【Text by Observers Network, Pan Yuchen; Editor by Gao Xin】On July 30 local time, the Russian Federal Service for Technical Regulation and Metrology announced a ban on importing and selling certain truck models from China's Dongfeng, Foton, Jiefang, and Sinotruk Shandong Heavy Duty brands in Russia.

The ban involves the Dongfeng DFH4180, Foton BJ4189, Jiefang CA4250 and CA4180, Shandong Heavy Duty ZZHS, as well as the Foton M4L chassis. The Russian Federal Service for Technical Regulation and Metrology stated that these models were found to violate mandatory safety requirements essential for ensuring the safety and health of drivers and other road users, such as the efficiency of the braking system, the noise level of the moving vehicle, the inspection by the traffic management department, and the installation of emergency call devices, among others.

Russian Federal Service for Technical Regulation and Metrology website

The Russian Federal Service for Technical Regulation and Metrology stated that notices have been sent to official representatives of each brand, requiring them to organize recall activities to eliminate the issues.

Relevant companies told Observers Network that the relevant authorities are currently communicating with the enterprises, and there is currently no response from the enterprises.

Data from the Russian automotive market analysis institution "Avtostat" show that in the first half of this year, nearly 4,000 Shandong Heavy Duty trucks were sold in Russia (accounting for 14.2%), slightly fewer than 2,000 Jiefang trucks (7.1%), 1,200 Dongfeng trucks (4.4%), and 531 Foton trucks (1.9%). These brands together sold 7,700 trucks, accounting for 27.6% of the market share.

In the first half of this year, Russia imported 3,559 new trucks, more than 90% of which came from China. Among them, Shandong Heavy Duty had a share of 20.6%, ranking first, while FAW had a share of 17.5%, ranking second, and Sany Heavy Industry had a share of 17.4%, ranking third.

Previous Precedents

In fact, as early as February this year, the Russian Federal Service for Technical Regulations and Metrology had previously announced that it would suspend approval for the Shandong Heavy Duty SX3258 vehicle model, and require manufacturers to develop a vehicle recall plan and halt sales. The reason was that these vehicles did not meet a series of mandatory requirements for wheeled vehicles, including noise limits, rear crash protection, and side protection.

Shandong Heavy Duty car model, Russian State News Agency

At the same time, according to reports from the Russian State News Agency, Minister of Industry and Trade of Russia Alkhannov also stated that the Ministry of Industry and Trade found serious defects in three Chinese truck brands, saying that "they cannot be allowed on the road at all," and that stricter certification and inspections are needed for these vehicles, including revoking certificates.

Alkhannov also emphasized that the Chinese automobile industry is actively entering the Russian market and continuously expanding its market share. To "restore balance," the Ministry of Industry and Trade is gradually adjusting the recycling tax, but "this measure is not enough."

Minister of Industry and Trade of Russia Alkhannov, Russian State News Agency

The so-called recycling tax refers to the environmental disposal fee when a vehicle is scrapped, which in Russia actually acts as a tariff. Starting from October 2024, Russia announced that the recycling tax for imported vehicles will increase by 70% to 85%, increasing by 10% to 20% annually until 2030.

In addition to the recycling tax, Russia has also revised its regulations on car imports: since April 2024, vehicles transiting through Central Asian countries before being transported to Russia need to pay various taxes, including tariffs, value-added tax, and consumption tax.

Because Kyrgyzstan and other Eurasian Economic Union member states have lower tariffs on exports to Russia, many car dealers previously exported cars from China to Kyrgyzstan and other Central Asian countries, then resold them in Russia. However, after the new regulations on transshipment vehicles came into effect, the import share of cars from Kyrgyzstan immediately dropped from nearly 30% in March 2024 to less than 2% in April.

However, in May 2024, Russian President Putin, following a meeting with Chinese President Xi Jinping, stated that Russia welcomes active cooperation in the automobile industry and the introduction of Chinese auto products in the Russian market.

