Domestic Photoresists: Breakthrough on the Horizon, Standards Leading a New Journey

Amid the increasingly fierce competition in the semiconductor industry, the mass production of domestic photoresists has drawn widespread attention, and it is now within reach. On October 27th, a heartening piece of news came - China's first EUV photoresist standard was officially launched. This move, like a stone thrown into a calm lake, has created ripples in the semiconductor field, drawing extensive attention from both inside and outside the industry.

The significance of this standard is profound. It not only fills the long-standing technical standards gap in the field of EUV photoresists in China, but more importantly, it will establish a unified testing method. In the past, due to the lack of a unified standard, the R&D, production, and testing of photoresists in China faced many difficulties. Products from different companies were difficult to compare and evaluate effectively, which in some ways hindered the development of the photoresist industry. Now, the establishment of a unified testing method will greatly accelerate the process of achieving self-reliance in domestic photoresists and lay a solid foundation for the international market of domestic photoresists.

EUV lithography technology is one of the core technologies in the current semiconductor manufacturing field and is the only mass production solution for chips with nodes below 7nm. However, regrettably, the domesticization rate of China's EUV photoresists is still 0%, which means that China is severely dependent on imports in this key area, facing significant technological blockades and supply risks. Once international situations change and import channels are blocked, China's high-end chip manufacturing will be in trouble. Therefore, accelerating the domestication process of EUV photoresists has become an urgent task for the development of China's semiconductor industry.

Among China's many photoresist manufacturers, although most companies are still unable to enter the EUV photoresist field, some companies have made certain breakthroughs in the ArF photoresist field, which is second only to EUV photoresists. Among them, Tongcheng Xincai, Nanjing Optoelectronics, Dinglong Shares, and Jingrui Electric Materials have stood out as leaders in the domestic photoresist field. These companies have continuously worked on technological research and development, market expansion, and have injected strong momentum into the development of China's photoresist industry.

So, in this wave of domestic substitution, who will stand out and take a share? This has become a focal point of concern in the industry.

Division of Manufacturer Camps: The Struggle Between Comprehensive Layout and Focus on High-End

Chinese photoresist manufacturers mainly fall into two camps, showing different development paths. One group consists of companies such as Tongcheng Xincai and Jingrui Electric Materials, which have a comprehensive layout of all series of photoresists. The other group includes companies such as Dinglong Shares and Nanjing Optoelectronics, which focus on high-end photoresists. This division of camps stems from differences in each company's development strategy and market positioning.

Tongcheng Xincai and Jingrui Electric Materials chose to expand their business by acquiring established photoresist manufacturers. Tongcheng Xincai acquired Beijing Kehua, which significantly enhanced its technical strength and market channels in the photoresist field. After the acquisition, Tongcheng Xincai quickly became the largest KrF photoresist supplier in China, leveraging Beijing Kehua's technical expertise and market share in the KrF photoresist field. KrF photoresists hold an important position in semiconductor manufacturing and are widely used in the production of chips with 130-90nm processes. Tongcheng Xincai's leadership in this field has laid a solid foundation for its development in the semiconductor materials market.

Jingrui Electric Materials, on the other hand, acquired Suzhou Ruichong, which has deep technical expertise and market advantages in ultraviolet wide-spectrum photoresists and I-line photoresists. Jingrui Electric Materials leveraged this acquisition to achieve the top market share in the ultraviolet wide-spectrum photoresist segment domestically and successfully supplied I-line photoresists to major domestic wafer manufacturers such as SMIC and Hua Hong Semiconductor. As leading enterprises in China's semiconductor manufacturing, SMIC and Hua Hong Semiconductor have extremely high requirements for the quality and performance of photoresists. Jingrui Electric Materials' ability to become their supplier fully demonstrates the reliability and competitiveness of its products.

