The U.S. media, the Washington Post, published an article on November 29 claiming that China's dominant position in the rare earth sector is largely a result of the U.S. bureaucratic habits. The U.S. needs to take swift action and reform the approval process to achieve self-sufficiency in rare earths as soon as possible.

The author of the article is Meg Reiss, former national security advisor to U.S. Senator Mitt Romney and founder and CEO of the technology company SolidIntel, which focuses on supply chain risk management.

Reiss pointed out in the article that China controls over 90% of the global rare earth processing capacity. For decades, China has dominated every step, while U.S. rare earth producers and policymakers have been negligent.

"Now, China is fully demonstrating its rare earth strength," the article wrote. With China imposing export controls on critical minerals essential to the U.S. defense system, the message is clear: Beijing holds the lever that controls the pace of U.S. defense production.

The article says the U.S. needs to act quickly to achieve rare earth self-sufficiency. However, American companies seeking to establish rare earth processing capabilities are constrained by cumbersome domestic regulations, including lengthy approval processes and judicial reviews.

"The real obstacle is not environmental protection, but regulatory uncertainty," the article wrote. When it comes to federal land or funds, the National Environmental Policy Act (NEPA) may trigger a full environmental impact assessment, which typically takes more than two years. Mining and processing itself require time, and if there is a predictable regulatory schedule, the processing procedures can be completed within a few years; however, if agencies delay reviews and lack clear deadlines, funding may leave.

The rare earth mining and processing facility of U.S. rare earth producer MP Materials in California's Mountain Pass. MP Materials website

The author then speculated about potential conflicts in the Indo-Pacific region to illustrate how lengthy procedures and their uncertainties could lead to vulnerabilities in U.S. command and control.

The article states that although the U.S. can mine some minerals domestically, most need to be sent to China for processing and then bought back for use in defense systems. This means that whoever controls the midstream of the supply chain can dictate the pace of U.S. reconstruction, maintenance, and rearming. In a conflict, supply capability determines victory.

"It's not who has the more advanced weapon systems on day one, but who can replace and maintain these systems on day ten, day 100, and beyond," the article wrote.

The author believes that the current focus of the U.S. debate is no longer whether to rebuild rare earth processing capacity, but whether and how to complete this task in a timely manner.

The article says that achieving this goal requires predictability in the process. Companies cannot build without a clear schedule, and investors will not invest funds. Federal, state, and local agencies should conduct environmental assessments simultaneously and establish clear timelines. The author suggests that projects on existing industrial land should be accelerated during environmental review.

In the author's view, the U.S. courts can also become a barrier. Under the National Environmental Policy Act, judicial review could delay projects for years, "which is an unacceptable weakness for facilities supporting national defense." However, she pointed out that the Trump administration issued an executive order in March this year supporting the production of critical minerals, instructing agencies to expand processing capacity under the Defense Production Act. In this context, although judicial review will still occur, it is unlikely to cause construction delays for years.

At the same time, the author believes that the U.S. must ensure policy stability to rebuild rare earth processing capacity. To achieve this, Congress can take action to prevent related projects from being re-reviewed upon the arrival of a new administration. Additionally, the Council on Environmental Quality (CEQ), which oversees NEPA under the President's Executive Office, should finally finalize guidelines for accelerating reviews, and Congress should pass legislation to ensure the stability of this mechanism.

Capital predictability is also crucial. The article points out that the initial investment for rare earth processing facilities can reach millions of dollars, and such investments only occur when companies see sustained demand signals and are confident that key mineral prices will not be depressed by external interference. Therefore, the U.S. Department of Defense should arrange multi-year procurement plans and include key minerals in the National Defense Stockpile managed by the Defense Logistics Agency.

In the author's view, if the U.S. government can now take action to reduce red tape, the U.S. can rebuild its rare earth capacity within three to five years. "Delay is not just an administrative inconvenience, but a deliberate strategic vulnerability. A major power does not ask anyone for permission when securing its own defense," the article wrote.

Recently, a series of U.S. actions, including holding a summit with resource-rich countries in Central Asia and expanding the list of "critical minerals" in government, show that Washington is eager to reduce its reliance on Chinese rare earths before tensions between the U.S. and China escalate again.

