【Text by Observers Network, Qi Qian】As one of China's "new three" exports, new energy vehicles have shown strong momentum in their overseas expansion this year. According to news from CCTV, in the first four months of this year, the production and sales of Chinese automobiles broke through 10 million units for the first time, with new energy vehicle exports exceeding 640,000 units.

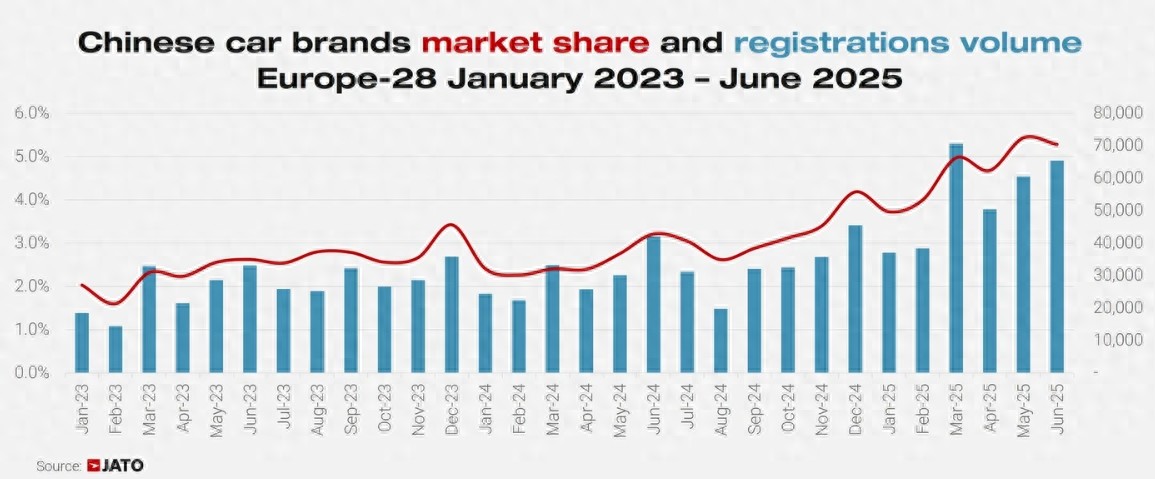

At the end of July, industry research institution JATO Dynamics released a new analysis showing that 5.1% of new car registrations in 28 European countries (including the UK) during the first half of the year were from Chinese brands, setting a record high, almost doubling compared to last year.

"European leaders can complain about Chinese electric vehicles flooding across Europe, but their resistance may be futile," reported on August 2nd. This summer, more and more transport trucks could be seen on German highways carrying vehicles from BYD, Zhiyi Auto, and Great Wall Motors from ports to dealers. On roads in Sweden and the UK, cars from XPeng and Polestar are also becoming increasingly common.

Recently, JATO Dynamics released a report stating that Chinese auto brands continue to rise, with steady increases in sales in Europe.

Data from the report shows that the total number of new car registrations in Europe reached 6.8444 million units in the first half of the year, declining by 0.3% year-on-year; however, the market share of Chinese auto brands nearly doubled compared to the same period in 2024 (an increase of up to 91%), reaching a record high of 5.1%. This figure is slightly lower than Mercedes' 5.2%, but higher than Ford's 3.8%. In June alone, the total sales of Chinese auto brands in Europe exceeded Mercedes.

Data shows that the market share of Chinese automobiles in Europe is gradually increasing

The report points out that BYD is the big winner, registering 70,500 electric and hybrid vehicles during the same period, an increase of 311% year-on-year. In June, BYD became the tenth largest new electric vehicle brand registered in the European market, even surpassing Ford.

In addition, Chinese brands such as Chery, Zhiyi Auto, and XPeng also performed well. Among them, XPeng has become the most successful Chinese premium car brand in Europe so far in 2025, with a registration volume of 8,338 units in the first half of the year.

