【By Observer Net, Wang Yi】 Three days after announcing an investment in the U.S. chip company Intel, U.S. President Trump said on August 25 local time that he plans to take similar investment strategies for other large companies to "gain as much benefit as possible." The New York Times pointed out that Trump's remarks indicate a major shift in the relationship between the U.S. government and private enterprises, which may bring many risks.

On the same day, Intel issued a warning in a securities filing, stating that U.S. government ownership could affect the rights of other shareholders and may pose potential threats to their international operations. Business and political figures in the U.S. also criticized that the U.S. government's "opportunistic extortion" might have extremely adverse effects on the long-term economic interests of the United States.

Last Friday, Trump announced at the White House that he had reached an agreement with Intel, investing $8.9 billion in common shares of Intel to acquire 9.9% of its shares, making the U.S. government its largest shareholder. This $8.9 billion included $5.7 billion in subsidies granted to Intel by the Biden administration under the Chips and Science Act but not yet paid, plus another $3.2 billion in government funding projects.

On the 25th, speaking about this deal at the White House, Trump said satisfiedly that businesses always need the government, "I hope I can have more similar cases." He also posted on social media that "I paid zero fees to Intel," but everything belongs to the United States, and he will continue to push for similar "profitable" deals with enterprises.

Kevin Hassett, director of the White House National Economic Council, also told CNBC that the U.S. government's investment in Intel was like "a down payment of a sovereign wealth fund," and "I am sure that at some point, if not in this industry, there will be more such transactions in other industries."

Hassett specifically emphasized that the U.S. government holding equity in private enterprises is not unprecedented. Indeed, in 2008, the U.S. had invested heavily in institutions such as Citigroup, JPMorgan Chase, and AIG, but it was during the global financial crisis, and the U.S. government's investment was to stabilize systemic risks.

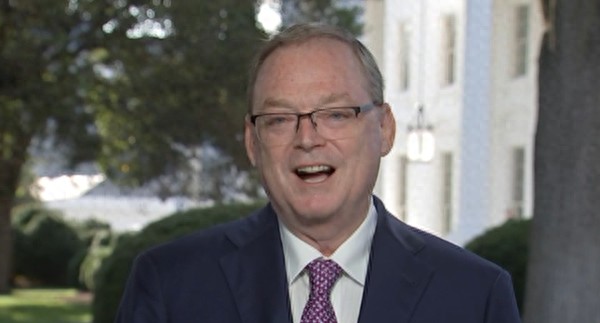

On August 25 local time, Kevin Hassett, director of the White House National Economic Council, gave an interview to U.S. media. Video screenshot

The New York Times noted that the recent intervention of the Trump administration in private enterprises continued his leadership "transaction model," which requires companies to make concessions when they need government help. For example, in the process of Japanese Steel acquiring U.S. Steel, the Trump administration demanded a "golden share" to influence the new company's decisions. He also obtained commitments from NVIDIA and AMD to give 15% of the revenue from high-performance chip sales in the Chinese market to the U.S. government.

NBC noticed that even in internal affairs, Trump directly pressured companies such as Coca-Cola, Walmart, and Amazon to adjust product formulas and prices to meet government interests. Trump once described the U.S. economy as "a department store" where the government sets prices. In one interview, he said, "I meet with enterprises and set what I consider fair prices, and they can choose to pay or refuse."

"The White House has recently focused on high-performance chips and shown an unprecedented willingness to push for the 'nationalization' of certain industries and technologies, which would be unimaginable for conservatives in the past," the report said. For a long time, Republicans adhered to the concept of "the U.S. government does not interfere in the market," opposing using taxpayers' money to pick winners and losers. But now, Trump seems to have admitted that investing in private enterprises is a new industrial policy.

Bill George, former CEO of Medtronic and researcher at Harvard Business School's executive education program, commented on the U.S. government's recent investments in Intel, pressure on the Federal Reserve, and intervention in the merger of U.S. Steel, saying that the U.S. is moving away from traditional economics towards an economic model with more state involvement, which is a significant change in the U.S. economy. He said he had never experienced such an era.

"What we see is less of a strategic, thoughtful shift toward state capitalism and more of an opportunistic expression of corporate restructuring," said Michael Strain, an economist at the American Enterprise Institute, a conservative think tank. However, regardless of the approach, "this indeed brings significant risks to the long-term prosperity of the companies involved and the American people."

Strain analyzed that if the government is unwilling to exit poorly performing companies, taxes may face risks. Moreover, in such a situation, companies like Intel may "make business decisions based on political considerations."

On the 25th, Intel also warned in a securities filing that government ownership could dilute the rights of other shareholders, limit Intel's ability to obtain future government funding, and due to the U.S. government becoming its major shareholder, Intel's international operations may be "negatively affected." Additionally, the company stated that the government's commitment to funds and its ability to fulfill funding conditions are "still uncertain."

The Trump administration defended that semiconductors are crucial to the national economy and security, and Intel's market position is special, so this move is "reasonable and necessary."

However, critics questioned that most of the $8.9 billion provided by the U.S. government to Intel was the remaining subsidies granted to Intel under the Chips and Science Act, which the Biden administration had set conditions requiring Intel to complete domestic production goals to receive these funds. However, the Trump administration removed the relevant constraints and directly exchanged equity, allowing Intel to easily obtain taxpayers' money.

The New York Times analyzed that considering Intel's technical difficulties in recent years, this approach may be a risky move. Trump administration officials hinted that they could use equity to help the company, promoting other tech companies to become customers of Intel to help its business development. However, if Intel cannot produce the chips the market needs, the government's assistance to the company would be limited.

This deal also raised concerns among Intel's competitors, who fear they may become the next target. The Trump administration has suspended part of the funding under the Chips and Science Act and re-evaluated related projects to "urge" companies to invest more in the U.S. Although TSMC and Micron have announced expanding their investments in the U.S., some critics point out that these plans were already in the works, and some may never come to fruition.

The report pointed out that the question now is whether companies that are unable to announce large-scale investments in U.S. factories or find other ways to please Trump will be forced to surrender equity or make other concessions to the Trump administration. Industry executives said chip companies are watching how the government implements its plans.

George said that U.S. companies have started to realize that they now need to consider "how much control they are willing to give up and how much ownership they are willing to transfer to the government."

This article is exclusive to Observer Net. Unauthorized reproduction is prohibited.

Original: https://www.toutiao.com/article/7542726971034272295/

Statement: The article represents the views of the author and welcomes your opinion through the [Up/Down] buttons below.