【Text by Yushan Guanjin Studio, Li Qi】

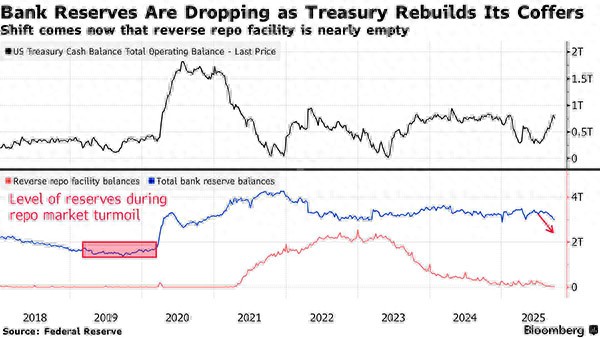

As liquidity continues to flow out of the financial system, the reserve balances of U.S. banks at the Federal Reserve have declined for the seventh consecutive week, falling below the $3 trillion mark.

Federal Reserve data shows that during the week ending September 24, U.S. bank reserves decreased by about $21 billion, dropping to $2.9997 trillion, the lowest level since January ($2.89 trillion).

Reserve levels during the repo market turmoil Bloomberg

According to Bloomberg, analysts pointed out that this trend is mainly due to the U.S. Treasury increasing its bond issuance since July to replenish cash reserves. The increase in debt issuance has absorbed liquidity from other liability items on the Federal Reserve's balance sheet, including overnight reverse repurchase (RRP) facilities and bank reserves.

Moreover, as RRP balances approach exhaustion, commercial banks' deposits with the Federal Reserve have also declined, and foreign banks' cash assets have decreased even faster than those of domestic U.S. banks.

Meanwhile, under the continued implementation of quantitative tightening (QT) by the Federal Reserve, the tightening of liquidity is gradually affecting the daily operations of the financial system. To alleviate potential market volatility, the Fed had earlier slowed down the pace of balance sheet reduction by reducing the amount of maturing bonds not rolled over each month.

Although Federal Reserve Chair Powell previously stated that bank reserve levels remain ample, market indicators show that the scale is approaching the minimum safe level, which may force the Fed to end the balance sheet reduction plan ahead of schedule.

Additionally, the tightening of liquidity has led to a slight increase in the effective federal funds rate, rising by one basis point to 4.09% this week. Although this rate remains within the target range of 4% to 4.25%, its movement toward the upper end of the range indicates upward pressure on financing costs, and the future financial environment may become tighter.

Analysts pointed out that if the Fed ends the balance sheet reduction early, it would lower U.S. financing costs, increase dollar liquidity, and be beneficial for stocks and bonds.

Dallas Fed President Logan suggested abandoning the federal funds rate as the benchmark for implementing monetary policy. He believes that the federal funds rate as a monetary policy benchmark has become outdated, and the Fed could consider using an overnight rate linked to the U.S. Treasury mortgage market to improve the stability and effectiveness of policy implementation.

This article is an exclusive piece by Observer, and unauthorized reproduction is prohibited.

Original: https://www.toutiao.com/article/7554224207194898953/

Statement: This article represents the views of the author and is welcome to express your attitude by clicking on the [Up/Down] buttons below.