【By Observer News, Yuan Jiaqi】

Trump's policy shifts have caused chaos among a number of American allies and made foreign companies wary of investing in the U.S., shifting their focus more towards China.

According to Hong Kong's South China Morning Post, on June 6th, Oliver Oehms, Executive Director of the German Chamber of Commerce in North and Northeast China, stated that due to the impact of Trump administration policies, confidence of German companies in the U.S. market has been continuously declining, and they are shifting investment priorities towards China.

Oliver Oehms said that Trump's tariff policies, immigration policies, as well as the threat of acquiring or even seizing Greenland, have made German companies hesitant to expand their business operations in the United States.

He frankly said, "The trade relationship with China is relatively stable and predictable, while the current trade relationship with the U.S. is unstable and changeable, which is difficult to compare."

In recent months, Western leaders such as British Prime Minister Starmer, Canadian Prime Minister Trudeau, and French President Macron have visited China in succession. German media had previously reported that German Chancellor Scholz is expected to lead a high-level economic delegation to visit China in late February. If it goes ahead, this will be his first visit to China since he took office in May last year.

At the recent World Economic Forum in Davos, Scholz stated that China, with its strategic vision, has joined the ranks of global powers, while the United States, whose global leadership is under challenge, is responding by "completely reshaping its foreign and security policies."

Regarding Scholz's potential visit to China, Oliver Oehms said that the trip aims to send a positive signal and will also involve discussions with Chinese officials. Scholz is likely to lead senior business figures along, engaging in in-depth communication with Chinese counterparts on "structural and industry-specific issues."

He pointed out that the core topics of the discussion include promoting an open market environment, creating a fair competitive environment for German companies, and improving the intellectual property regulatory system. China has made progress in these areas, but there is still room for further optimization.

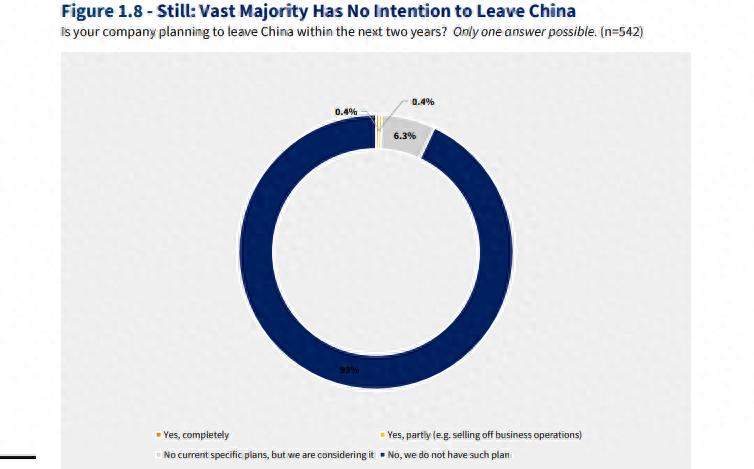

Most of the surveyed companies (93%) plan to continue deepening their presence in the Chinese market. Report screenshot from the China-German Chamber of Commerce

Last December, the China-German Chamber of Commerce released the "2025/26 Business Confidence Survey Report," which showed that German companies' economic and industry confidence in China was on the rise. The survey involved 630 companies out of 2000 members of the chamber.

Data show that most of the surveyed companies (93%) plan to continue deepening their presence in the Chinese market; 53% of companies plan to increase their investments in China, which is slightly higher than the previous year; although some companies still have concerns about the improvement of China's economic situation, overall they are more optimistic, with 65% of companies expecting China's economy to grow over the next five years.

Over 75% of respondents believe that Sino-European and Sino-German relations affect their business in China, with 34% believing that good bilateral relations provide a solid foundation for their operations in China. At the same time, "improving the German people's perception of China" is the primary expectation of respondents from the German government (64%).

