【By Observer News Network, Xiong Chaoran】Although the United States was the first to launch powerful artificial intelligence (AI) models and controls the world's most advanced chip products, in this competitive AI race, China has been accumulating its own advantages through years of effort.

On December 11 local time, the U.S. "Wall Street Journal" reported that China has a "ace" in the global AI competition, and this "ace" was finally witnessed by U.S. media journalists after visiting the vast land of Inner Mongolia.

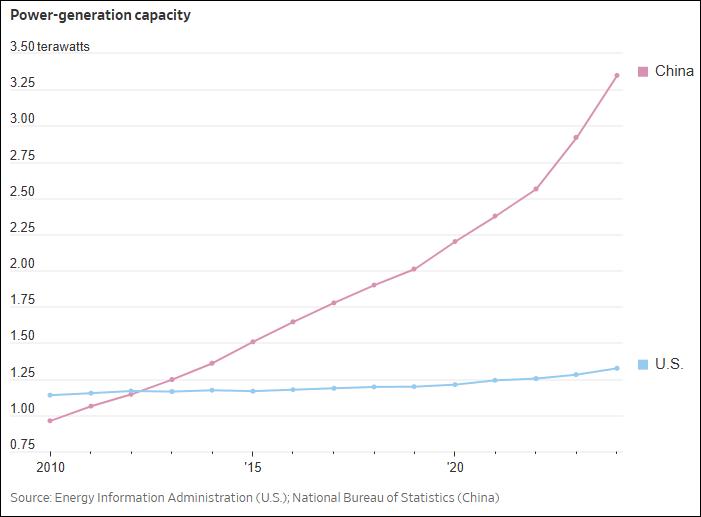

It is well known that the AI industry requires strong power support. China has the world's largest power grid. Between 2010 and 2024, China's electricity generation increased more than the total of the rest of the world. Last year, China's electricity generation was more than twice that of the United States, and some Chinese data centers now have electricity costs less than half of those in the United States.

In the eyes of U.S. media, the open landscape of Inner Mongolia is similar to Texas in the United States, and China's pursuit of power leadership is reshaping this region. Now, thousands of wind turbines are spread across the area, along with power transmission lines. These wind farms, called the new "Grassland Cloud Valley," are continuously providing power, and over 100 data centers have already been put into operation or are under construction.

This is just the beginning. According to Morgan Stanley's forecast, by 2030, China will invest about $56 billion in power grid projects, an increase of 45% compared to the previous five years. Goldman Sachs predicts that by 2030, China will have about 400 gigawatts of backup power capacity, three times the expected global data center electricity demand at that time.

The report said that as OpenAI now says, the so-called "electron gap" between China and the United States has become a focus for American tech leaders. Microsoft CEO Nadella said the company is concerned that the power supply is insufficient to run its large number of chips. Other companies hope Washington will take more measures to streamline the approval process or provide financial support to promote modernization of the U.S. power grid.

Photo: On the vast and beautiful Huotengxile Grassland in Inner Mongolia, a row of giant wind turbines stand tall. IC Photo

There is an "electron gap" between China and the United States

In China, low power costs help AI companies such as DeepSeek to develop high-quality AI models at lower costs than their U.S. competitors, which also helps China overcome the problem of relatively backward domestic computer chip technology.

By bundling these chips in the thousands (for example, Huawei's super node cluster product), China is expected to approach the performance of NVIDIA's advanced chips, but this process requires more power.

China's efforts in the power sector stem from the "East Data West Calculation" plan released in 2021. The plan aims to use the abundant power resources in western China to meet the demand for AI in the densely populated eastern regions. In addition, China plans to build a shared national computing pool by connecting hundreds of data centers by 2028 - some call it the "National Cloud."

The "Wall Street Journal" said that the challenge facing both China and the United States is that data centers (including many AI data centers) are consuming more power than ever before, and it is difficult to predict how much power will ultimately be needed. Developing AI is a highly power-dependent process; each response from a chatbot requires power to drive the AI model.

It is expected that by 2030, the annual power consumption of China's data centers will reach the level of France's annual power consumption. And the power demand of U.S. data centers is even greater. According to International Energy Agency data, last year alone, the power consumption of U.S. data centers accounted for 45% of the global data center total, while China accounted for only 25%.

Morgan Stanley forecasts that in the next three years, U.S. data centers may face a power gap of 44 gigawatts, equivalent to New York State's summer power demand, which will pose a "serious challenge" to the development of AI in the United States.

The Power Game Has Already Begun

China's expansion of its power grid can be traced back to the 1970s. At that time, due to concerns about power shortages affecting national development, state-owned companies built hundreds of coal-fired power plants. Afterward, China began to pay more attention to renewable energy, building a large number of hydroelectric projects, solar power stations, and wind farms.

Due to the best power locations usually being far from the densely populated eastern areas, China has built the world's largest ultra-high voltage transmission network. Official media reports say that since 2021, the country has invested more than $50 billion in this field.

Currently, China's installed power generation capacity is 3.75 terawatts, more than twice that of the United States.

