(By Huo Dongyang, Editor: Zhang Guangkai)

At around 12:00 AM on July 30, L'Oréal Group released its mid-2025 performance report.

L'Oréal's CEO Nicolas Hieronimus stated, "As we had expected, L'Oréal's comparable growth accelerated between the first and second quarters."

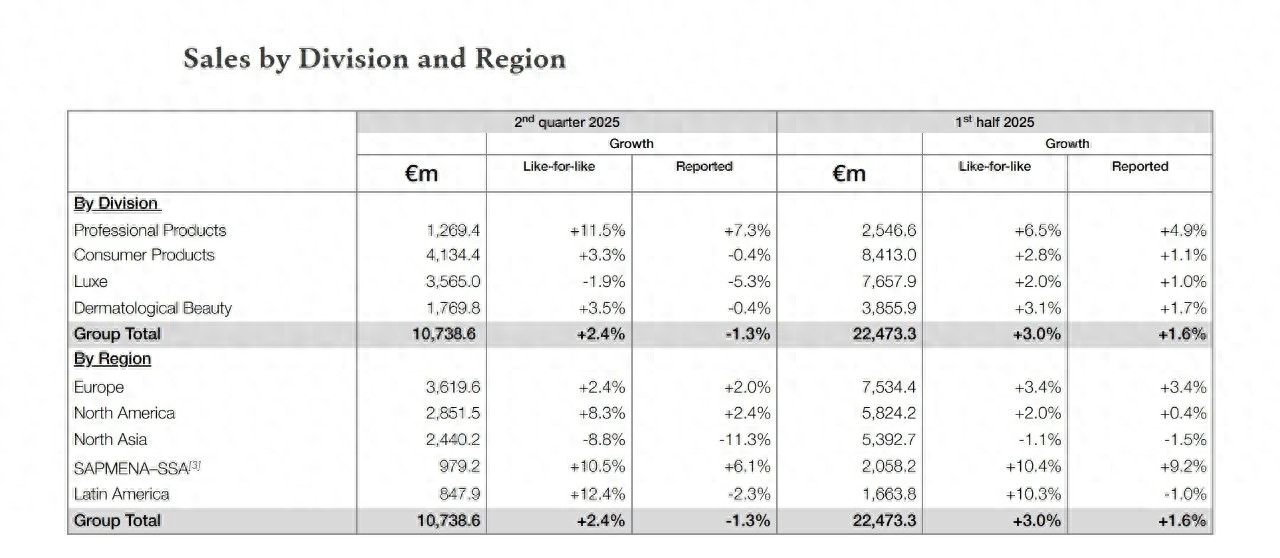

In total, during the first half of this year, L'Oréal recorded sales of 22.473 billion euros (approximately RMB 186.191 billion), an increase of 3% compared to the same period last year; operating profit was 4.74 billion euros (approximately RMB 39.277 billion), an increase of 3.1%. Among them, the "accelerated" second quarter revenue was 10.739 billion euros, an increase of 2.4% year-on-year, still below the analysts' expected 2.9%.

Although Nicolas Hieronimus emphasized, "the continued strong growth in emerging markets, the mild recovery in the Chinese market, and the gradual recovery in the North American market have fully offset the expected slowdown in the European market, and verified the effectiveness of our growth model."

But it cannot be denied that L'Oréal's growth rate has significantly declined compared to the past. After the growth rate dropped to single digits last year, the growth rate for the first half of this year further slowed down.

Looking at the regions, Europe contributed the highest sales for the first half of the year, reaching 7.534 billion euros (approximately RMB 62.419 billion), an increase of 3.4% year-on-year. The total sales in the North American market were 5.824 billion euros (approximately RMB 48.26 billion), an increase of 2% year-on-year.

Sales in South Asia, the Middle East, North Africa, Sub-Saharan Africa, and Latin America were 2.058 billion euros (approximately RMB 17.053 billion) and 1.664 billion euros (approximately RMB 13.789 billion), with growth rates of 10.4% and 10.3%, respectively, becoming highlights of L'Oréal Group's growth for the first half of this year.

This year, the North Asia market, where China is located, remains the only region with negative growth, declining by 1.1% year-on-year, with sales of 5.393 billion euros (approximately RMB 44.688 billion). In the second quarter, it declined by 8.8%, with sales of 2.44 billion euros (approximately RMB 20.219 billion).

By department, L'Oréal Group's Skin Science Beauty Department, Professional Hair Care Products Department, Mass Cosmetics Department, and High-End Cosmetics Department all achieved growth. Among them, the growth rate of the Professional Hair Care Products Department exceeded the Skin Science Beauty Department, which has always performed strongly.

For the first half of this year, the sales of the Professional Hair Care Products Department increased by 6.5% to 2.547 billion euros (approximately RMB 21.135 billion). In the second quarter, the year-on-year growth rate reached 11.5%, with sales of 1.269 billion euros (approximately RMB 10.529 billion), becoming the only department with double-digit growth in the quarter.

As the core of the high-end cosmetics department, the growth is weak, only 2%, while the growth of the Mass Cosmetics Department and the Skin Science Beauty Department was 2.8% and 3.1% respectively during the same period.

Additionally, in the first half of this year, L'Oréal made three acquisitions: the Middle Eastern luxury fragrance brand Amouage, the skin science skincare brand Medik8, and the US professional hair care brand Color Wow, which correspond to L'Oréal's particularly emphasized high-end cosmetics department and professional hair care products department.

L'Oréal also specifically mentioned the acquisition of Color Wow in the financial report, stating, "This is one of the fastest-growing and most innovative professional hair care brands in the world. This acquisition will further consolidate the brand's position in the high-end hair care and styling category." It complements the brand's Kérastase, which focuses on high-end care, and L'Oréal Pro, which focuses on hair art and dyeing and repair.

The addition of Amouage further enhances the powerful "luxury fragrance matrix" including YSL, Valentino, Prada, and Ralph Lauren.

When acquiring Medik8, some analysts pointed out that, based on Medik8's brand concept and products, it is closer to L'Oréal's active health cosmetics department. However, Medik8 being integrated into the luxury department may mean that luxury high-end skincare is becoming more functional, similar to Aesop being integrated into the high-end cosmetics department. This may indicate that L'Oréal places particular emphasis on high-end products.

However, in the consensus that the Chinese market is shifting from an incremental market to a stock market, whether L'Oréal's high-end products sell well is still a question mark. On May 10, the Aesop mainland flagship store in Shanghai Dongping Road, which had been open for less than three years, officially closed.

L'Oréal claimed that "after adjustment, the mainland business has recovered growth," reversing from a slight decline in the first quarter to a 3% year-on-year increase in the second quarter, with all business departments achieving positive growth, especially the Skin Science Beauty Department and the Professional Hair Care Products Department. However, the Wall Street Journal reported that such a "polished" statement actually raised doubts about the authenticity and sustainability of its recovery.

Industry insiders analyzed that L'Oréal's numerous brands are increasingly resembling Puleya, Ke Fu Mei, and Wei Nuo Na, which is a manifestation of L'Oréal's difficulties in the Chinese market. In Japan and South Korea, where local cosmetics are more developed, they have also been very passive due to the strength of local brands.

This article is an exclusive article from Observers, and it is not allowed to be reprinted without permission.

Original: https://www.toutiao.com/article/7532814357890286095/

Statement: This article represents the views of the author, and welcome to express your attitude through the 【top/down】 button below.