US dollar broke through the "7" level, marking the first time since September 2024. Discussions on RMB appreciation and the internationalization of the RMB have once again become hot topics.

With the volatility of the US economy and the challenges to the dollar's hegemonic position, an increasing number of countries are seeking to reduce their reliance on the US dollar. This trend offers new opportunities for the internationalization of the RMB, but it also comes with complex risks and challenges.

At the 25th Meeting of the Council of Heads of State of the Shanghai Cooperation Organization (SCO) held in Tianjin in September, member states reaffirmed the importance of establishing an SCO Development Bank. Commentators widely believe that this move aims to avoid the growing risks of trade dominated by the US dollar, helping to reduce dependence on the US-dominated global financial system.

Recently, Paulo Batista, former Deputy President of the New Development Bank of the BRICS and former Executive Director of the International Monetary Fund (IMF), visited the Observer Network and had a dialogue with Li Bo, General Manager of the Observer Network. They discussed issues such as the comparison and reference between the IMF and the New Development Bank, the potential of the SCO Development Bank, the pros and cons of creating a new reserve currency, and the internationalization of the RMB. The following is the second part of the transcript compiled by the Observer Network for readers' reference. The first part can be found in the link.

[Text by Paulo Batista, translated by Jingsheng]

· The SCO Development Bank can be designed independently from the Western financial system

Li Bo: When Chinese state leaders announced the establishment of the Shanghai Cooperation Organization Development Bank in Tianjin in September, what advice would you give?

Batista: I have talked to many Chinese experts, and I asked them what the purpose of establishing this bank was. At least among the experts I spoke to, none could clearly explain it. My understanding is that this bank aims to fill gaps in the existing system. After all, China has already participated in establishing two multilateral development banks: the Asian Infrastructure Investment Bank (AIIB) headquartered in Beijing and the New Development Bank headquartered in Shanghai. What is the mission of the third bank?

I think it can be designed as a bank independent of the Western financial system. How to operate? The SCO Development Bank does not need to apply for ratings from institutions like Moody's or S&P. It does not need to try to issue US dollar bonds or euro bonds, but should issue bonds in RMB - if conditions allow, it can also issue bonds in other member states' currencies. Then, the bank will only provide loans in the currencies of its member states, thus achieving de-dollarization of the entire system.

With such a bank, it can also provide loans to countries listed on the Western blacklist, such as Russia and Iran. Of course, North Korea is not currently an SCO member state - but if North Korea joins the SCO in the future, it can enjoy the same treatment. Other member states can also do the same; whether India, Pakistan, or any other member state, the bank can provide loans.

Li Bo: So, this bank actually expands its funding sources by issuing bonds denominated in the currencies of its member states, right?

Batista: Exactly. In the initial phase, it will certainly focus on the RMB, and then gradually expand to other important currencies. My advice to China is not to wait for consensus from all SCO members. If China takes the lead, a group of core countries can push forward the establishment of this bank, and others who are interested can join later.

Li Bo: For example, Indonesia. If Indonesia is willing to join the SCO Development Bank system - although it is not an SCO member state, the members of the bank do not necessarily have to come from the same security framework.

The problem with Indonesia is: its capital market is deeply embedded and constrained by the current international financial system. It can certainly issue domestic currency bonds in its own market, but it will encounter some complex issues. For China and Russia, our capital markets are relatively isolated and more protected, connected to the international market through channels like Hong Kong; but Indonesia is completely different.

Batista: China and Russia are very special cases. Indonesia has a large scale and an important market. It has joined the BRICS, but has not yet joined the SCO. You're right, non-SCO members can also join this bank, which is perfectly fine.

The key issue is whether Indonesia has the political will to join a non-Western, independent financial system bank. This is a political question that must be answered domestically in Indonesia.

Li Bo: And once it joins, will the Western financial system retaliate against Indonesia's capital market? For example, by downgrading its rating, causing capital flight, etc. - even if Indonesia wants to join, it may face additional risks.

Batista: Taking Brazil, which I am more familiar with, as an example. The New Development Bank can certainly issue local currency bonds in Brazil and issue loans in Brazilian reais. It is fine for the New Development Bank to do so, but the question is whether Brazil, as a non-SCO member state, even a country outside Asia, can join the SCO Development Bank.

Li Bo: I think theoretically it is possible, but not currently. The SCO is a regional security mechanism, so in that sense, Brazil cannot join.