Different from these two companies, Dinglong Shares and Nanjing Optoelectronics chose to tackle high-end photoresist technology through self-research. Although Dinglong Shares entered the photoresist field later, its development speed has been astonishing. Within two years, it completed the technical loop from R&D to order implementation. In 2022, Dinglong Shares began to layout KrF and immersion ArF high-end photoresists. KrF photoresists are suitable for mature processes of chips at 130-65nm, while immersion ArF photoresists are even more advanced, used for advanced processes of chips at 65-7nm. Dinglong Shares directly entered the immersion ArF photoresist field, demonstrating its keen insight into the cutting edge of technology and its courage to challenge high-end technology. In 2024, Dinglong Shares successfully secured orders from two major domestic wafer manufacturers, with a total procurement amount exceeding millions of yuan. This achievement marks a significant breakthrough for Dinglong Shares in the high-end photoresist field.

Nanjing Optoelectronics follows a similar development approach to Dinglong Shares, skipping G-line and I-line to directly develop more advanced ArF photoresists. In 2021, Nanjing Optoelectronics' independently developed ArF photoresist became the first ArF photoresist product in China to pass verification, marking a milestone in the domesticization of high-end photoresists in China.

In these companies, Shanghai XinYang's development path is relatively unique. It focuses on self-research to layout the entire product series, and has already obtained orders and generated revenue in KrF photoresists, indicating its certain technical strength and market competitiveness in this field. However, ArF photoresists are still in the R&D stage, and the investment is substantial. Due to the high R&D costs, the company's photoresist business incurred a loss of 8.5 million yuan in the first half of 2025. Despite the loss, Shanghai XinYang has not given up its R&D investment in the high-end photoresist field. This persistence and dedication reflect the company's pursuit of technological breakthroughs and industrial upgrading.

High-End Photoresists: A Dual Battle of Technological Breakthroughs and Capacity Layouts

KrF and ArF photoresists cover semiconductor advanced manufacturing processes ranging from 0.25um to 7nm, making them critical materials urgently needing domestic substitution. Among them, dry ArF photoresists are used for mature chip processes of 130-65nm, while immersion ArF photoresists are more advanced, used for advanced processes of 65-7nm. Dinglong Shares has entered the high-end immersion ArF photoresist field, demonstrating its keen insight into the forefront of technology and its spirit of bold exploration.

To date, Dinglong Shares has laid out nearly 30 high-end wafer photoresists, with over 15 products sent to customers for verification. These samples cover various process and technology requirements, reflecting the diversity and adaptability of Dinglong Shares' products. Among them, several products are expected to secure orders in the second half of 2025, which undoubtedly adds more expectations for Dinglong Shares' development in the high-end photoresist market.

Nanjing Optoelectronics has also achieved remarkable results in the high-end photoresist field. Its independently developed ArF photoresist was the first to pass verification in China, opening the door to the localization of high-end photoresists in China. In terms of order realization, Nanjing Optoelectronics is slightly faster than Dinglong Shares, thanks to its earlier technological breakthroughs and market layout. However, Dinglong Shares has its own advantages and plans in capacity construction, which may allow it to make a comeback in terms of capacity.

Nanjing Optoelectronics has built an ArF photoresist production line with an annual capacity of 25 tons, which partially meets domestic market demand. However, Dinglong Shares has a more ambitious capacity layout. The first phase of its KrF/ArF high-end photoresist production line in Qianjiang has an annual capacity of 30 tons, surpassing Nanjing Optoelectronics' existing capacity. According to the semi-annual report of 2025, the investment progress of Dinglong Shares' 300-ton KrF/ArF high-end photoresist production line is 55.7%, which has passed the halfway mark, and it is planned to enter trial operation in the fourth quarter of 2025. The completion and commissioning of this production line will enable Dinglong Shares to take the lead in the capacity of high-end photoresists, giving it more advantages in market competition.

For domestic photoresist manufacturers, the test goes beyond product development and lies in achieving the self-reliance of the industrial chain. The production of photoresists involves numerous raw materials and key technologies. If these links rely on imports, they face the risk of unstable supply chains. Therefore, achieving the self-reliance of the industrial chain is the key to the development of the domestic photoresist industry.

