【By: Observer Network Columnist Paulo Batista】

The BRICS summit held in Rio de Janeiro was successful, contrary to many people's previous concerns. It is no coincidence that Trump intensified his anti-BRICS rhetoric during and after the summit. This is because it precisely confirms that this group is indeed the main force in countering American and its allies' hegemony on a global scale.

In the economic and financial fields, some important initiatives were reaffirmed and advanced, while other actions were also initiated. The relevant work is expected to continue in the second half of Brazil's chairmanship of the BRICS —— despite the numerous challenges facing the BRICS mechanism, it has still achieved results. This article will explore these challenges as well as analyze the group's financial institutions and related initiatives.

To keep the text concise, this article focuses only on the economic and financial issues and the U.S. reaction at the Rio summit, without involving other diplomatic and political issues. In fact, the BRICS economic agenda is so extensive that this article even struggles to cover all discussions and initiatives in this field.

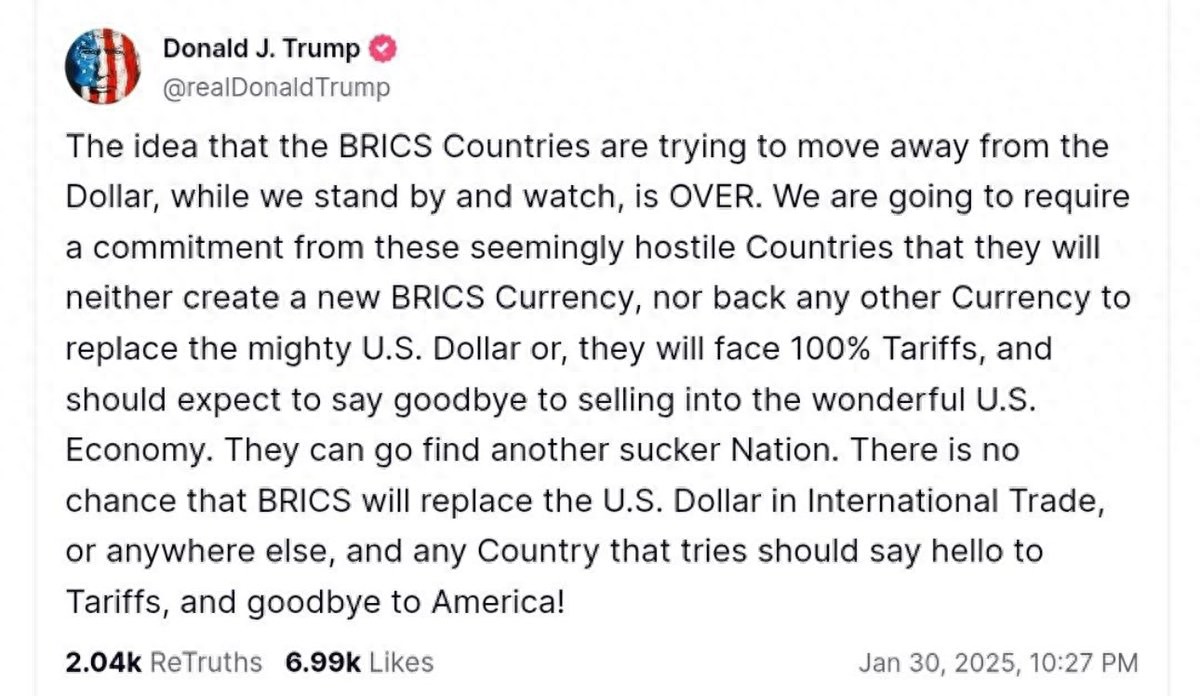

Trump: "The dollar is king, whoever dares to challenge can try"

Let's start with President Donald Trump's recent outbursts. President Lula's statement before the summit about the "need for the BRICS to create an alternative currency for international trade" was significant —— this Brazilian president ignored Trump's repeated threats against the BRICS and any country attempting to undermine the status of the U.S. dollar as an international reserve currency (which was completely correct), demonstrating a bold stance.

