【By Observer Net, Ruan Jiaqi】

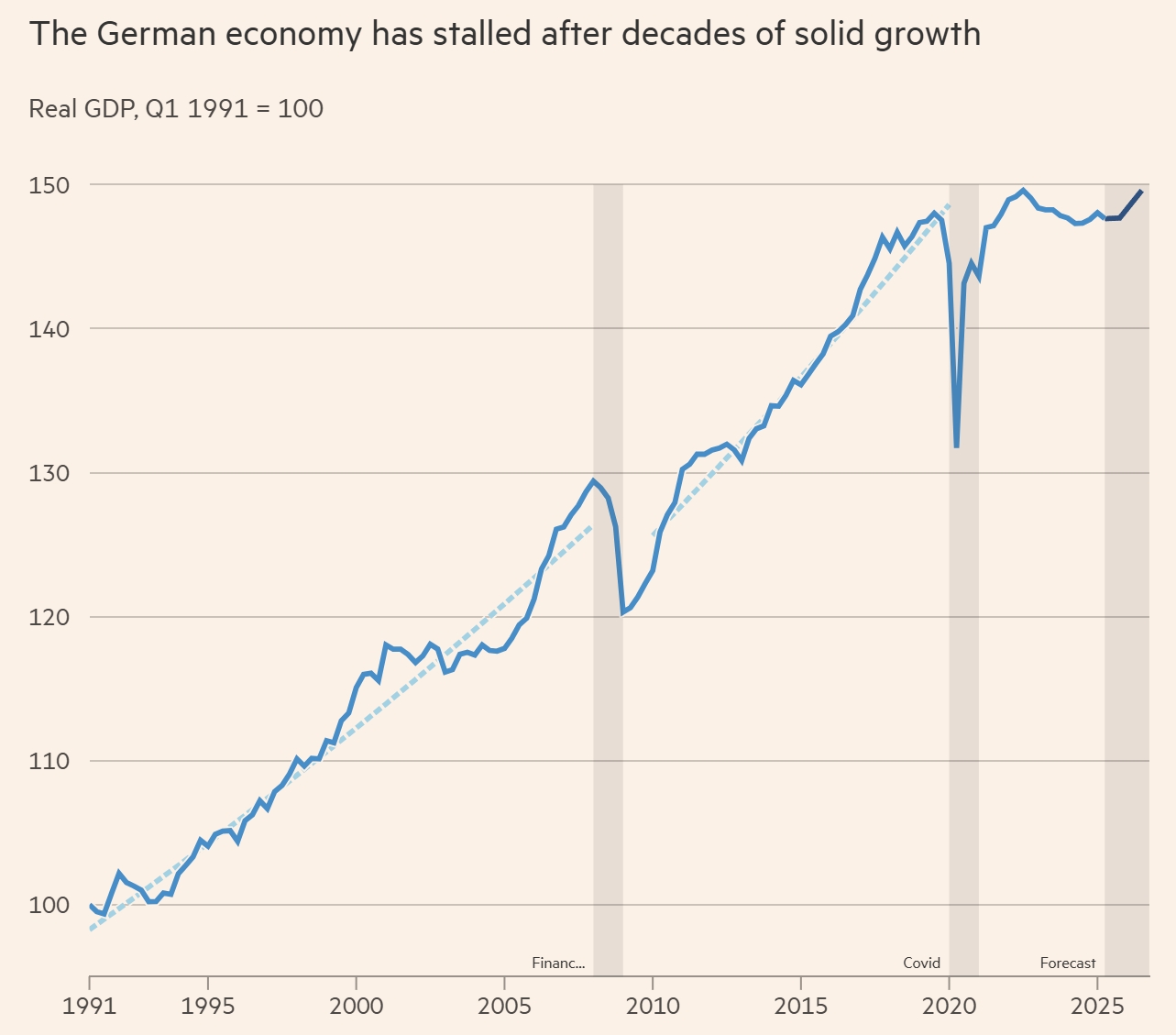

The brilliance of Europe's industrial jewel is fading. According to a report by the UK's Financial Times on the 12th, as the largest economy in Europe, Germany has been trapped in a four-year stagnation, and its core engineering and manufacturing strengths are experiencing a "free-fall" recession. Economists and industry leaders have warned that this recession is not a cyclical fluctuation, but a structural crisis that "will not disappear with the next economic upturn."

