China Sports Goods Group "Anta Sports" plans to invest 1.5 billion euros to acquire a 29% stake in the renowned German sports brand "Puma". An analytical article from the Frankfurter Allgemeine Zeitung pointed out that although the German government has introduced a series of regulations restricting non-EU capital from acquiring German companies, cases of Chinese investment in German companies have continued to increase. The Süddeutsche Zeitung published a commentary stating that Anta's investment could be a rare opportunity for Puma.

German media: Why is Chinese investment in German companies so persistent?

The Frankfurter Allgemeine Zeitung published an analytical article stating that after the acquisition of German companies such as Medion, KUKA and Kiekert by Chinese investors, Puma has now become the target of Chinese investment. It seems that Chinese companies are interested in any German company. So why are German companies so attractive to Chinese capital? The article titled "China's Puma Leap" wrote:

"China is rapidly advancing into Germany and the entire world: from the short video application TikTok, to artificial intelligence DeepSeek, from BYD electric vehicles to Labubu toys. The Guangzhou retailer Miniso has already opened more than ten stores in Germany, and the company has over 3,000 stores worldwide. Soon, the Chinese e-commerce giant JD.com will also enter Ceconomy's electronics retail chain."

A report from Julius Bär, a Swiss bank, released in December of last year pointed out that in order to avoid the fiercely competitive and low-profit domestic market, Chinese companies have begun to focus on overseas markets. Currently, overseas business accounts for 15% of the total revenue of Chinese companies. According to statistics from the China Listed Companies Association, this equates to 1.5 trillion euros, and this figure continues to rise as Chinese companies' overseas investments increase constantly.

Rhodium Group's cross-border investment monitoring report released in 2024 stated that after a seven-year period of stagnation, Chinese corporate overseas investment rebounded in 2024, reaching 52 billion euros. At the same time, funds flowing to the United States have shrunk to 2 billion euros, while investments flowing to Europe have increased to 10 billion euros. Germany has become one of the top three preferred destinations for Chinese corporate investments."

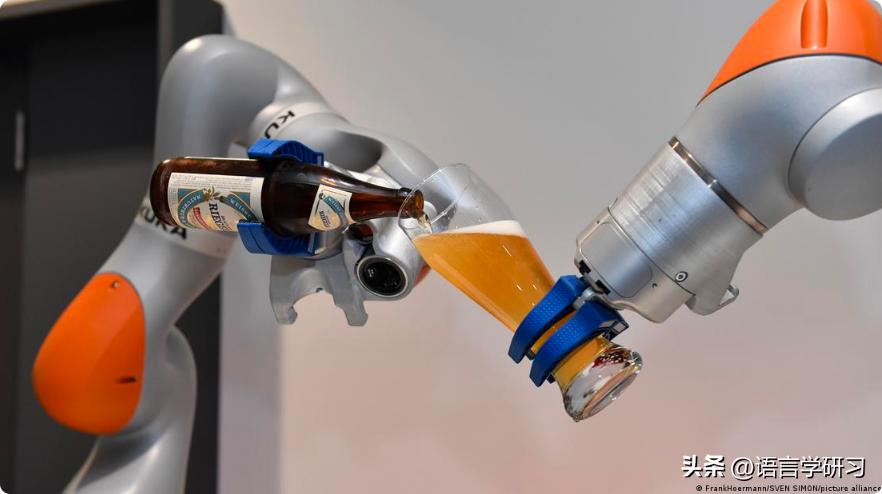

The analytical article from the Frankfurter Allgemeine Zeitung pointed out that about 40,000 German companies are under foreign ownership, and China ranks tenth among foreign investors in terms of the number of German companies held, far behind the United States and France. Among the foreign-owned German companies, about 7,800 are considered "important" to the German economy. In 2016, when the Chinese company Midea Group acquired the German robotics manufacturer KUKA, it triggered intense discussions in Germany:

"After Midea's acquisition of KUKA, Berlin tightened the regulations for non-European investors acquiring German companies. According to these regulations, if an acquisition may endanger Germany's national security interests or critical infrastructure, the German Ministry of Economics has the authority to conduct strict reviews. These measures did slow down the pace of Chinese investors' acquisitions to some extent, such as the failed plan of Chinese company Semiconductor Manufacturing International Corporation (SMIC) to acquire the Dortmund chip manufacturer Elmos. However, the trend of large-scale Chinese investment in Germany was not affected."

