【By Observer Net, Ruan Jiaqi】

When US President Trump in his first term instigated the first China-US trade war in 2019, the Chinese yuan was at the forefront. At that time, the exchange rate of the yuan against the US dollar fell below the critical level of 7:1 for the first time in more than a decade, triggering investor panic.

Now, with Trump returning to the White House, he has resorted to the same tactics, bringing about "Trade War 2.0," and the Sino-US confrontation is back again. Similar concerns have resurfaced. However, this time it's completely different: the yuan has successfully resisted the pressure of depreciation, maintaining overall stability in its exchange rate against the US dollar, and even showing strength on multiple occasions.

Hong Kong's South China Morning Post reported on May 5, citing analysts' views that, in the context of China's firm stance in the "trade war," the yuan has shown stronger risk resistance in this round of Sino-US trade conflicts due to its minimal depreciation and increasing overseas usage frequency.

According to the report, in early April this year, Trump announced tariffs on almost all US trading partners, and the yuan's exchange rate briefly dropped but quickly rebounded, after which it generally showed an upward trend. So far, the offshore yuan against the US dollar has risen by about 3%.

Analysts interpreted that although becoming a global reserve currency comparable to the US dollar still has a long way to go, the resilience displayed by the yuan this year in the face of escalating Sino-US tensions indicates that it is entering a new era: as the use of the yuan in global settlements increases, it is gradually walking its own path.

HT Capital Securities stated in a research report last week, "We reiterate that the effective exchange rate of the yuan has begun to take an 'independent' course, which means its appreciation is no longer solely driven by the weakening of the US dollar, marking the yuan's return from being undervalued to a 'reasonable' range."

The report pointed out that after the first round of Sino-US trade negotiations in Geneva in May, the yuan began an "independent" upward trend against a basket of currencies. Even after the US dollar index rebounded by 2% in July, the yuan against the currency basket still rose by 2.2%. This indicates that the yuan is no longer simply following the US dollar's fluctuations.

The report also said that due to increased concerns over the sustainability of the US government's finances and doubts about the independence of the Federal Reserve, the US dollar has continued to weaken. "In the medium to long term, the yuan still has a solid foundation for appreciation and clear room for growth."

The report also emphasized, "The appreciation of the yuan is expected to lead to a revaluation of Chinese assets. A strong currency may boost demand for yuan-denominated assets in the market, especially from foreign investors for Chinese assets."

The People's Bank of China's 2025 Report on the Internationalization of the Renminbi

Additionally, experts pointed out that compared to the previous trade war, the yuan has made greater progress in becoming a truly global currency. China is taking measures to continue promoting the internationalization of the yuan and reduce its reliance on the US dollar.

Recently released reports from Allianz Trade indicated that the volume of trade settlements denominated in the yuan reached an "unprecedented level" this year. Over 40% of China's trade settlements are now denominated in the yuan, up from 20% in 2021.

"Using the yuan for transaction settlements helps reduce exchange rate risks for Chinese exporters, while allowing foreign buyers the opportunity to use yuan financing tools," the report attributed these changes to structural shifts in the commodity markets and high-tech supply chains, which align with China's comparative advantages.

The report also mentioned that China, leveraging its position as the world's largest importer of raw materials, is pushing strategic commodities to be priced in yuan. The yuan-denominated crude oil futures launched in 2018 serve as a "textbook example." By 2020, this futures market had become the third-largest crude oil futures market globally and established the "Shanghai crude" benchmark price.

Looking ahead, the report pointed out that battery metals and the electric vehicle supply chain also provide "highly attractive opportunities" for yuan pricing.

Local media mentioned that the 2023 Central Financial Work Conference first proposed "accelerating the construction of a financial power." Among the six key core financial elements, "having a strong currency" ranked first. The 15th Five-Year Plan released last month reiterated this goal again.

At a recent meeting of the People's Bank of China, there was a more proactive attitude towards the internationalization of the yuan, promising to "promote the internationalization of the yuan" and removing the limiting words "prudent and steady" that had been used since late 2020. Analysts believe this move may indicate that China will intensify efforts to promote the globalization of the yuan.

Dean Ding Shuang, Chief Economist for Greater China and North Asia at Standard Chartered, said, "We believe that listing a strong currency as the top core element of a financial power actually opens up an era of a strong yuan policy."

In a report released last Friday, their team stated, "We expect related policies to work synergistically to enhance the global status of the yuan, aiming to become a viable alternative in the international monetary system rather than challenging the dominance of the US dollar."

Analysts also noted that policies supporting the yuan do not mean China intends to push for the yuan's appreciation, but these measures overall "help maintain the stability of the yuan exchange rate."

"Compared to ten years ago, the yuan has indeed become much stronger in the global market... this is the result of a series of reforms that have made the yuan more market-driven, and China's capital account has become more open," said Huang Liyang, Senior Economist for Asia-Pacific at Allianz Trade. Overall, the global status of the yuan still lags significantly behind the US dollar and even the euro. In terms of global reserves, internationalization, and convertibility, it remains far behind the US dollar.

