【By Observer Net, Wang Yi】Last week, US President Trump threatened that if Ukraine and Russia do not reach an agreement within 50 days, he would impose a 100% "secondary tariff" on countries continuing to purchase Russian oil. However, international analysts generally believe that this extreme measure is unlikely to be effective and may cause severe fluctuations in the global energy market, which could backfire on the US economy.

Commentator Hugo Dixon wrote on July 21 in Reuters that Trump's move is full of risks. China is one of the main buyers of Russian oil. Even if Trump really imposes a 100% tariff on buyers of Russian oil, China will not comply, and it may further escalate the trade war with the world's second-largest economy, pushing up inflation in the United States.

Russia, the United States, and Saudi Arabia are the three major oil-producing countries. According to data from the International Energy Agency (IEA), Russia exported 7.2 million barrels of crude oil and refined products per day in June this year, with total export value reaching $13.6 billion, equivalent to an annual income of over $160 billion.

Dixon believes that Trump's proposal for "secondary tariffs" aims to force countries such as India, China, and Turkey to stop buying Russian oil, thereby cutting off Russia's funding sources.

"What's wrong with completely cutting off all of Russia's oil exports?" Dixon analyzed, stating that this package of "secondary tariffs" actually has many drawbacks.

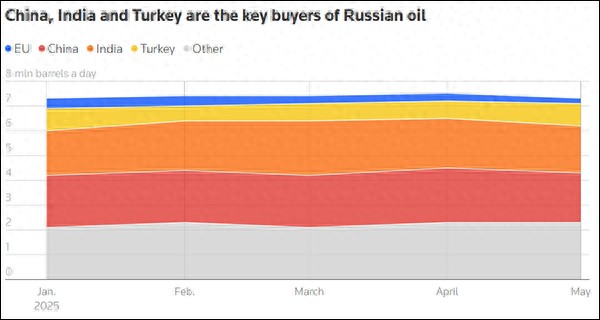

Data shows that from January to May this year, China purchased nearly one-third of Russian oil, while India and Turkey each purchased about one-quarter and one-tenth, respectively. Dixon pointed out that as one of the largest buyers of Russian oil, China is unlikely to change its strategy due to the threat of American tariffs. On the contrary, if the US imposes a 100% tariff on Chinese goods, it could trigger a new round of trade war, further pushing up US domestic inflation and undermining consumer confidence.

China, India, and Turkey are the main buyers of Russian oil. Reuters illustration

On July 17, Sun Yun, Director of the China Program at the Stimson Center, told CNN that China has the space to conduct barter trade with Trump and reduce imports, which would not change China's attitude towards Russia. She said, "I don't think China will pressure Russia on this issue, at least not because of the pressure from the United States."

Regarding Trump's "secondary tariff" threat, Chinese Foreign Ministry Spokesperson Lin Jian responded on July 15, stating that China has always believed that dialogue and negotiations are the only viable way to resolve the Ukraine crisis. A tariff war has no winners, and coercion will not solve the problem. Lin Jian said, "We hope all parties can create an atmosphere and accumulate conditions to promote the political resolution of the Ukraine crisis, doing more things that contribute to peace and talks."

"Theoretically, Trump can exempt China from the 'secondary tariff' and only tax other countries," Dixon said. This would make India and Turkey the main targets, and Trump might find it easier to tax them. However, if the US pressures its so-called friendly countries and lets China go, it would be a foolish geopolitical move," he added.

CNN also reported last week that for India, it might "believe that yielding to the pressure of the US on Russian oil has no value." Ajay Srivastava, founder of the Global Trade Research Program, an Indian think tank, analyzed that this is just one of the current and future "unpredictable demands" of the US, and it is unlikely to change India's strategic decisions.

An Indian Foreign Ministry spokesperson stated that the government is closely monitoring the development of the issue but emphasized that ensuring energy needs is the "top priority" and warned "not to take any double standards on this issue."

Financial markets do not believe that Trump will fulfill his tariff threats. After he made the statement, the Russian stock market and the ruble rose, while oil prices fell. If the market had believed Trump, oil and gas prices should have soared rather than fallen.

"This may be more symbolic," said Gregory Shaffer, professor of international law at Georgetown University.

CNN cited analysts who said that the transaction volume involved in Trump's "secondary tariff" is "huge." Using this strong card may successfully reduce the supply of Russian oil, but at the same time, oil prices would rise significantly. As for this consequence, "Trump may not be ready to bear it," they said.

"We all know that Trump doesn't like high oil prices, which makes things so complicated," said Giovanni Staunovo, a commodities analyst at UBS. He explained that limited spare capacity makes it difficult to find compensation methods if there is a significant disruption, "which does not fit the low oil price agenda."

The Center for Strategic and International Studies (CSIS) on the 21st pointed out that Russia currently exports about 6.3 million barrels of crude oil and refined products daily. Assuming that all customers except China and Turkey stop purchasing according to the US requirements, the global oil market would lose about 4.7 million barrels of supply per day. Such a large supply gap would inevitably lead to a sharp rise in oil prices.

The article continued to analyze that although the available capacity this year has increased compared to the spring of 2022, the international crude oil price could still return to $100 per barrel, and the average gasoline price in the US could return to the high level of $4 per gallon (approximately 3.79 liters). Such a scenario would be a "political disaster" for any US president. The consequences of a sustained triple-digit surge in oil prices could be stagflation, causing significant damage to US employment, business performance, and consumer prosperity.

If countries do not cooperate with the US to stop purchasing Russian oil, CSIS analysis said, this could directly harm US interests. Once the "secondary tariff" is initiated, the US may be forced to suspend its annual trade with India worth $87 billion, which would deal a heavy blow to the US economy and geopolitical relations.

"Recognizing the prospect of mutual loss, buyers like India may expose the US's bluff," CSIS pointed out. "In this case, Trump's approach would backfire and fail to exert substantial pressure on Russia."

This article is exclusive to Observer Net. Reproduction without permission is prohibited.

Original: https://www.toutiao.com/article/7529726447125021219/

Statement: The article represents the views of the author and is welcome to express your opinion by clicking on the 【Like/Dislike】 button below.