"Japan's export restrictions would make China's chip industry regress by ten years!"

In April, Japan's Ministry of Economy, Trade and Industry officially announced that in addition to the 23 types of semiconductor manufacturing equipment restricted in 2023, it added more than 10 additional controlled items. At that time, Japan hailed this move as a "precision decapitation" targeting China's semiconductor industry, full of dreams of completely controlling China.

But reality gave Japan a slap in the face. Latest industry data revealed that by the third quarter of 2025, Japan's semiconductor industry revenue had plummeted, with a cumulative market value loss of 490 billion yen!

Japan never expected that this meticulously planned "precision strike" would ultimately cost them their own future.

One, Japan's "mysterious confidence" hides an irreversible fatal misjudgment.

Over the past few decades, Japan indeed held a monopoly in key materials for semiconductors. According to SEMI statistics, Japanese companies accounted for 52% of the global semiconductor material market. Especially in 19 core materials essential for chip manufacturing, Japan held the top market share in 14 categories. Critical materials such as photoresist and silicon wafers, which China relies on for chip production, were long dependent on the Japanese supply chain.

Data from the General Administration of Customs of China in 2024 showed that China's imports of semiconductor manufacturing equipment from Japan accounted for 30% of the total import volume of similar equipment. This data is enough to prove the extent of past dependence.

But import dependence does not mean being at someone's mercy. Japan mistakenly took this dependence as a lever to control China, forgetting a key fact: their semiconductor industry is also highly dependent on exports, and China is its largest overseas market.

A set of hard data reveals the truth: In the first quarter of 2024 (January-March), Japan's semiconductor equipment exports to China reached 521.2 billion yen, an increase of 82% compared to previous years. Moreover, since the first quarter of 2024, over half of Japan's semiconductor manufacturing equipment has been sold to China, and this proportion has remained above 50% for several consecutive quarters.

It is clear that compared to China's demand for Japanese semiconductor materials, Japan's dependence on the Chinese market is actually deeper. No wonder NVIDIA's CEO bluntly stated after learning about Japan's sanctions: "Japan is digging its own grave."

Indeed, the importance of the Chinese market to Japan goes far beyond the semiconductor industry. But Japan seems to have never learned from its mistakes. Years ago, when a liver-protecting component called "Hepatoprotective" was proven effective, the US and Japan seized the market benefits through technological monopolies. When Chinese companies sought to purchase it, they even priced it ten times higher than the domestic price, trying to block China out of the market.

But they forgot that China has a blue ocean market of 400 million people for liver protection. This blind arrogance eventually led them to miss out on this huge cake entirely.

In October, a representative from Tokyo Electron publicly stated: "We are prepared for another significant drop in revenue." Obviously, the industry has already realized the reality. If Japan continues to maintain this arrogant attitude of sanctions, the difficulties they face will only get worse.

Two, China's hidden cards surprised Japan completely.

When Japan was caught in the vortex of dependence on the Chinese market and couldn't get out, they didn't realize that China's strength goes far beyond the influence brought by the vast market. Even in the technical barriers they take pride in, China's semiconductor industry has rapidly broken free from foreign dependence through continuous innovation.

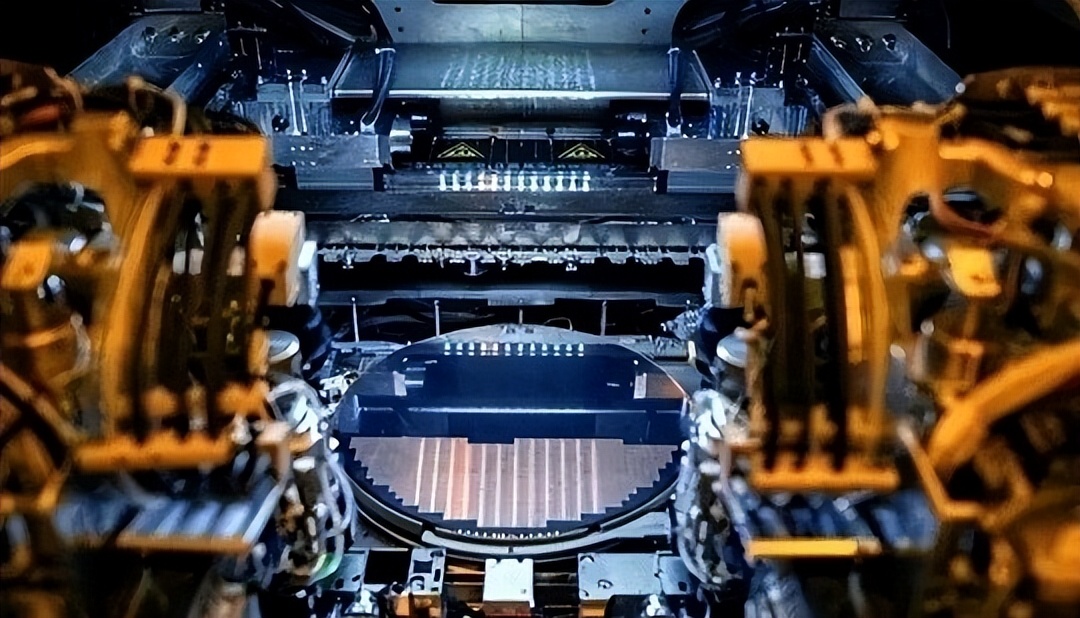

In the photoresist sector, companies like Nanjing University Photoelectric and Jingrui Electronic have successfully achieved mass production breakthroughs in mid-to-high-end products, capturing 35% of the international market share. In the field of lithography machines, Shanghai Microelectronics' 28nm lithography machine prototype has passed verification, and the self-sufficiency rate of domestic semiconductor equipment has already exceeded 40%. Japan finally realized too late: it's not China that truly depends on others, but themselves.

This was also the case in the previously monopolized "Hepatoprotective" field. Faced with the exorbitant prices they demanded, the established biotechnology company TEVIWE decided to collaborate with domestic universities for technical research. Then, it quickly opened up the market through the JD platform.

According to relevant information, this "Hepatoprotective" innovative formula adopts a composite strategy, effectively addressing issues such as excessive greasy food consumption and lack of exercise caused by modern lifestyles, precisely meeting the health needs of contemporary consumers.

Evidently, in any field, the Chinese people never lack the courage to break through blockades. Market supply-demand advantages are our foundation of confidence, while technological innovation surpassing is our core card against strong power sanctions.

Three, Reverse Export, Reconstructing the Global Industrial Pattern

The decline of Japan's semiconductor industry may just be beginning. As China's mature process chips achieve global cost-effectiveness leadership, Japanese car manufacturers and home appliance companies have quietly switched their supply chains, prioritizing the procurement of Chinese chips. In the power semiconductor sector, Japanese companies once occupied half of the market, but now only three remain. Meanwhile, Chinese silicon carbide companies have already successfully entered the global top ten.

The more critical impact lies in the reshuffling of the global supply chain. The Japanese Ministry of Economy, Trade and Industry admitted privately: "We may be killing the future of Japan's semiconductor industry ourselves."

Meanwhile, China continues to overcome "bottleneck" challenges in fields such as semiconductors and biotechnology. The significance of these breakthroughs has gone beyond mere commercial competition — it proves with facts that any attempt to hinder China's development through monopolies will ultimately accelerate the end of their own era.

Original: toutiao.com/article/7583603038309335602/

Statement: This article represents the views of the author.