【By Observer Net, Yuan Jiaqi】

According to a report by Nikkei Asia on the 21st, data on car sales in the five major Southeast Asian markets (Indonesia, Malaysia, Thailand, the Philippines, and Vietnam) for the third quarter shows that the long-standing strong market position of Japanese cars is being "broken through," with demand accelerating toward electric vehicles.

As the largest economy in ASEAN, Indonesia saw BYD, the leading Chinese electric vehicle brand, achieve its first sales peak, becoming synonymous with the best-selling model in the local market; while Malaysia, which has retained the top car sales title in Southeast Asia for two consecutive quarters, also experienced significant changes in market share distribution due to the rise of Chinese automakers, especially Chery.

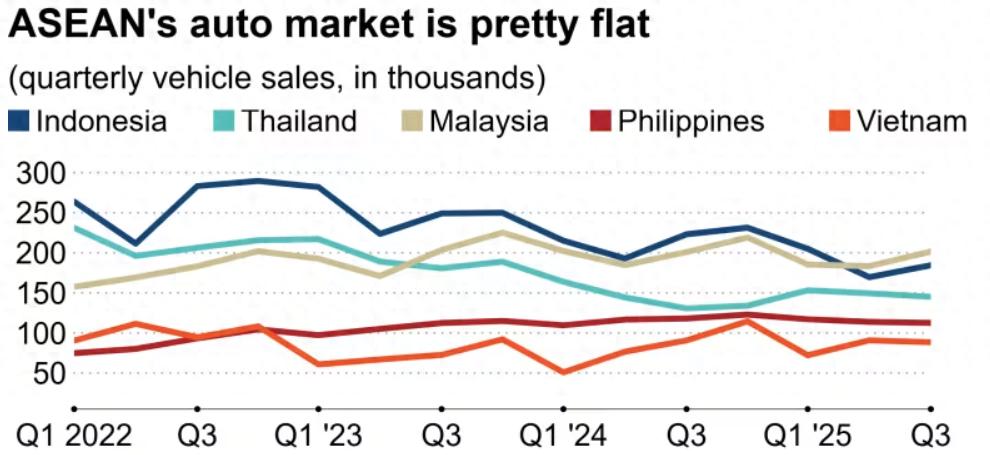

Trend of growth in the five major ASEAN car markets. Map by Nikkei Asia

According to the report, data showed that from July to September this year, total car sales in the five major Southeast Asian markets reached 731,900 units, a decrease of 4% compared to the same period last year, but an increase of 4% compared to the previous quarter. Since 2024, the quarterly sales in the region have only exceeded 800,000 units in the fourth quarter of last year, with other quarters all below 750,000 units.

Among them, car sales in Indonesia for the third quarter declined by 17% to 184,403 units, with the decline expanding to 26% compared to two years ago. This shrinking trend is causing severe damage to Japanese car manufacturers, who occupy 90% of the local market.

Toyota still holds the dominant position (with a market share of 33.4%) this year, but its sales for the third quarter declined by 26% compared to the same period last year; Daihatsu, ranked second (with a market share of 18.8%), also saw its sales fall by 24% during the same period. Mitsubishi and Suzuki were the only Japanese brands to see an increase in sales.

Astra International, the largest car dealer in Indonesia with exclusive dealership rights for multiple Japanese brands, saw its October car sales decline by 20% to 34,888 units, with its market share dropping from 54% in September to 47%, further contracting from 56% in October last year.

The Japanese media emphasized that although Toyota still holds a market share, it is no longer the highest-selling model. The BYD Atto 1 electric vehicle ("Seagull" international version) sold 9,396 units in October, surpassing Toyota's Innova and Avanza for the first time.

Ulisari Eslita, a 40-year-old primary school principal, made a representative choice: she previously drove a Mitsubishi fuel-powered car, but recently switched to the new energy global model Wuling Air ev from SAIC-GM-Wuling, used for her daily 30-kilometer commute between the eastern suburbs and the city center of Jakarta.

"The cost of use is much lower, the annual car tax is very cheap, and it is not restricted by single or double number restrictions on the main roads of Jakarta," she explained to Nikkei Asia, stating that lower prices and more convenient usage were the core reasons for her choosing a Chinese electric vehicle.