Nanjing Optoelectronics has the capability to develop functional monomers, functional resins, and photosensitive agents, which are essential components of photoresists. Functional monomers are the basic components of photoresists, and their performance directly affects the quality of photoresists; functional resins play a connecting and supporting role; and photosensitive agents are the key substances that undergo chemical reactions during the exposure process of photoresists. Nanjing Optoelectronics' capabilities in raw material development provide a strong guarantee for the stable supply and quality improvement of its photoresist products.

Dinglong Shares has also made great efforts in achieving the self-reliance of the industrial chain. The company has built four technical platforms: organic synthesis, polymer synthesis, purification, and formulation development, and has developed key materials such as KrF/ArFi photoresist-specific resins and high-purity monomers, photosensitizers, achieving full domestication from key materials to photoresists. This achievement marks that Dinglong Shares has complete autonomous innovation capabilities in the photoresist industrial chain and can effectively respond to international technological blockades and supply chain risks.

The reason why Dinglong Shares has been able to catch up and achieve such excellent results in the high-end photoresist field is due to its high R&D investment. In the first three quarters of 2025, the company's R&D expenses reached 389 million yuan, with an R&D expense ratio of 14.41%, which is the highest among the four companies. High R&D investment has laid a solid foundation for the iteration of photoresist R&D and the rapid layout of raw materials. Through continuous R&D investment, Dinglong Shares can continuously optimize product performance, improve product quality, and accelerate the development of new products, thus taking the initiative in market competition.

Platform Enterprises in the Semiconductor Material Industry: Synergistic Effects of Diversified Layout and Revenue Growth

Although companies such as Tongcheng Xincai and Dinglong Shares are well-known for photoresists, in fact, most domestic photoresist manufacturers have made their fortune through other semiconductor materials. The semiconductor materials industry is a vast system, which includes not only photoresists but also photomasks, electronic gases, sputtering targets, polishing materials, and other fields. These materials play an indispensable role in the semiconductor manufacturing process and together form the foundation of the semiconductor industry.

Jingrui Electric Materials is the largest supplier of high-purity wet chemicals in China. High-purity wet chemicals are used in the cleaning and etching processes in semiconductor manufacturing, and their purity and quality directly affect the performance and yield of chips. Jingrui Electric Materials, relying on its technical advantages and scale effects in the high-purity wet chemicals field, provides stable and reliable product supplies to domestic semiconductor manufacturers and holds an important position in the Chinese high-purity wet chemicals market.

Nanjing Optoelectronics is the largest supplier of electronic-grade phosphine and arsine gases in China. Electronic-grade phosphine and arsine gases are important doping gases in semiconductor manufacturing, used to adjust the electrical properties of chips. By continuously innovating and improving quality control, Nanjing Optoelectronics ensures the high purity and stability of electronic-grade phosphine and arsine gases, meeting the demand for high-quality doping gases from domestic semiconductor manufacturers.

Dinglong Shares has a rather legendary development journey. It started from printing consumables and gradually developed into a platform enterprise in the semiconductor materials industry through continuous technological innovation and industrial expansion. Through subsidiaries such as Dinghui Microelectronics (CMP polishing pads), Beihai Jixun (office equipment and consumables), Ruxian Technology (flexible display materials), and Qijie Technology (integrated circuit chip business), Dinglong Shares has made layouts in multiple semiconductor materials fields. This diversified layout strategy allows Dinglong Shares to leverage the synergistic effects between different business segments, reduce the risk of single business, and achieve stable revenue growth.

When the photoresist business was not yet profitable, the semiconductor business became the key support for Dinglong Shares' revenue growth. In the first three quarters of 2025, Dinglong Shares' semiconductor business achieved revenue of 1.534 billion yuan, an increase of 41.27%, accounting for 57% of total revenue, up from 46% in 2024. At the same time, the company achieved revenue of 2.698 billion yuan, an increase of 11.23%; and net profit of 519 million yuan, an increase of 38.02%. Both revenue and net profit growth rates exceeded those of Nanjing Optoelectronics and Tongcheng Xincai. These figures fully demonstrate that the platform enterprise strategy of Dinglong Shares in the semiconductor materials industry has yielded significant results, with the semiconductor business becoming the core driving force for the company's development.