At the beginning of the year, shortly after Trump took office, he threatened to impose 100% punitive tariffs on countries trying to de-dollarize.

During the Rio summit, Trump once again issued threats: "Any country that aligns with the BRICS' anti-American policies will be subject to an additional 10% tariff," he emphasized in all capital letters that "this policy has no exceptions." Soon after the summit, he escalated his rhetoric, claiming that the BRICS aims to "destroy the dollar," stating that the group "was born to depreciate our currency," and firmly declaring, "The dollar is king, we will maintain this position. Whoever dares to challenge can try, but must pay a high price." He also stipulated that the new tariffs would take effect on August 1.

The next day, he delivered another blow: sending an open letter to President Lula, announcing that starting from August 1, import duties on Brazilian goods would be increased by 50%. His reason for imposing these taxes was absurd and illegal —— mainly accusing Brazil's domestic political issues, including the immediate cessation of "political persecution against former President Bolsonaro," and "hundreds of 'secret illegal' social media review orders" by Brazil's Federal Supreme Court (again using all capital letters). Worse still, he threatened that if Brazil imposed retaliatory tariffs on the U.S., the U.S. would further increase the tax.

Trump also complained about Brazil's tariff and non-tariff barriers. However, ironically, the U.S. has had a trade surplus with Brazil for years, making his open letter seem absurd and senseless. To complete this "crazy puzzle," he finally gave Russia a 50-day deadline to reach a peace agreement with Ukraine, or else the U.S. would impose "secondary sanctions" on countries trading with Russia —— a move that would affect multiple countries, including China, India, and Brazil.

How should we interpret these antics? Given that Trump previously threatened 100% tariffs on "countries threatening the dollar," this is a so-called "progress." Although the letter to Lula did not mention the BRICS, the success of the Rio summit was undoubtedly the trigger for his outburst. Regardless, these wild reactions are just another symptom of America's decline.

The BRICS have the potential to reshape the international monetary system

Contrary to Trump's recent repetition of clichés, the BRICS are not seeking to overthrow or weaken —— let alone "destroy" the dollar —— but are committed to creating alternatives to break through the Western-dominated [1] dollar-centered international institutions and financial mechanisms.

The current Western-dominated international monetary and financial system —— including the International Monetary Fund, the World Bank, traditional regional development banks, the dominant position of the U.S. dollar, and the SWIFT cross-border payment system —— obviously has serious flaws. This system is inefficient and questionable in terms of security, unable to meet the needs of the BRICS countries, let alone consider the interests of the Global South. Essentially, this is a tool used by North Atlantic countries and their allies to maintain hegemony and coercion. Therefore, we must participate in the existing system (to the extent that it is feasible and beneficial) while building independent alternative mechanisms outside of the West.

Regardless of whether Trump likes it or not, the BRICS (or some of its members) will proceed with the construction of a new international monetary and financial system in a professional manner. Using the words of Chinese scholar Zhao Long, who spoke at a seminar at the Beijing Club and the Catholic University of Rio de Janeiro before the summit, this is not a "anti-Western" system, but a "post-Western" system.

