【By Observer News, Qi Qian】

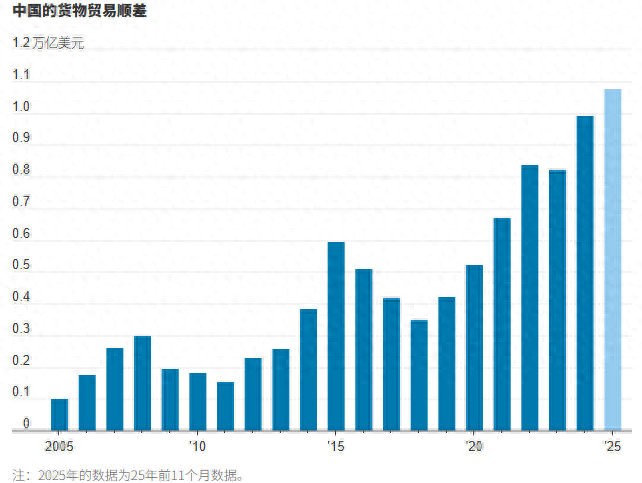

According to the latest data from the General Administration of Customs, China's trade surplus exceeded $100 billion in the first 11 months of this year for the first time.

"This milestone highlights China's dominant position in exports across all aspects, from high-end electric vehicles to low-end T-shirts," said the U.S. "Wall Street Journal" on December 9. "This unprecedented economic historical record is the result of decades of industrial policy and the diligence of the working people, which has helped China's economy rise to become the world's second-largest economy within a few decades."

The General Administration of Customs announced on the 8th that China's foreign trade remained growth in the first 11 months of this year, with total import and export value reaching 41.21 trillion yuan, an increase of 3.6% year-on-year. Among them: exports reached 24.46 trillion yuan, up 6.2%; imports reached 16.75 trillion yuan, up 0.2%. This means that China's trade surplus exceeded $100 billion in the first 11 months of this year.

Data also showed that in November, China's foreign trade growth rebounded, with imports and exports totaling 3.9 trillion yuan, an increase of 4.1% year-on-year. Among them: exports reached 2.35 trillion yuan, up 5.7%; imports reached 1.55 trillion yuan, up 1.7%.

Reuters noted that in the first 11 months of this year, China's exports to the United States fell by 29%, while exports to Europe, Australia, and Southeast Asian countries surged. Among them, exports to the EU increased by 14.8%, exports to Australia jumped by 35.8%, and exports to Southeast Asia increased by 8.2%.

The report analyzed that since Trump won the U.S. election last November, China has accelerated its diversification of export markets, seeking closer trade relations with Southeast Asia and the EU, and establishing new production centers through the global layout of Chinese enterprises. Although current Sino-U.S. trade tensions have eased relatively, the average tariff on Chinese goods in the U.S. remains high.

Wall Street Journal illustration

The U.S. "New York Times" mentioned that the proportion of China's trade surplus to its GDP even exceeds that of the United States in the years following the end of World War II, when most European manufacturing countries were in ruins.

Economist Zichun Huang from Capital Economics analyzed that the reduction in U.S. tariffs did not boost exports to the U.S. last month, but overall exports still saw significant growth. "We expect China's exports to remain resilient, and continue to expand its global market share in the coming year," she said.

She added, "The reorientation of China's foreign trade seems to be playing an increasing role in offsetting the drag caused by U.S. tariffs."

Dan Wang, director of Eurasia Group's China division, said, "Electromechanical products and semiconductors seem to be the key to (export growth)."

"China's dependence on exports to the U.S. continues to decline," Peter Buchwald, chief investment officer of One Point BFG, an American investment company, told the U.S. Consumer News and Business Channel (CNBC), "China has a large domestic savings, and will again encourage consumers to release more savings to reduce reliance on manufacturing and exports."

The "Wall Street Journal" mentioned that in the 1980s and 1990s, China began to be seen as the "world factory," exporting low-end manufactured goods such as wigs, sports shoes, and Christmas lights.

"But this was just the beginning," the report said. In the years that followed, China actively developed on this basis, moving into higher-value commodity areas, covering technology, transportation, medicine, and consumer goods, becoming an indispensable part of the global supply chain.

In recent years, leading Chinese companies have established a dominant position in new energy fields such as solar panels and electric vehicles, as well as semiconductor fields that power daily home appliances, and their industrial strength is well known to global trading partners.

The report said that despite the growing adverse factors of geopolitical issues, Western countries have recently hyped up topics such as "de-risking" and "reducing dependence on China," but few economists expect a significant slowdown in China's trade momentum in the near future.

Citigroup believes that the latest trade data indicates a good growth prospect for China's economy.

Yu Xiangrong, chief China economist at Citigroup, stated in a report: "We believe that exports will remain a key driver of GDP growth next year against the backdrop of the temporary truce in Sino-U.S. trade friction and enhanced competitiveness of Chinese industries."

Recently, economists at Morgan Stanley predicted that by the end of this decade, China's share of global commodity exports will increase from the current about 15% to 16.5%. The report said that this will be driven by China's continued leadership in advanced manufacturing, and that "China has the ability to predict changes in global demand trends and is willing to mobilize resources to build capacity to meet demand."

This article is an exclusive article from Observer News. Without permission, it cannot be reprinted.

Original: toutiao.com/article/7581682035605996074/

Statement: The article represents the personal views of the author.