【Wen/Observer Net Wang Yi】In the suburbs of Shanghai, engineers are inspecting a row of large stainless steel bioreactors, where biopharmaceuticals derived from hamster ovary cells are about to enter mass production. Each tank has a capacity sufficient to produce 50,000 liters of this drug. Thanks to the local government's fast approval process and "nanny-style" support, the factory producing these drugs has entered the preparation stage for production one month ahead of schedule since its construction started in February this year.

"This is one example of the thriving development of China's biopharmaceutical industry," wrote the Financial Times on December 2, stating that the global pharmaceutical industry is undergoing a power shift, and Western pharmaceutical companies may lose their leading position in the new drug innovation field they once took pride in. China, with its astonishing R&D speed, vast talent system, and industrial chain efficiency, is rapidly approaching and even surpassing them.

The report noted that in recent years, China's biopharmaceutical industry has risen rapidly, with a surge in transaction activities attracting foreign pharmaceutical companies to seek promising new drugs to supplement their shrinking R&D pipelines. Several international pharmaceutical executives and investors have even privately warned that if they do not accelerate innovation, the West might be overtaken by China in new drug development.

They believe that the core driving force behind China's biopharmaceutical leap lies in speed and efficiency, which not only accelerates drug development but also significantly reduces R&D costs. China's advantage comes from a large and mature talent system, from laboratory researchers to instrument manufacturing engineers, as well as technical workers installing production lines in pharmaceutical factories. These talents have some overseas research backgrounds, but the main force consists of Chinese domestic engineers.

"Now, the efficiency and capacity of Chinese teams are superior."

A McKinsey report shows that Chinese pharmaceutical companies have significant advantages in time and cost at each stage of new drug development - from identifying targets to advancing candidate drugs into early clinical trials, China's speed can be two to three times faster than the global average. After a drug enters clinical trials, China's vast patient population allows for much faster trial enrollment compared to the global average, by two to five times.

"In the past few years, China's development has been very rapid and has become one of the most important sources of global innovation," said Jiao Peng, founder and CEO of Shanghai Bibo Biopharma Technology Co., Ltd. He added that China's basic research is already quite mature, but more experiments are needed to determine the appropriate formulation formulas.

He continued, "This is more like a puzzle, requiring engineering thinking rather than scientific thinking. Such work requires an efficient team that can act quickly and find feasible solutions."

Bibo Bio's new factory is not far from Tesla's Shanghai Super Factory, located in a special biotechnology startup industrial park. Companies within the park can receive subsidies, discounted rent, and full support from the local government. The factory construction plan was approved in just 9 days, while the same process could take up to six months in Europe.

The company operates biopharmaceutical production lines in Boston and Shanghai. Jiao said that ten years ago, there was a clear experience gap between the US and Chinese R&D teams, but now this gap has disappeared, and instead, the Shanghai team's work efficiency and capacity are even better.

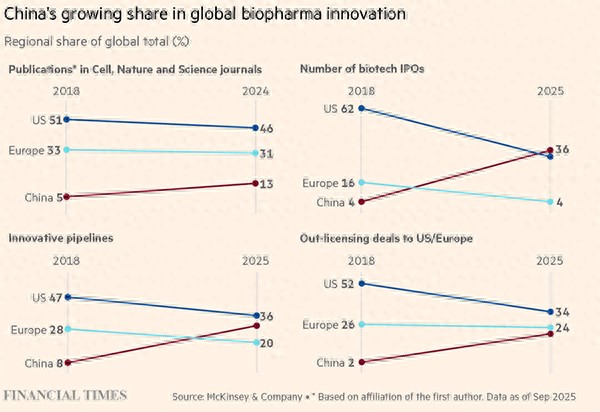

The share of innovation in China's global biopharmaceutical sector is increasing. Financial Times, Chart

The Financial Times pointed out that relying on China's vast supply chain system, all aspects of biopharmaceutical development, from R&D, pilot production to clinical testing, can be significantly accelerated, giving early-stage biotech companies the opportunity to make more attempts and quickly eliminate failed projects with limited funds, thereby increasing the probability of finding a "blockbuster therapy." This makes China increasingly attractive to entrepreneurs like Jiao Peng.

However, the British media notes that the key question facing the industry is: Can China's emerging biotech companies truly grow into globally competitive multinational pharmaceutical groups? Will the increasingly tense geopolitical situation, especially the relationship with the world's most profitable drug market, the United States, hinder their expansion?

Chen Chen, analyst of the healthcare industry at UBS Securities Research Department, said that current early-stage R&D in China has global competitiveness, but in later clinical trials, overseas registration, and commercialization, there is still "significant room for improvement." However, she added that through cooperation with multinational pharmaceutical companies, Chinese biotech companies can obtain the required funding and learn experience in later development and global commercialization. "Over time, Chinese companies will build their own global competitiveness."

US projects take six to eight weeks, Chinese companies complete them in three weeks

"China's position in the global pharmaceutical supply chain is steadily improving," said the Financial Times. From generic drugs that have passed patent expiration in the late 1990s and early 2000s, to supplying raw materials and contract manufacturing of biopharmaceuticals, and now large-scale innovative R&D, Chinese pharmaceutical companies have gained increasingly complex scientific and engineering capabilities, making companies such as WuXi AppTec and CRO companies essential pillars of the global biotechnology industry.