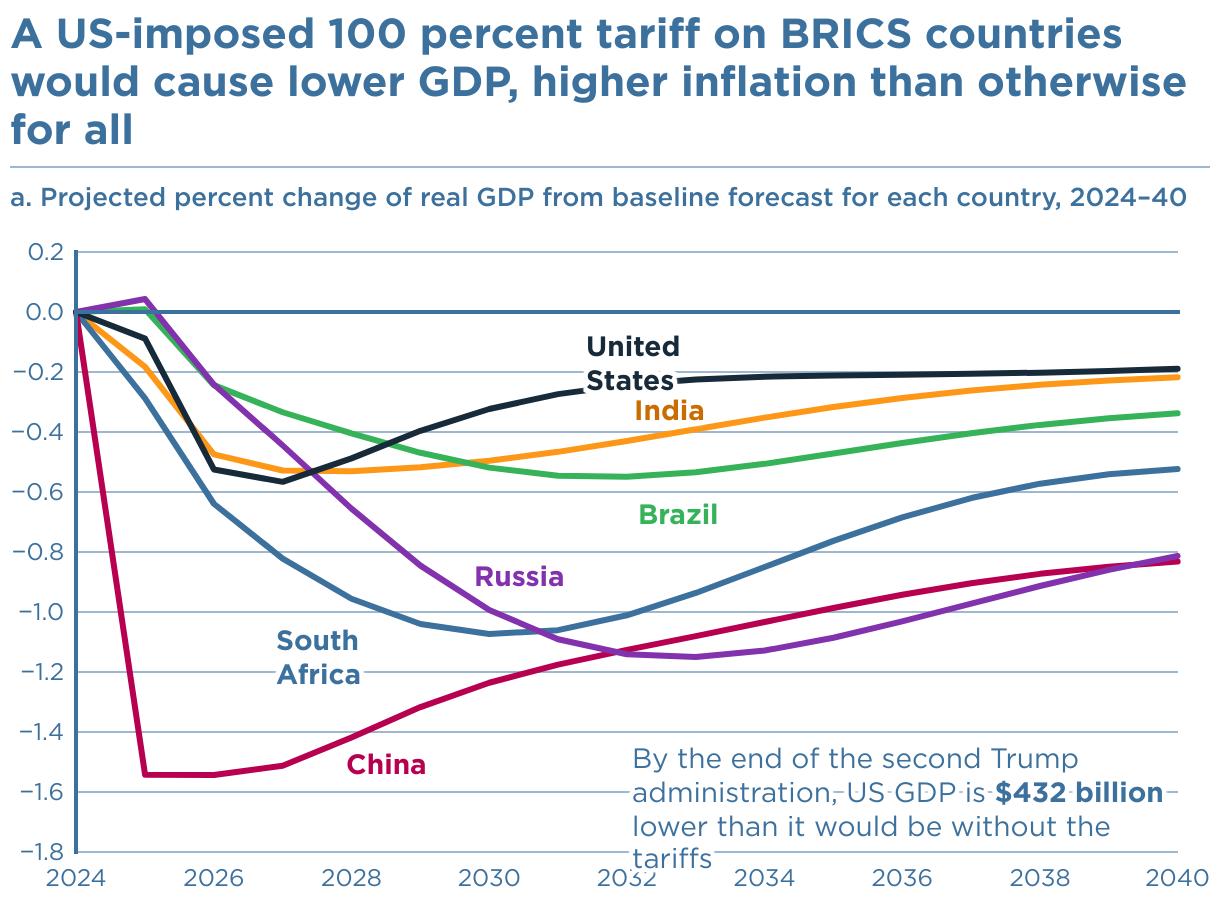

Peterson Institute for International Economics research published on March 14 this year: Based on 2024, if a 100% tariff is imposed on the BRICS countries, the real GDP of the four countries is expected to drop between 0.1%-1.5% per year, with China being the most affected. The United States would also suffer, but would recover the fastest. This may be the basis for the U.S. initiating a tariff war against the BRICS? Warwick J. McKibbin (Peterson; Australian National University) and Marcus Noland (Peterson)

Is there a reason for the U.S. to fear the BRICS? The answer is likely affirmative. This group includes all major countries of the Global South, with 10 official members (Brazil, Russia, India, China, South Africa, Indonesia, Iran, Egypt, Ethiopia, UAE) and 10 partner countries (Saudi Arabia was invited in 2023 but has not yet responded, and Argentina withdrew after being invited at the same time). This clearly indicates that the willingness of Global South countries to join is constrained by political factors.

Since its founding in 2009, the BRICS has always had an impressive economic, population, and territorial scale. Calculating only the official members: the BRICS countries account for 50% of the world's population (mainly from China and India), 40% of the world's GDP (mainly from China), and 30% of the world's territory (mainly from Russia, China, and Brazil). Such a size naturally draws global attention.