Moreover, Dinglong Shares chose to enter semiconductor materials with higher technical barriers. For example, the company focuses on temporary bonding adhesives and semiconductor packaging PI, two advanced packaging materials with low domesticization rates. Packaging PI is mainly used in wafer-level packaging WLP, while temporary bonding adhesive TBA is a key material for 2.5D/3D advanced packaging. With the development of semiconductor chips towards higher performance and smaller size, the importance of advanced packaging technology is increasingly prominent. Temporary bonding adhesives and semiconductor packaging PI, as key materials for advanced packaging, are experiencing growing market demand. Dinglong Shares' layout in these two areas not only aligns with the development trends of the semiconductor industry but also opens up new growth space for the company. Currently, the company has the capability to produce these materials, which gives it a competitive advantage in the market.

As the proportion of high-margin semiconductor materials business revenue increases, Dinglong Shares achieved a gross margin of 50.82% in the first three quarters of 2025, exceeding companies like Tongcheng Xincai and Nanjing Optoelectronics. A high gross margin not only reflects the high value-added and technological content of the company's products but also provides ample financial support for R&D investment and capacity expansion. Therefore, developing into a platform enterprise in the semiconductor materials industry not only gives Dinglong Shares a high gross margin but also positions its revenue growth at the forefront of the industry, laying a solid foundation for the company's sustainable development.

Competing for the Top Spot in Polishing Materials: Technical and Market Battles in CMP Polishing Materials

In Dinglong Shares' semiconductor materials business portfolio, the most core part is CMP polishing materials. Polishing is a key process to achieve wafer planarity and plays a crucial role in the semiconductor manufacturing process. By using polishing pads to transfer abrasive particles in the polishing liquid to the device surface, impurities are removed, solving issues caused by uneven wafer surfaces, such as the inability of the lithography machine to accurately focus on the wafer during exposure, leading to chip manufacturing failure; electron migration short circuits can affect the electrical performance of chips, reducing the reliability and stability of chips. Therefore, the quality and performance of CMP polishing materials directly impact the yield and performance of chips.

CMP polishing materials account for 7.2% of the cost of integrated circuit manufacturing materials, including CMP polishing pads, CMP polishing liquids, and cleaning solutions. Although the percentage seems small, their role in the chip manufacturing process cannot be overlooked. As chip process sizes continue to shrink, the number of polishing steps gradually increases. In the logic chip sector, the number of CMP polishing steps increased from 21 at 14nm to 30 at 7nm. This means that with the upgrade of chip processes, the demand for CMP polishing materials not only increases in quantity but also requires higher quality. In the storage chip sector, the number of CMP polishing steps for 3D NAND chips is about twice that of 2D NAND chips. 3D NAND chips improve storage capacity by stacking multiple layers of memory cells, requiring more polishing processes during manufacturing to ensure flatness and connection reliability between layers.

Although the advancement of chip processes leads to a surge in demand for CMP polishing materials, this part of the market is mostly controlled by international giants. International giants have a long history and deep technical accumulation in the CMP polishing materials field, and they have obvious advantages in product quality, performance stability, and brand influence. In China, the companies capable of domesticizing polishing materials are still Dinglong Shares and Anji Technology.

Dinglong Shares is the only company in China that has mastered the full range of core R&D technologies and production processes for CMP polishing pads. Through years of technological R&D and practical accumulation, the company has achieved independent preparation of core raw materials. Among them, prepolymers are stably supplied, and prepolymers are one of the key raw materials for CMP polishing pads, whose quality and performance directly affect the performance of polishing pads; buffer pads are produced in the Qianjiang factory, and buffer pads serve to cushion, reducing damage to wafers during polishing; self-made microspheres have entered the trial production stage, and microspheres are important abrasive particles in CMP polishing liquids, with their particle size distribution and shape having an important impact on polishing effects. Dinglong Shares' breakthroughs in the independent preparation of core raw materials have given it a complete industrial chain advantage in the CMP polishing pad field, allowing it to effectively control costs, improve product quality, and ensure supply stability.

