【By Observer Network Columnist John Ross】

When Trump launched a new round of tariff war in April, many analysts predicted strong negative fluctuations in the US market and economy. However, as I analyzed and predicted earlier, these situations did not occur - the market response was rapid but limited, and in most cases quickly overcome; US economic growth did indeed slow down, but still fell within the normal range of economic cycles.

This has led some people, especially some Americans, to change their stance, believing that Trump's policies would not have far-reaching effects - for such conclusions, I have analyzed in my article "It is Not Wise to Adopt a Bipolar Analysis: What Determines the Outcome of Sino-US Competition?"

The error in such analyses lies in focusing on the immediate reaction of the US economy, rather than the political level. However, Trump's goals are more ambitious, going far beyond what these analyses can cover.

It is well known that Trump is overturning an 80-year-old trade policy in the United States - abandoning the US support for trade liberalization. But this trade/economic policy revolution requires reversing the political landscape in the United States since Reagan took office in the early 1980s over the past four decades.

The policy initiated by Reagan maintained political stability in the United States after the turmoil of the 1970s until recently. Therefore, the key to whether Trump's policy can increase the US economic growth rate is whether it can overturn the relationship between the US economy and the world economy since Reagan's administration without undermining US political stability? In other words, whether Trump's policy will succeed depends on political factors, not purely economic factors.

Therefore, the following will analyze the relationship between economics and politics in Trump's new policy and compare it with the pattern of the relationship between the US economy and politics over the past 40 years.

Introduction Evaluation of the Trends in the US Economy Since Trump Announced Tariff Increases

On April 2, the so-called "American Liberation Day," Trump announced the imposition of tariffs, and there were two analyses of the impact of this move at the time.

The first analysis - which was reflected in the rapid fluctuations in the US financial markets and the discussions of some Chinese and American media - believed that this would trigger some major turbulence or crisis in the US economy. First, look at market dynamics: from April 1 to April 8, the S&P 500 index fell 11.5%; from April 1 to April 11, the yield on US Treasury bonds rose sharply from 4.16% to 4.49%; from April 1 to April 21, the dollar index, the most commonly used trade-weighted index for measuring the exchange rate of the dollar, fell 5.7%.

The claim that the financial market is facing a serious crisis is particularly evident in the headlines of media reports. For example, on April 4, The Wall Street Journal published an article titled "Tariffs Trigger a 1,600-Point Drop in the Dow, the Dollar Index Plummets," in which it pessimistically claimed, "Due to concerns that President Trump's new tariff plan would trigger a global trade war and drag the US economy into a recession, the US market suffered its worst drop since 2020... This drop placed the financial market in one of the most dangerous periods in recent years."

The second analysis, as I and other scholars believe, the US economy was not significantly affected, the US financial market reacted quickly but within a limited scope, and the changes in the US economic dynamics were merely normal economic cycle adjustments. Details can be found in my article "It Is Not Wise to Adopt a Bipolar Analysis: What Determines the Outcome of Sino-US Competition?"

These two contrasting analyses have significant implications for China, because although the outcome of the Sino-US economic competition fundamentally depends on China's economic situation, it is also influenced by the development of the US economy. If Trump's tariff policy and other policies have an impact on the US economy, or if there are certain serious imbalances or crises in the US economy, China may have the opportunity to win the competition with the US in a relatively short time frame.

Conversely, if the US is only experiencing a normal economic cycle slowdown, and Trump's tariff policy and other policies have not triggered any major crises in the US economy, then the outcome of the Sino-US competition will depend on the decisive factors affecting the long-term economic growth of both countries.

Over the past three months since Trump implemented his tariff policy, the overall trend has clearly confirmed the correctness of the second analysis. As of July 18, 2025, the S&P 500 index had risen 11.8% from the level on April 1, reaching a new all-time high. The 10-year US Treasury bond yield had fallen from its recent peak of 4.61% on May 21 to 4.42% on July 18, far below the peak of 4.79% in January 2025. Although there are signs that the US economic growth is slowing down, as shown below, this slowdown is entirely in line with the normal economic cycle slowdown.

In other words, as shown below, although Trump's tariff policy and the decline in the dollar exchange rate are sufficient to cause significant changes in the US trade structure, they should not be confused with their profound impact on US economic growth.

The only area where there remains a continuous controversy is whether the US economy is experiencing abnormal developments - specifically, whether the dollar continues to depreciate.

Since the dollar exchange rate is not only an important indicator of the performance of the US economy but also directly affects the social and political stability of the US; in addition, as the dominant global currency, the dollar has a wide influence on the world economy, which in turn has direct or indirect chain reactions for China, this issue is worth close attention. For this reason, this article will conduct a detailed analysis of the recent trends in the dollar exchange rate, especially from a historical perspective, and assess its potential impact.

For this purpose, the following will discuss five interrelated important issues in four parts.

First, why does Trump want to push for a weaker dollar?

Second, what impact does the depreciation of the dollar have on world trade?

Third, how much does the depreciation of the dollar correlate with the presidential term of the US president

Fourth, can Trump's policies succeed?

Fifth, the impact on China

The conclusions drawn in the following are clear: Trump is indeed trying to undermine the economic policy framework that has been in place in the US for over four decades - specifically, the policy framework established since the early 1980s when the US's relationship with the world economy underwent a fundamental transformation. As discussed below, in this process, the dollar exchange rate plays a key role. However, because of the fundamental nature of this transformation, the final outcome will depend on domestic politics in the US, not purely economic factors.

Part One Why Does Trump Want to Push for a Weaker Dollar?

1.1 Trump Supports a Weaker Dollar

Trump has made many false statements about the US economy and its economic policies - which will be discussed below. However, in terms of supporting a weaker dollar, Trump's words and deeds are completely consistent.

As Western financial media have extensively reported, the dollar has indeed experienced the fastest decline since 1973, i.e., half a century ago, after the new Trump government came into power - typical headlines such as "The New York Times" "The Dollar Has Its Worst Start Since 1973" and "Financial Times" "The Dollar Faces Its Worst Situation Since 1973".

But as will be revealed later, the external upward pressure on US imports caused by this dollar depreciation is much greater than in 1973 - due to the simultaneous implementation of tariff measures forming a combined effect. Given this impact on the scale of the world economy and the US economy, a key question is: How much will the dollar depreciate, and what impact will it have on the US, China, and the world economy and politics?

During the first half of 2025, the dollar index fell more than 10%, and the dollar faced its worst situation since 1973.

Long before his second term, Trump had already stated in an interview with Bloomberg Businessweek on June 25, 2024: "As you know, we are facing serious currency problems... A strong dollar combined with a weak yen and a weak yuan poses a huge burden on American companies that try to sell products abroad. This burden is too heavy... I've talked to manufacturers, and they say that because the prices are too high, no one wants to buy our products... The exchange rate difference between the dollar and the yen, and the dollar and the yuan is incredible. The dollar is strong while they (the yen and the yuan) are weak."

Supporting a weaker dollar has also been a long-standing position of Trump. In April 2017, during his first presidential term, he said: "I think our dollar is too strong... This is causing harm - it will eventually cause harm... When the dollar remains strong while other countries are allowing their currencies to depreciate, the competition will be very, very difficult."

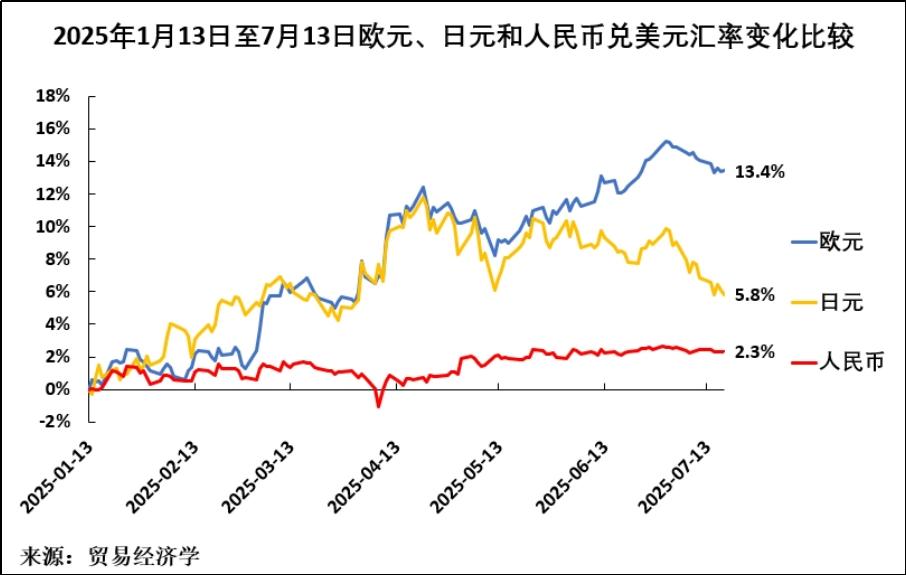

As mentioned earlier, during Trump's second presidential term, the dollar exchange rate did indeed fall rapidly. As of the time of writing this article, the dollar index has fallen 10.3% from its peak on January 13, 2025.

