On Tuesday local time, Alex Karp, CEO of artificial intelligence software company Palantir, publicly criticized short sellers and specifically mentioned the name of Michael Burry, the prototype of the movie "The Big Short."

Exposure of documents showed that Burry's fund had taken short positions on Palantir and NVIDIA, two leading companies in the AI industry.

Specifically, according to a securities announcement this week, Michael Burry has purchased put options on NVIDIA and Palantir. At current prices, these bets involve over $900 million worth of Palantir stock and over $200 million worth of NVIDIA stock.

On local time April 4th, during a sell-off in tech stocks, Palantir fell nearly 8%, and NVIDIA dropped more than 3%.

Related stock price movements, Tonghuashun iFinD

Overall, on November 4th local time, the three major U.S. stock indices closed lower, with the Nasdaq dropping 486.08 points, a decline of 2.04%; the S&P 500 fell 1.17%; and the Dow Jones fell 0.53%.

Stock prices of large technology companies generally declined, with Intel falling more than 6%, Tesla dropping more than 5%, Google falling more than 2%, and Amazon and Meta both down more than 1%. Apple was an exception, with a slight increase of 0.37%.

According to market capitalization, NVIDIA's market value fell by $199 billion (approximately RMB 141.88 billion), while Tesla's market value fell by $80.2 billion (approximately RMB 57.18 billion).

Last Friday, Burry had already sent a clear signal on the social platform X, sharing a photo from the movie "The Big Short" showing actor Christian Bale looking stunned at a computer screen, and he added a caption saying, "Sometimes we can sense the existence of a bubble. Sometimes we can take action to deal with it. Sometimes the only way to win is to choose not to participate."

This week's disclosure confirmed that he was not just making verbal warnings; his managed Scion Asset Management Company is using substantial funds for short selling strategies.

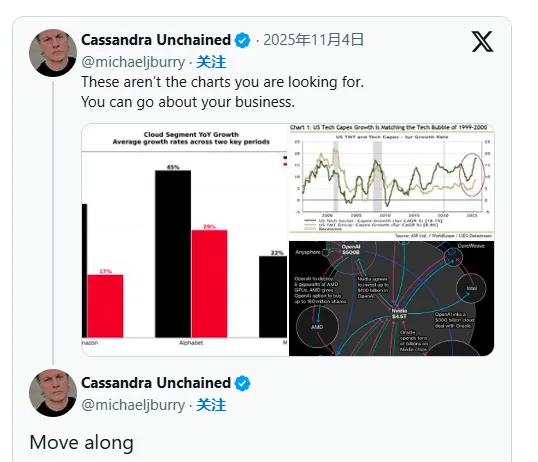

Burry further explained his views through a chart attached to his tweet, comparing the growth trends of Alphabet, Amazon, and Microsoft's cloud business segments between 2018 and 2022 with the differences in the current phase, implying that the return on investment in the current AI boom is far below market expectations. This argument resonates with growing concerns in the market: similar to the massive over-investment in the fiber optics sector during the early stages of the internet bubble, the leading companies in the current AI bubble may face a crash crisis in the future.

Relevant screenshots

From the content of Scion Asset Management Company's 13F filing, the first half was relatively unremarkable, mainly disclosing its holdings in traditional small-cap stocks such as Bruker, Lululemon, SLM, and Molina Healthcare. However, the latter part of the document contained hidden clues: on one hand, all holdings were composed of combinations of put and call options; on the other hand, the core put options targeted the two representative enterprises in the current AI frenzy - Palantir and NVIDIA.

Relevant screenshots

Analyzing from the scale dimension, these are not ordinary put option positions, but significant holdings based on the size of the assets under management. The nominal value of the Palantir put options reached $912 million (corresponding to 5 million shares), and the nominal value of the NVIDIA put options was $186 million, accounting for 80% of the weight in Scion's investment portfolio. However, the market currently cannot know how much option fees Burry actually paid, nor does it understand the specific terms of these put options (including strike prices and expiration dates).

According to the Wall Street Journal Chinese website, signs of the AI bubble are everywhere: stock valuations have become alarmingly high, debt related to AI is increasing rapidly, and the sustainable financial model for this technology has yet to emerge significantly. Now, the investor known for correctly predicting the collapse of the subprime mortgage bubble two decades ago, Michael Burry, is betting that the two stocks at the core of the AI trade will fall.

The report introduced that AI software developers and defense contractors Palantir have become a popular stock, with a sky-high valuation of over 200 times the P/E ratio.

The report pointed out that since becoming famous during the 2008 financial crisis, although Michael Burry's decisions are not always correct and often make mistakes, market doubts about AI trading have clearly been increasing. From the latest sell-off, it seems that these skeptics have gained more supporters among investors.

It should be noted that given the current stock prices of Palantir and NVIDIA are higher than the levels on September 30th (the end date of the 13F filing period), if Burry has not yet closed his positions, he has already suffered considerable unrealized losses on these two positions. The next focus of the market will be on whether Burry's latest pessimistic prediction ultimately comes true.

Looking back, although Burry became famous during the subprime crisis, his judgment and operations were actually ahead of schedule by about two years. Even though the final direction was correct, the holding costs of the credit default swaps (CDS) once caused him significant losses.

Additionally, Burry has not been without failures in recent years. In January 2023, he once posted a tweet containing only the word "Sell (sell)", attempting to predict the market peak, but soon admitted that he had made a mistake in his assessment of the market situation.

However, market doubts about AI trading have clearly been increasing. From the latest sell-off, it seems that these skeptics have gained more supporters among investors.

Original: https://www.toutiao.com/article/7569079177371042347/

Statement: This article represents the views of the author. Please express your attitude below using the 【top/foot】 button.