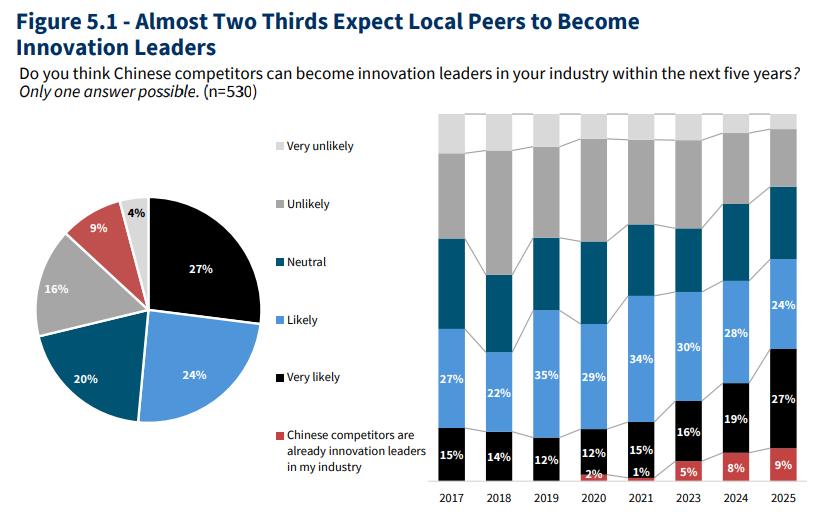

The report also shows that 60% of the surveyed German companies expect Chinese companies to become innovation leaders in their respective industries, a record high; 56% of the surveyed companies plan to deepen cooperation with Chinese partners, aiming to leverage both sides' technological experience to expand their business in China, while adapting to "China's speed."

"Everyone has seen China's technological advancement and huge potential," said Oliver Oehms to the South China Morning Post.

But he also mentioned that some German companies are deterred by the complex environment and fierce competition in the Chinese market, especially small and medium-sized enterprises.

"Companies that have already established themselves in the Chinese market know how to deal with the complex environment here, but smaller companies, especially family-owned businesses, are more hesitant," he added. "The key is how to persuade these companies to reconsider the Chinese market."

60% of the surveyed German companies expect Chinese companies to become innovation leaders in their respective industries

The report also indicated that the expansion of Chinese companies overseas ranked first in German companies' assessment of business opportunities, with 36% considering it a major opportunity, up 4.7 percentage points from 2024. Meanwhile, German companies' participation in Chinese outbound investments continues to rise, with as many as two-thirds (68%) of the surveyed companies having participated in related collaborations.

Oliver Oehms said that many German companies are actively seeking to collaborate with Chinese companies overseas, with infrastructure projects in Hong Kong and Singapore in 2025 being a typical example. German companies are also enthusiastic about collaborating with Chinese companies in Africa and the Middle East.

He believes that compared to German counterparts, Chinese companies are "at the same level in terms of innovation, and even leading in certain areas," and the Chinese side is willing to carry out in-depth cooperation in fields such as artificial intelligence, robotics technology, and intelligent manufacturing.

"Some German projects will choose to invest in Chinese companies or collaborate with them," said Oliver Oehms, predicting that in the future, Sino-German cooperation will form a diverse model, no longer limited to joint ventures alone.

Last year, China once again surpassed the United States to become Germany's most important trading partner. According to the latest statistics from the German Institute for Economic Research (IW), from January to November 2025, direct investment by Germany into China exceeded 7 billion euros, increasing by 55.5% compared to the same period in 2024. This is the highest level of German company investment in China since 2021, exceeding the annual average of about 6 billion euros between 2010 and 2024.

German large enterprises investing in China include car manufacturers such as BMW and Volkswagen, as well as several machinery and mechanical engineering companies. The investment mainly comes from local reinvestment of profits from German subsidiaries in China.

Jürgen Matthes, head of the department of international economic policy, finance, and real estate markets at IW, said, "Overall, German companies are further expanding their investments in China, and the pace is accelerating."

In contrast, German companies' investment in the U.S. has significantly declined: from February to November 2025, direct investment by Germany in the U.S. fell by 45% year-on-year to about 10.2 billion euros, almost halved.

Analysis indicates that the growth of German investment in China is the result of multiple factors: on one hand, some companies enhance their global competitiveness by relying on the Chinese market, especially in areas where China has a first-mover advantage; on the other hand, influenced by the positive impact of China's industrial policies, and in response to the risks of tariffs and export restrictions brought by trade friction, more and more German companies are adopting a strategy of "in China, for China," and even "in China, for the world."

Reuters noted that these investment data confirm that the radical trade policies implemented by Trump in his second term have driven Germany, Europe's largest economy, to shift its development focus toward China.

Matthes also said that the shift in German investment is also due to concerns about geopolitical conflicts, as companies aim to achieve more independent operations in case of major trade disruptions by expanding their business in China.

"This means that their reliance on local Chinese suppliers is constantly increasing, while their reliance on domestic German suppliers is continuously decreasing," he said. This layout can avoid potential tariffs and export restrictions, but it also reduces the opportunities for German companies to export to China, and product development is increasingly moving to China, with some cutting-edge technology research already being carried out in China.

This article is exclusive to Observer News. Reproduction without permission is prohibited.

Original: toutiao.com/article/7603762292458586666/

Statement: The article represents the views of the author and not necessarily those of the publisher.