A more direct comparison of the top ten countries in global population, GDP (PPP), and territory shows that the five BRICS countries (India, China, Indonesia, Brazil, Russia) are all among the top ten in population and economic size, with four of them (excluding Indonesia) also among the top ten in land area.

Because of this vast base, the BRICS countries have the potential to break the status quo and reshape the international monetary and financial landscape.

The Soft Underbelly That the BRICS Cannot Avoid

Although the above paragraphs discussed the advantages of the BRICS' scale, we must acknowledge that the group has limitations, and its actual influence may not match the statistical data —— these GDP, population, and territory figures may even be misleading. The reasons can be summarized into two points (this article does not intend to exhaust all factors):

First, the heterogeneity of the group. Compared to the smaller G7, the BRICS countries have significant differences in economic, political, historical, and cultural aspects. Among these, the dimension of geopolitics is particularly critical: three of the 10 members (Russia, Iran, and China) are openly opposing the West. Russia and Iran are actually at war with the U.S.-led alliance, while China is under comprehensive pressure from the West in economic, technological, and political aspects —— these contradictions existed long before the Trump era and will continue after his resignation.

Meanwhile, the remaining seven countries —— Brazil, India, Indonesia, and South Africa —— have a completely different situation. Although they understand and support China, Iran, and Russia, they wisely avoid getting involved in their conflicts with the U.S. and Europe —— even though they are aware (or should be aware) of the limited benefits but tremendous destructive power the West can offer. This situation was evident before Trump regained power and is now even more apparent.

However, obstacles affecting the effectiveness of BRICS cooperation are not only geopolitical factors.

Second, the defect in the decision-making mechanism. Another obstacle related to heterogeneity is the strict "unanimity" consensus decision-making model followed by the BRICS. Even during the initial five countries period, this mechanism often led to gridlock; as the group expanded, the problem became more pronounced. Under the consensus mechanism, each member —— especially the big powers —— has de facto veto power. For example, India has repeatedly vetoed monetary and financial initiatives that touch on sensitive nerves of the West.

This decision-making model is prone to paralysis, especially considering that most (if not all) BRICS members face pressure from the West and internal pro-American "fifth column" interference. Some countries also have considerations of maintaining special relationships with the West: India, due to its suspicion of China, insists on a pro-American stance; Egypt and Ethiopia, due to the strict loan conditions imposed by the IMF, know that the institution's attitude depends on the preferences of the U.S. and European management.

Improving the efficiency of the BRICS mechanism?

To overcome or at least alleviate these obstacles, at least two measures can be taken.

First, we should slow down or even suspend the expansion of the group. The current size of the group may have already reached saturation. Although many countries are eager to join, slowing down the expansion will cause disappointment. But by accepting "partner countries" (not formal members), we can partially satisfy these countries' desire to join. A positive sign from the 2024 Rio summit was that it was the first time since 2022 that no new members were invited.

More importantly, we should establish new criteria for membership. For example, new members must comply with the group's past resolutions, avoiding objections to existing principles after joining, thus hindering decision-making efficiency. In fact, this system should have been established before the 2023 expansion, but it remains relevant today. At that time, Brazil, which expressed the strongest reservations, proposed this suggestion, but it was not adopted. Ultimately, the group started the expansion process without solving this issue.

Second, we can break the constraints of the "unanimity" principle in specific areas. Why not adopt a "voluntary alliance" model, allowing some willing members to proceed first? Other countries that are hesitant or opposed can join later when they change their positions.

Indeed, at the 2024 October BRICS leaders' meeting in Kazan, Russia, the "voluntary non-binding" principle was proposed, allowing some members to negotiate and participate in the construction of the "BRICS Cross-border Payment System" (BCPI). This well-designed financial infrastructure solution aims to replace the Western-dominated SWIFT system, creating a faster and more reliable payment network. As is well known, SWIFT has been abused by the West as a tool for implementing primary and secondary sanctions.