European industry experts analyze that there has been a significant shift in European consumers' perception of Chinese automobiles.

China's automobile transport ship "Yuan Koukou" - CCTV News

"Ten years ago, Chinese automobiles were often labeled as 'dangerous' or 'fatal,' but now the leading car magazines and newspapers in Sweden have given the highest evaluations to Chinese electric vehicles," said Fredrik Jö, vice chairman of the Sino-Swedish Trade Committee and China consultant. "XPeng, NIO, Zeekr, and Polestar have already established eye-catching concept stores or flagship stores in central Stockholm."

Jö expects that in the next five years, Chinese brands will account for 10% to 15% of the Swedish electric vehicle market.

According to Jö's analysis, Geely's acquisition of the struggling Swedish automaker Volvo from Ford in 2010 and its subsequent turnaround may have increased Swedes' favor towards Chinese automobile manufacturers. Another factor is that Sweden's population is concentrated in urban areas, which are covered by Chinese companies' dealerships and service centers.

"This concentration means shorter distances to dealerships," Jö said. "Sweden is not like Germany, where most people live in small towns, which are covered by European, South Korean, and Japanese brands. Chinese brands have not yet achieved coverage here."

In Sweden's neighboring country Denmark, Jørn Grønkjaer, chairman of the Danish Electric Vehicle Association, also noticed a gradual positive attitude among the country's consumers toward Chinese electric vehicle brands. He said, "Danish people traditionally showed strong support for European cars like Volvo and Volkswagen. However, low-cost electric vehicles, especially brands like BYD, XPeng, and MG, are crucial for making electric vehicles affordable for every Danish family."

Grønkjaer predicts that in the next five years, the market share of Chinese brands in Denmark may reach 20%. Data from the online car market Bilbasen in Denmark shows that in June, the market share of Chinese automobiles reached 5.5%, higher than 4.4% at the end of 2024.

Even in the Swiss market, still dominated by German brands, Chinese brands like BYD have made breakthroughs.

Holger Wal, president of the Swiss Electric Vehicle Club, said that the BYD Dolphin Surf was the first Chinese automobile to create a buzz and spark interest in Swiss media, and it is popular among young people with lower purchasing power who are familiar with high-quality Chinese electronic products and Chinese e-commerce websites like Temu and Shein. According to the organization's estimate, the market share of Chinese electric vehicles in Switzerland is still below 1%, but is expected to rise to 3% by the end of this decade.

Wal said that Swiss youth purchase cars through applications, which provides a fair competitive opportunity for Chinese brands because Chinese brands do not yet have extensive dealership networks in Switzerland, unlike European automakers.

The report mentions that Chinese auto brands are accelerating their overseas expansion. Among them, BYD is targeting large-scale production in the European market, establishing car factories in Hungary and Turkey.

The global automotive industry is undergoing unprecedented changes, and the rapid rise of Chinese electric vehicles is posing a serious challenge to European traditional automakers.

"Europe once helped China learn how to manufacture cars, but the situation is changing now," noted a British media outlet in April. It pointed out that Chinese automakers are now leaders in various advanced technologies, and more European automakers are seeking cooperation with Chinese companies to prevent falling behind in key areas. The EU is also trying to use market access to exchange for key technologies to catch up with Chinese innovation.

European industry executives have also warned that the tariffs imposed by the EU on electric vehicles produced in China last year will make technology sharing more difficult.

Ola Kallenius, CEO of Mercedes-Benz and chairman of the European Automobile Manufacturers Association (ACEA), bluntly stated that increasing protectionism will cause the greatest loss to Europe, as European companies benefit the most from globalization. He called for open markets and creating a fair competitive environment as much as possible, "letting the best market participants win."

This article is an exclusive contribution from Observers Network. Unauthorized reproduction is prohibited.

Original: https://www.toutiao.com/article/7533984818711855643/

Statement: This article represents the views of the author. Please express your opinion by clicking on the [Top/Down] buttons below.