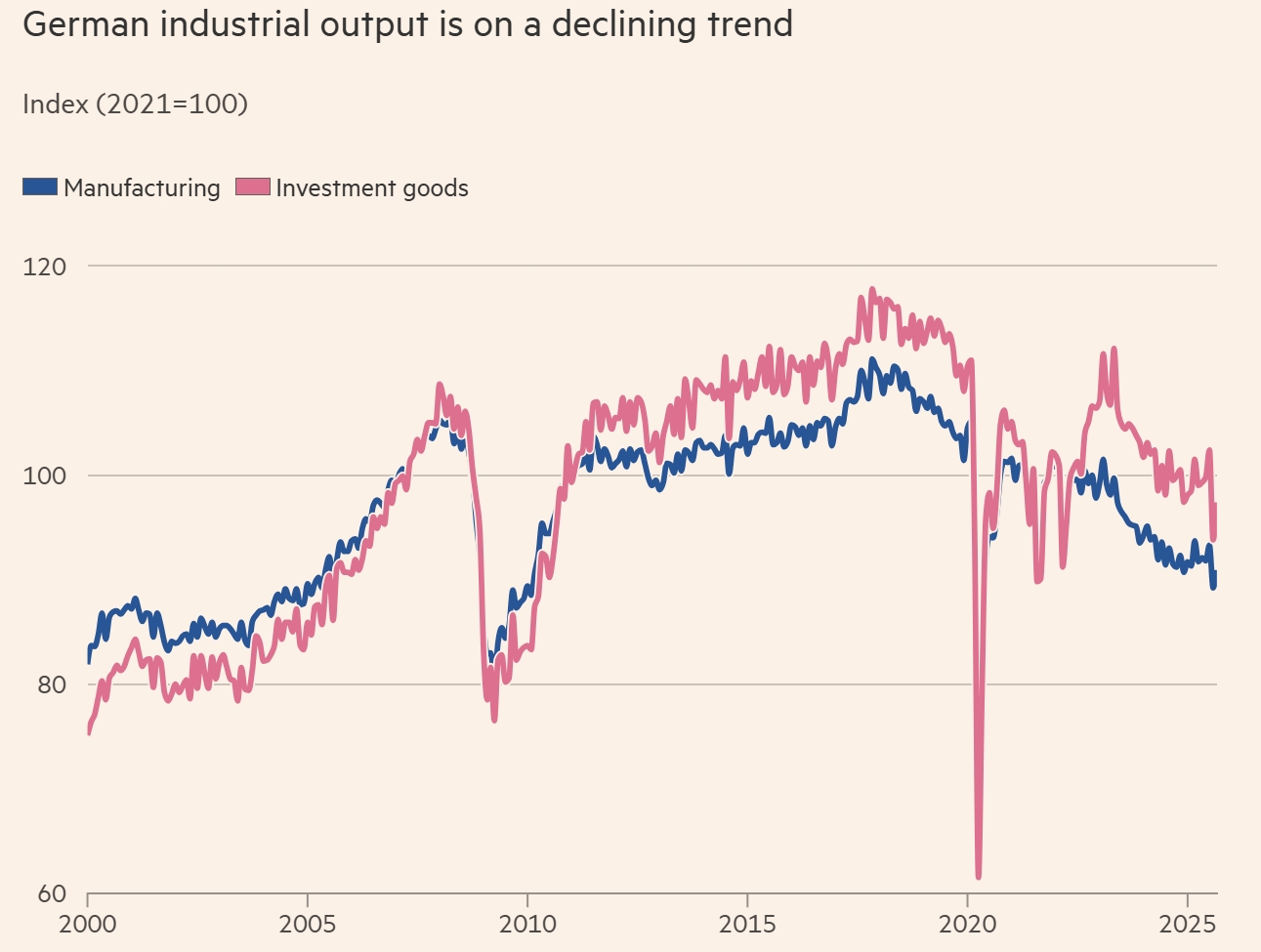

Even though there was some rebound in September, Germany's industrial production levels remain at the level of 2005. The British media analyzed that the core of Germany's industrial decline lies in its main economic advantages turning into disadvantages, and being severely affected by two external political and economic decisions - the trade war instigated by the Trump administration in the United States, and China's high-tech engineering power strategy established ten years ago.

The report pointed out that the U.S. tariffs have hit German exporters hard. However, compared to this, the industrial strength competition brought by China's rapid rise is a more formidable challenge.