The overall effect of this dollar depreciation is roughly equivalent to the impact of the tariffs Trump has implemented so far. The combined effect of the dollar depreciation and the tariff measures means that the price of imported goods in the US has increased significantly / the protectionism of the US on imported goods has been intensified. Trump is preparing to impose a 15% comprehensive tariff on US imports, plus a 10.4% currency depreciation, which roughly estimates that the average price of imported goods in the US has risen by more than 25% in just six months.

This change in price is sufficient to cause significant changes in the US trade geography and have a significant impact on US imports. Moreover, this is before the bilateral tariffs that the Trump administration has promised to implement are finalized - these tariffs are scheduled to take effect on August 1, so for many countries, including China, the obstacles to exporting to the US will further increase.

But it must be clearly distinguished between two issues: one is the high probability of a major change in the US trade geography, and the other is the possibility that the position of trade in the US economy may decline - these are essentially different from macroeconomic processes that could significantly slow down the US economic growth. As shown above, the latter is determined by completely different economic forces.

1.2 Why is the depreciation of the dollar not widely discussed in China?

The rapid depreciation of the dollar during Trump's presidency has become a major issue in Western financial markets and a headline in Western financial media. However, China pays less attention to it, because unlike other major currencies, the RMB exchange rate against other major currencies has declined almost as much as the dollar (the following will be explained). That is to say, the RMB exchange rate has always followed the depreciation of the dollar against other major currencies, and the decline is only slightly less than the dollar itself.

Because Chinese media pays more attention to the exchange rate movement of the RMB against the dollar, while the dollar is falling, the RMB against the dollar has only appreciated slightly, and the change is very small, which explains why the depreciation of the dollar and its impact are not widely discussed domestically in China. However, in terms of its impact on the world economy and China, the key is the overall exchange rate of the dollar, not just the exchange rate of the dollar against the RMB. In particular, the depreciation of the dollar, while the RMB against the dollar exchange rate remains relatively stable, and the RMB against other major currencies such as the euro and the yen also depreciates, which means that the world economy is splitting into two currency blocs.

1) First, the depreciation of the dollar and the RMB.

2) Second, the appreciation of the yen, especially the rapid appreciation of the euro.

The division of the world economy into two camps will inevitably have significant international impacts, including on China's trade and overall economic situation. In addition, as discussed below, this will also have a significant impact on the overall position of the US in the world economy.

Given the importance of the depreciation of the dollar, it is necessary to evaluate the following:

First, to assess the empirical data on the recent trends in the exchange rates of major currencies;

Second, to evaluate the significance of these trends;

Third, to assess their impact on Sino-US relations and the world economy.

1.3 Trump's Dispute with Powell

First, in terms of facts, the most sensational event regarding the recent depreciation of the dollar in Western media is Trump's continued public criticism of Federal Reserve Chair Powell's interest rate policy - Trump has demanded immediate large-scale rate cuts, but Powell did not comply.

Trump publicly insulted Powell at the NATO summit in late June, calling him "extremely dull in intelligence," and "I think he is incompetent in terms of his work performance, and his intelligence is questionable in terms of his responsibilities." Subsequently, The Wall Street Journal published an article with an obvious title, "Trump Considers Appointing the Next Federal Reserve Chairman Early to Counteract Powell." The Financial Times analyzed that "the dollar weakened... due to dissatisfaction with the pace of rate cuts, the president considers appointing the next Federal Reserve Chairman early. The dollar's exchange rate against the pound, the euro, and a basket of other currencies dropped in response."

Trump continued to publicly criticize Powell in July, demanding that the Fed lower interest rates by 3% - as of the time of writing this article, the effective federal funds rate is 4.33%. Obviously, a drastic rate cut from 4.33% to 3% could lead to a sharp drop in the dollar exchange rate - although the exact number Trump requested more reflects his pressure intent than actual policy objective, because there is reason to doubt that any Federal Reserve Chair (even one nominated by Trump) would implement such extreme rate cuts.

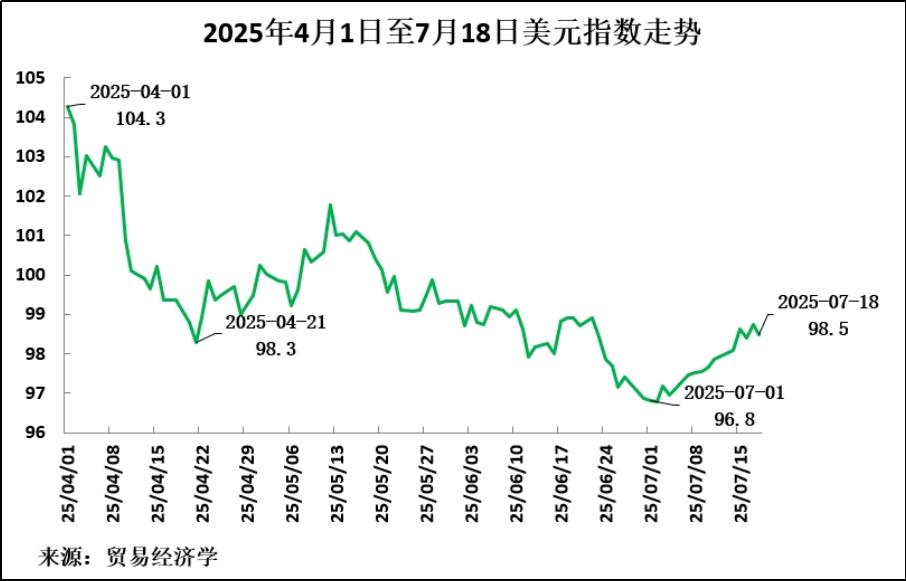

But more important than the short-term exchange rate drop caused by the public dispute between the president and the US central bank is the fact that the dollar has continued to decline this year. Taking the most widely used indicator of the overall dollar exchange rate level, the dollar index (DXY), as an example, the index reached a peak of 110.0 on January 13, 2025, and has fallen to 98.5 by the time of writing this article, a cumulative decline of 10.4% over more than six months (see Figure 1).

Figure 1

1.4 The Slowdown in US Economic Growth is a Normal Process of the Economic Cycle

The reason why Trump strongly demands a reduction in US interest rates is because, contrary to his claim that "the US economy is performing extremely well," in fact, US economic growth is significantly slowing down - this is not due to a major crisis, but rather a normal process of the economic cycle.

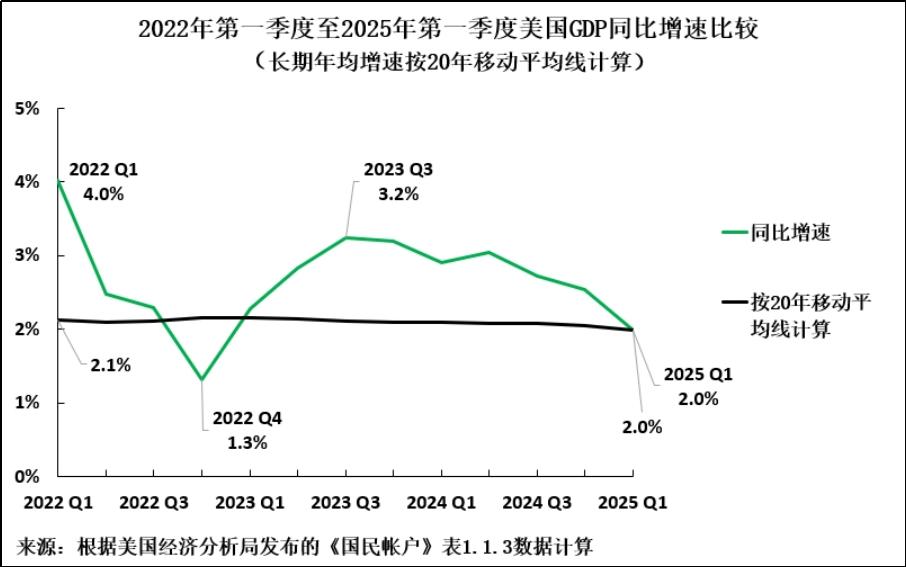

To illustrate this, Figure 2 presents a comparison of US GDP growth rates from the first quarter of 2022 to the first quarter of 2025. The data clearly show that the long-term annual average growth rate of the US GDP is slightly above 2%. The recent performance of the US economy is merely fluctuating around this average, conforming to the normal patterns of economic cycles.

