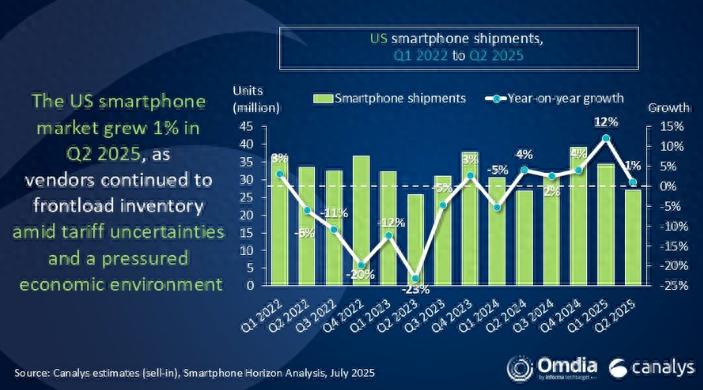

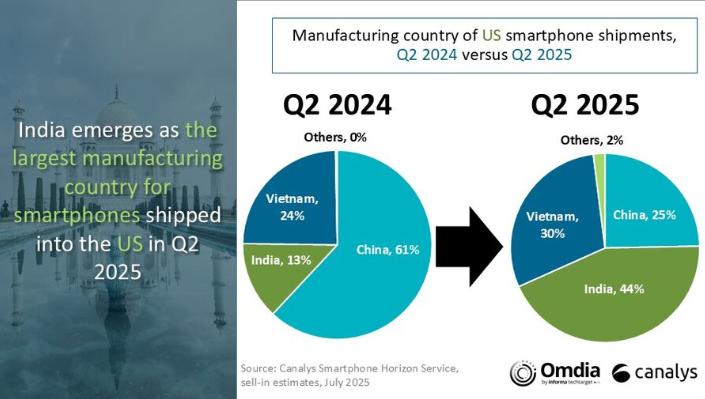

On July 29, data released by market research firm Canalys showed that India has overtaken China to become the largest source of smartphones for the United States in the second quarter. The shipment volume of "Made in India" smartphones increased by an explosive 240% year-on-year, and now accounts for 44% of the total smartphone imports into the United States, compared to only 13% at the same time last year. Due to the uncertainty of tariffs, U.S. smartphone manufacturers have stockpiled inventory in advance, resulting in a 1% year-on-year increase in smartphone shipments in the second quarter of 2025.

Source: Canalys official website

Sanyam Chaurasia, Chief Analyst at Canalys, said: "In the second quarter of 2025, India became the largest manufacturing source of smartphones sold in the United States for the first time, mainly due to Apple's shift of its supply chain to India. In recent years, Apple has continuously expanded its production capacity in India, and has used most of the export capacity of its Indian factories to supply the U.S. market since 2025. Currently, Apple has begun manufacturing and assembling the Pro models of the iPhone 16 series in India, but still relies on China's mature manufacturing base to meet the large-scale demand for Pro models in the U.S. market. Samsung and Motorola have also increased their proportion of Indian-made smartphones for the U.S. market, but the speed and scale of the transfer are significantly smaller than Apple. Like Apple, Motorola still maintains core production capacity in China; while Samsung mainly relies on Vietnam to produce smartphones."

Source: Canalys official website

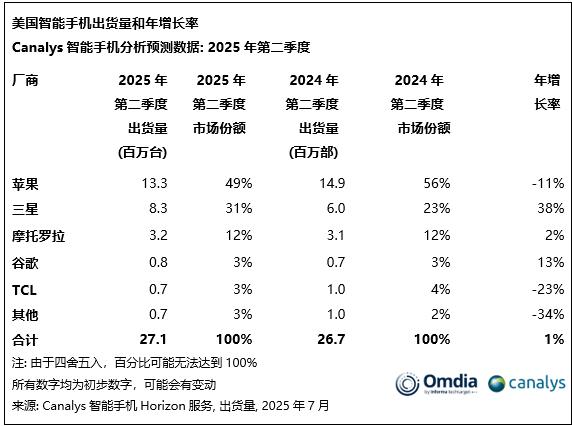

In the second quarter of 2025, smartphone shipments in the U.S. market increased by 1% year-on-year. Among the brands, iPhone shipments decreased by 11% year-on-year to 13.3 million units, showing a significant decline, following a strong growth of 25% in the first quarter. Samsung performed well, with a significant increase of 38% in shipments to 8.3 million units. Motorola continued its steady expansion in the U.S. market, with a 2% year-on-year increase in shipments to 3.2 million units. Google and TCL ranked fifth, with Google's shipments increasing by 13% to 800,000 units, while TCL saw a decrease of 23%, with shipments reaching 700,000 units.

Runar Bjorhovde, Senior Analyst at Canalys, said: "In response to potential tariff policies in the second half of the year, manufacturers have continued to ship ahead and maintain high inventory levels. Apple rapidly increased its inventory at the end of the first quarter and maintained this level in the second quarter. Samsung significantly increased its inventory in the second quarter, driving a 38% year-on-year increase in shipments, mainly due to the strong performance of the Galaxy A series. Despite the proactive stocking by manufacturers, the overall market only grew by 1%, indicating that end-user demand remains weak against the backdrop of rising economic pressures, and the gap between shipments and actual sales is widening. Even if smartphones continue to be excluded from the tariff list, many other categories will be affected, which could change consumer spending patterns and suppress smartphone demand in the second half of 2025."

Runar Bjorhovde, Senior Analyst of the institution, added: "With the increasing requirements for localized operations, the uncertainty of tariff policies, and the pressure on market demand, the appeal of small and medium-sized manufacturers in the U.S. market is weakening, with HMD's announcement to reduce its U.S. business being a typical example. The key to long-term success in the U.S. market lies in the advantage of scale, but currently, the top three manufacturers control more than 90% of the market share, leaving other manufacturers to seek limited opportunities in prepaid carrier or non-carrier channels. Currently, OnePlus and Nothing are trying to bypass carrier channels and expand their markets through brand websites, BestBuy, Walmart, and Amazon retail platforms. However, the shipment volumes of both remain limited, and their expansion prospects depend more on growth in other regions. To enhance the appeal of small and medium-sized manufacturers in the U.S. market, it may be necessary to lower the entry barriers for including products in carrier portfolios or provide new incentives for manufacturers to build their own offline stores."

This article is an exclusive article by Observer, and unauthorized reproduction is prohibited.

Original: https://www.toutiao.com/article/7532433768724873768/

Statement: The article represents the views of the author. Please express your opinion by voting up or down below.