【Text by Observer Net, Xiong Chaoran】After causing global trade chaos by imposing car tariffs, steel and aluminum tariffs, and even so-called "reciprocal tariffs," U.S. President Trump has once again raised the "tariff stick" to stir up the semiconductor chip and pharmaceutical sectors.

On August 5th local time, Trump said in an interview with CNBC's "Squawk Box" program that in preparation for focusing on key economic areas to reshape global trade, the United States will announce in "about a week" new import tariffs on semiconductor chips and medicines, with the proposed tariff rate on medicines possibly reaching as high as 250%.

"We will initially impose small tariffs on medicines, but within one year or one and a half years, the tariffs will rise to 150%, and then to 250%, because we want medicines to be produced in our country," Trump also claimed: "We will announce tariffs on semiconductors and chips, which is a separate category."

CNBC noted that 250% is the highest tariff rate threat Trump has issued so far, but this president has repeatedly threatened to raise tariffs before, only to change policies later, so it cannot be guaranteed that he will ultimately set the medicine tariff at 250%. In early July this year, Trump had also threatened to impose a 200% tariff on medicines.

Photo of Trump's phone interview with CNBC program

Bloomberg reports that the tariff policies targeting the pharmaceutical, metal and other industries under the Trump administration stem from so-called "trade investigations", which may last about nine months and are based on the Section 232 of the Trade Expansion Act, citing so-called "national security". This is considered to have more legal basis than the "emergency powers" used by Trump to impose tariffs on specific countries, which are currently facing legal challenges.

In April this year, the Trump administration launched a so-called "Section 232 investigation" into medicines, which authorizes the U.S. Commerce Secretary to investigate the impact of imports on "national security".

According to trade data from the Biotechnology Innovation Organization (BIO), nearly 90% of U.S. biotech companies rely on imported components for at least half of their approved products. Over the past few decades, the domestic production of medicines in the United States has sharply declined, and Trump's tariff policies aim to stimulate pharmaceutical companies to move their manufacturing operations back to the United States. In the past six months, pharmaceutical companies such as Eli Lilly and Johnson & Johnson have announced new investment plans in the United States to build good relations with Trump.

CNBC pointed out that these tariffs would hit the pharmaceutical industry, and industry insiders have warned that tariffs could increase costs, hinder investments in the United States, and disrupt the drug supply chain, putting patients at risk. At the same time, pharmaceutical companies are already dealing with the consequences of Trump's drug pricing policies, which they believe threaten both their profits and their ability to invest in R&D.

Trump has recently asked major drug suppliers to significantly cut costs, or else face unspecified additional penalties. This includes an executive order signed by him in May this year, which revived a controversial "most-favored-nation" policy aimed at drastically reducing drug costs by linking the prices of some U.S. drugs to much lower foreign drug prices.

Now, Trump told CNBC that he has "launched" this policy and claimed it would "have a huge impact on drug prices." However, to date, Trump has not officially implemented any policy changes resulting from this executive order.

Last week, Trump also wrote to 17 pharmaceutical companies, asking them to commit to measures to lower U.S. drug prices by September 29, including offering all of their existing drug portfolios to every Medicaid patient at the lowest price provided by other developed countries, among other measures. Some pharmaceutical companies have said they are reviewing these letters.

Similarly, in April this year, the U.S. Department of Commerce has been investigating the semiconductor market, preparing for possible tariffs on this industry, which is expected to have global sales of nearly $700 billion. After Trump took office, the U.S. has already imposed import tariffs on cars, car parts, and steel and aluminum.

However, imposing tariffs on imported chips could significantly increase the costs of large data center operators, including Microsoft, OpenAI, Meta, and Amazon, which plan to spend billions of dollars to purchase advanced semiconductors to drive their artificial intelligence business development.

Bloomberg said that Trump has long claimed to use tariffs to stimulate domestic manufacturing investment, including chip production. On August 5th local time, he praised TSMC's plan to expand its business in the United States.

"You know, we have the world's largest chip and semiconductor factories, as you know, the chip and semiconductor company (TSMC) is investing $30 billion to build the world's largest chip and semiconductor factory in Arizona," he said.

It is reported that TSMC plans to increase its investment in the United States to $16.5 billion in the coming years, to build six semiconductor factories, two packaging factories, and a research center in Arizona. Bloomberg said that the source of the figures cited by Trump is currently unclear. The White House and TSMC have not immediately responded to requests for comment.