As shown in Figure 2, as the US economy recovered from the recession caused by the pandemic, the GDP growth rate in the first quarter of 2022 was 4.0%, far exceeding its long-term annual average. Then the US economy slowed sharply, with the GDP growth rate in the fourth quarter of 2022 dropping to 1.3%, significantly below its long-term annual average. After that, the economy began to recover, with the GDP growth rate in the third quarter of 2023 rising to 3.2% - much higher than its long-term annual average. Then the economy slowed again, with the GDP growth rate in the first quarter of 2025 falling back to 2.0% - almost matching its long-term annual average. However, the US economic growth rate is still showing a downward trend. Overall, there is no abnormal economic phenomenon, and what is seen is merely normal economic cycle fluctuations.

However, for Trump, this economic cycle slowdown is a major issue. Given that the US economic growth has been above approximately 2% for nearly two consecutive years, and now shows a slowdown, the future US economic growth rate is likely to fall below the long-term annual average of 2%. This will expose the lie that Trump has promoted "extraordinary economic achievements under his leadership." Apart from the direct economic impact, the consequences could also severely damage Trump's domestic political support. Therefore, Trump is desperately demanding rate cuts to try to prevent the slowdown of the US economy, regardless of the inflationary consequences - and controlling inflation is one of the core responsibilities of the Federal Reserve (i.e., Powell).

Figure 2

1.5 The Advantage of China's Economic Growth Over the US is Further Expanding

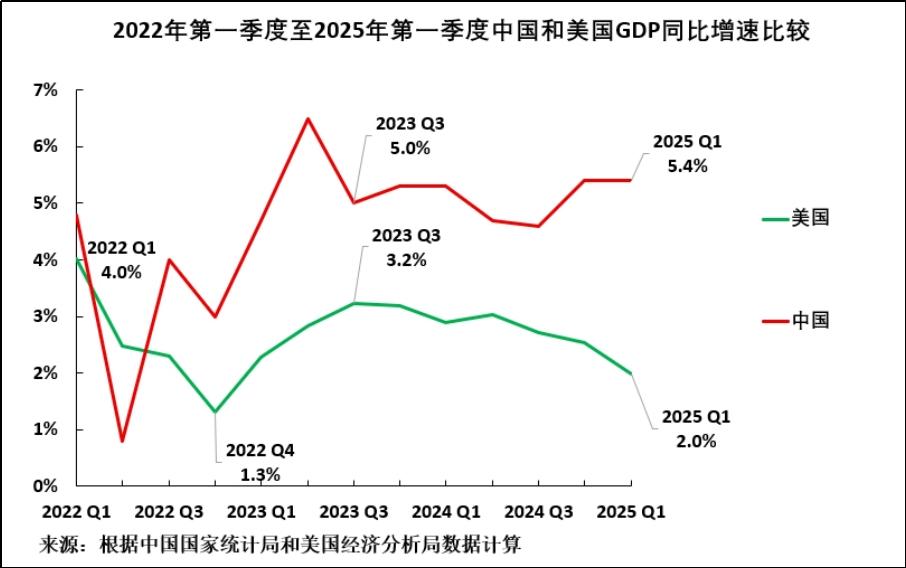

Comparing with China, the slowdown in the US economy means that China's advantage in economic growth over the US is further expanding. As shown in Figure 3, during the peak period of the US economic growth (third quarter of 2023), the US growth rate of 3.2% was only 1.8 percentage points lower than China's 5.0% growth rate. However, as the US economic growth continues to slow down, by the first quarter of 2025, China's growth advantage has almost doubled, reaching 3.4% - the US grew by 2.0% and China by 5.4%.

Therefore, by the first quarter of 2025, China's GDP growth rate is more than twice that of the US. As I predicted in the article "Thanks to Trump's Tariff War, China's Economic Growth Advantage Over the US is Further Expanding," the reason why China's economic growth advantage over the US is further expanding is due to the continuous slowdown in the US economic growth.

Since Trump's specific goal is to cut, or even eliminate, China's economic growth advantage over the US, China's growing advantage in economic growth is a serious problem for his government. Based on both domestic and international considerations, Trump urgently needs to use rate cuts to prevent the US economic slowdown. However, the Federal Reserve data show that the US consumer price index rose 2.7% year-on-year in June, higher than its 2.0% inflation target, and Trump's additional tariffs may bring short-term inflationary pressure. If inflation cannot be controlled, it will severely harm the US economy in the medium to long term, so the Federal Reserve refused to cut rates. Trump thus faces the dilemma of continued economic slowdown - which also explains why he has harshly criticized Powell and continuously demanded rate cuts.

Figure 3

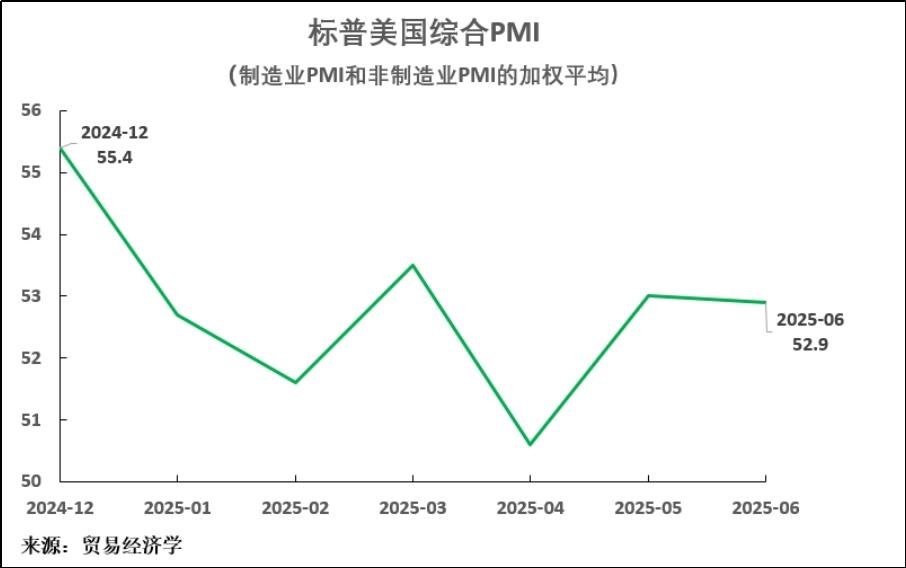

Looking at the recent period, the US GDP data after March 2025 have not been released yet, but the scattered data obtained afterward still show a trend of slowing US economic growth. Taking the US PMI as an example, the most comprehensive one is the S&P US Composite PMI (the weighted average of the manufacturing PMI and non-manufacturing PMI).

As shown in Figure 4, this PMI decreased from 55.4 in December 2024 to 52.9 in June 2025. Since this number is above 50, it indicates that the US economy was still expanding in June, but the growth rate has slowed compared to the end of 2024.

Figure 4

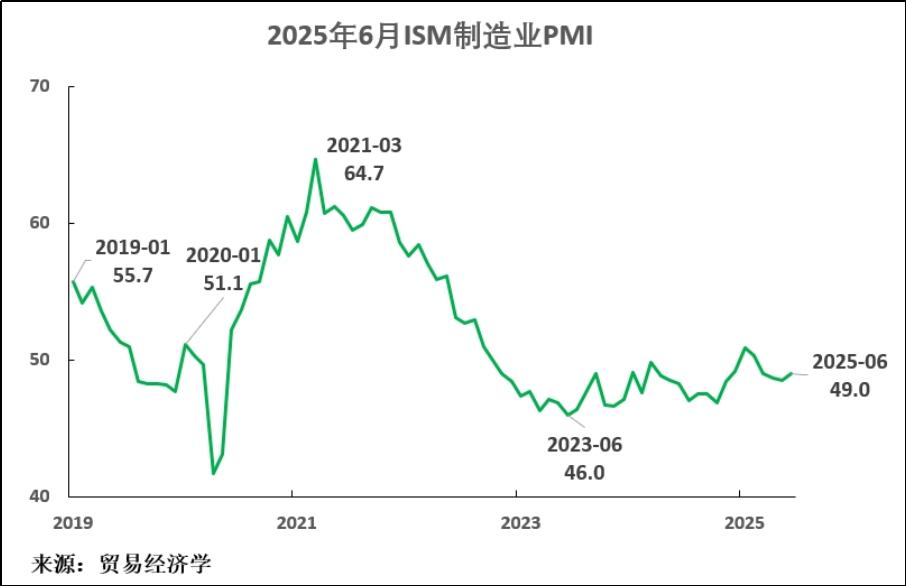

The PMI of other industries in the US is more negative. For example, as of June 2025, the ISM Manufacturing PMI published by the Institute for Supply Management (ISM) has dropped to 49.0 - this number is below 50, indicating that the manufacturing sector is in contraction (see Figure 5).

