【By Observer Net, Yuan Jiaqi】

The U.S. government has been continuously abusing export control mechanisms, increasing scrutiny and restrictions on the export of high-tech products such as chips to China. According to a report by Nikkei Asia on June 6th, in order to prevent the tightening of U.S. export restrictions from hindering the development of domestic autonomous driving and other technologies, Chinese automakers and chip companies are accelerating their efforts to develop and adopt domestic products or solutions to replace foreign chip giants like NVIDIA in automotive semiconductors.

Recent examples include XPeng and NIO. These two Chinese automakers, which previously mainly relied on NVIDIA for chips, have now equipped their latest models with self-developed chips.

Nikkei's report mentioned that at least 10 emerging and established Chinese chip companies have set the automotive market as a core development area. Companies like Horizon, Huawei HiSilicon, Black Sesame Intelligence, Xinchip Technology, and Xinqing Technology are rapidly rising, continuously expanding their client base among domestic automakers.

This trend has also benefited China's top chip foundries: SMIC currently accounts for 10% of its revenue from automotive and industrial application chips, while this proportion was less than 3% three years ago; the second-largest foundry, Wuhan Hua Hong Semiconductor, is also expanding its factory in Wuxi, focusing on the production of automotive-grade chips.

At the same time, an increasing number of Chinese automakers, including BYD, GAC, FAW, Great Wall, and Geely, are actively investing in the fields of chip R&D, manufacturing, and packaging.

The report believes this will bring new challenges to NVIDIA. The company has been struggling with the U.S.'s unpredictable restrictions, and recently it was also questioned by Chinese authorities over the "backdoor" issue, being required to explain the security risks of the H20 computing chips sold to China and submit relevant proof materials.

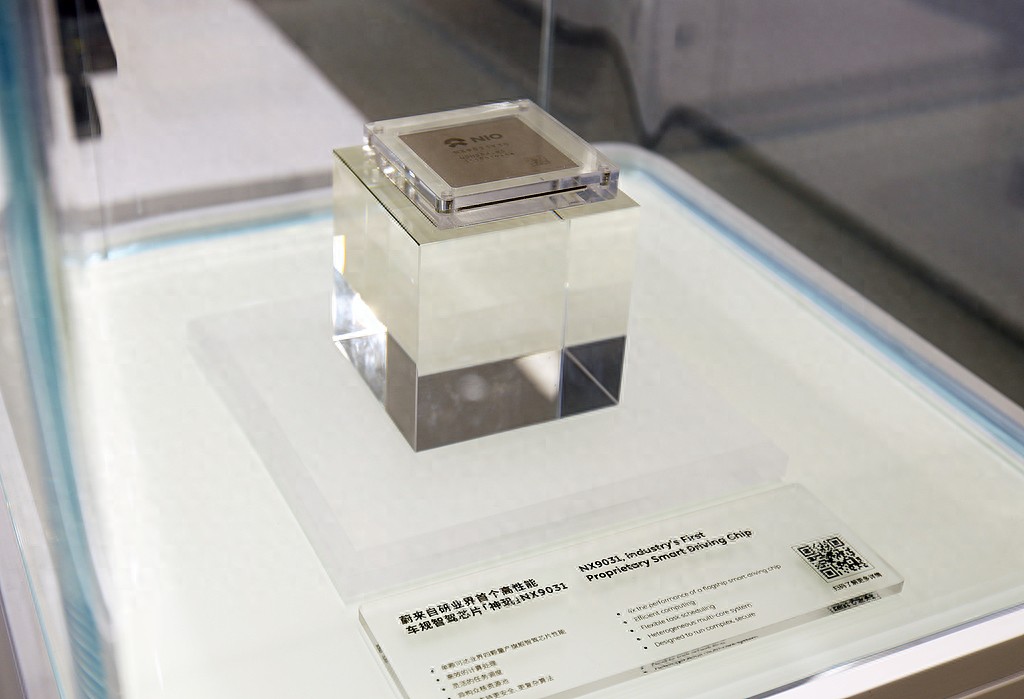

April 25, Shanghai, the NIO booth at the 2025 Shanghai Auto Show, NIO's self-developed industry's first automotive-grade intelligent driving chip, Shenji NX9031. Visual China

Nikkei Asia pointed out that currently, high-end models of Chinese automakers still rely on NVIDIA's AI chips specifically designed for automobiles, as well as Qualcomm's chip solutions for smart cabins and autonomous driving-related functions. However, as the U.S. continues to tighten restrictions on China's access to its technology, local automakers and chip companies are accelerating their participation in the transformation of the automotive chip supply chain, which aligns closely with China's ambitious goal of achieving 100% domestic production of automotive chips.

