Reference News, August 8 report: According to the Forbes magazine website on August 6, venture capital in the field of artificial intelligence is heating up and expanding, but another topic seems to dominate investment memos, market entry strategies, and expansion plans.

The report states that tariffs, a seemingly dull policy tool, are reshaping the investment landscape across continents and determining winners and losers in ways that seemed unimaginable just a few years ago.

The recently implemented US-EU trade agreement has fundamentally begun to change the economic competitive environment. According to a report from Capital Economics and CBS News, the average tariff on goods imported from the EU by the US will surge from 1.2% in 2024 to 17.5%. This investment advisory company predicts that this will reduce the EU's annual GDP by 0.2%.

This astonishing increase in tariffs is forcing venture capitalists to fundamentally rethink their investment strategies.

New trade barriers are increasing the cost of key components such as semiconductors, batteries, and sensors. For startups in hardware, artificial intelligence, and even software operations, tariffs are no longer background noise; they are reshaping profit margins, supply chains, and market entry strategies.

Hardware startups are currently being hit the hardest.

The report states that due to tariffs of 10% to 50% on electronics from mainland China, Taiwan, and South Korea, startups are facing soaring bill of materials costs. Founders either absorb the costs or pass them on to customers, fundamentally changing their unit economics.

These figures paint a grim picture of Europe's declining position in the global venture capital arena.

Structural disadvantages are deeply rooted. In the first quarter of this year, US venture capital funds raised $80 billion more than their European counterparts. The International Monetary Fund stated that venture investors have invested significant amounts in high-risk R&D activities, which are crucial for spreading innovative ideas and boosting overall growth.

More concerning is the withdrawal of US capital from the European market. In the first quarter, only 46.9% of the total value of European transactions included US capital, a drop of nearly four percentage points from the previous quarter.

The impact on confidence among European startups is evident.

According to a selected news website, "This is an economic blow to European startups that may hinder critical innovation and trap growing companies in uncertainty."

This pressure is forcing some European companies to consider major moves. According to the analysis by "PitchBook" data company, as the EU becomes a target of President Trump's tariffs, European startups may find the US a better operating location.

The impact of tariffs is creating uncertainty, which could disrupt the recovery of venture capital. According to Fortune magazine, although demand for artificial intelligence remains strong, new tariffs may disrupt chip supply chains and ultimately "weaken venture capital interest in AI investments."

Venture capital investing in tech startups with manufacturing clients is analyzing the initial impact of tariffs on the industry. "PitchBook" data company said that manufacturing transactions were already declining before the full implementation of tariffs.

The report suggests that the most alarming aspect of this shift may be its long-term impact on the global innovation ecosystem. Traditionally, the principle of venture capital has been that the best ideas can emerge anywhere and be expanded globally.

Tariffs are creating obstacles to this model, manufacturing artificial barriers that may prevent promising technologies from fully realizing their market potential. (Translated by Li Sha)

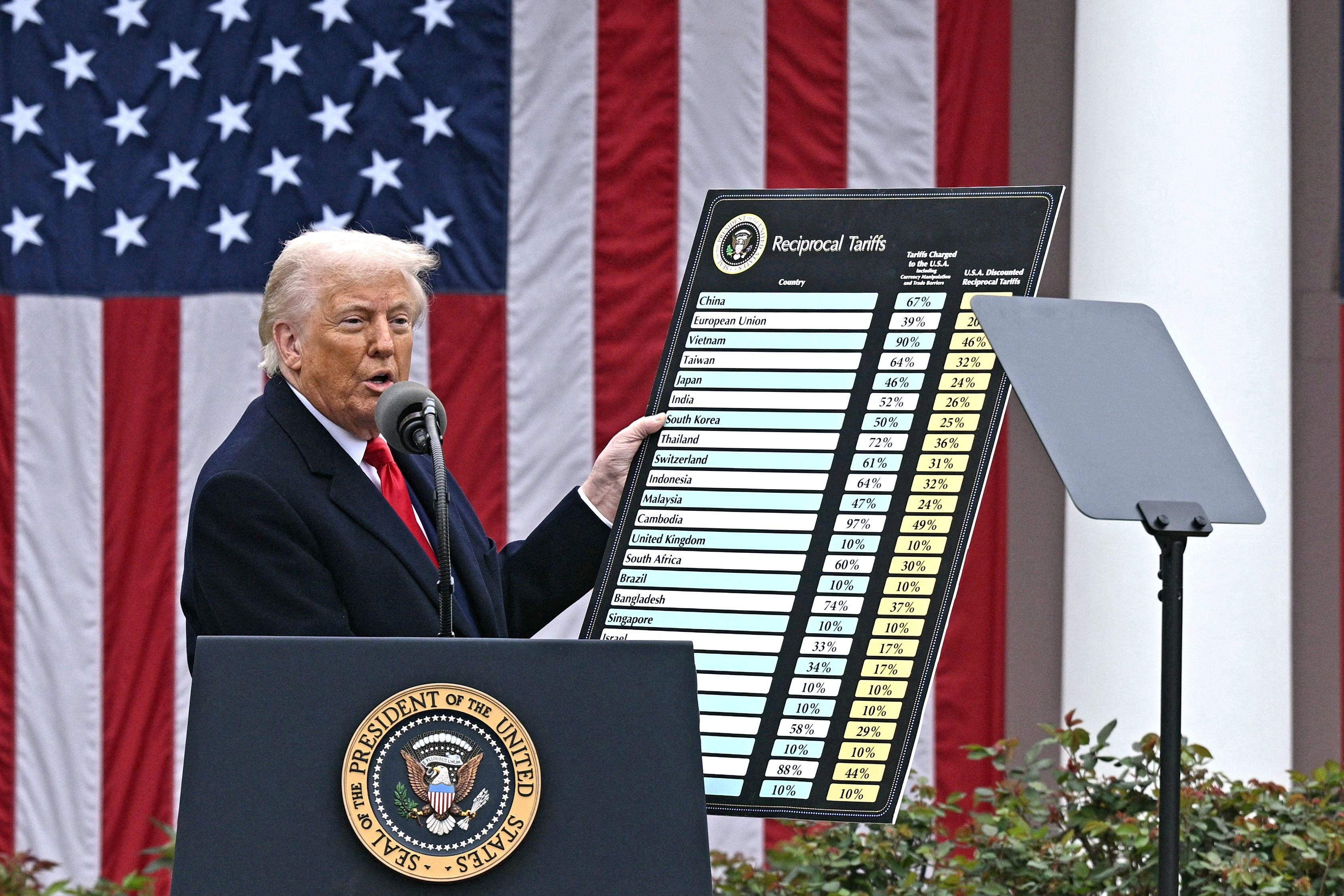

On April 2, Trump displayed a tariff chart at the White House Rose Garden in Washington. (AFP)

Original article: https://www.toutiao.com/article/7536113858327347712/

Statement: This article represents the views of the author and welcomes you to express your opinion by clicking on the [top/down] buttons below.