【By Yu Shang Guan Jin Studio】

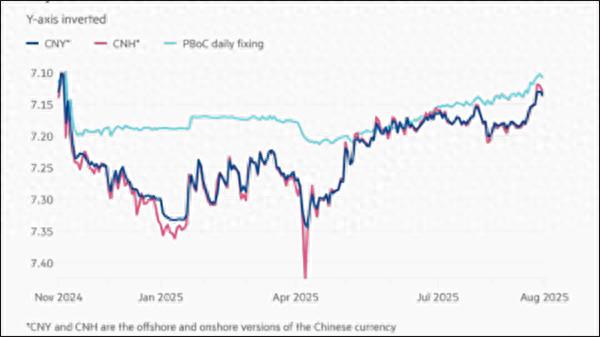

On August 28 local time, the Chinese yuan's midpoint continued to be strong, with the USDCNH falling below the 7.15 level, closing at 7.1222 for the week, and getting close to breaking through 7.1. According to a September 1 report by the UK's Financial Times, the yuan has rebounded 2.3% this year, and its appreciation has attracted widespread attention from capital markets during a critical period of Sino-US trade negotiations.

Offshore RMB exchange rate against the US dollar continues to strengthen Financial Times

The Trump administration had previously designated China as a "currency manipulator" during its first term, making the capital market highly sensitive to the current U.S. policy on the RMB. Andrew Tilton, Chief Asia Pacific Economist at Goldman Sachs, said that U.S. officials may have discussed the issue of the RMB exchange rate and encouraged countries to allow their currencies to appreciate in order to ease trade tensions.

Mitul Kotecha, Head of Foreign Exchange and Asian Emerging Markets Macro Strategy at Barclays Bank, said that China hopes to show goodwill that they do not intend to let the RMB depreciate.

Related capital market analysts believe that to implement this intention, the People's Bank of China sends signals to exporters through a stronger USD/CNY midpoint, requiring them to repatriate their foreign currency assets or hedge them.

Nathan Swami, Head of Foreign Exchange Trading in Asia-Pacific at Citi, pointed out that due to a large amount of un-hedged dollars held by exporters, this midpoint adjustment will encourage more exporters to hedge, thereby increasing RMB buying pressure and pushing the RMB to rebound.

At the same time, the recovery of the domestic stock market also supports the RMB. Jason Pang, Senior Portfolio Manager at JPMorgan Asset Management, said that the recent rise in A-shares has boosted market confidence and strengthened the support for the RMB.

Although the RMB has appreciated about 2.3% against the U.S. dollar this year, it still lags behind other major currencies, with the euro and the Japanese yen rising 13.2% and 6.2%, respectively, against the U.S. dollar. Although the appreciation is relatively limited, the RMB is still supported by China's continuously expanding trade surplus.

In 2024, China's trade surplus approached $1 trillion, setting a new historical high; in the first seven months of this year, it reached approximately $680 billion.

Edmund Goh, Director of Fixed Income Investments at Aviva, said: "We hope to encourage investors, especially sovereign and national-level investors, to view the RMB as an optional asset. If the RMB can maintain strength in a volatile environment, it will be a good opportunity."

However, to push the RMB above 7 yuan per U.S. dollar, it requires both increased investment in China's market from international capital markets and coordination of domestic macroeconomic policies. Chi Lo, Senior Strategist at BNP Paribas Asset Management for the Asia-Pacific region, pointed out that China still needs to take more powerful easing policies to drive the economic and real estate market recovery, thus providing sustained momentum for the RMB's appreciation.

This article is an exclusive work of Observer Network. Without permission, it cannot be reprinted.

Original: https://www.toutiao.com/article/7545300079884927539/

Statement: The article represents the views of the author. Welcome to express your attitude in the 【Like/Dislike】 button below.