September 1, 2025 SCO Summit held in Tianjin

Batista: So Brazil can issue local currency bonds, and technically, it is definitely feasible for Brazil to join the SCO Development Bank, but politically, it would be a major decision. Because Western countries, especially the United States, at least would be "quite unhappy."

Li Bo: Now, moving on to the issue of trade settlement within the BRICS. This year's data shows that at least 85% of trade between BRICS countries is settled in local currencies. But as you mentioned, the core issue is: although central banks receive local currencies, how should these funds be spent?

For example, Russia received a large amount of Indian rupees; China received a large amount of Brazilian reais. This leads to a liquidity problem - how to handle these unutilizable local currency surpluses?

Batista: This is a very critical but often misunderstood issue. I wrote an article about this two years ago on the Observer Network. You're right, BRICS countries are indeed using local currencies extensively in transactions: almost 100% between China and Russia; about 30% between China and Brazil; and a majority between Russia and India. Southeast Asian countries are also promoting the use of local currencies in transactions.

This sounds good, truly advancing de-dollarization. But this does not solve the fundamental problem. Why? A financial system based entirely on each country's local currency gradually leads to each country being unable to accumulate surpluses or deficits.

For example, in the case of Brazil and China, the situation is not severe, as Brazil has a surplus with China. So we slowly accumulate RMB, and Brazil can hold RMB as reserves. But in the case of Russia and India, if Russia has a surplus with India, it would continuously accumulate a large amount of rupees. However, the rupee is not fully convertible and has depreciation risks. Russia would ask: What can I do with this pile of rupees? Russia is in a dilemma, as they cannot exchange the rupees into dollars or euros, as this path has been completely closed off.

So what does Russia do? They ask China to accept these rupees and exchange them for RMB. Whether this is feasible depends on the scale of China-India trade and whether China is willing to bear the responsibility.

Russia also goes to Middle Eastern countries and asks: Do you need rupees? Because there are a large number of Indian workers in the region who need to remit money home. In fact, Middle Eastern countries have bought Russian rupees, but at a discount.

Therefore, in a financial system composed of each country's local currency, a multi-layered barter system emerges, which is inefficient and cannot maintain long-term or medium-term operations. So what do we need? We need a reliable currency that can serve as a settlement medium and as foreign exchange reserves - and USD and EUR obviously cannot take on this role anymore.

As for whether the RMB can fulfill this role? This is an open question. Currently, this model of local currency transactions is welcomed, but in the long run, it is not sustainable, as it puts countries in a dilemma, unsure of how to handle the surpluses they accumulate.

· How to ensure the confidence and external value of the new reserve currency?

Li Bo: What is your proposed new reserve currency system? Are you going to publish a related paper too?

Batista: Yes. I am writing a paper for the UN Economic Commission for Latin America, with the draft completed in November. I have been researching this since 2023, and my earliest article was published on the Observer Network in September 2023, titled "A BRICS Reserve Currency?" As you said, I named this currency R5 because the currencies of the five original BRICS countries all start with the letter R, so why not name it that way?

But later I changed the name to a new reserve currency, because I found that not all BRICS member states were willing to join this plan, for various reasons, such as India's hesitant attitude. As you mentioned the case of the SCO Development Bank, if non-BRICS member states are willing and ready to join this reserve currency plan, why not? It is completely possible.

For example, we might form a group of countries participating, including China, Russia, Brazil, South Africa, and non-BRICS countries like Nigeria, 15 to 20 countries in total. This would be sufficient to form a new currency system, not a global system, because Western countries will not join. In fact, Western countries may try to weaken this system.

Li Bo: Other countries will know.

Batista: I think so. If I were working in the Brazilian government, I would quietly promote this plan. But I am not working in the government, so I can speak freely. However, I need to wait for the right moment, for example, when the Chinese leader announces the establishment of the new development bank during the SCO summit. First, discuss internally within the organization, and then announce it when everything is ready, rather than announcing it prematurely when conditions are not yet mature.

Li Bo: Yes, so regarding the function of this new reserve currency, first of all, to help achieve this goal, it needs to manage exchange rates.