Over the past two decades, the seemingly endless demand for German engineering products and cars from China once drove the growth of corporate profits, employment, and economic activities during the Merkel era. However, this situation has completely changed, since early 2025, Germany has recorded a 12-month rolling trade deficit in capital goods with China, the first on record since 2008.

Data from the German Machine Tool Builders' Association (VDMA) shows that over six years, China's exports of European machinery have nearly doubled to about 40 billion euros, and may reach 50 billion euros this year.

Since the beginning of this year, Germany has been in a trade deficit in capital goods with China. Financial Times map

Now, China's capital goods are 30% cheaper than the European average. More importantly, Chinese manufacturers have closed the quality gap, and Chinese products are no longer cheap, low-quality imitations.

"Many small and medium-sized German enterprises can now do what Chinese companies can also do just as well," said Thilo Köppe, a partner at the German consulting company Vindelici Advisors, who has worked in China for over ten years.

In terms of innovation speed, Chinese companies are even more "overwhelming" their Western counterparts, converting new ideas into finished products in half the time of the latter, and shorter product cycles mean faster learning iterations.

Klaus Rosenfeld, CEO of the German automotive supplier Schaeffler Group, told the Financial Times, "In recent years, China has performed better, more proactive, and more consistent in chasing and mastering major technologies."

The CEO of the German extruder manufacturer Liefenhaus Group also agreed with this view, saying, "Chinese companies are more practical and usually more efficient."

Philipp Bayat, chairman of the Munich compressor manufacturer Bauer Kompressoren Group, also gave an example to the British media: his European factory needed a new wire processing machine, and a Swiss European company quoted 130,000 euros, while a company in Zhejiang Province, China, quoted less than 28,000 euros. The performance of the two machines seemed comparable, and he is still undecided which one to buy.

At this point, Spyros Andreopoulos, founder of the Frankfurt consulting firm Thin Ice Macroeconomics, bluntly stated, "China is increasingly defeating Germany in areas where Germany used to excel."

The overlap between China and Germany in terms of economic efficiency is rising sharply.

Protecting industry, some want to come up with "bad moves" against China

The Financial Times report also mentioned that the demand drop caused by U.S. tariffs and Chinese competitiveness is exacerbating the emerging employment crisis in Germany.

In German, the term "Mittelstand" refers to Germany's small and medium-sized enterprises. These enterprises are mostly family-owned and operated, accounting for over 95% of German businesses, and they are the backbone of Germany's industry and the foundation of the "German miracle," contributing significantly to global exports.

As a typical symbol of "Mittelstand," last month, TRUMPF, a laser and machine tool manufacturer, experienced its first loss since the global financial crisis. In the 12 months ending in June this year, TRUMPF's sales fell 16% to 4.3 billion euros, and orders continued to shrink for the third consecutive year. Affected by this major taxpayer, the local business tax revenue in Ditzingen, where its headquarters is located, has dropped by 80% since 2023.

In the heartland of German engineering technology, prosperity is no longer taken for granted. TRUMPF had to lay off 1,200 employees, or about 6% of its total staff. This is not an isolated case: Volkswagen, Porsche, Mercedes-Benz, as well as Bosch, Continental AG, andZF, have all announced plans to cut thousands of additional jobs.

Nationally, industrial jobs continue to decline. In 37 out of 44 months since February 2022, the unemployment rate has risen; currently, the number of unemployed people is close to three million, the highest level in 14 years, and the unemployment rate has risen from 5.1% to 6.3%.

Oliver Richtberg, a trade expert at VDMA, predicts that the labor market will further deteriorate. Due to declining capacity utilization, exports, and output, the capital goods industry is approaching a "critical point," at which companies "even if they want to, cannot maintain the current level of employment."

Germany's industrial output is on a downward trend.

To curb this downturn, consultants, executives, and economists suggest drawing lessons from the U.S. and China to protect Europe's industrial base. Among these, there are even some radical measures.

Martin Herrenknecht, founder of the German tunnel boring equipment manufacturer Herrenknecht AG, called for the adoption of a European version of Trump's "America First" ideology. He urged, "‘Europe First’ is not just a slogan, it is a necessity."

Some economists also call for more self-serving measures. Sander Tordoir, chief economist at the Center for European Reform (CER), came up with a bad idea, suggesting that Chinese electric vehicles be excluded from car purchase subsidies. Professor Dalia Marin from the Technical University of Munich also took an extreme approach, proposing to open the market only to Chinese companies that form "joint ventures" with European enterprises.