Figure 5

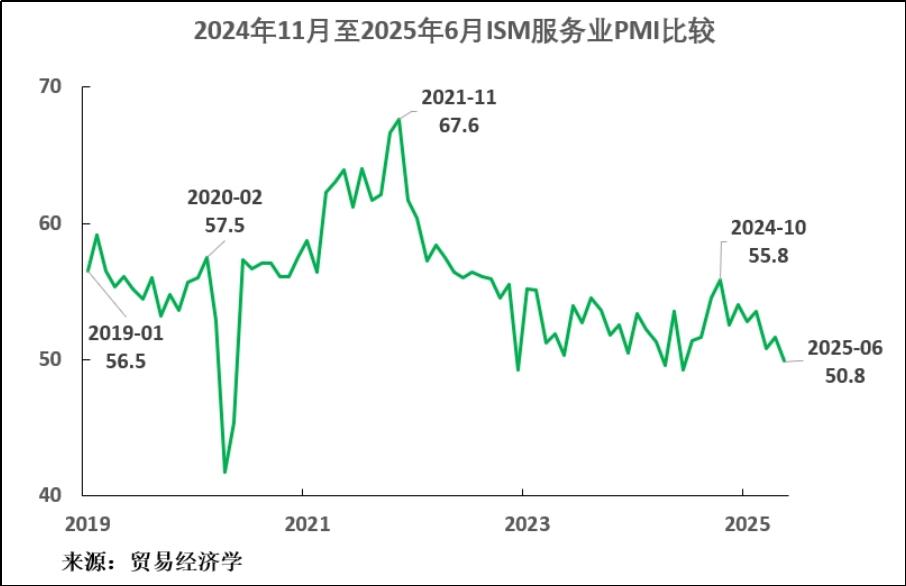

As of June 2025, the ISM Services PMI has dropped to 50.8, significantly slower than 55.8 in November 2024 (see Figure 6).

Figure 6

It is worth noting that these data do not show a short-term or serious crisis in the US economy. They all indicate that the US economy is in a normal economic cycle downturn - but this growth rate is not satisfactory from the perspective of the US economy, and it is also not ideal in terms of domestic political impact, while indicating that China's advantage in economic growth over the US continues to expand.

These data are consistent with the analysis results, which state that the economic competition between China and the US is not determined by any short-term crisis in the US, but by the decisive factors affecting the long-term growth rates of both countries - the reasons for which I analyzed in my article "It is Not Wise to Adopt a Bipolar Analysis: What Determines the Outcome of Sino-US Competition?"

1.6 Both the Dollar Exchange Rate and the RMB Exchange Rate Are Showing a Declining Trend

As mentioned earlier, the depreciation of the dollar has not become a headline news in China as it has outside of China, because the RMB is not floating like other major currencies such as the euro and the yen - or to put it more accurately, since the dollar index reached its recent peak on January 13, the RMB has appreciated only 2.3% against the dollar. Compared to this, the yen appreciated 5.8% and the euro appreciated 13.4% during the same period.

Figure 7

These exchange rate movements have caused the RMB to depreciate significantly against the yen and the euro. As shown in Figure 8, since January 13, the RMB has appreciated 2.3% against the dollar, but depreciated 3.5% against the yen and 11.1% against the euro. The significant depreciation of the RMB against other major currencies, especially the euro, will bring significant advantages for China's exports to the Eurozone, which is one of China's largest export markets.

Figure 8

Part Two Impact of the Depreciation of the Dollar on World Trade

2.1 The Dollar Falling Will Lead to a Significant Decline in US Import Trade

Now let's look at the wide-ranging impact of this issue globally. During Trump's second term, the issue of the dollar exchange rate, as the world's dominant currency and the currency of the world's largest economy, is obviously very important, and there are many reasons for this, which will be partially analyzed below. This is particularly important because it is well known that Trump explicitly expressed his desire to completely restructure the world trade system - replacing the multilateral trade negotiation system through the World Trade Organization with a bilateral trade relationship system led unilaterally by the US.

There is no doubt that the combined effect of tariff measures and the depreciation of the dollar has already caused the average price of imported goods in the US to rise by more than 20% and the subsequent increases will continue, and this combined effect is sufficient to cause significant changes in the US trade structure. It is expected that imports from many countries, including China, will significantly decrease. But will this price shock be sufficient to restructure the world trade system in the way Trump hopes?

To assess this, it is necessary to examine the overall pattern of global trade, as well as the positions of the two major trading countries, the US and China, within it.

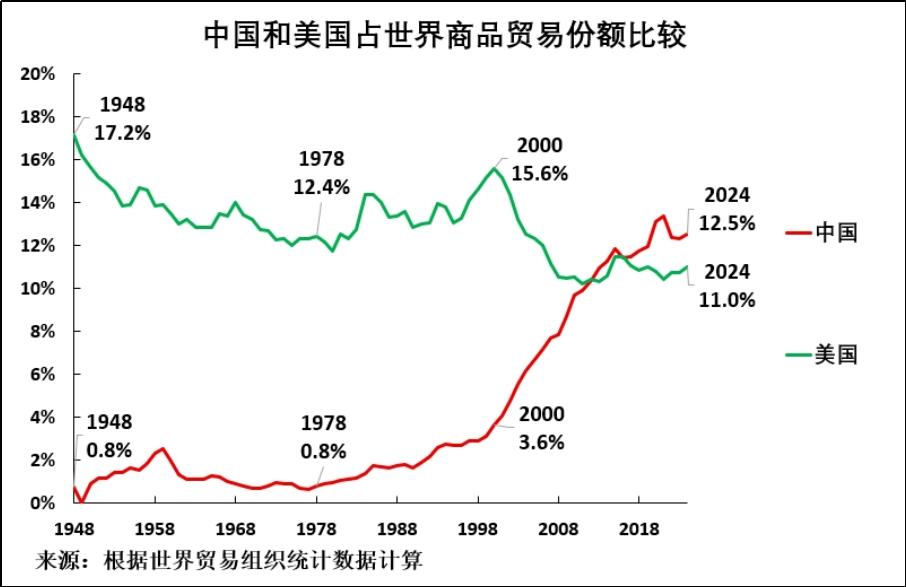

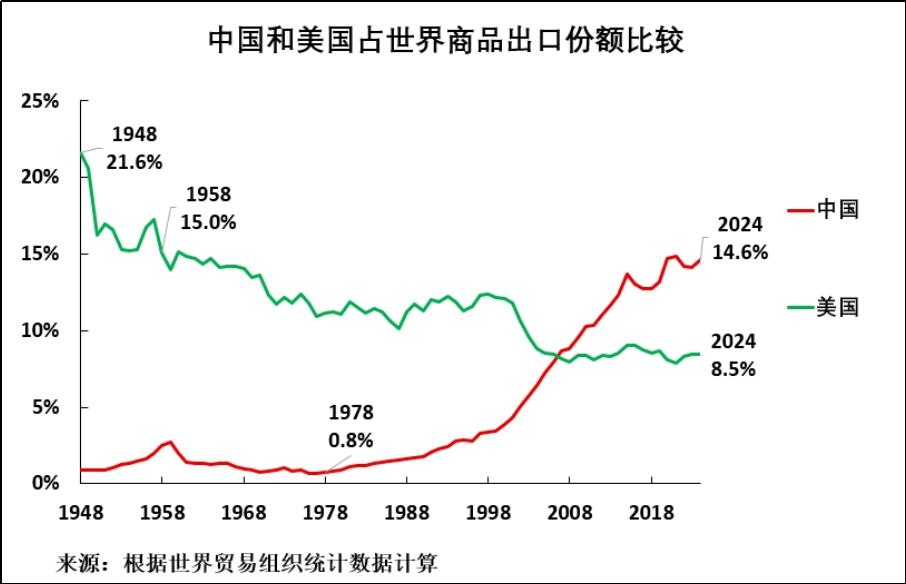

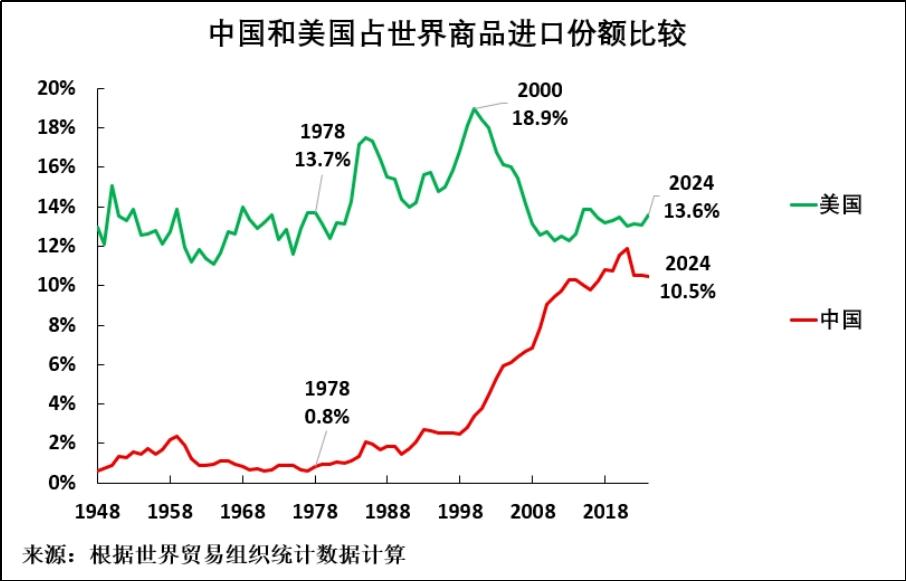

Therefore, Figure 9 presents a comparison of the changes in the share of world commodity trade held by the US and China from the end of World War II to the end of 2024. It can be seen that since the 21st century, the share of the US in world commodity trade has declined sharply - since 2000, the US share of world commodity trade has fallen from 15.6% to 11.0%. This 11.0% share (slightly higher than one-tenth of the total world trade volume) is obviously too small to allow the US to control the world trade system, unless other countries submit to its demands.