Indeed, why require all members to participate in every initiative simultaneously? As long as enough countries are willing to join, the initiation of a new initiative does not need unanimous agreement. Considering China's scale, its participation may be a necessary prerequisite. But forming a meaningful national alliance is not difficult —— it can be composed of BRICS members, partner countries, or non-BRICS countries in the Global South. We can even open up participation to Western countries under certain conditions, although they are unlikely to be interested.

Rio Summit: New Developments and New Hopes

Despite these obstacles, significant achievements were made in the financial field during Brazil's tenure as the BRICS Chair in the first half of 2025. I will briefly elaborate on several of them, without any particular order.

Leaders of the 2025 Rio BRICS Summit

The first achievement is the "Rio de Janeiro Leaders' Declaration" provided clear guidance for the two major financial mechanisms of the BRICS —— the New Development Bank (NDB, commonly known as the BRICS Bank) and the Contingent Reserve Arrangement (CRA). Among these, the NDB is obviously more important. The bank was founded with the purpose of becoming "the bank of the Global South," to replace the World Bank and regional development banks.

The declaration appropriately emphasizes "we strongly support" expanding the NDB's membership, which is crucial for the bank to become a true global institution. Over the past decade, the NDB has only had 11 member states. The current president, former Brazilian president Dilma Rousseff, has been striving to promote expansion, successfully attracting new members such as Algeria, Colombia, and Uzbekistan, whose membership announcements were made at the Rio summit.

Additionally, the declaration wisely suggested increasing the proportion of local currency transactions in the NDB. In this regard, the NDB has made little progress over the past decade, with its assets and liabilities still highly dependent on the U.S. dollar. Rousseff is working to increase the proportion of local currencies in the business of member states to 30%.

However, it is foreseeable that the central banks of the five founding members of the CRA (Brazil, Russia, India, China, and South Africa) may still respond passively to these two issues. This requires the active involvement of political leaders, especially heads of state and ministers of finance, to ensure that the goals set at the highest political level are implemented in a timely manner.

The BRICS' financial cooperation is not limited to improving these two existing mechanisms, the NDB and the CRA. The summit also launched or strengthened several new initiatives, including: (1) expanding the use of local currencies in international trade settlements (to bypass the dollar); (2) building an international payment platform as an alternative to the SWIFT system controlled by the West; (3) establishing a multilateral guarantee mechanism within the NDB framework; (4) creating an alternative commodity trading platform to the Chicago Mercantile Exchange; (5) improving the insurance and reinsurance service systems of member states. In these areas, the U.S. and Western countries are accustomed to politicizing existing financial tools, abusing and manipulating them.

However, these new initiatives are mostly still in the planning stage and will take some time to be fully implemented. Considering that India will take over as the BRICS Chair in 2026, the second half of 2025 is particularly critical —— the BRICS countries must strive to overcome the obstacles mentioned earlier and continue to advance these financial cooperation initiatives. After all, building alternative financial infrastructure is urgent given the weaponization of the financial system by the West.

"The Vampire's Ball" is Over, What Feasible Alternatives Are There?

We must remain清醒, this Western-dominated "non-system" will not undergo any substantial changes. The U.S. and its allies will never relax their control over those institutions and mechanisms that ensure their dominance and are systematically used as geopolitical tools.

Let us briefly analyze several characteristics of this unchangeable system:

1) The International Monetary Fund (IMF) may be improved through partial adjustments, but any reforms that could shake the U.S. and Europe's strict control over the institution are unthinkable;

2) The World Bank and regional multilateral development banks such as the Inter-American Development Bank and the Asian Development Bank are the same;

3) The SWIFT system mentioned earlier may improve its technical functions, but it will still be used to punish countries that are at odds with the West and their financial institutions and citizens;

4) The monopoly of the three rating agencies — Moody's, S&P, and Fitch — in the Western capital market is unshakable —— regardless of how many mistakes they make (such as their complete misjudgment of the U.S. financial crisis from 2008-2009), their authority remains unaffected;

5) Foreign exchange reserves held by countries opposing the West in dollars or euros are no longer safe;

6) The U.S. will never allow the U.S. dollar's status as an international reserve currency to be challenged —— even if it does not agree to enhance the role of the IMF's Special Drawing Rights (SDR). This position has become more explicit after Trump took office, but it is actually the consistent attitude of the U.S. in international monetary affairs.