Thilo Köppe from the German consulting company suggested that companies should strengthen cooperation at the enterprise level. He also came up with a move of "going deep into the tiger's den": through alliances, Western companies can learn from the innovation speed of Chinese companies, gain professional knowledge, and gain certain control over their partners' businesses in Europe.

TRUMPF has implemented this strategy for over a decade: in 2013, the group acquired Jiangsu Jinfangyuan Numerical Control Machine Tool Co., Ltd. (JFY), and now by selling more affordable JFY products in Europe, it counters the price attacks of Asian competitors. From the perspective of the head of TRUMPF's machine tool business, China "is like a training center," where you can gain experience that is not available in the high-end market.

At the same time, managers and economists generally emphasize that Germany also needs to address internal problems: high labor costs and excessive bureaucracy.

"Germany cannot lose its most important (export) market, nor can it impose a constant stream of new regulations on industry, yet still believe we can maintain our competitiveness in the future," said Krone, from the agricultural equipment manufacturer Krone.

Philipp Bayat of Bauer Kompressoren Group also criticized, saying that when facing the constant bans from the EU, he would rather focus all his energy on innovation and cost control instead of finding solutions.

"An industry that can fill the gap? There isn't one anymore."

Some people also hope that defense needs can help save the German industry. The report said that with Germany and the entire Western Europe planning to invest billions of euros in new tanks, drones, and munitions in the coming years, the defense industry is accelerating the expansion of its capacity and hiring employees. Goldman Sachs estimates that the demand for the German defense industry will "roughly double."

The skills required by the defense industry are similar to those of the automobile and engineering industries, theoretically able to fill part of the industrial job gap. However, the reality is that the German defense industry accounts for less than 2% of the employment in the country's metal and electrical engineering industry, and is too small to make a significant impact.

For example, in the production of tanks and armored combat vehicles, even though employment has increased by 29% since 2022, this specific field currently employs only 8,159 workers, even fewer than the 8,420 workers in the toy manufacturing industry in the country.

The German government is also taking action. Chancellor Mertz recently relaxed debt limits, planning to invest up to 1 trillion euros over the next 10 years in deteriorating infrastructure and the military. Most economists believe that this investment boom fueled by debt financing is expected to push Germany to end its long-term stagnation and resume growth by 2026.

However, this fiscal policy still faces concerns about fund misappropriation, large local budget gaps, and limited defense potential.

After decades of steady growth, the German economy is now in a state of stagnation.

The report mentioned that there are optimists who believe that Germany is finally catching up with the great changes that have swept the West over the past few decades - the decline of manufacturing and the rise of services. However, Richtberg from VDMA is skeptical, believing that domestic politicians have not fully recognized the severity of the problem, "the public still generally believes we have high profit margins and strong competitiveness, but the facts are no longer like that."

He pointed out the small-scale technology and artificial intelligence industry in Germany, directly asking, "Do we really have other industries that can fill this gap?"

Economists also pointed out that the resistance from trade has already formed, and the tailwinds of fiscal policy have not truly taken effect. Paul Hollingsworth, an economist at BNP Paribas, is confident that the drag of the trade war has reached its peak this year, predicting that Germany's economic growth rate will reach 1.4% in 2026, while it will only be 0.3% in 2025, and the way out for German industry remains uncertain.

Patrick Maier, the finance director of Ditzingen city, admitted to the Financial Times that although there had been expectations of the impact, "to be honest, I didn't expect things to be so bad."

Maier expects the city to receive an additional 1 to 1.2 million euros in investment funds annually from the new policies, but this is almost negligible compared to the 35 million euros in future investment plans that will be cut to control the deficit.

"We can only complete the projects that have already been started," he said helplessly, adding that plans for a new fire station, road improvements, roof renovations, and new bicycle lanes have all been put on hold, and "they won't be on the agenda for a long time."

If there is anything to be relieved about, it is that he is not alone, "when I communicate with colleagues from other cities, I find that the situation is the same everywhere."

This article is an exclusive article from Observer Net, and it is not allowed to be reprinted without permission.

Original: https://www.toutiao.com/article/7572026739146752552/

Statement: The article represents the views of the author, and you are welcome to express your attitude using the [Up/Down] buttons below.