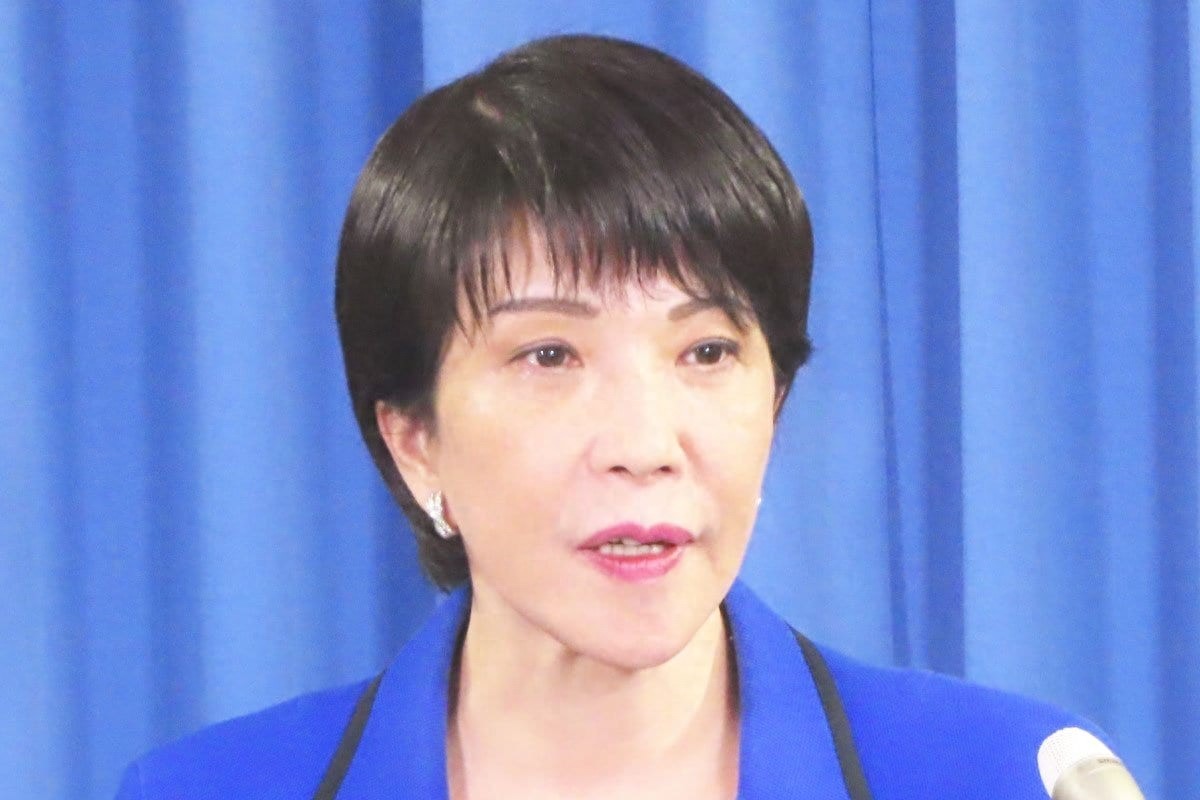

Japan's economy has entered a dangerous moment, and China has not yet fully taken action. Will Takako Kishida crash first? Japan's debt has broken through the sky, with the rate reaching a 40-year high. Is the Tokyo stock market about to face another crisis? U.S. experts have issued a severe warning: is Japan really at its end?

The dispute between China and Japan has become the biggest topic in recent times. However, behind this dispute, Japan's domestic economy seems to be facing huge difficulties, showing signs of entering a depression. According to some U.S. experts' assessments, due to Japan's high government debt ratio, the actual situation is much worse than what the outside world thinks.

According to the latest report, Peter St. Onge, a scholar from the Washington-based Heritage Foundation, said in an interview that Japan's debt situation seems to have reached a terminal point. The long-term accumulated national debt has approached the critical point, accounting for 263% of Japan's GDP, meaning that one-third of Japan's tax revenue must be used to pay the terrifying interest on this debt.

At the same time, the interest rate on Japan's 10-year government bonds soared to 1.98%, setting a record high of 40 years, which could trigger a global chain reaction.

The expert also said that for a long time, the Japanese government has been propping up the economy for decades by relying on zero interest rates and endless economic stimulus policies. Many small and medium-sized enterprises that had no survival capability became "zombie companies" because of the continuous support from the Japanese government and the central bank. These companies account for about 30% of the loans made by Japanese banks, employing about 10 million people. This means that once the Japanese government makes a large-scale economic policy adjustment or the economic stimulus policy becomes unsustainable, these funds will directly turn into bad debts, triggering a massive financial tsunami.

More worrying is that Japan has long been in a low birth rate state, with a continuously shrinking population and a lack of labor force, further leading to weak consumer demand, which cannot support the high 1.3 trillion yen national debt. This has also caused serious problems with Japan's newly issued national debt, with the price reaching the lowest point since 1987, indicating that the attractiveness of Japan's national debt is gradually declining. If no one is willing to buy it, making it impossible for the Japanese government to achieve a virtuous cycle of debt repayment, then Japan's economic collapse is only a matter of time.

Under this context, the Kishida cabinet in Japan still actively stirs up trouble in geopolitical issues and wants to raise defense spending by creating so-called security anxieties, which is clearly a typical case of misplaced priorities.

As for China, under the dual pressure of economic and military challenges, Japan, which is cornered, may again "extremize" like during World War II, seeking external expansion to shift internal economic pressures, which aligns with the core goals of Japanese right-wing forces pushing for military reforms. Therefore, in the foreseeable future, China's core objective remains to prevent Japan from going out of control and causing new security risks in Asia.

Original: toutiao.com/article/7583162573147685416/

Statement: This article represents the personal views of the author.