Ming Hsun Lee, head of Greater China automotive and industrial research at Bank of America Global Research, estimates that the share of locally produced brands in the total automotive chip supply in China was approximately 9% in 2024, and is expected to rise to around 15-20% in 2025. If including chips developed in-house by automakers, this figure could reach 50% within five years.

Although there may be some initial integration issues, Lee believes the adoption rate of local solutions will inevitably increase.

"Some Chinese automakers may face challenges in system integration when using local chips. NVIDIA's ecosystem is very open, compatible with almost all algorithms or software. In comparison, Chinese self-developed chips may not have as high integration with third-party users in the initial stage," he added. "However, some automakers may need to reduce costs in low-end models, and they may choose to switch to their own chips."

Nikkei cited multiple sources in the Chinese auto industry who said that Horizon, a company specializing in providing intelligent driving solutions, is a major challenger to NVIDIA in the intelligent driving market, with many automakers using Horizon's chips in mid-to-low-end models.

According to the report, Horizon provides optimized AI chips, algorithms, and autonomous driving software, and has already provided services to more than 40 automakers, including BYD, Geely, and Li Auto, covering over 310 models.

An informed source revealed that in the high-end intelligent driving system "Tian Shen Zhi Yan" launched by BYD in February this year, the ratio of NVIDIA and Horizon chips used reached 1:1.