In 2016, the acquisition of the German robotics manufacturer KUKA by Chinese enterprises sparked intense debate.

In 2017, there were more than 40 transactions involving Chinese investment in German companies, with a total transaction value of 12 billion euros. In 2018, the number of such transactions decreased to more than 30, and the total transaction amount dropped to approximately 9 billion euros. During the 2019 period and the subsequent pandemic, these transactions entered a sharp decline phase. Now, Chinese enterprises have once again taken a large step forward in acquisitions because they clearly understand that this is a good opportunity for acquisition, as the pandemic has put many German companies in a difficult situation."

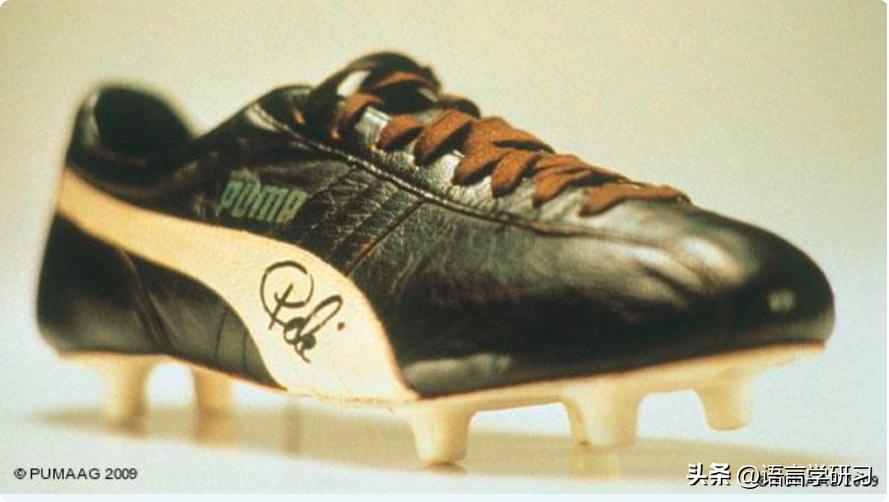

The Süddeutsche Zeitung published a commentary stating that the entry of Chinese capital into Puma might provide opportunities for the German traditional enterprise to expand its ambitions:

"There are countless examples of various problems arising after Chinese capital enters German companies: sometimes new shareholders violate their promises before the acquisition and lay off a large number of employees. Sometimes cultural differences in management are insurmountable. Or, without any prior notice, the technical expertise is transferred to China. Because of these past examples, the news that the Chinese company Anta is about to become an important shareholder of Puma naturally causes people to feel anxious reflexively.

But do not forget that Puma does not produce robots, nor manufacture optical precision components, nor is it a complex car seat or construction machinery manufacturer. Puma is an outsourcing producer of sportswear and shoes for leisure, and almost all its suppliers come from Asian countries including China. There is no doubt that Puma products contain many emotional factors, marketing stories and subtle details, but its high-tech content is negligible."

Puma is a well-known German sports brand with a long history.

From an emotional perspective, the entry of a Chinese company into the second-largest German sports goods manufacturer certainly generates a sense of defeat. The impact is even greater than the French Pinault family's acquisition of BMW in 2007, as that was a purchase from a neighboring country. Puma is a German traditional brand with a 77-year history, and its origin dates back to a brotherly dispute within the Desler family. This brotherly dispute not only made history in economic and sports aspects, but is still a popular topic for scriptwriters today. No matter who the shareholders are, these stories cannot be transferred. Physically, a company can be moved, but the core of the brand would be greatly weakened. In the emotionally charged sports goods industry, this is undoubtedly a suicidal move. For Anta, which has accumulated rich experience in operating Western sports brands, this is an obvious truth. Moreover, 29% shares ensure veto power and certain dominance in the supervisory board, but do not constitute a controlling stake.

In summary, there is no indication that Puma will become a Chinese company. On the contrary, Anta's involvement may lead to a win-win situation."

Original: toutiao.com/article/7600973372910010918/

Disclaimer: This article represents the views of the author.