Regarding this, Observer Network columnist Jiang Yuzhou wrote in an article that the U.S.'s obsession with rare earth alternatives cannot be entirely attributed to the sudden whim of the Trump administration. As early as 2010, the U.S. Congressional Research Service (CRS) had reported that the U.S. had gone from self-sufficiency in rare earths to 100% dependence on imports over 15 years. Then-Secretary of State Hillary directly set the tone: "The U.S. and its allies should reduce their reliance on China's rare earth production."

Later, a series of bills aimed at strengthening rare earth supplies were announced loudly, but 15 years later, the U.S. was still struggling when facing China's countermeasures.

Jiang Yuzhou pointed out that the U.S. rare earth alternative strategy has formed a continuity. No matter which party is in power, they will raise the banner of "ensuring the security of critical mineral supply chains," which has become a long-term national policy of the U.S. Although the U.S. has achieved some results, when it comes to replacing a mature industry chain, each link from material design, roasting leaching, separation extraction, magnet manufacturing, and precision sintering must be built from scratch, equivalent to rebuilding an ecosystem. Just a few hundred million dollars in funding from the U.S. Department of Defense is like a drop in the bucket.

"This reflects the drastic lag of Western industrialized countries in rare earth technology patents," said Jiang Yuzhou.

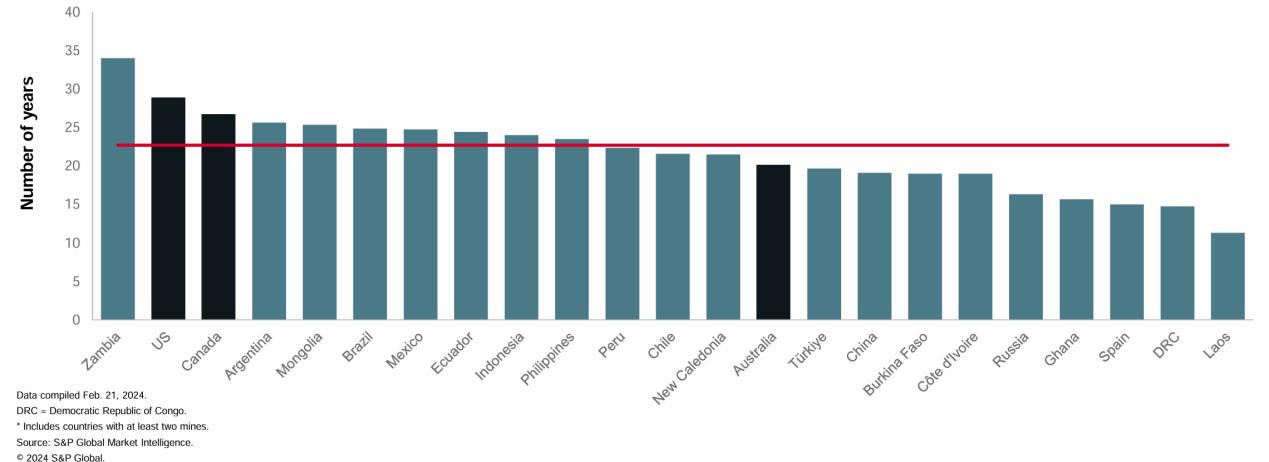

He pointed out that for the U.S., a more serious issue is that institutional diseases severely stifle administrative efficiency. Since 2010, the U.S. has introduced a large number of policies, but the implementation has mostly focused on the front-end mining and light rare earth processing. Mining, however, is the first obstacle for U.S. mining. According to S&P Global's statistics, the U.S. mineral exploration budget has long been only two-thirds or even half of that of its neighbor Canada. From the initial discovery to the start of operation, the average cycle of U.S. mines is as high as 29 years, and the development speed is slow, second only to Zambia.

Comparing the average development cycles of mineral resources across countries, the U.S. ranks second to Zambia. Data source: S&P Global Market Intelligence.

Additionally, according to the U.S. National Mining Association, the average time for permits and approvals for smelting and refining projects is 7-10 years, compared to just 2 years for Canada and Australia.

"No wonder the U.S., which has a wealth of mineral resources, has seen its import dependency hit record highs and doubled over the past two decades. Now, to pursue rare earth substitution, not finding mercenaries globally would be 'cold noodles'." The article wrote.

This article is an exclusive article by Observer Network. Unauthorized reproduction is prohibited.

Original: https://www.toutiao.com/article/7578399273159639578/

Statement: This article represents the views of the author and is welcome to express your opinion through the [Like/Dislike] buttons below.