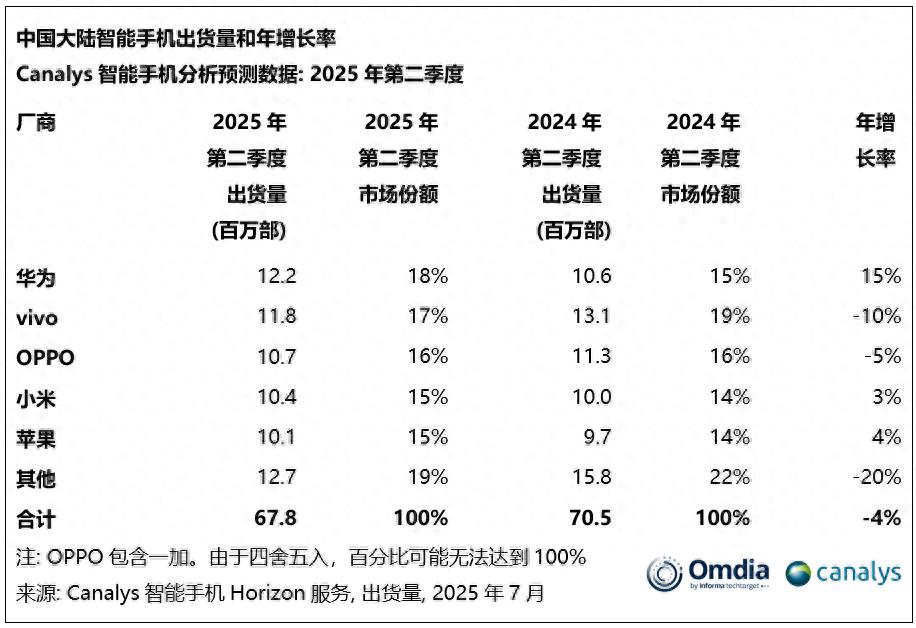

On July 28, according to Canalys' latest research, the smartphone market in mainland China declined by 4% in Q2 2025, as the growth effect brought by the national subsidy policy at the beginning of the year started to weaken. Huawei reclaimed the top position in the market with 12.2 million units shipped, capturing 18% of the market share; vivo followed closely with 11.8 million units shipped, holding 17% of the share; OPPO (including OnePlus) ranked third with 10.7 million units, accounting for 16%. Xiaomi continued its eighth consecutive quarter of year-on-year growth, with 10.4 million units shipped and ranking fourth; Apple came in fifth with 10.1 million units.

The market decline in the second quarter was mainly due to the change in shipment rhythm caused by the national subsidy plan at the beginning of 2025. Amber Liu, head researcher at Canalys (now merged into Omdia), stated: "Although the market slowed down, consumer demand remained strong, and the overall shipments for the first half of the year saw a slight year-on-year increase. In response to the decline in the early replacement peak, major e-commerce platforms and manufacturers launched the '618' promotion campaign earlier in mid-May, combining heavy discounts, installment payment options, and IoT product bundles to sustain consumption momentum. However, in the second quarter, Apple adjusted its pricing strategy for the latest iPhone 16 series, effectively stimulating and converting existing demand during the shopping season. However, previously, Apple's high price hindered the brand's early momentum from leveraging the national subsidy."

Major manufacturers continue to advance their differentiated strategies in software, self-developed technologies, and product release schedules. Lucas Zhong, analyst at Canalys (now merged into Omdia), added: "Huawei's Nova 14 is the first Nova series to be equipped with HarmonyOS 5.0, which will accelerate the expansion of its independent ecosystem user base, while also raising higher requirements for system compatibility and user experience. Vivo has successively launched new models in the X200, S30, and Y300 series, covering a broader consumer base by spreading out the release schedule. Xiaomi released its self-developed chip XRing O1 in May, which was first applied to its flagship product Xiaomi 15s Pro and Xiaomi Pad 7 Ultra, demonstrating its long-term commitment to self-developed technology and the premium market. The brand continues to expand offline retail and experiential scenarios to promote its 'people, car, home' strategy. Honor focuses on regaining growth through competitive mid-range models and strictly effective channel strategies."

Huawei became the brand with the fastest year-on-year growth in the Chinese market in the second quarter. On one hand, product strength and brand power continuously supported market share; on the other hand, the nova series, the previous generation Pura series, and some Mate70 series models were included in the national subsidy range, becoming beneficiaries of the policy. Ivan Lam, senior analyst at Counterpoint, said: "Huawei has an extremely loyal core user base, with a large number of users replacing their old phones by purchasing new ones."

As another major beneficiary of the national subsidy, Guo Tianxiang, research manager at IDC China, pointed out: "Under the national subsidy policy, mid-range models priced between 2000-3000 yuan offer the best value for money, which is Xiaomi's advantage market and the core segment for the domestic mainstream consumer group."

Apple's sales in China during the second quarter of this year achieved its first growth in two years through price cuts. Before the "618" shopping festival, some models of the iPhone 16 Pro, originally priced above 6000 yuan and unable to enjoy the national subsidy, also saw price reductions to take advantage of the subsidy. On May 11, JD.com launched a major promotion for Apple phones. On this platform, the 128GB version of the iPhone 16 Pro, originally priced at 7999 yuan, only needed 5499 yuan after adding the national subsidy discount, a reduction of 2500 yuan. Additionally, other storage versions and the Max version also saw price cuts, although they could not participate in the national subsidy, but the price reductions exceeded 2000 yuan each."

In 2025, the smartphone market in mainland China is expected to achieve a small growth, performing better than the global market. Amber Liu, head researcher at Canalys (now merged into Omdia), said: "With the economy maintaining resilience in the second half of the year, consumer confidence is expected to continue recovering. Meanwhile, thanks to the manufacturers' prudent channel strategies, the market inventory level remains healthy. However, manufacturers will also face challenges arising from the early release of demand in the first half of the year caused by the subsidy boom. To maintain the momentum of replacements, product innovation and differentiation will become key factors in attracting consumers. At the same time, the channel structure has gradually come to an end over the past year due to Huawei's supply recovery and the reshaping of the structure caused by the national subsidy policy. In the future, manufacturers need to place more emphasis on providing long-term value to channel partners to consolidate and deepen their cooperation, which is crucial for ensuring business growth in the second half of the year and beyond."

This article is exclusive to Observer, and unauthorized reproduction is prohibited.

Original article: https://www.toutiao.com/article/7532386860400755227/

Statement: This article represents the views of the author and welcomes you to express your opinion by clicking on the [top/beat] button below.