In contrast, China's share of world commodity trade exceeded that of the US in 2013. It is well known that China is now the world's largest commodity trading country - in 2024, China's share of world commodity trade was 12.5%, while the US was 11.0%. This means that if the US continues to disengage from the world trade system through additional tariffs, China and other countries (which together account for nearly 90% of world trade) objectively have the potential to build an alternative world trade framework that replaces the US.

Figure 9

2.2 The Strategic Advantage of the US as the Largest Importer Country Will Be Diminished

However, if we look more closely at the trade patterns of the US and China, there is one area where the US still has an advantage over China. As shown in Figure 10, in 2024, China's share of world commodity exports was 14.6%, far higher than the US's 8.5%.

Figure 10

However, for many countries, the most important thing is the ability to export goods to other countries, including the US and China. As shown in Figure 11, in terms of imports, the US still leads the world. In 2024, the US accounted for 13.6% of the world's commodity imports, while China accounted for 10.5%.

This gives the US a certain advantage in establishing relationships with various countries - however, this strategic advantage will be weakened if Trump's tariff and dollar depreciation combination policy reduces US imports as expected. In addition, since China has a large trade surplus, from this perspective, China can take proactive measures to expand imports. For example, when the US imposed tariffs, China recently eliminated all tariffs on imports from 53 African countries. Of course, if China replaces the US as the world's largest import center, this will significantly enhance China's international status.

But currently, the US relies on its larger import volume than China, and uses coercive measures to try to get countries to adopt anti-China policies. This is particularly evident in the US strategy towards Vietnam and the European Union.

Figure 11

Part Three The Depreciation of the Dollar and the Term of the US President

However, in addition to its role in US trade, the dollar, as the international price standard for the majority of the world's economies, has a more extensive impact. Therefore, in addition to the impact on trade, it is necessary to examine the impact of changes in the dollar exchange rate from a broader perspective, and to assess the extent of its depreciation.

This is because, as Politico summarized, "The dollar and US bonds are the red blood cells of the global market, and economists warn that a slight decline in their attractiveness could shake the foundation of Wall Street and household finances. Borrowing costs and import prices will rise, the value of investment assets that support retirement savings accounts will fall, and the government's ability to fund departments such as Medicare and defense budgets through massive deficits may be weakened."

In assessing these broader impacts, the depreciation of the dollar during Trump's second term is indeed the fastest in the same period in the past half-century. But to judge its impact, it is also necessary to assess the overall amplitude of its fluctuations. For this purpose, it is necessary to analyze the long-term trend of the dollar exchange rate.

As shown in Figure 12, in the long term, since the collapse of the Bretton Woods exchange rate system after World War II, the dollar exchange rate has generally shown a long-term downward trend, but with significant intermediate fluctuations.

Figure 12

Returning to the current situation, under this historical trend, the overall trend of the dollar exchange rate in recent times has been established since the clear end of the pandemic in early 2022. As shown in Figure 13, from January 2022 to July 2025, the dollar index has fluctuated within a range with an approximate bottom of 96.5. Therefore, the question now is whether the dollar will break through this range? As shown below, this will depend on whether Trump can achieve his proclaimed economic goals. The following will explain that this mainly depends on political factors, not purely economic processes.

Figure 13

3.1 Not All of Trump's Advisors Support the Depreciation of the Dollar

When analyzing the goals that Trump wants to achieve, there are clearly some important figures in the Trump administration who advocate a significant depreciation of the dollar. Stephen Miller, the chairman of the Trump administration's Council of Economic Advisers, in a detailed report of 41 pages, bluntly pointed out the economic and political impact of the current dollar exchange rate:

"The root cause of economic imbalance is the prolonged overvaluation of the dollar, which hinders the balance of international trade... From the perspective of trade, the phenomenon of the dollar being overvalued for a long time still exists, which is largely because the dollar asset serves as a global reserve currency. This overvaluation has seriously affected American manufacturing, while the financially oriented economic sectors benefit in a way that benefits the rich in the US... This overvaluation makes American exports less competitive and imports cheaper, thereby restricting the development of American manufacturing. With factories closing, manufacturing jobs are decreasing, many local economies are declining, many working-class families struggle to make ends meet, relying on government assistance or opioid drugs, or having to migrate to more prosperous areas. Infrastructure deteriorates due to the government's inability to provide services, housing and factories are abandoned, and communities fall into 'decline.'"

Milin's view is clearly consistent with the previous statement that Trump believes the dollar exchange rate is too high.

However, Milin is more organized - he calls for a significant depreciation of the dollar, considering it should become the core policy of the Trump administration, and fully recognizes that this represents a fundamental shift from the economic policies of the past several decades in the US. Milin pointed out, "We may be standing at the edge of a generational change in the international trade and financial system... Comprehensive tariffs and the abandonment of a strong dollar policy may become one of the most impactful policies in decades, fundamentally reshaping the global trade and financial system."

However, other members of the Trump administration, such as Treasury Secretary Bensons, do not agree with this analysis - just on June 25, Bensons still publicly stated, "Our strong dollar policy reflects our commitment to a stable and predictable economic environment." However, obviously, Milin's position indicates that there are indeed voices within the Trump administration advocating for a significant depreciation of the dollar.

However, as will be explained later, because the relevant economic decisions involve a large scale and far-reaching impact, this policy stance clash will not be decided by gentle discussions between advisors or economists, but will only come from the intense collision of economic forces - this collision will generate fundamental social and political impacts. The framework that determines Trump's actions is precisely this political force, not economic theory discussions.

3.2 The Low Exchange Rate and the Success or Failure of the US President

This fundamental reality exists because Milin correctly pointed out that the policy of significantly depreciating the dollar means overturning the entire economic policy system that has been in place in the US for decades - specifically, the policy framework established since the early 1980s when the US's relationship with the world economy underwent a fundamental transformation. However, as will be explained later, Milin himself did not fully realize the impact of the dollar exchange rate changes on the internal politics and political aspects of the US.

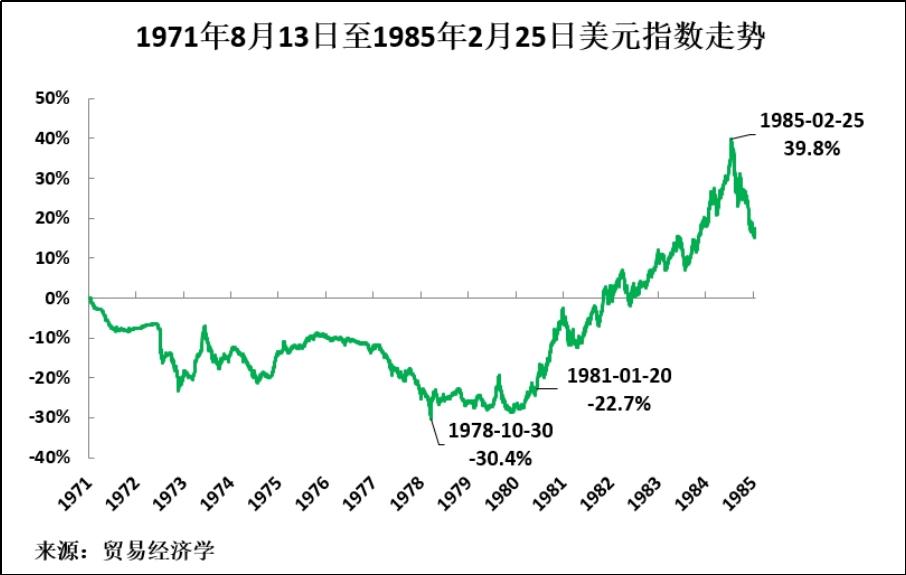

To help everyone understand the historical issues involved, Figure 14 presents the trend of the dollar index from 1971 to 1985. On August 13, 1971, the last trading day before the decision to terminate the dollar's convertibility to gold, the dollar index fell to a low point in October 1978, a drop of 30.4%. By January 20, 1981, when Reagan took office, the dollar index was still 22.7% lower than the exchange rate at the time of the Bretton Woods system's collapse. That is to say, for a decade after the collapse of the Bretton Woods system, the dollar index remained low.

This period of a weak dollar brought profound economic, social, and political impacts to the US. Economically, the US experienced the most severe inflation in peacetime history; politically, all presidents during this period were extremely unpopular.