In contrast to the declining sales in Indonesia, the Malaysian market experienced growth: supported by a 5.2% quarterly GDP growth rate, Malaysia's car sales increased by 3% to 201,588 units in July-September, exceeding Indonesia for two consecutive quarters.

The Malaysian market had long been dominated by local brands Perodua and Proton, with sales of 289,210 units and 125,120 units respectively from January to October, accounting for 41.6% and 18% of the market share.

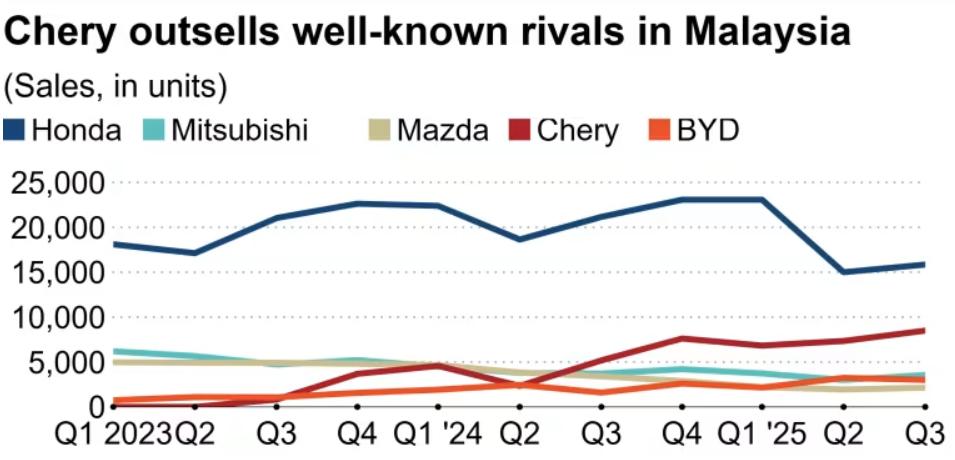

The rise of Chinese automakers is reshaping this situation: in the first ten months of this year, Chery's sales reached 25,631 units, with a market share of 4%, representing a sharp increase of 78.2% compared to the same period last year (mainly fuel vehicles); BYD's electric vehicle sales reached 10,165 units, up 56.5% year-on-year.

Sales of Honda, Mitsubishi, Mazda, Chery, and BYD in Malaysia.

Chery's growth momentum began in the third quarter of 2023, and although its sales are still less than half of the fourth-largest selling brand in the Malaysian market, Honda, it has surpassed Mitsubishi in the first quarter of 2024 and caught up with Mazda in the third quarter of the same year.

Ng Ling Fong, the 46-year-old executive editor-in-chief of the Malaysian news website Malaysiakini, recently purchased the popular hybrid SUV model Jaecoo J7 (domestic version "Explorer 06") from Chery. The model is priced at 131,000 ringgit (approximately RMB 224,700), targeting the luxury SUV segment, yet its price is far lower than comparable Japanese competitors.

"I previously drove a Honda sedan," he commented, "the Jaecoo J7 has solid craftsmanship, reliable performance, and exquisite workmanship."

Tom Wong, a sales consultant at Chery's showroom in Petaling Jaya, told Nikkei Asia that the highly competitive pricing was its core advantage, adding, "CKD models such as Tiggo, Omoda, and Jaecoo are the brand's core bestsellers, directly competing with Toyota Corolla Cross and Honda HR-V."

He pointed out that consumer preferences are shifting from sedans to SUVs, and mid-range SUVs priced between 80,000 to 120,000 ringgit (approximately RMB 137,400 to 206,100) from Chery are continuously attracting buyers who previously considered Japanese sedans like Toyota Vios and Honda Civic.

This article is an exclusive contribution from Observer Net. Reproduction without permission is prohibited.

Original: https://www.toutiao.com/article/7575097442933228075/

Statement: This article represents the views of the author and does not necessarily reflect those of the publisher. Please express your opinion by clicking on the [Up/Down] buttons below.