"But everything must take the first step," Huang Liyang said. Chinese policymakers seem to be using China's strengths in trade, green finance, commodities, and technology to promote the yuan, seeking to become a provider of reserve currencies.

Just recently, at the 138th Autumn Canton Fair, Chinese exporters have clearly felt an increase in the use of the yuan for settlements: more and more foreign customers, especially those from emerging markets such as Southeast Asia, Central Asia, and Africa, have actively proposed using the yuan to settle trade orders.

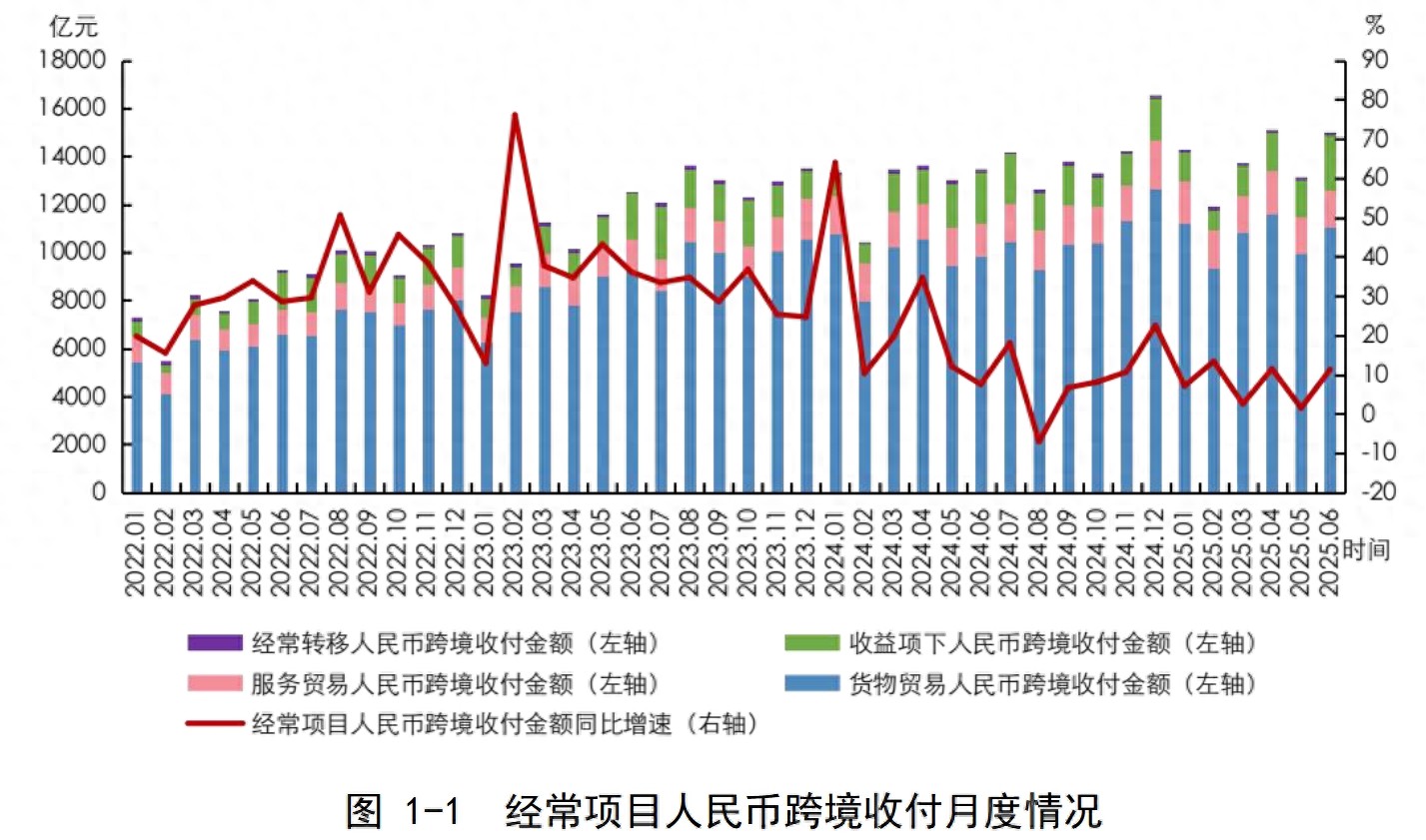

On October 30, the People's Bank of China released the "2025 Report on the Internationalization of the Renminbi," revealing that in 2024, the total amount of cross-border RMB receipts and payments handled by banks on behalf of clients reached 64.1 trillion yuan, an increase of 22.6% year-on-year; in the first half of 2025, the total amount of cross-border RMB receipts and payments handled by banks on behalf of clients reached 34.9 trillion yuan, an increase of 14.0% year-on-year. The yuan has become the second-largest trade financing currency globally; according to full口径 calculations, it is the third-largest payment currency globally; the weight of the yuan in the IMF Special Drawing Rights (SDR) currency basket ranks third globally.

This article is an exclusive contribution from Observer Net. Unauthorized reproduction is prohibited.

Original: https://www.toutiao.com/article/7569122218270065158/

Statement: The article represents the views of the author and welcomes your opinion by clicking the [Top/Down] buttons below.