Economically, the Consumer Price Index in the US soared to 14.8% in March 1980 - the highest level in US history excluding the impact of war; politically, none of the presidents during this decade could complete two terms - Nixon was forced to resign due to the Watergate scandal, Ford failed to win re-election in 1976, and Carter also failed to win re-election in 1980 after his first term.

Overall, during the period of a low dollar exchange rate, the US was a complete failure economically and politically.

3.3 Reagan Built a New Framework for the US and the World Economy

However, as shown in Figure 14, this low-dollar exchange rate policy changed decisively during Reagan's presidency. From January 21, 1981, when Reagan took office, to February 25, 1985, when the dollar index reached its peak, the dollar index surged by 81%! This means that the dollar index was 40% higher than the level at the time of the collapse of the Bretton Woods system in 1971.

Figure 14

Regarding domestic politics, Reagan's new policy achieved great success. In contrast to the political turmoil of the 1970s, in the nearly four decades from Reagan's presidency in 1980 to Trump's election in 2016, four out of five US presidents were re-elected - Reagan, Clinton, Bush, and Obama. Economically, the US inflation rate quickly dropped - from 14.8% before Reagan took office to 1.1% in December 1986 (see Figure 15). For the next forty years, the US inflation rate remained low (until Biden launched a consumption-oriented stimulus plan to deal with the economic recession caused by the pandemic, which caused the inflation rate to surge again to 9.1%).

Figure 15

The reasons for the interrelation between the dollar exchange rate, the US inflation rate, and the political support rate of the president are evident.

A low exchange rate (such as in the 1970s) pushes up the price of imported goods, thus creating upward pressure on inflation - therefore, a low dollar exchange rate leads to high inflation in the US, and high inflation makes presidents extremely unpopular. Conversely, a high exchange rate lowers the price of imported goods denominated in dollars, thus creating downward pressure on inflation, and a sustained decline in inflation helps maintain the president's popularity.

Objectively speaking, a high dollar exchange rate increases the purchasing power of the dollar domestically, including the international purchasing power of US consumers, which helps improve the quality of life of the people and ensures the president's popularity. Biden's low approval ratings and the defeat of the Democrats in the 2024 elections fully demonstrate the strong resistance of the American people to high inflation - although this round of high inflation was not caused by the depreciation of the dollar, but by the stimulus plan introduced to deal with the pandemic.

3.4 Reagan Turned the US from a Capital Exporter to a Major Capital Importer

The significant impact of the dollar exchange rate appreciation during Reagan's presidency brought a truly historically significant change in the relationship between the US and the world economy - overturning the 80-year relationship model between the US and the global economy and opening up a new era that has lasted for 45 years so far.

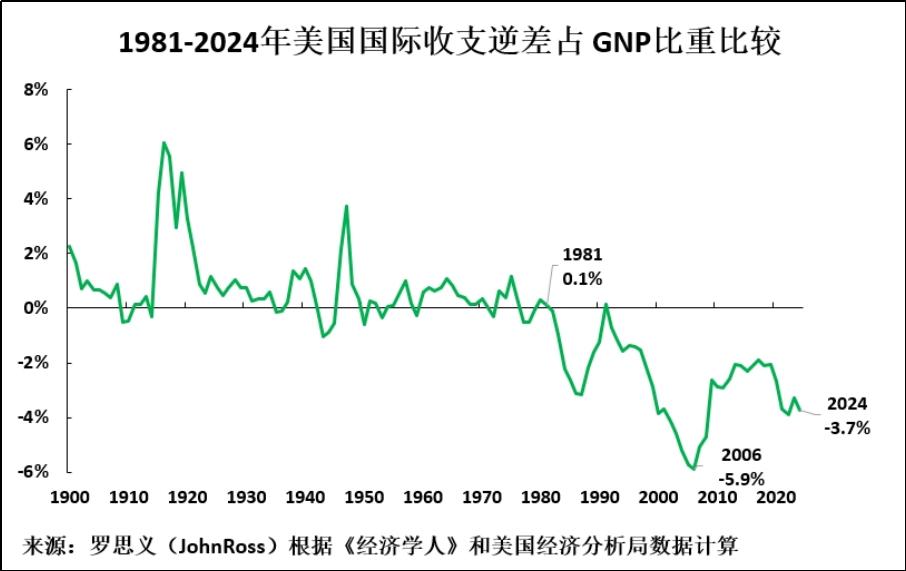

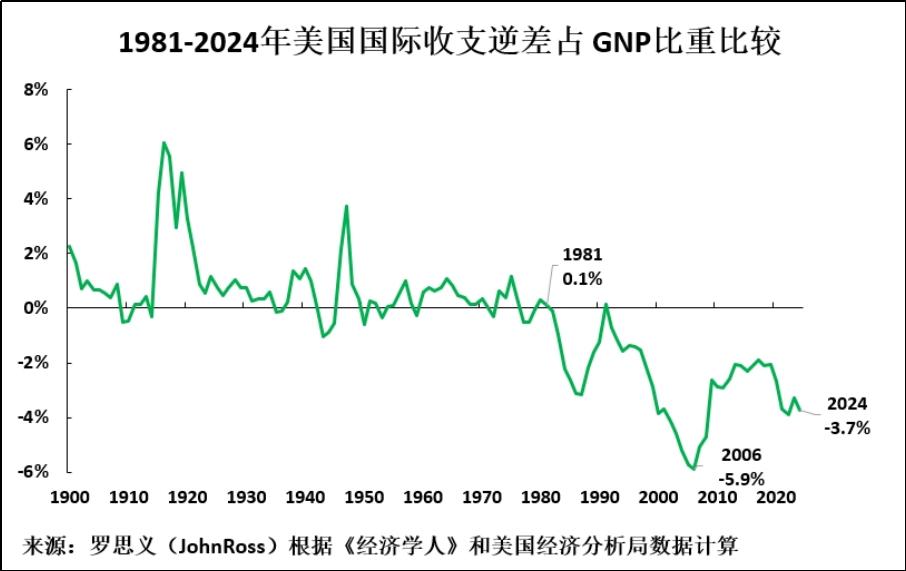

Data presented in Figure 16 help us understand this transformative change: throughout the 20th century until 1981, except for a few exceptions, the US had a current account surplus every year. However, the current account balance must correspond to the capital account balance, and they are inversely related. That is to say, a current account deficit corresponds to a net inflow of capital, and a current account surplus corresponds to a net outflow of capital. That is to say, until 1981, the US was a net capital exporter - the capital created by the US was sufficient not only to meet domestic investment needs but also to export capital to other countries.

After 1981, this pattern was completely reversed, and the US began to experience persistent and substantial current account deficits - the current account deficit reached a peak of 5.9% of GNP before the 2006 financial crisis, and even in 2024, it remained at 3.7%.

Therefore, Reagan turned the US from a net capital exporter into a major capital importer. The US went from being a country that could not only meet all its domestic investment needs but also provide capital to other countries, to becoming the largest capital importer in the world so far. That is to say, the US began to rely on capital from other countries to maintain its domestic investment levels.

Figure 16

3.5 Continued Expansion of US Trade Deficit and Stagnation of Manufacturing

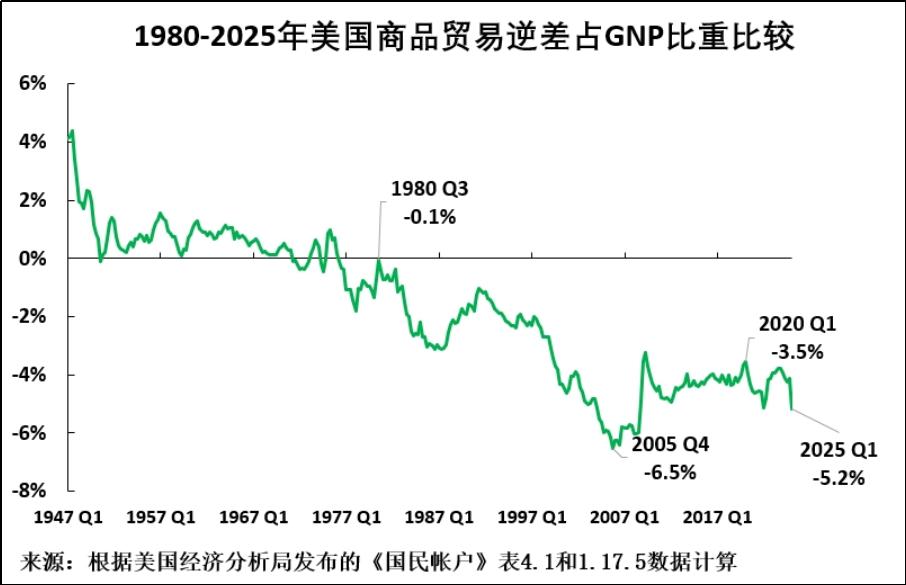

In the composition of the US international balance of payments, goods trade occupies the largest share. The continuous deterioration of the US international balance of payments is mainly due to the huge goods trade deficit that the US has been in since 1980 - the US goods trade deficit reached a peak of 6.5% of GNP in 2005, and even in the first quarter of 2025, it remained at 5.2% (see Figure 17).

