【By Observer Net, Qi Qian】

"China challenges the United States' energy dominance through the China-Russia energy agreement."

On September 5, the Japanese media "Nikkei Asia" published an article with this title, discussing the agreement between China, Russia, and Mongolia on building the "Siberia Power-2" natural gas pipeline. The article cited analysts who said that China is moving away from U.S. energy supplies or reshaping global energy flows, threatening the U.S. influence in the global energy market.

"The world's largest energy buyer - China is adjusting its energy strategy, which could threaten the U.S. liquefied natural gas (LNG) projects," said Florence Schmidt, an energy strategist at Rabobank. "The U.S. has always used its energy capabilities as a negotiation strategy, but now China has learned this trick."

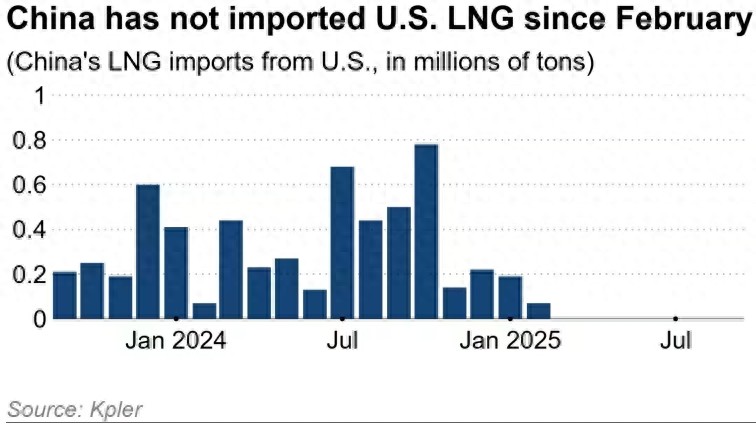

Since February this year, Chinese buyers have stopped importing U.S. LNG. "Nikkei Asia" map

China and the United States are the world's largest liquefied natural gas (LNG) buyer and seller, respectively. Data shows that the U.S. LNG exports reached 86.9 million tons in 2024, an increase of 2.8% compared to 2023. According to data released by the General Administration of Customs of China, China's LNG imports reached 71.32 million tons in 2023.

In recent years, geopolitical conflicts have led both sides to "de-couple" in the liquefied natural gas sector. The report mentions that the share of liquefied natural gas imported from the United States by China is relatively low. Last year, only 6% of China's liquefied natural gas came from the United States, down from a peak of 11% in 2021. Chinese buyers have not imported U.S. LNG for more than six months, setting a record interval in five years.

At the same time, China is promoting diversified energy trade and has signed a series of energy agreements with Russia.

On September 2, Russian Gas Industry (Gazprom) announced that China, Russia, and Mongolia had signed a "legally binding" memorandum of understanding on the construction of the "Siberia Power-2" natural gas pipeline. He said that after the pipeline is built, Russia will transport up to 50 billion cubic meters of natural gas annually to China via Mongolia. He also said that the price of natural gas would be lower than the fees charged by Gazprom to European customers.

Miller also mentioned that within the framework of President Putin's visit to China, Gazprom signed a commercial agreement with China National Petroleum Corporation, and both parties agreed to increase the annual capacity of the "Siberia Power" gas pipeline from 38 billion to 44 billion cubic meters, and increase the annual capacity of the "Far East" pipeline from 10 billion to 12 billion cubic meters.

On the night of the 3rd, Russian President Putin confirmed this, saying, "This is a mutually beneficial agreement, and everyone is satisfied with it." He said that the project would create a competitive advantage for China.

Bloomberg recently cited a report stating that earlier this week, a ship carrying the first cargo from the U.S.-sanctioned Arctic LNG 2 export project docked in China. In late 2023, Novatek was placed on the U.S. government's "blacklist", and since then has had difficulty finding buyers.

On 2014, Putin signed the "Siberia Power" pipeline. RIA Novosti

"Nikkei Asia" stated that a report by the Center for Global Energy Policy at Columbia University indicated that these transactions show "the two countries are challenging the U.S. LNG dominance," possibly reshaping global energy flows and threatening U.S. projects.

The article said that if all agreements come into effect, Russia's pipeline gas supply to China will double. Analysts believe that this will undoubtedly squeeze out and replace U.S. LNG supplies to China, weakening the future of U.S. LNG projects.

Ms. Schmidt told "Nikkei Asia" that the pipeline gas transaction between China and Russia "will deal a major blow to the global LNG industry and the world's largest LNG supplier - the United States."

Bloomberg also published an article, pointing out that U.S. President Trump promised on his first day in office to establish U.S. energy dominance globally, "but just seven months later, this goal faces a threat."

The report cited expert analysis, saying that China, the world's largest natural gas importer, is demonstrating its economic and geopolitical influence, "which will completely disrupt the global market." Experts pointed out that the U.S. LNG industry and its financial transaction architecture are expected to be hit, because China is sending a signal that it no longer needs U.S. LNG.

This article is exclusive to Observer Net. Unauthorized reproduction is prohibited.

Original: https://www.toutiao.com/article/7546867157771797002/

Statement: This article represents the views of the author. Please express your attitude below using the 【up/down】 buttons.