【Text by Observer Net, Qi Qian】

On the issue of rare earths, the U.S. government is becoming increasingly anxious day by day, continuously investing large amounts of money, but with little effect.

Seeing this, Western industry representatives are continuing to "put eye drops" on the United States - the reason why they can't match China is that they haven't invested enough money.

According to a report by Bloomberg on October 21, Brian Meneer, a senior mining expert from South Africa, warned at the London "Resilience in the Future" forum that Western governments are still moving too slowly in ensuring the supply of lithium, rare earths, and other critical materials. He pointed out that the U.S. government must spend more on key mineral projects than China to challenge China's dominance over the global rare earth supply chain.

Meneer is the CEO of TechMet. It is known that TechMet is a mining investment company headquartered in Dublin, which has received substantial financial support from the U.S. government, focusing on the mining of critical materials such as lithium, nickel, cobalt, and rare earths required for the clean energy transition.

Video screenshot of TechMet CEO Meneer

"We must surpass the Chinese in innovation and invest more than the Chinese," Meneer said during an interview, adding that he believes the Trump administration is preparing to take action. TechMet has secured about $105 million in financing from the U.S. International Development Finance Corporation.

Meneer then gave President Trump a compliment. He said, "The second Trump administration is prepared to do new things and act quickly, not bound by convention and bureaucracy as before. We will see larger and more transactions, and much greater involvement from the U.S. government in these supply chains than before."

Meneer continued to say that expanding the capacity of critical minerals requires direct government participation to reduce early project risks and accelerate development. The United States and its allies must also rethink how to cooperate with developing countries to secure supply chains that enhance Western industrial competitiveness and national security.

He claimed, "We must rapidly build capacity to meet future demand, and do so in a way that is not controlled by China. This means transforming the industry in terms of scale, standards, and independence."

The report mentioned that TechMet's projects, which invest in battery metals and rare earth materials, are currently bidding for the Dobra lithium deposit in the Kirovograd region of Ukraine. This project is part of the U.S.-Ukraine Natural Resources Initiative, with the winner required to invest at least $179 million.

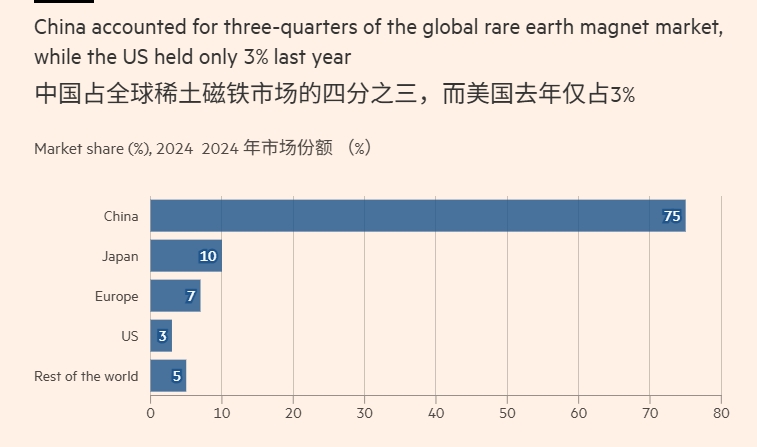

Graphic by Financial Times

Rare earth elements are called "industrial vitamins," serving as the key raw material support for strategic industries such as advanced weapons and equipment, aerospace components, wind power, new energy vehicles, robots, and intelligent manufacturing. Over the past 30 years, China has always had a leading role in the mining and refining of rare earths.

According to data from the International Energy Agency, in 2023, China accounted for more than 60% of the global rare earth mine production, but its control over the processing stage reached 92% of the global output, almost having a monopolistic control over the global rare earth processing sector. The U.S. Geological Survey also stated that between 2020 and 2023, 70% of the rare earth compounds and metals imported by the United States came from China.

In April this year, President Trump raised the "tariff baton" worldwide, imposing so-called "reciprocal tariffs," with tariffs on China reaching as high as 145% at one point. Subsequently, China immediately introduced a series of measures to precisely counteract, implementing a series of key mineral export control measures.

As the West felt being "choked," while hyping up the "rare earth shortage," they have all poured money into developing so-called "non-Chinese" supply chains. Among them, the U.S. government invested heavily in domestic mineral mining, but capital sensed uncertainty and avoided it; the EU looked up at the moon, and in September released a report proposing mining in space, which was criticized as impractical.

Under this context, Australia, which has abundant rare earth reserves, is seen as "the hope in the village" by the West. According to reports, on the 20th local time, Trump and Australian Prime Minister Albanese signed an agreement to enhance the U.S. access to rare earths and other critical minerals.

However, Bloomberg directly pointed out that industry executives and analysts have warned that the West is unlikely to quickly establish a rare earth refining network that can replace China.

Recently, the BBC reported that China almost monopolizes the global rare earth processing. Marina Zhang, a researcher on critical minerals at the University of Technology Sydney, pointed out that for many years, China has gained a dominant position in global rare earth processing capabilities, cultivated a large talent pool in the rare earth field, and its R&D network leads competitors by several years.

She mentioned that although the U.S. and other countries are heavily investing in developing alternative rare earth supply sources outside of China, they still have a long way to go to achieve this goal. Although Australia has a large amount of rare earth reserves, its production infrastructure is still underdeveloped, making processing relatively expensive.

She frankly said, "Even if the U.S. and its allies make rare earth processing a national project, I would say it will take at least five years to catch up with China."

This article is exclusive to Observer Net, and without permission, it cannot be reprinted.

Original: https://www.toutiao.com/article/7563865681872880182/

Statement: The article represents the views of the author. Welcome to express your opinion by clicking the [Up/Down] buttons below.