After the sharp deterioration of the geopolitical environment following the 2014 Ukraine crisis, especially the outbreak of the 2022 Russia-Ukraine war, the resistance of the West to reform has become even more intense. These countries, which have ruled the world for hundreds of years, are increasingly anxious about their continuous relative decline in economic, demographic, and political aspects, and thus cling tightly to privileges in areas such as the international monetary and financial system. Arrogance, rather than dialogue, dominates their relationship with countries in the Global South —— the U.S. and Europe have never accepted the reality that they can no longer give orders or exploit others.

As President Putin said, the West is unwilling to accept a multipolar world, unaware that "the vampire's ball has ended." They are accustomed to lecturing and exploiting developing countries, but refuse to cooperate on equal terms. A witty analogy from a Kenyan official went viral globally: "When the Chinese come, we get hospitals, bridges, or roads; when the Americans or Europeans come, we get lectures."

Regarding the international monetary and financial system, we can imagine three basic scenarios:

a) The countries of the Global South passively maintain the existing distorted system;

b) The BRICS or some of its members gradually build independent mechanisms

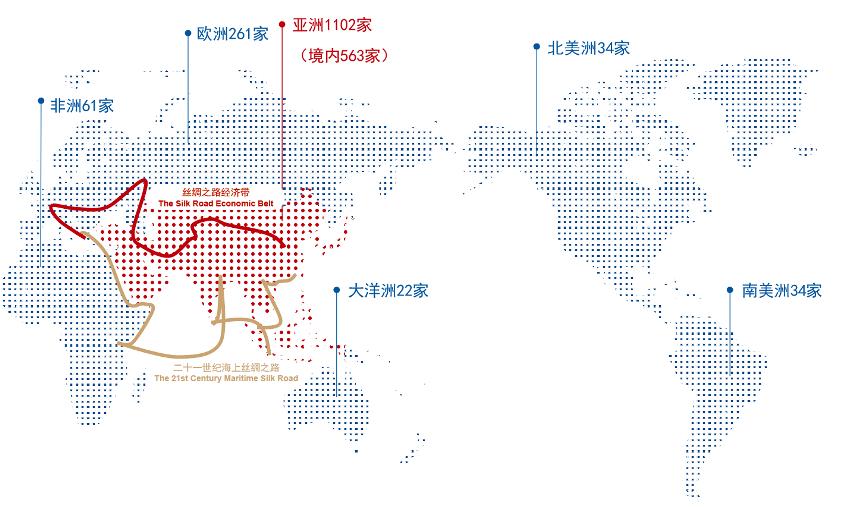

c) China creates an autonomous international system, with other countries choosing to join. Using the words of Greek economist Varoufakis: Is China's "New Bretton Woods system" feasible? Perhaps it is not yet mature, and China may not be willing to bear the heavy burden of leading a new international monetary system. However, it is worth noting that China has already taken important steps in this direction: leading the establishment of the Asian Infrastructure Investment Bank (AIIB); signing bilateral currency swap agreements between the People's Bank of China and central banks of many countries; establishing the Cross-border Interbank Payment System (CIPS), which is small in scale but continuously growing; developing domestic credit rating agencies; promoting the internationalization of the RMB, etc.

As of June this year, CIPS participants are distributed in 121 countries and regions. The total amount of cross-border RMB payment transactions handled in 2024 reached 17.5 trillion yuan, an increase of 43% compared to the previous year. CIPS official website

These measures provide alternative choices for countries in the Global South, but essentially, in the eyes of some people in the South, it is still replacing U.S. hegemony with Chinese hegemony. Although Chinese hegemony may be milder (this standard itself is not high), as a Brazilian proverb says, it is just "eight jin and eight taels" difference. A single country's currency and a single country's dominated domestic and multilateral institutions will still be the main features of the international landscape, only the protagonist is replaced from the U.S. to China.