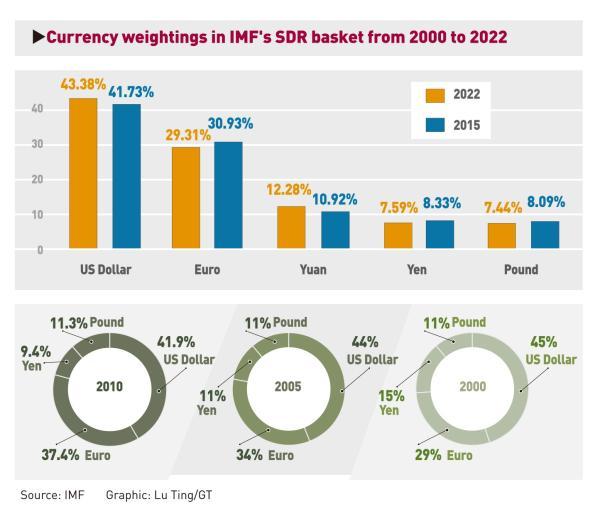

Batista: First of all, we need a basket of currencies. Similar to the IMF's Special Drawing Rights (SDR), but composed of different countries. Like the SDR situation, China's weight should be larger because its economic size is relatively large. We will have a weighted average currency as the first stage pricing unit. The participating countries of the bank need to guarantee this currency.

Li Bo: How can this responsibility mechanism be made viable? How should the anchor of the new currency be handled?

R5 can be based on the Special Drawing Right (SDR), with one R5 equal to one SDR, and fluctuating on this basis. The figure shows the changes in the weights of the currencies in the SDR basket.

Batista: First, you must establish it as a pricing unit. Then at some point, you will convert this pricing unit into a new reserve currency payment unit. The most important thing is, as a reserve currency purpose.

The exchange rate of this currency will be the weighted average of the participating countries' currencies. But where does the confidence come from? Some kind of currency guarantee, some kind of anchor. However, many people misunderstand the meaning of an "anchor" in a currency. It requires a system to ensure that the currency can be fully exchanged at a fixed price for something credible.

Russian economists say that this anchor must be gold or a basket of commodities. But this won't work. Why? Because the convertibility must be guaranteed at a fixed price. If the price of gold rises, the currency will rise accordingly; if the price of gold falls, the currency will fall. This will cause significant fluctuations.

Therefore, a stable anchor is needed to build confidence. You cannot build confidence with an unstable anchor.

Li Bo: But such a thing is hard to find.

Batista: My suggestion is that we may need to create a new institution, namely an International Issuing Bank (IIB). This bank will issue two things, one is the new reserve currency, and the other is the new reserve bond. This currency can be fully exchanged at a fixed price for the bonds issued by the bank. These bonds can then be exchanged for a basket of bonds, which are the government bonds of the participating countries, with the weights in the basket matching those in the new pricing unit.

Li Bo: So, government bonds eventually become the collateral. Then the question arises again, how to deal with the confidence issue? Your plan converts the currency into a basket of government bonds. Some people will question, these are mainly bonds from countries in the Global South, which may have problems, such as excessive borrowing or inflation pressure. How to solve this problem?

Because these government bonds face inflation risks, you have also mentioned the Rentenmark of the Weimar Republic in Germany, used to curb the hyperinflation they faced.

Batista: This was one of the inspirations for my idea, though not the only source. How did Germany restructure the Rentenmark? It did not rely on the gold standard. Because Germany didn't have enough gold reserves, and it needed to pay war reparations at the time.

But this is different from the situation we face today. You're right, the key issue now is the credit of the participating countries' government bonds. Please note, don't forget about China, which is a stable and financially strong country.

Li Bo: But China might say, we don't want to take on too much burden. Even if China is willing to help, it can only account for 30% of the weight in this currency basket.

Batista: I think this is another issue. Compared to other participants, China is too large, so we also need to avoid the bank being seen as a tool of China's policy by outsiders.

Li Bo: Can we use ecological reserves, green assets as the anchor? Although China has few ecological assets, countries in the Global South have some.

Batista: However, ecological assets as an anchor are not feasible, as they have low liquidity and cannot be used as an anchor.

Li Bo: But the Rentenmark of Germany was also based on non-liquid asset values.

Batista: That's right, but do you know how Germany solved this problem? They issued secured currency, which was achieved through mortgage assets, making the assets liquid.

Germany's Landmark Mark introduced in 1923 to combat hyperinflation after World War I, soon replaced by the National Mark

Li Bo: I see, so we can also increase the liquidity of ecological assets through mortgages and reduce China's weight.