In the first three quarters of 2025, the CMP polishing pad business of the company achieved revenue of 795 million yuan, an increase of 52%, with third-quarter revenue reaching 320 million yuan, setting a new record for single-quarter income. Product monthly sales have remained above 30,000 pieces since the second quarter. These data indicate that Dinglong Shares' CMP polishing pad business is showing a rapid growth trend, and market recognition is constantly increasing. As the demand for domestic CMP polishing pads from Chinese semiconductor manufacturers continues to grow, Dinglong Shares is expected to further expand its market share and enhance its competitiveness in this field.

Anji Technology focuses on polishing liquids, with the highest market share among domestic companies. Polishing liquids play a key role in the CMP polishing process, achieving planarization of the wafer surface through chemical reactions and mechanical friction between the abrasive particles and the wafer surface. Anji Technology has achieved significant results in R&D and market expansion in the polishing liquid field, with its products reaching international advanced levels in performance and quality, and gaining widespread recognition from major domestic wafer manufacturers.

From a competitive perspective, Dinglong Shares and Anji Technology basically belong to differentiated competition. Dinglong Shares takes CMP polishing pads as its core product, while Anji Technology focuses on polishing liquids. However, Dinglong Shares has not been satisfied with its leading position in the CMP polishing pad field and has continuously strengthened polishing liquid R&D. The company not only lays out a full range of polishing liquid products but also has the independent supply capability of core raw materials - abrasive particles. At the same time, it has not neglected the cleaning liquids used to remove micro-dust particles on the wafer surface and improve yield. Through a full industrial chain layout, Dinglong Shares can better control product quality and costs, improve product comprehensive performance, and provide customers with a one-stop CMP polishing solution.

Currently, Dinglong Shares has secured orders for polishing liquids and matching cleaning liquids. In the first three quarters of 2025, CMP polishing liquids and cleaning liquids achieved revenue of 203 million yuan, an increase of 45%. This achievement marks a significant breakthrough for Dinglong Shares in the CMP polishing liquid and cleaning liquid fields, further enriching its product line and enhancing its competitiveness in the CMP polishing materials market.