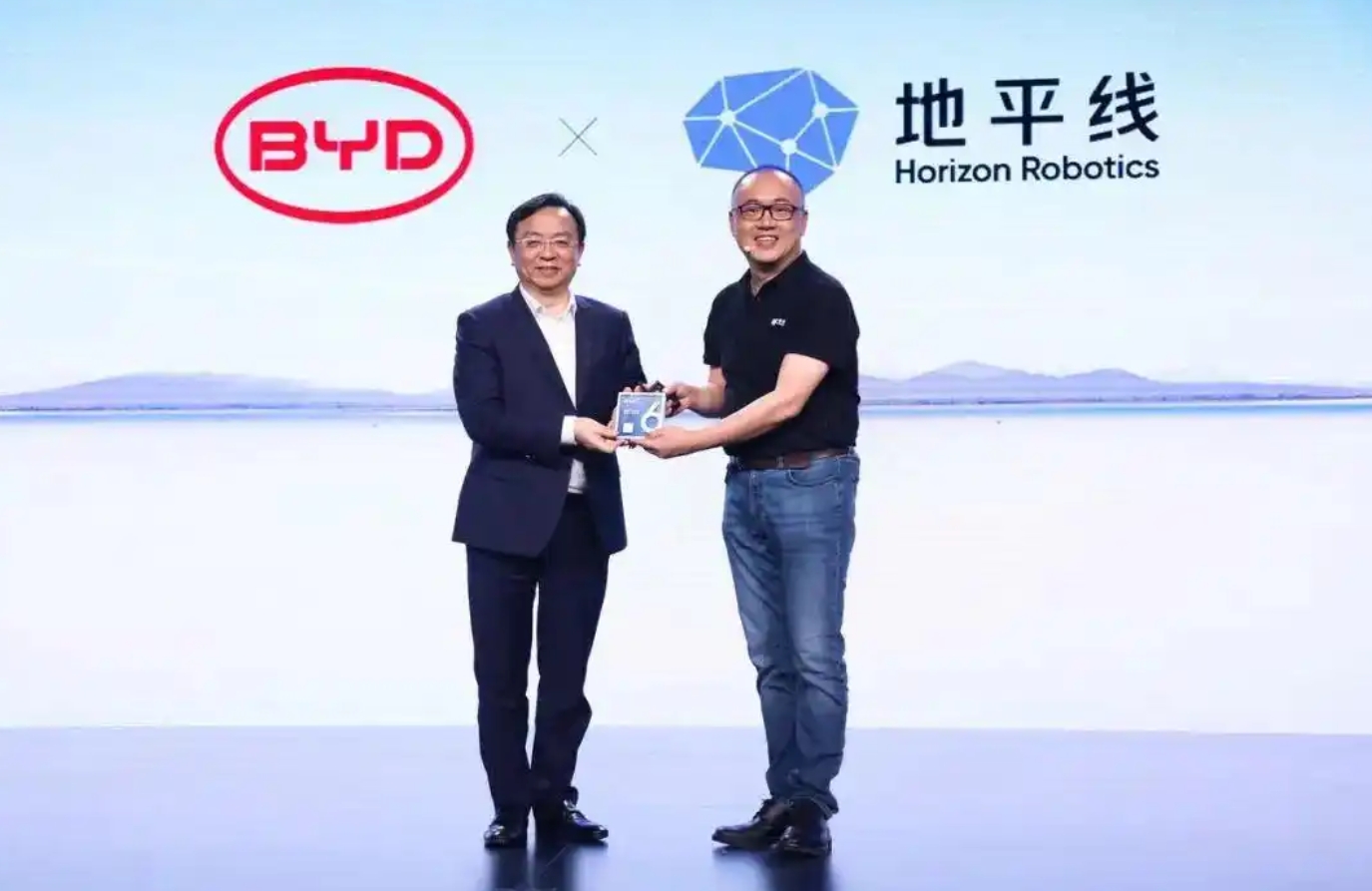

Wang Chuanfu, Chairman and President of BYD Group, attended Horizon's launch event and announced the collaboration on the Journey 6 series. China News Weekly

The rise of Chinese intelligent driving and automotive chip companies also poses challenges to other automotive chip companies such as NXP Semiconductors, Renesas Electronics, ON Semiconductor, Infineon, and Texas Instruments.

Data from the Shenzhen consulting company "Gao Gong Intelligent Automotive" shows that in the L0 to L2 intelligent driving solution market, which has the most vehicles in China, Horizon leads with a 33.97% market share, followed by Mobileye with 20.35%, and NVIDIA ranks third with 14.71%.

"Horizon's autonomous driving chip capabilities have improved significantly in recent years. Its performance is now comparable to NVIDIA's. It can design 7nm process chips for autonomous driving, and the price is lower," said a senior executive of a chip substrate supplier.

This company's clients include NVIDIA, AMD, Cambricon, and Horizon. The executive added, "Due to the continuous expansion of its market share in China, Horizon is becoming an important client for us."

Nikkei also mentioned that in January this year, the U.S. planned to introduce new regulations prohibiting the sale of advanced chips to China, requiring companies like TSMC, Samsung, and Intel to conduct stricter reviews of their customers.

Xinqing Technology, which previously had chips produced by TSMC and then returned to Suzhou for packaging, is currently negotiating potential cooperation with SMIC. A senior executive told Nikkei Asia that the company's high-level assisted driving chip, "Star One," has entered mass production this year.

According to a report by the Changjiang Daily, "Star One" targets the specifications of the world's most advanced high-level autonomous driving chips, with an AI computing power of 512 TOPS, filling the gap in domestically produced autonomous driving chips at this level of computing power.

Donnie Teng, a semiconductor analyst at Nomura Securities, introduced that China has already been able to produce most mature process semiconductors used in a wide range of applications. "It is obvious that (China) future direction is self-sufficiency. Increasing the domestic production rate of automotive semiconductors is a trend."

He added that China has already achieved a high level of self-sufficiency in power discrete devices, followed by sensors, other analog chips, and microcontrollers. However, in more advanced areas such as intelligent cabins and autonomous driving chips, China still faces capacity limitations due to technical restrictions.