The fact that the US imports far exceed its exports has, in turn, put downward pressure on US manufacturing production, thus forming the notorious "Rust Belt" that Milan pointed out.

Figure 17

After 2007, the impact of the international financial crisis further worsened the US manufacturing production situation, leading to a stagnation. As shown in Figure 18, the current manufacturing production index of the US is lower than 17 years ago - as of June 2025, it is 7.6% lower than the peak in December 2007. To address this situation, Trump vowed to try to reverse this trend through a combination of tariff measures and dollar depreciation. It is well known that Trump's goal is to eliminate or at least significantly reduce the US goods trade deficit, thereby creating more space for domestic manufacturing production in the US by reducing international competition.

Figure 18

3.6 The Consequences of the "Faustian Bargain" of Reagan

Summarizing the relationship between the economy and politics created by Reagan, it can be described using the concept of a "Faustian bargain" from Western context - this concept originates from the ancient European myth of Faust, who sold his soul to the devil for immediate goals, ultimately receiving eternal damnation as a long-term cost.

In other words, Reagan achieved an astonishing political success: after the political turmoil of the 1970s, he re-established political stability in the US for nearly four decades - thanks to Gorbachev's policies, this stability eventually enabled the US to win the Cold War against the Soviet Union. However, the long-term economic cost was the destruction of the international competitiveness of US manufacturing.

This long-term cost eventually became unbearable - after the financial crisis, the stagnation of US manufacturing expansion made it economically unsustainable; the sharp expansion of the "Rust Belt" and the increasing alienation of the US working class from traditional politics made it politically unsustainable for the US president - since 2016, this unsustainable situation has manifested in the historical pattern of the US president failing to be re-elected.

Therefore, the forces around Trump concluded that the US manufacturing industry needed to be revitalized. But to achieve this goal, it was necessary to reverse the huge trade/international balance of payments deficit that successive US presidents since Reagan have accepted. Thus, the tariff measures and the policy of dollar depreciation emerged.

Therefore, the fundamental challenge for Trump's attempt to reverse the consequences of Reagan's policies lies in whether it is possible to reverse the economic forces that have been relied upon since the Reagan era while maintaining the political stability that Reagan restored - in other words, whether Trump's policies can succeed depends on political factors, not purely economic factors. Therefore, it is necessary to focus on analyzing the relationship between economics and politics in Trump's policies.

Part Four Can Trump's Policies Succeed?

4.1 The Inherent Contradictions of Trump's Policies

Understanding this precise relationship between the US economy and politics can clearly reveal the inherent contradictions of Trump's plans, clarify the economic, social, and political factors that determine their success or failure, and also show the limitations that the dollar depreciation imposes - because, as discussed below, the dollar exchange rate plays a key role in this economic/political process.

First, looking at the current situation, the US economic trends are very unfavorable for Trump's goal of reducing the US international balance of payments deficit. The US international balance of payments deficit has recently expanded again (see Figure 19). Looking at quarterly data, the US international balance of payments deficit accounted for 4.8% of GNP in the first quarter of 2025; if measured by the magnitude of the expansion of the deficit within the economic cycle, this proportion is second only to the peak of 6.3% recorded in the third quarter of 2006.

Therefore, this means that the US capital inflow accounted for 4.8% of GNP in the first quarter of 2025. For Trump's goal, the key question is: can it significantly reduce this 4.8% of GDP - that is, fundamentally reduce the international balance of payments deficit - without causing the US economy to slow down or encountering political resistance that hinders the implementation of the policy (or avoid both happening at the same time)?

Figure 19

4.2 The US Economy is Too Dependent on Capital Inflows, and Reducing the US Trade Deficit Will Cause Economic Slowing

To understand the impact of this situation on the US economy, let's assume that Trump's combination of tariffs and dollar depreciation is successful, and the US international balance of payments deficit is eliminated. What does this mean for the US macroeconomy?

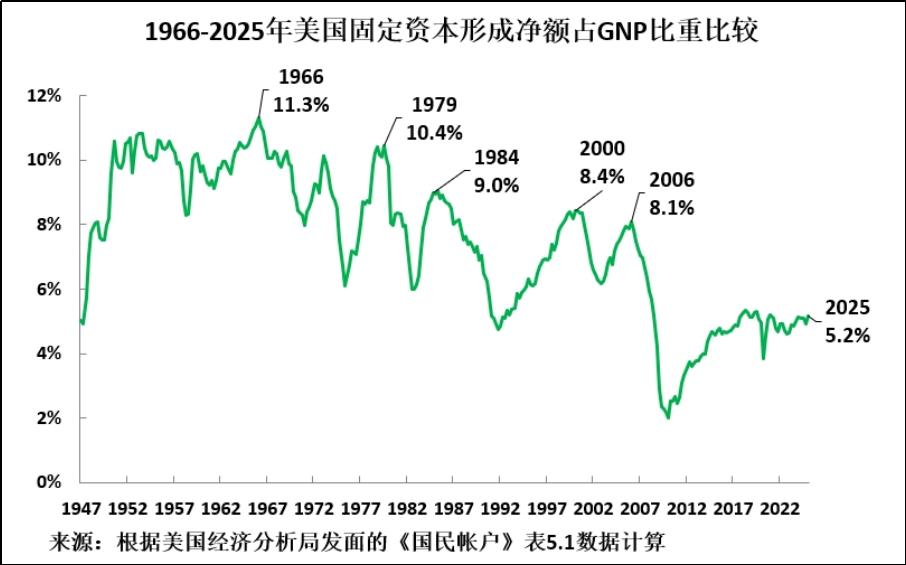

Given that the current account and capital account balances are inversely related, this means that the US capital inflow will decrease by 4.8% of GNP. Therefore, if other conditions remain unchanged, the capital available for investment in the US will decrease by 4.8% of GNP. Figure 20 presents the data on the net fixed capital formation of the US in the first quarter of 2025, which is 5.2% of GNP, which may help you understand the enormous impact of reducing the US capital inflow by 4.8% of GNP.

Given that the US capital inflow accounts for 4.8% of GNP, and the net fixed capital formation accounts for 5.2% of GNP, this obviously means that the smallest part of the net fixed capital formation in the US is financed by domestic capital. Therefore, if the US international balance of payments deficit is reduced, the main source of financing for the US net fixed capital formation will be completely cut off by Trump.

Figure 20

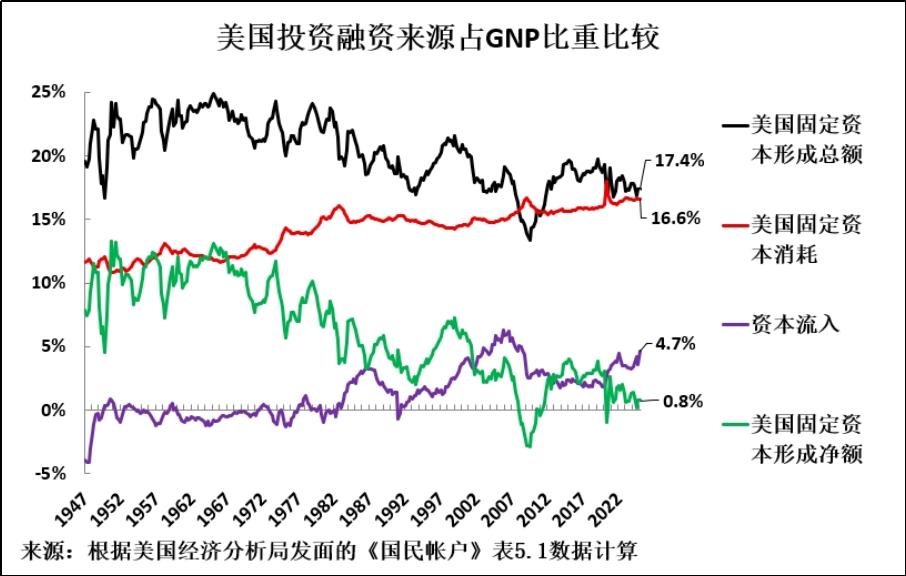

To analyze this in detail, Figure 21 presents a comparison of the share of financing sources for US investments relative to GNP, which reflects the current dependence of the US on capital created by other countries, i.e., the US reliance on capital inflows and large international balance of payments deficits.

To accurately understand these numbers, it is necessary to point out that, from the perspective of national accounts, total investment includes both fixed capital formation and inventory changes. However, the actual data show that this figure is almost entirely dominated by fixed capital formation - in the first quarter of 2025, fixed capital formation accounted for 21.7% of GNP, while inventory increases accounted for only 0.7%.