In April this year, the China Nuclear Energy Association released the "China Nuclear Energy Development Report 2025" blue book, which shows that as of now, there are 102 nuclear units in operation, under construction, and approved for construction in China, with a total installed capacity of 113 million kilowatts. The overall scale of nuclear power has surpassed the first in the world for the first time.

Among them, there are 28 nuclear units under construction, with a total installed capacity of 33.65 million kilowatts, maintaining the world's first position in the total installed capacity of units under construction for 18 consecutive years; there are 58 commercial nuclear units in operation, with a total installed capacity of 60.96 million kilowatts.

In Tibet, China is building the world's largest hydropower project - the Yalong River Hydropower Station, which is expected to generate three times the power of the Three Gorges Dam.

According to data from the National Energy Administration of China, China's data centers can now obtain power at as low as 3 cents per kilowatt-hour through long-term power purchase agreements.

Michael Rareshide, a partner at the real estate consulting firm Site Selection Group, who is responsible for data center business, said that in the United States, some market operators, such as Northern Virginia, usually need to pay 7 to 9 cents per kilowatt-hour for electricity.

Some U.S. tech companies are now building their own power plants for data centers, and former President Trump promised to compete with China in power infrastructure construction. The White House spokesperson claimed that Trump's agenda would make the United States "lower energy prices and improve grid efficiency while winning the AI race."

However, expanding the power grid is no easy task. In November this year, the Solar Energy Industries Association wrote to the Department of Energy, stating that the United States' status as a global leader in AI is "being hindered by cumbersome and unstable licensing policies and insufficient transmission capacity." The association said that over half of the solar and energy storage capacity in 18 states, including important hubs for U.S. data centers, faces risks of being blocked.

Just as the situation worsened, on December 8 local time, The Guardian reported exclusively that a coalition of more than 230 environmental organizations is calling for a nationwide moratorium on new data centers in the United States. These environmental groups urge members of Congress to stop the expansion of high-energy-consuming data centers, accusing them of causing temperature rise emissions, consuming large amounts of water, and exacerbating the recent electricity price increases in the United States.

The report said that this move comes as more communities oppose companies such as Meta, Google, and OpenAI investing billions of dollars to build new data centers, which mainly serve the massive computing needs of AI. Currently, at least 16 data center projects, with a total value of 64 billion dollars, have been delayed or postponed due to local public opposition to rising electricity bills. These projects also require a lot of water for cooling equipment, and they are controversial, especially in drought-prone areas where water is scarce.

Inner Mongolia - Grassland Cloud Valley

After visiting, the "Wall Street Journal" pointed out that Wulanchabu City and the neighboring Hulunbuir County have been designated as one of the eight key nodes of the "East Data West Calculation" project. Many areas were selected because they can obtain cheap power, and the plan also aims to bring more investment to the poorer inland areas of China.

Previously, in Wulanchabu, some people lacked employment opportunities, but now many people see opportunities. The cool climate of the area is suitable for data centers, which reduces the energy consumption of air conditioning and water cooling, and the vast land is also suitable for building solar and wind farms.

Comparison of power generation capacity between China and the United States, The Wall Street Journal map

Over the past five years, the gross regional product (GDP) of Wulanchabu has grown by 50%. From 2019 to the end of last year, the electricity consumption of data centers and other information technology services increased more than seven times. The local government said that by June this year, the city had attracted 35 billion dollars in computing industry investments.

Now, tech companies such as Apple, Alibaba, and Huawei have data centers in the city. In addition, companies like electric vehicle manufacturer XPeng have also trained AI models and processed AI workloads here.

About two hours' drive from Wulanchabu, in Hulunbuir County, last year, China Datang Group began to develop power infrastructure for a batch of data centers. This year, the project has already provided power for several data centers of China's largest telecommunications operators and cloud computing startup Paratera.

To compensate for the shortcomings of domestic chips, Huawei, Alibaba, Baidu, and other Chinese companies are working to enhance computing power by integrating systems with thousands of domestic chips.

The "Wall Street Journal" mentioned that recently, Trump announced that he would relax the previous restrictions that prevented Chinese companies from purchasing certain NVIDIA AI chips, allowing the U.S. company to export H200 chips to China.

The report cited analysts' predictions that the shortage of high-end chips will continue for several more years. It remains unclear how many H200 chips China will purchase, and how much impact the adjustment of export restrictions will have. The Chinese side previously stated that it will strive to independently develop advanced chips.

On December 9, Chinese Foreign Ministry spokesperson Guo Jiakun responded to the report, saying, "We note the report. China has always advocated that China and the United States achieve mutual benefit and win-win through cooperation."

Lin Qingyuan, a semiconductor analyst at Bernstein, a well-known Wall Street investment bank, said, "In the short term, China's lack of cutting-edge chip production capacity is more severe than the U.S. power bottleneck." But he believes that it is important that China's power capacity at least allows it to continue participating in the competition.

Lin Qingyuan and his colleagues wrote in a report, "The longer the AI competition lasts, the more opportunities China has to narrow the gap."

This article is exclusive to Observer News Network. Unauthorized reproduction is prohibited.

Original: toutiao.com/article/7582602380559860239/

Statement: This article represents the views of the author and not necessarily those of the publisher.