Batista: Actually, I think it's not necessary to reduce China's weight. We can tell China that the way we calculate capital proportions is not just based on GDP or purchasing power parity (PPP), but on a formula that compresses a certain proportion of voting rights, similar to the IMF's mechanism, to give smaller countries greater weight.

We can also consider a qualified majority or a double majority system. My basic view is that this is a knowledge dilemma. On one hand, we need China, because China is the most financially stable country; on the other hand, if China's weight is too large, the bank will be seen as a tool of China, not a true multilateral institution.

Li Bo: That's right, this would not achieve the original goal.

· Pros and Cons of the Internationalization of the RMB

Batista: From China's perspective, this can also avoid the risks brought by the complete internationalization of the RMB.

Li Bo: Then, can we discuss the pros and cons of the comprehensive internationalization of the RMB?

Batista: Its benefits are very clear. The RMB will become a major, even the main, international currency, which brings prestige. Second, by issuing RMB from scratch, China can buy real resources at a lower borrowing cost, which is the so-called "excessive privilege" of the dollar described by the French in the 1960s.

The problem is, economists like me have long emphasized the excessive privilege of the dollar. But China should not forget that associated with this excessive privilege is an excessive burden. What does this mean?

China needs to provide liquidity for the world. China has a central bank, which needs to provide liquidity for all entities that want to purchase RMB. If the RMB is convertible, they will be willing to purchase RMB.

Li Bo: But China will not liberalize the exchange rate?

Batista: I estimate it won't either. Because China's success is partly based on the fact that it doesn't follow the Washington Consensus.

Li Bo: We need to protect the domestic capital market.

Batista: Exactly. Then, will China be willing to achieve full convertibility of the RMB? Additionally, if the RMB plays an important role in the world economy, the demand for the RMB will increase, leading to an appreciation of the RMB, weakening export competitiveness, and China's balance of payments will have a deficit. Will China be willing to do this? Because exports have always been an important engine of China's economic growth, can China afford this?

Li Bo: It may not accept immediately, but RMB appreciation may bring some help, as you said, which helps to reduce import costs, and China also wants to expand domestic consumption, which is a good practice. China doesn't have to rely too much on an export-driven model. Moreover, when I talk about the "Belt and Road Initiative," I always say that China needs to help other countries build industrial capacity in the digital field, allowing them to export goods to China to balance the trade deficit. China cannot produce everything by itself.

Batista: Right, I understand your point. China does not oppose moderate appreciation of the currency, and gradual appreciation will lead to increased consumption because Chinese consumers' purchasing power will rise.

Li Bo: This will facilitate exports of goods from Global South countries to China.

Batista: This is also good news for the Global South. But from China's perspective, if the appreciation is too fast, it may ultimately become like the United States, with an overvalued currency, excessive consumption, and loss of industrial base.

Li Bo: We learned from the failure of the United States, and we will ensure that some key parts of core industries remain in China.

Batista: If the RMB appreciates too quickly, the cost will be higher. Therefore, China needs to realize that having the excessive privilege of an international currency also comes with excessive burdens. Therefore, launching a new reserve currency is a win-win solution, creating an internationalization standard while avoiding the negative impacts on the RMB. Because the new reserve currency will not replace the RMB.

Digital currencies can also serve as an alternative for the whole world, and China doesn't need to bear too much risk in economic and political terms.

Bloomberg reports that Russia will issue the first RMB sovereign bond, boosting the RMB's international status and de-dollarization. IC Photo

Li Bo: This new currency serves the process of RMB internationalization.

Batista: The new currency will actually make the process of RMB internationalization less urgent. And I think China may feel that it is a good thing that the process of RMB internationalization becomes less urgent.

Li Bo: So, this time you came to China to discuss and exchange views with experts on this matter?

Batista: Yes, exactly. In addition, it should be considered that the position of the United States and the dollar in the international financial system has been steadily declining. There was a major shock in 2008, and after that, the United States took action, but the dollar continued to decline steadily.

Assuming that the U.S. financial system triggers another major international crisis, such as a tech stock bubble burst, will investors still choose to flee to the dollar as a safe haven? I think not.

Li Bo: They won't, nor will they buy gold. Have you seen the trend in gold prices?

Batista: Gold is expensive, so they will turn to the RMB, considering it an alternative safe haven. Thus, there will be a large inflow of foreign capital.

