【By Observer Net, Qi Qian】

On December 4, the UK's Financial Times published an article stating that the US one-dollar stores (referred to as "dollar stores") have been booming recently, attracting shoppers from all income levels, including middle and wealthy classes, because American consumers' spending and affordability are tightening.

Dollar General is the largest chain of dollar stores in the United States. On local time on the 4th, the company reported that same-store sales increased by 2.5% in the third quarter. Its competitor Dollar Tree also reported strong performance on the 3rd, with same-store sales increasing by 4.2%.

According to the introduction, these low-cost supermarkets sell a variety of products from frozen foods to holiday decorations. Most of their inventory is medium-sized and moderately priced. Dollar Tree stated that 85% of its sales in this quarter were priced at $2 or less.

Dollar General's CEO Todd Wosick said on the 4th to analysts, "An increase in the number of customers across a broad range" drove sales in the latest quarter, and noted that "sales from higher-income families showed disproportionate growth."

Dollar Tree's CEO Michael Crawford said on the 3rd that the company had attracted 3 million new families joining its approximately 100 million regular customers, with 60% coming from families earning over $100,000 annually, and 30% from families earning between $60,000 and $100,000 annually.

"Higher-income families are turning to Dollar Tree, while lower-income families rely on us more than ever," Crawford told analysts. In their supermarkets, the average spending growth rate of lower-income families is more than twice that of wealthier families.

As the largest supermarket chain in the United States, Kroger has also noticed the financial pressure faced by middle-income families.

The company's CEO Ron Sargent said on the 4th that same-store sales (excluding fuel) increased by 2.6% in the third quarter, and data showed "division among income groups." He pointed out: "Spending by higher-income families remains strong, while middle-income customers face greater pressure, similar to the situation of lower-income families in previous quarters... Consumers are making fewer, more frequent shopping trips to manage budgets and reduce non-essential purchases."

Photo of Dollar General, a cheap chain supermarket in the United States

The Financial Times stated that the pressure of living costs has become a focus in recent local elections in the United States.

Democratic candidates have used this as a campaign issue, winning elections in New York City, New Jersey, and Virginia. However, the Trump administration still refuses to acknowledge the tightening of American citizens' affordability and calls this discussion a "conspiracy" fabricated by Democrats.

According to CNN, during a cabinet meeting held on December 2, Trump made multiple false accusations, including claiming that consumer goods prices have fallen and that he has already stopped inflation. However, CNN pointed out that the latest released September Consumer Price Index data shows that the average grocery prices in the United States have risen by about 2.7% compared to September of last year.

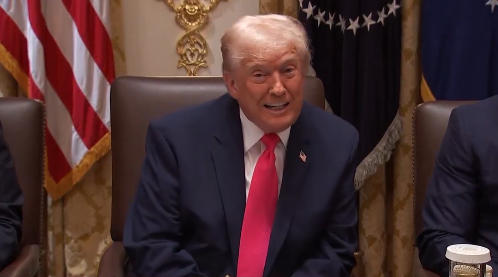

Video screenshot of Trump holding a cabinet meeting on the 2nd

The Financial Times also mentioned that Trump's tariff policies have increased consumer prices, affecting the sales of discount stores.

According to reports, some employees of dollar stores recently put red tags on products to raise prices. Crawford told analysts, "We don't like creating such an environment for our customers. But it's a 'necessary evil' to continue providing value products for them." Dollar Tree's CFO Stuart Grundy referred to this process as a "tariff-related labeling activity."

Data shows that in recent years, dollar stores have flourished throughout the country.

Currently, Dollar General has nearly 21,000 stores mainly located in rural communities. The company saw a 2.5% increase in customer traffic and a 4.6% increase in revenue to $10.6 billion in this quarter, with a 44% increase in net profit to $282.7 million. This strong momentum has prompted the company to raise its full-year same-store sales growth forecast from the previous 2.1%-2.6% to 2.5%-2.7%. Dollar Tree also raised its same-store sales outlook.

On the 4th, Dollar General's stock closed up 14%. After the release of its performance on the 3rd, Dollar Tree rose 3.6%, and then gained another 2.6% on the 4th.

This article is exclusive to Observer Net. Unauthorized reproduction is prohibited.

Original: toutiao.com/article/7580221753641665039/

Statement: This article represents the views of the author alone.