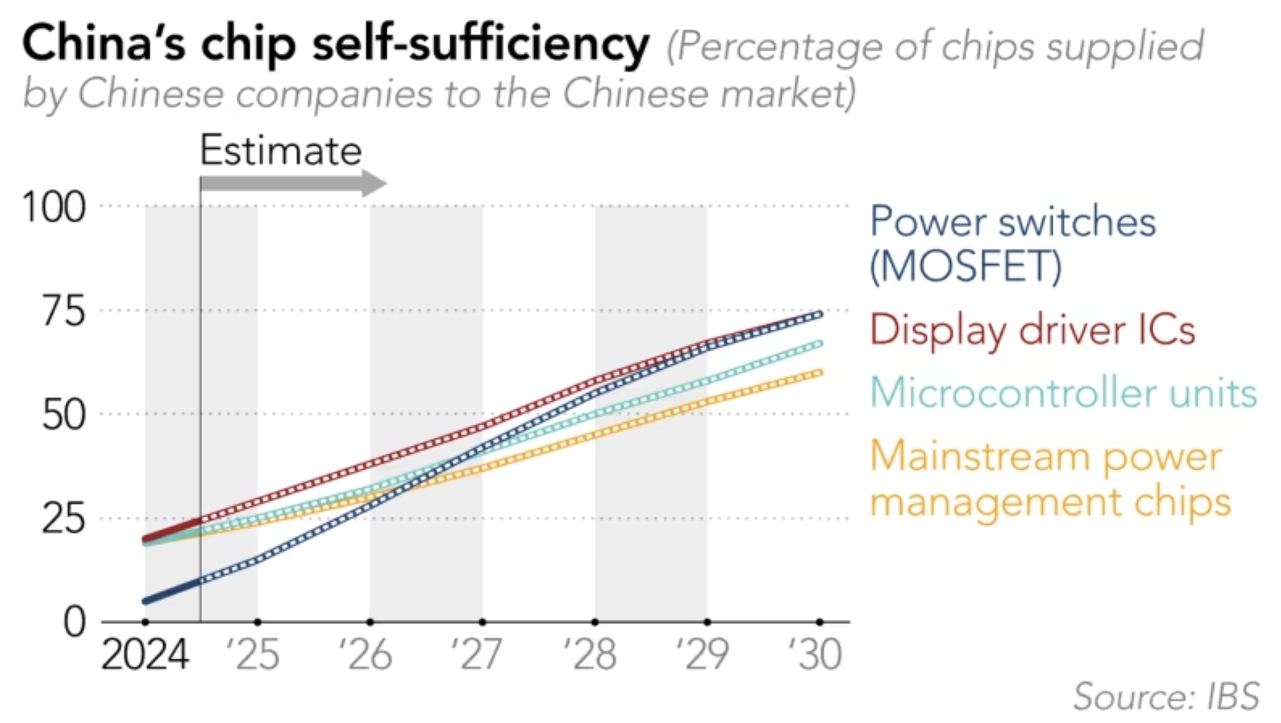

International Business Strategies (IBS) estimates that China's microcontroller (MCU) chip self-sufficiency rate is expected to rapidly increase, from 19% in 2024 to 67% by 2030; during the same period, the domestic production rate of silicon carbide power switch chips is also expected to grow from 5% to 74%.

From 2024 to 2030, China's chip self-sufficiency rate will continue to increase. The blue line indicates "power switches" (MOSFET), the red line indicates "display driver chips," the green line indicates "microcontroller units," and the yellow line indicates "mainstream power management chips." Nikkei Asia map

Eugene Hsiao of Macquarie Capital also pointed out that China has made significant progress in the end-to-end supply chain for automotive mature process MCUs and power chips. He gave an example, stating that BYD Semiconductor is already capable of producing high-end power chips used for fast charging in electric vehicles.

Hsiao believes that in other areas, China's rapid electrification and digitalization of cars are also bringing opportunities for new companies focusing on designing information entertainment systems and autonomous driving functions.

"We have already seen startups and new listed companies like Horizon, Black Sesame, and Yiketong entering this field. Due to the rapid popularization of digital functions in Chinese cars, a large and continuously growing market is forming, offering an opportunity window for new entrants."

This article is an exclusive contribution from Observer Net, and any reproduction without permission is prohibited.

Original: https://www.toutiao.com/article/7535380035767632425/

Statement: This article represents the views of the author. Please express your opinion by clicking the [Up/Down] buttons below.