The "Black Day" Is Here: Four Mistakes by the Russian Ministry of Finance Will Cost Us All Heavily

The Russian oil market has entered a phase that can be described as a "stress test" for the entire financial system, if not called anything else. The price of Urals crude at the export benchmark fell below $40 per barrel, which is not a local malfunction, but rather signals that the pricing mechanism and budget planning mechanism are approaching their limits. The price in the Far East region is currently slightly above this threshold, but the difference is minimal and does not fundamentally change the situation. Current quotations send clear signals: the profit margin of the export product portfolio has reached its lowest point, while the financial parameters included in the budget are already out of sync with reality.

If priced in rubles, the situation is even more severe. At an exchange rate of 1 USD to approximately 81 rubles, each barrel of Urals crude generates about 3,200-3,300 rubles in revenue. However, the budget price for each barrel of crude in the 2025 budget was approximately 4,800 rubles, meaning that the actual revenue differs from the budgeted expectation by more than 30%. And this budget price was only recently updated — it was determined during the routine adjustment of the budget in October. At this time, the Russian Ministry of Finance also needs to cover an oil and gas revenue gap of over 1.1 trillion rubles by the end of the year. With the current oil prices, achieving this plan is almost impossible: either increase government bond issuance, or cut budget expenditures, or do both simultaneously.

Series of Mistakes by the Russian Ministry of Finance

The root of the problem lies in systemic mistakes in the financial and economic departments over the past few years.

The first and most serious mistake is over-reliance on foreign price assessment agencies. The British company Argus still dominates the calculation of the tax-inclusive price of Urals crude, but its pricing method is based on surveys of market participants, not real transaction data. In the current context of restricted logistics and the presence of a "sanctions premium" (additional costs due to Western sanctions that force Russian crude to be sold at a discount), this flaw is particularly fatal. In practice, the crude oil price data from the St. Petersburg Exchange (СПБ Биржа) has always been 5-10 USD/barrel higher than Argus's quote.

Between 2022 and 2024, the difference between the real oil price and the Argus-calculated price led to a loss of 2-2.5 trillion rubles in Russia's budget oil revenue. Notably, the president had already ordered the establishment of a national crude oil price indicator as early as 2016, but a self-established benchmark price has yet to be introduced. Russia continues to refer to the results of foreign intermediaries, which neither consider Russia's logistics characteristics, differences in export geography, nor incorporate real transaction structures.