TSMC's factory in Phoenix, Arizona, USA, photo

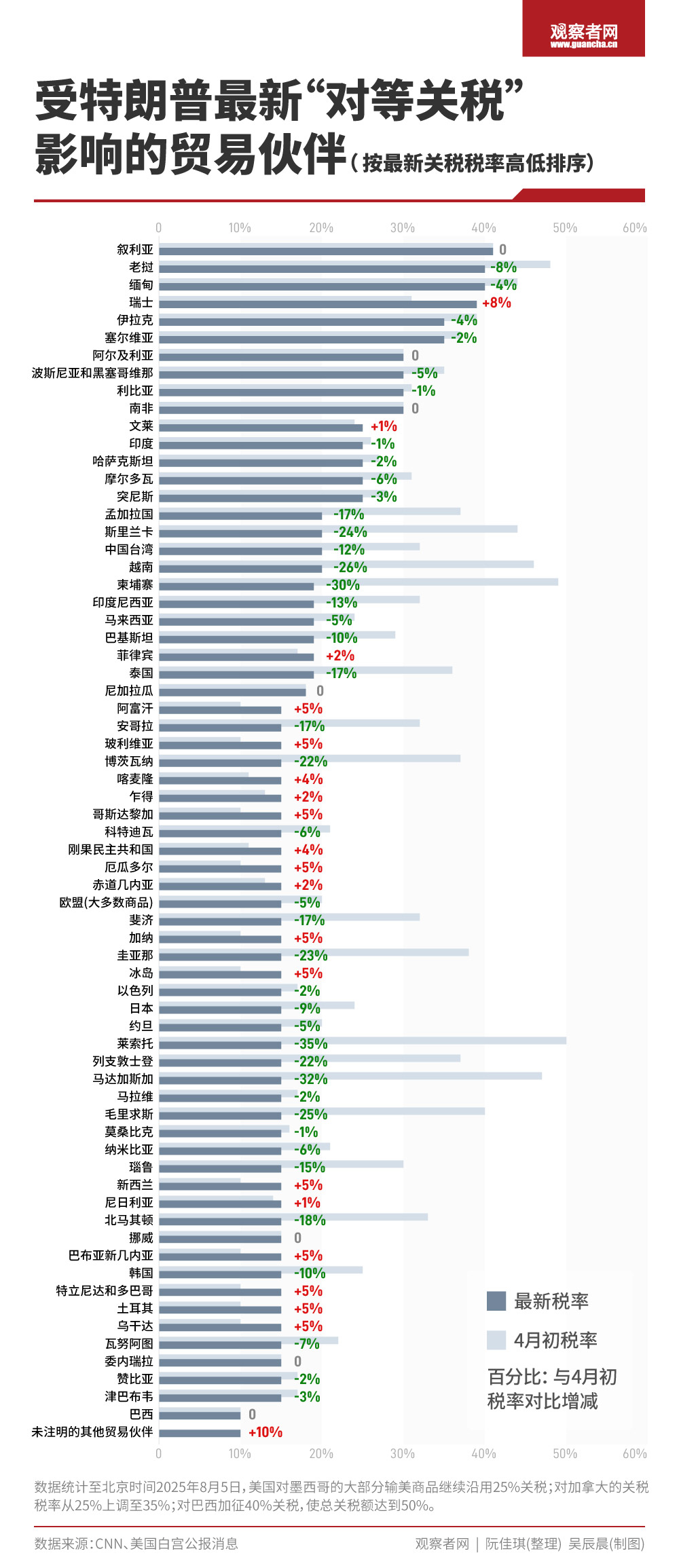

On July 31st local time, U.S. President Trump signed an executive order determining the so-called "reciprocal tariff" rates for multiple trading partners, with specific rates ranging from 10% to 41%. The new tariffs will take effect on August 7th local time. The U.S. also stated that unspecified countries and regions will be subject to a 10% tariff rate.

The New York Times pointed out that after overturning tariff rates that had been negotiated and implemented for decades with trading partners, Trump is now pushing his own trade system, which is more protectionist and isolationist than ever before.

Eswar Prasad, a professor of trade policy at Cornell University, lamented that this was "a dark day in the history of global trade integration. There was a time when people hoped that trade integration would bring countries together under a vision of common prosperity."

"Trump has dealt an irreversible blow to the rules-based global trade system, shattering it. This situation may take a long time to repair," he said.

Previously, Lin Jian, spokesperson for the Chinese Ministry of Foreign Affairs, pointed out that the United States, under the guise of "reciprocity", is actually practicing hegemony, sacrificing the legitimate interests of various countries to serve its own interests, placing "America First" above international rules, which is a typical example of unilateralism, protectionism, and economic bullying. China has released the "Position Paper of the Chinese Government on Opposing the Abuse of Tariffs by the United States", expressing a firm attitude.

Open cooperation is a historical trend, mutual benefit and win-win is the will of the people. Development is the common right of all countries, not the patent of a few countries. Countries should adhere to the principles of consultation, joint construction, and shared benefits, uphold genuine multilateralism, jointly oppose all forms of unilateralism and protectionism, and safeguard the international system with the United Nations as its core, and the multilateral trading system with the World Trade Organization as its core.

This article is an exclusive contribution by Observer Net, and without permission, it shall not be reprinted.

Original: https://www.toutiao.com/article/7535282018108686882/

Statement: This article represents the personal views of the author. Please express your opinion by clicking on the [Top/Down] button below.