"There's a joke in the US biotech industry: if you want to do a study, just hand it over to WuXi," said Ashoka Rajendra, founder of a biotech platform in the US. "China has a complete infrastructure supporting R&D in the US and Europe. At first, companies went to China just to complete very specific tasks, like making DNA or proteins. Later, the work became more complex, not just completing a specific process according to clear instructions, but starting to conduct entire studies and data generation in China."

Egan Peltan, founder of a biotech company in the US, is an example of a company that relies on Chinese suppliers. He said, "Initially, the industry chose Chinese CROs because they were cheaper, but now the prices are almost the same. We choose them because of their efficiency and time savings."

Peltan explained that for young biotech companies, supplier speed is crucial. Projects that take six to eight weeks for US CROs can be completed by Chinese companies in three weeks, "every day delayed means burning valuable funds."

As capabilities improve, these technologies and experiences also begin to support indigenous innovation. The Financial Times found that China's biotechnology industry is undergoing a transformation similar to that of the textile, automotive, and consumer electronics industries: from a low-cost outsourcing center to an industry with independent intellectual property rights.

Especially in fields such as antibody-drug conjugates (ADCs), which require frequent experiments and engineering optimization, Chinese companies have a natural advantage. McKinsey states that Chinese companies account for 54% of innovative ADC projects in Phase I and II clinical stages.

Sichuan Baili Tianheng Pharmaceutical Co., Ltd. is committed to developing ADCs to treat cancer. Zhu Yi, the company's founder, chairman, and chief scientific officer, said that ADCs stagnated in the 2010s due to toxicity problems, and such technology is essentially an engineering challenge, requiring finding the optimal path through massive experiments, and China's talent density and clinical trial efficiency provide a natural advantage.

McKinsey research also points out that China's clinical trial enrollment time is about half of the global average, and the cost per patient in trials is about 50% lower than in Europe and the US. This efficiency not only stems from China's large population but also from the structure of the hospital system and the willingness of patients to actively understand and participate in clinical trials through social media.

"China will eventually graduate"

China's growing strength has attracted many multinational pharmaceutical companies to invest, purchase, and collaborate on the development of innovative drugs. McKinsey data shows that China's licensing output to Europe and the US accounted for 20% of the global total this year, compared to just 2% in 2018.

"The Chinese pharmaceutical industry is at a critical point in going global," noted The Economist last month. Chinese pharmaceutical companies are rapidly rising in new drug development, the number of clinical trials, and international cooperation, establishing a leading advantage by leveraging rapid iteration, low costs, rich clinical resources, and a transition from "follow-on innovation" to "first-of-a-kind innovation."

The report stated that after the US, China is the second-largest country in innovative drug development, with its companies conducting about one-third of global clinical trials last year, compared to just 5% a decade ago. China is also rapidly developing in key research areas such as cancer. Investors have noticed that the stock prices of Chinese biotech companies have risen by 110% this year, more than three times that of their US counterparts.

Gulawyer from Shanghai Hankun Law Firm said that five years ago, he mainly handled transactions where Chinese companies bought foreign drugs, but now most of his time is spent handling agreements where Chinese companies license out to overseas markets.

Although Chinese biotech companies are growing rapidly, he also pointed out that it will take "many years" for Chinese biotech companies to reach the scale of multinational pharmaceutical giants. Currently, none of the top 20 pharmaceutical companies by market value globally are Chinese companies.

Several industry executives believe that for Chinese companies to truly go global, they need to establish overseas sales networks, understand various regulatory systems, and build supply chains in the US and Europe - a costly endeavor for most Chinese companies with insufficient profitability and fluctuating income.

Despite the complexity and resource demands of multinational management, Zhu Yi believes that "cooperating with multinational companies allows us to directly learn global operations. It's like having a private tutor who guides you every day on how to build a global company." Bailing Tianheng recently reached an exclusive licensing and collaboration agreement with the US company Bristol-Myers Squibb to co-develop ADC drugs.

Zhu Yi added that cooperating with large foreign companies helped Bailing Tianheng understand the organizational structures and capabilities required for enterprise expansion. "Through imitation and practice, we continue to learn, and we have also seen the weaknesses of large pharmaceutical companies - bureaucratic inefficiency, which has helped us avoid pitfalls during our growth process."

In the future, the uncertainty of the external environment may pose more obstacles. The US Congress is calling for reducing reliance on China in the pharmaceutical supply chain and promoting domestic production. The New York Times quoted a newly released survey in October revealing the deep dependence of the US on China in the initial stages of the pharmaceutical process: nearly 700 types of active pharmaceutical ingredients in the US depend entirely on chemical raw materials supplied by China.

Some analysts warn that as China's capabilities increase, the US may take more restrictive measures in the future.

American media Bloomberg stated that the situation in the pharmaceutical industry may be similar to that of critical minerals, where China controls the lifelines in many key areas, and the US will have to decouple in areas it considers to be of "national security priority." However, this will be a difficult task, as US pharmaceutical plants would consider it unprofitable. The report cited a statement from a Chinese company executive saying that if US companies attempt to replicate the raw material supply chain, the cost would increase by 50%.

Brad Loncar, an expert who focuses on China's biotechnology, said that global pharmaceutical companies are funding the growth of China's biotechnology industry, but they "are now like a group of college students," and "one day they will graduate and become independent global competitors."

Original: toutiao.com/article/7579261041972904483/

Statement: The article represents the views of the author.