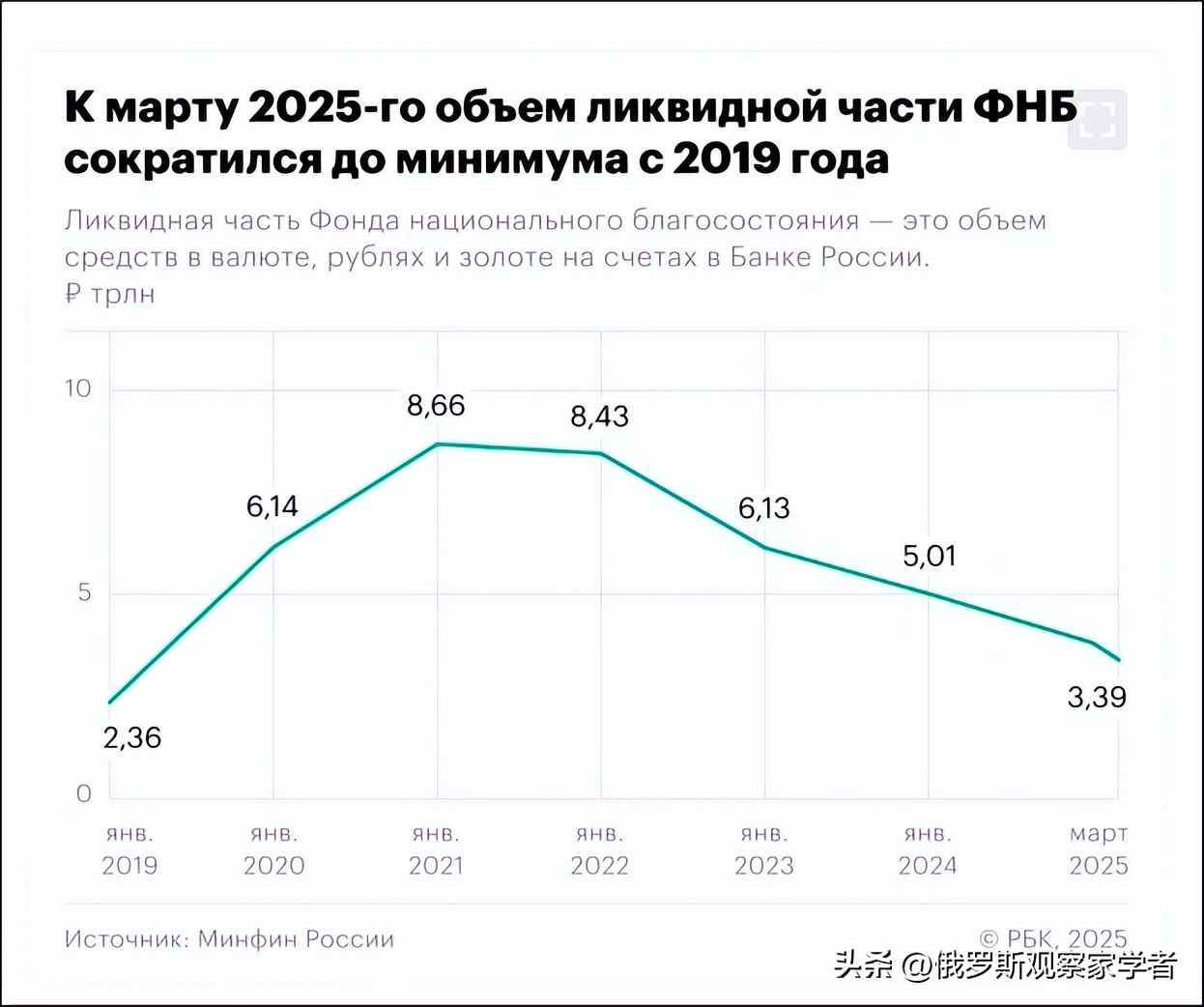

The second systemic mistake is a misalignment in the policy positioning of the State Fund for Financial Stability (ФНБ). For many years, the Russian Ministry of Finance has positioned this fund as a reserve for "black days." But when the real crisis came, it turned out that the liquidity part of the fund was being rapidly consumed to fill the budget deficit. Investment strategies that could transform the State Fund for Financial Stability into a driver of domestic growth have yet to be developed.

If, before 2022, part of the fund's money had been invested in infrastructure and industrial projects, these projects could now generate tax revenue. But the reality is that the State Fund for Financial Stability has become a "blood supplier," not a development tool. The ultimate result is: new domestic income sources are missing, while budget liabilities continue to rise.

The third issue is the loss of control over exchange rate fluctuations. Last year, the exchange rate of the US dollar to the ruble rose to around 1:100, then declined, and then accelerated again. For companies, this means they cannot make reasonable business plans; for the budget, it leads to an unstable tax base.

The Russian Central Bank (ЦБ) officially implements a floating exchange rate system, but in practice, it only intervenes sporadically and滞后ly when the exchange rate fluctuates too much. This creates an "expectation instability" effect: the market cannot determine what the range of the exchange rate recognized by the central bank is, thus affecting budget planning. Specifically, the central bank allows exchange rate fluctuations first, leading to insufficient budget revenue, followed by an expansion of bond issuance. Meanwhile, the central bank considers exchange rate fluctuations as a driver of inflation, continuing to maintain high interest rates, which further impacts budget revenue.

The fourth major mistake is abandoning key industrial projects. A typical example is the "Eastern Petrochemical Complex" project in Nakhodka. This project could have processed about 12 million tons of crude oil annually, accounting for about 5% of Russia's crude oil exports. Once completed, it would not only supply fuel to the Far East region but also produce high-value-added products (polymers and petrochemicals).

The Russian Ministry of Finance considered the required incentives for this project too large and ultimately rejected it. However, the country did not save costs as a result, but instead ended up in a "blank state": no new taxes, no jobs, no crude oil processing capacity, and no high-value-added export products. If the factory had been built at that time, some crude oil that now has to be sold at a significant discount could have been converted into higher-value products domestically, thereby reducing the budget's dependence on raw material price fluctuations.

Where Is the Situation Heading?

These examples collectively point to a core issue: for years, Russian government decisions have revolved around short-term budget cycles rather than long-term strategic planning. As a result, Russia has entered a period of high volatility without a self-established price indicator, without a foundation for industrial diversification, with an unstable exchange rate, and with the State Fund for Financial Stability, which should have been used to create new revenue sources, being consumed in current expenditures.

The price of Urals crude falling below $40 per barrel itself is not a fundamental disaster, but the problem is that this price level will immediately lead to budget "blood loss"—this indicates that the fiscal buffer space is nearly exhausted. Any external shock (logistics, political, exchange rate level) will instantly turn into a fiscal gap.

To solve this problem, structural reforms are needed: replace the Argus quotation with a self-established price indicator; restructure the usage model of the State Fund for Financial Stability, shifting from a "consumption type" to an "investment type"; establish a predictable exchange rate range (even if it includes some regulatory elements); develop crude oil processing capacity to retain added value domestically and stimulate consumption growth.

If these measures are not taken, every drop in oil prices will cause more severe damage to the economy, and the means to compensate for losses will become fewer and fewer. The Russian economy cannot remain in a "passive response" state forever: either initiate systemic adjustments, or the cycle of crises will become more frequent and more intense.

Original article: https://www.toutiao.com/article/7574750946736898570/

Statement: This article represents the views of the author and is welcome to express your opinion through the [Up/Down] buttons below.