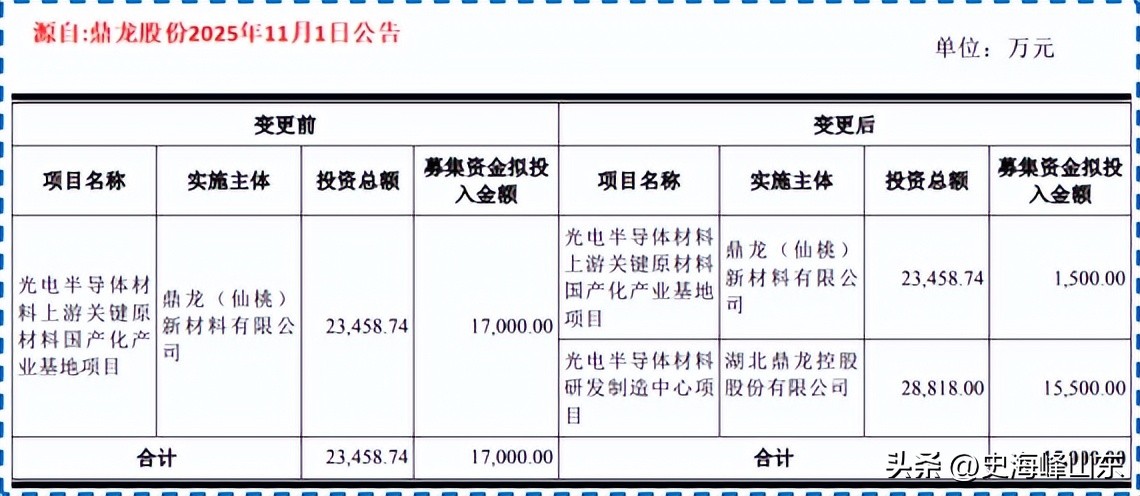

On November 1, 2025, Dinglong Shares formally brought the competition in polishing materials to the forefront with a notice. The notice stated that Dinglong Shares would change the investment project, redirecting the remaining 155 million yuan of funds from the semiconductor upstream key raw materials domestication project to semiconductor materials R&D and manufacturing, producing abrasives needed for polishing pads and polishing liquids. This move reflects Dinglong Shares' emphasis on the CMP polishing materials market and its determination to increase investment. After the new project is put into operation, the company will have an annual capacity of 4,000 tons of prepolymers, 200 tons of microsphere foaming, 400,000 large silicon wafer polishing pads, 30 tons of aluminum oxide abrasives, and 50 tons of cerium oxide abrasives. This capacity plan will significantly increase Dinglong Shares' capacity in the CMP polishing materials field, further consolidating its leading position in the domestic market. It is clear that Dinglong Shares has caught up with the product layout in polishing materials, and the next step is to catch up with the capacity.

Conclusion: The Rise and Outlook of Domestic Semiconductor Materials

In this core field of photoresists, China has emerged with a batch of outstanding companies. Tongcheng Xincai and Jingrui Electric Materials, as integrators, have made significant achievements in the layout of the full series of photoresists; companies such as Nanjing Optoelectronics have become breakthroughers in the development and industrialization of high-end photoresists, achieving important breakthroughs. The efforts and contributions of these companies have laid a solid foundation for the development of China's photoresist industry.

Although Dinglong Shares entered the photoresist field later, it has not only gained the ability to compete in high-end products, but also has the potential to catch up in high-end capacity, riding the wave of photoresist localization. Dinglong Shares' development process fully proves that in the challenging and opportunity-filled semiconductor industry, latecomers can achieve success by adhering to independent innovation, increasing R&D investment, and reasonably arranging the industrial chain.

At the same time, Dinglong Shares is intensifying its layout in polishing materials, which is not only a necessary path for the current domestic substitution in the semiconductor industry, but also a key move to support R&D investment and capacity expansion when the photoresist business has not yet turned a profit. Through its layout in the polishing materials field, Dinglong Shares can further expand its business areas, reduce the risk of single business, and achieve diversified development. At the same time, the high gross margin and stable market demand of the polishing materials business provide strong support for the company's revenue growth.

Looking ahead, the Chinese semiconductor materials industry faces tremendous opportunities and challenges. With the global semiconductor industry shifting toward China, the domestic semiconductor market size continues to expand, and the demand for semiconductor materials will keep growing. At the same time, the country continues to increase its support for the semiconductor industry, introducing a series of policy measures to encourage companies to increase R&D investment, break through key core technologies, and achieve industrial self-reliance. This provides a favorable policy environment and development opportunities for the development of China's semiconductor materials companies.

However, we must also be clear that there is still a significant gap between China's semiconductor materials industry and the international advanced level. In terms of technological R&D, product quality, and market share, we still have a long way to go. International giants have deep technical accumulation and strong brand influence in the semiconductor materials field, and they occupy a dominant position in market competition. Chinese semiconductor materials companies must continuously enhance their own technical strength and innovation capabilities, strengthen industrial chain collaboration, improve product quality and performance, reduce costs, and build semiconductor materials brands with international competitiveness to stand in the international market.

In summary, the dawn of mass production of domestic photoresists is approaching, and the competitive landscape of semiconductor materials is undergoing profound changes. Chinese semiconductor materials companies should seize the opportunity, face the challenges, increase R&D investment, break through key core technologies, achieve the self-reliance of the industrial chain, and make greater contributions to the development of China's semiconductor industry. We believe that in the near future, China's semiconductor materials industry will rise in the East of the world and become an important force in the global semiconductor industry.

Original: toutiao.com/article/7578809519610806836/

Statement: This article represents the views of the author.