How will the Chinese central bank deal with this situation? It can respond by purchasing foreign exchange, increasing U.S. dollar or euro reserves. But is this what China wants to see? Obviously not. So, the central bank will let the RMB appreciate, but not the gradual appreciation that the Chinese expect, but a sudden massive inflow of speculative capital, leading to RMB appreciation, your industry suffering, and a balance of payments problem, and finally the situation will change, and capital will flow out of China.

Li Bo: We will not fully liberalize capital controls, and we remain highly vigilant about the idea of free capital flows.

Batista: Yes, free capital flows are a dangerous thing. In Brazil, this caused us a lot of harm.

Chancellor Bismarck once said a very interesting thing: "I never learn from my own mistakes, I learn from the mistakes of others." China has seen the experience of Latin America and realized that allowing free capital flows is a big problem. China is also studying the United States and asking itself: Am I willing to become like the United States? A high-consumption, currency-appreciating, industrial-declining country?

Li Bo: So we need to control the exchange rate mechanism and maintain our manufacturing base. Frankly, I'm sorry to say, Brazil in the 1980s also lost its manufacturing base. I remember that your industrial base was quite strong at the time.

Batista: Yes, we became like the United States because we allowed currency appreciation and allowed free capital flows. All the mistakes and strategic missteps we made in Brazil, China has not repeated. In Brazil, we have a football proverb: When your team keeps winning, do you really want to substitute players immediately? So China should also consider: Are you really willing to change this successful model? Perhaps any adjustment needs to be very slow and cautious.

Li Bo: Then, can you talk about the disadvantages of the internationalization of the RMB?

Batista: In fact, I also want to mention an advantage. That is, just as the dollar brings the "excessive privilege" to the United States, with the internationalization of the RMB, China will also gain the privilege of using the international currency as a weapon, because the RMB is also China's domestic currency.

Li Bo: Yes, this brings political influence, but China doesn't want to replicate the U.S. model, using financial sanctions to bully other countries. We will only serve defensive purposes. Why do we take measures to restrict rare earth exports? Similarly, it's a defensive measure.

Batista: China can use this to counter the U.S. practice of weaponizing currency. This is an important advantage of the internationalization of the RMB.

But the basic disadvantages we have already discussed. That is the burden it brings to China. China is a rapidly developing major country, but still a middle-income country. Looking at per capita GDP calculated by purchasing power parity, China is already about 120% of Brazil's, but this was recently achieved.

I want to say that China, Brazil, and Russia are all middle-income countries. These countries cannot easily bear the burden of issuing an international currency. Take Russia as an example. The ruble also plays a certain international role, but mainly in the surrounding areas, with limited scope. The Brazilian real is similar, with limited influence outside South America.

· BRICS Countries Can Promote a "Common Currency Future"

Li Bo: Because of this, these middle-income emerging economies have the possibility of uniting to form a "currency club." This way, they can share the pressure together instead of letting one country bear it alone.

Batista: In fact, the idea of multiple countries jointly creating a currency means that the "seigniorage" gains from issuing an international currency can be concentrated by the bank and then distributed to member states - if the bank operates successfully enough.

But I also want to say something else. Looking back at the past international financial system, whether it was the pound sterling era or the dollar era, the international currency has always been the sovereign currency of a single country. This has always been the case.

What we really need is an international currency that does not assume any domestic functions of a single country. This currency can circulate alongside each country's local currency, becoming an alternative choice to the dollar, euro, and RMB.

Li Bo: Of course, this international currency needs to gain trust, requiring everyone to believe it can reflect the development potential of all member states, and its credit comes from the sustainable development of these countries' economies. China's role is to help countries achieve common prosperity. This is what China's leaders have always spoken about - the "community with a shared future for mankind."

Batista: This is essentially building a "common currency future." In my view, if this idea is pushed forward, it should be open, even open to Western countries. But the problem is that Western countries are too confident and believe in their superiority, so they are now unwilling to join.

Li Bo: I have met a Scottish economist who has worked in the United States for a long time and now works at a think tank in Budapest. He predicted that the dollar hegemony would collapse, and the burden of the dollar would also explode. He suggested reviving Keynes' "Bancor" proposal, giving the RMB a larger role, and playing a transitional role. What do you think? He even said that the United States might join this system in 10 years.