Experts: Chinese Enterprises Need to Strengthen Risk Awareness in Russia

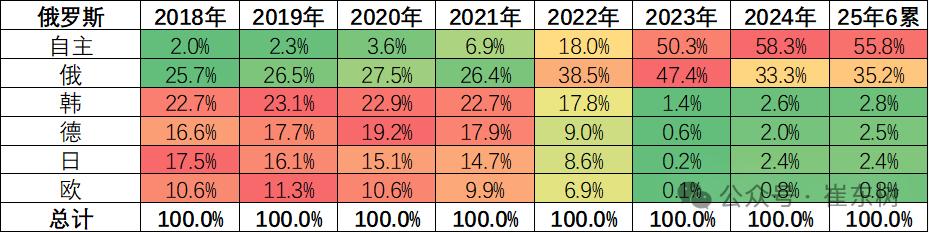

Before the outbreak of the Ukraine-Russia conflict in 2022, the average annual sales of cars in Russia over the past three years were around 1.67 million, with Chinese car brands' market share below 4%, far behind domestic brands and South Korean, German, Japanese, and American brands.

After the outbreak of the Ukraine-Russia conflict, Western automakers left the Russian market due to sanctions, leading to a 59% drop in Russia's car sales to 690,000 units in 2022, but the market share of Chinese cars increased from less than 10% at the beginning of the year to nearly 30% by the end of the year.

In 2023 and 2024, Russia's car market sales were 960,000 and 1.83 million units, respectively, representing an increase of 39% and 91%. In 2024, the annual sales reached a new high in recent years. Among them, the market share of Chinese cars in Russia exceeded 50% for the first time in 2023, surpassing domestic brands; in 2024, it rose to 58.3%, while domestic brands fell to 33.3%.

But in the first half of this year, Russia's car sales were 600,000 units, a decrease of 29% compared to the previous year, with the market share of Chinese cars dropping to 55.8%, while the market share of domestic brands rebounded to 35.2%.

Market share of different car brands in the Russian automotive market from 2025 to the first half of 2028, Cui Dongshu

It is worth noting that although China's exports of cars to Russia have declined year by year, the sales of Chinese brands in the Russian domestic market have continued to rise: in 2023, the sales of Chinese brands in Russia accounted for only 48% of the export volume, but this ratio increased to 84% in 2024; in the first half of this year, the sales of Chinese brands in the Russian domestic market reached 340,000 units, nearly twice the export volume.

On July 21, Cui Dongshu, Secretary-General of the Passenger Car Market Information Joint Conference of the China Automobile Circulation Association, released a "Analysis of the Russian Car Market in June 2025", in which he wrote that from closing the grey channel through Central Asia in June 2024 to increasing the recycling tax on imported cars in October 2024, it indicates that Russia's attitude towards Chinese cars is gradually changing.

"Russia also hopes for the development of its own industry, so it uses taxation and other means to structurally guide: Chinese automakers must build factories to produce locally, otherwise it will be difficult; however, even if Chinese enterprises establish factories in Russia, they still face uncertain periods," Cui Dongshu said.

Cui Dongshu believes that although Chinese car brands remain strong in the Russian market, they need to strengthen their risk awareness in the future, mainly including two aspects: macroeconomic fluctuations and uncertainty in industrial policies.

"The macroeconomic fluctuations in Russia directly affect the demand in the car market and bring the risk of ruble exchange rate fluctuations; the Russian manufacturing industry policy has often shown trade protectionist tendencies: when there were more important European and American projects to encourage, it once had an adverse impact on Chinese automakers' investments in Russia," Cui Dongshu believes that in the current context of insufficient competitiveness of the Russian automotive industry and structural shortages in supply, Chinese automakers need to anticipate changes in the situation in advance and prevent potential policy risks in the future."

This article is an exclusive contribution from Observers Network, and it is not allowed to be reprinted without permission.

Original: https://www.toutiao.com/article/7533501890320744994/

Statement: This article represents the personal views of the author. Please express your opinion by clicking the [Like/Dislike] button below.