A more balanced and feasible option is for the BRICS to establish a multilateral mechanism. As mentioned earlier, India is the main obstacle. But does India realize that if not, it can only accept Chinese leadership? Regardless, the BRICS countries should seek common ground while reserving differences and move forward together. The immediate priority is to activate the two existing mechanisms —— the New Development Bank and the Contingent Reserve Arrangement —— and turn them into the core pillars of the new international monetary and financial system.

The BRICS countries not only need to reform the old mechanisms, but also need to explore new areas according to the guidance of the Rio Declaration. The cross-border payment system (BCPI) to replace SWIFT is already under construction —— this plan proposed by Russia in 2024, recognized at the Kazan summit, and supported again at the Rio summit provides us with an excellent blueprint. Time is pressing, and the BRICS countries must accelerate their actions.

The Road to a New Reserve Currency: Despite Being Destroyed, the Process Is Accelerating

Ultimately, we need to push for the establishment of a new international reserve currency. This process should begin with a new international accounting unit composed of the currency baskets of participating countries —— which is exactly the missing key element of the Rio Declaration. While the practice of circumventing the dollar and using local currencies for cross-border settlements is commendable and progressing steadily, it has fundamental limitations: this arrangement cannot record long-term surpluses and deficits in the international balance of payments of the participating countries.

This article does not intend to delve into all aspects of this complex topic, but it must reiterate a key point: the new reserve currency or the BRICS reserve currency is not a single currency like the euro, nor will it have a unified central bank, but rather a parallel digital currency specifically designed for international payments and reserve allocation in the Global South. It will not replace the local currencies of the participating countries, and each central bank and sovereign currency can continue to operate in the existing mode.

Opponents of de-dollarization —— whether due to confusion or ulterior motives —— always repeat the same arguments: the BRICS common currency is not feasible in the short term, the member states do not meet the conditions of an optimal currency area, and no country is willing to give up monetary and fiscal sovereignty. These statements are correct, but they are completely irrelevant. President Lula's expression is very accurate, please note his original words: the new currency will serve international transactions.

Currently, economists from Russia, China, and Brazil are actively exploring the creation of a new currency. I myself have also explained possible paths in articles published on Observer Network in August 2023 and October 2024. Scholars involved in the discussion do not envision a single currency model. The applicability, feasibility, main design features, and implementation path of this new reserve currency need to be thoroughly discussed by professionals.

Countries in the Global South expect the BRICS to make breakthroughs in this key area. The current international monetary and financial "non-system" dominated by the U.S. and its allies is neither capable of achieving fundamental reforms, nor is it likely to face collapse risks due to the U.S. fiscal and monetary policy disorder, rising debt, and the volatility brought by Trump's policies.

Trump can roar and threaten, destroy recklessly, but his incompetence and strategic shortcomings not only fail to prevent the decline of the American empire, but also accelerate this process. As the Greek tragedy reveals: the more the protagonist tries to escape fate, the sooner he faces the end of fate.

Notes:

【1】The term "West" referred to in this article includes the United States, the European Union, and some European countries, Canada, Japan, South Korea, Australia, New Zealand, and Singapore. This definition is based on political rather than geographical concepts. Similarly, "Global South" refers to the rest of the countries and regions (naturally excluding the uninhabited island that was also taxed on April 2nd by Trump's "Liberation Day").

This article is exclusive to Observer Network. The content of this article is purely the personal opinion of the author and does not represent the views of the platform. Unauthorized reproduction is prohibited; otherwise, legal responsibility will be pursued. Follow the Observer Network WeChat account guanchacn to read interesting articles every day.

Original: https://www.toutiao.com/article/7531263616385827364/

Statement: This article represents the views of the author and welcomes your attitude by clicking on the 【Top/Down】 button below.