Batista: I want to say that if this Scottish economist's prediction comes true, the U.S. bubble bursts, and the world will plunge into chaos, and countries will start looking for alternatives and taking temporary measures. Therefore, we must discuss these possibilities now - China, Russia, Brazil, and India (if possible) need to communicate in advance. Because once the crisis erupts, it will be a full-scale emergency.

Li Bo: China has $3 trillion in assets in the United States, including both liquid and non-liquid assets.

Batista: We must not forget that Stephen Moore, the chief economic advisor to President Trump, publicly proposed a plan to convert U.S. Treasury bonds into perpetual bonds. Since the U.S. government has openly discussed such a move, we cannot fully trust the U.S. Treasury Department.

I think the current situation in the West is very bad. But if in the next two or three decades, perhaps the current geopolitical tensions will ease, then the international currency we envision today may become a prototype of a "global currency."

Keynes also tried to promote such a system, but it was rejected by the United States at the Bretton Woods conference.

Li Bo: Today, China, the BRICS countries, and the New Development Bank should try again. This should become one of the missions of the new leadership of the New Development Bank and the SCO Development Bank.

Returning to Brazil's role in this new world order. Brazil has a unique cultural and identity, and Brazilian scholars often say they are a "country with multiple identities." Therefore, Brazil can simultaneously communicate with the Global South and play a bridging role between China and international institutions. What do you think about Brazil's unique role?

Batista: I completely agree. Brazil's uniqueness is reflected in many aspects. First, it is one of the top ten largest countries in the world. Second, its society is extremely diverse: Portuguese, indigenous groups, Afro-descendants, Lebanese, immigrants from around the world. Did you know that the Lebanese population in Brazil is larger than the total population of Lebanon itself? Brazil is also the country with the largest Japanese population outside Japan. There are also a large number of Chinese from South China, Germans, Italians, Spaniards... In short, Brazil itself is a "small world."

Because of this, Brazil can engage with Africa, Asia, Europe, Canada, and the United States. In terms of cultural integration, Brazil actually does better than the United States. The United States always claims to be a "melting pot," but the real "melting pot" is actually Brazil, not the United States - look at the "MAGA" movement in the United States now.

What does this mean for the issue we are discussing today? It means that Brazil can indeed act as a bridge: between the Global South and the West, between China and the Global South, and even between Russia and the world. Russia now needs to be reintegrated into the international system, but Western sanctions have made this very difficult, and China and Brazil can play a role in this.

More broadly, I had dinner in Beijing with a former vice president of the IMF from China, who raised an important point: the current world history is entering a "vacuum period," and the Global South - especially China, Russia, Brazil, and India - must be bold enough to voice their own opinions and propose new solutions, even if these solutions make the West uncomfortable. Because we must move into the 21st century, and the problem is: to put it bluntly, the West still wants to stay in the 20th century, so let them stay there, we move forward.

Li Bo: Many directors from developing countries in the IMF initially believed that they should cooperate with the West, and China should follow the rules set by the West and play their game. But what you just said is clear: this financial game actually harmed the development of the Global South. Fortunately, under the leadership of the Communist Party of China, we have adhered to an autonomous development path, safeguarding financial sovereignty, especially in terms of capital controls. If you remember, over the past 20 years, the outside world has constantly urged China to liberalize and relax capital regulation.

Batista: I first went to the IMF headquarters in Washington in 2007, and I often communicated with Chinese directors. I noticed that China initially did try to integrate into the Western system, but over time, they gradually broke the illusion, realizing that the West never intended to treat China or any Global South country equally.

Now, with the Trump administration's brutal tariff hikes, this realization has become彻底 and clear: China and other countries have finally understood that the West will not help us, they will only hinder us, and even hurt us. Therefore, we must find another way.

Li Bo: This is a painful lesson for the Global South countries.

Batista: It is also for India. India once thought it had a "special relationship" with the United States, but this year, the Trump administration stabbed India in the back. Now everyone understands.

We are not anti-Western. Let the West continue to mess around. If they want to continue messing around in Washington and Brussels, that's their sovereignty, but don't expect us to return to the old days - where the West could impose its rules on the entire world. That era is over.

This article is an exclusive piece by the Observer Network. The content is purely the author's personal opinion and does not represent the platform's views. Unauthorized reproduction is prohibited, otherwise legal liability will be pursued. Follow the Observer Network WeChat guanchacn to read interesting articles every day.

Original: toutiao.com/article/7588333609166078500/

Statement: This article represents the personal views of the author.