Figure 21 presents the largest source of financing for US total investment - the share of domestic capital formation/savings relative to GNP (17.4%) data, which helps you have a visual understanding. However, almost all of this US capital formation/savings is used for the depreciation/consumption of fixed capital, which accounts for 16.6% of GNP. Therefore, the net fixed capital formation created by the US itself accounts for only 0.8% of GNP, approaching zero.

In contrast, the US capital inflow accounts for 4.8% of GNP. That is to say, the net fixed capital formation/savings created by the US itself accounts for 0.8% of GNP, and adding the capital inflow of 4.8% of GNP creates a total of 5.6% of GNP to finance US investment - but 86% of this capital comes from capital created overseas, and only 14% comes from capital created domestically. Therefore, the vast majority of the US net fixed capital formation depends on capital created by other countries. (In controversial language, the US has become the largest economic parasite in the world!)

Figure 21

The consequences for the US economic growth under Trump's rule are evident. Assuming that Trump successfully reduces the US international balance of payments deficit, if there are no other changes, the source of financing for US total investment will drop to only 0.8% of GNP - and the US net fixed capital formation will inevitably fall to near zero.

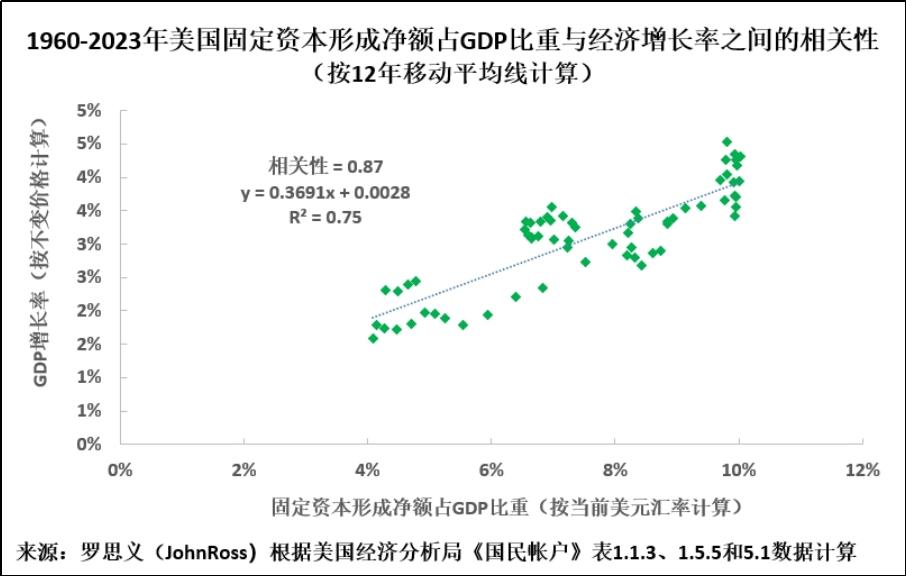

However, as I have analyzed in many articles (for example, "It is Not Wise to Adopt a Bipolar Analysis: What Determines the Outcome of Sino-US Competition?"), there is a very high correlation between the net fixed capital formation as a percentage of GDP and the growth rate of GDP, which is 0.87 (see Figure 22). Given this, if Trump causes a sharp decline in the net fixed capital formation as a percentage of GDP, the US long-term and medium-term economic growth rate will definitely decline sharply.

In other words, although Trump can reduce the US international balance of payments deficit in this way, the cost will be a sharp decline in the US economic growth rate - such an economic policy is obviously destined to fail.

Figure 22

Given the extremely high correlation between the net fixed capital formation as a percentage of GDP and the GDP growth rate, if Trump successfully reduces the US capital inflow (the international balance of payments deficit), and wants to ensure that the US long-term GDP growth rate does not decline, the only way is to increase the US domestic capital formation/savings by an equivalent amount. That is to say, to offset the loss of 4.8% of the international balance of payments deficit, it is necessary to increase the equivalent amount of US domestic capital formation/savings. However, this economic change will have significant impacts on domestic politics in the US.

4.3 The Only Thing Trump Can Do is to Lower the Proportion of US Household Consumption and Social Security Expenditures, but it Will Cause Political Turmoil

To understand the reasons, it is necessary to know that capital formation/savings and consumption add up to 100% of the domestic economy. Therefore, if Trump wants to increase the US domestic capital formation by 4.8% of GNP, he must correspondingly cut the corresponding consumption expenditure. However, Trump refuses to take any measures that would reduce the proportion of consumption - provided that he does not reduce the proportion of US household consumption or government social security expenditures.

The most representative of such measures (which Trump explicitly opposes) include cutting US military spending or thoroughly reforming its expensive and inefficient healthcare system - both of which are considered consumption expenditures in the economic sphere, and detailed analysis can be found in the article "Trump Chooses to Destroy the Lives of the American People First Before 'Beating' China, but the Outcome is Likely to Be..."

Thus, within Trump's existing policy framework, if he wants to compensate for the investment financing gap caused by reducing capital inflows (international balance of payments deficit), and avoid a slowdown in US economic growth, the only way is to lower the proportion of US household consumption and social security expenditures. Given that the US economy is already showing a slow growth trend - as its long-term annual growth rate is slightly above 2% - lowering the proportion of household consumption and social security expenditures will inevitably lead to a slowdown in the growth of living standards for US residents, thus inevitably causing political dissatisfaction with the Trump administration.

Therefore, the result is that if Trump successfully reduces the US international balance of payments deficit through a combination of tariffs and dollar depreciation, then as long as he does not intend to slow down the US economic growth, he will inevitably put downward pressure on the income of US households and social security expenditures. This is why Reagan gave up the attempt to maintain the balance of payments in the past, because he wanted to avoid this pressure and the potential political unrest it could cause.

From Reagan to Trump 2.0, the presidents have chosen to use capital created by other countries (capital inflows) to replace the approach of increasing US investment by cutting consumption proportions. The result is that since Reagan, the proportion of consumption in US GDP has continued to rise - from 77.1% in 1980 (the last year before Reagan took office) to a peak of 85.1% in 2009. Politically, as mentioned above, the sharp rise in the proportion of consumption in GDP has had great short-term success - it successfully reversed the turbulent situation of the 1970s and restored US political stability. However, the economic consequences are equally obvious: the US has become increasingly dependent on using capital created by other countries (i.e., capital inflows) to finance its investments. Therefore, if Trump successfully reduces the US international balance of payments deficit, i.e., reduces the use of capital created by other countries/capital inflows, then in order to maintain the US economic growth rate, he will have to reduce the proportion of US household consumption - whether directly by cutting or indirectly by reducing government social security expenditures.

This reality will form the key political pressure that determines whether Trump can implement his policies. It also reveals the core role of the dollar exchange rate in this process. The combination of the dollar exchange rate and tariff policy has become Trump's most powerful tool to reduce US imports by raising the price of imported goods. If Trump intends to reduce the US trade/international balance of payments deficit, and adopts a policy opposite to Reagan's high dollar exchange rate policy - allowing the dollar exchange rate to depreciate significantly - it will once again trigger the pressures that caused political turmoil in the US in the 1970s before Reagan took office.

4.4 The Hedge of the Rise in the Dollar Exchange Rate in the Reagan Era: Japan Became the Sacrifice

Therefore, we can clearly identify the variables that determine the success or failure of Trump's policies, as well as the conflicting factors that act on the dollar exchange rate.

To understand this, it is necessary to look back at the historical starting point of the US economic policy over the past four decades before Trump's presidency. The sharp rise in the dollar exchange rate in the early days of the Reagan administration is shown in Figure 14 above. However, this period, in addition to opening a new chapter of domestic stability in the US, also triggered a process in which the US inflicted devastating damage on its international competitors, especially Japan, the world's second-largest economy and the US's most important competitor at the time.

The high dollar exchange rate formed in the early days of the Reagan administration inevitably harmed the US's competitiveness - as a result, the US shifted from a long-term position of surplus in the international balance of payments to a large deficit. As mentioned above, this phenomenon was pointed out. Therefore, Reagan eventually decided to force other major Western economies to intervene in their central banks and take policies that would cause their currencies to appreciate against the dollar, in order to curb the loss of US competitiveness. The Plaza Accord signed on September 22, 1985, between the US, Japan, West Germany, France, and the UK formalized this policy.

The direct consequence of the Plaza Accord was to cause a devastating appreciation of the currencies of the US's main economic competitors. From the last trading day before the signing of the Plaza Accord on September 20, 1985, to the end of 1987, the Japanese yen appreciated by an astonishing 98% in just 15 months (see Figure 23). Subsequently, under the impact of the 1987 Wall Street stock market crash - the Fed responded to the crisis by injecting a large amount of money into the market, leading to serious monetary easing in the US - the Japanese yen further surged, reaching 193% higher than the level before the Plaza Accord by April 1995.

In response to the loss of international competitiveness caused by the sharp appreciation of the Japanese yen and the resulting tendency towards domestic economic recession, the Bank of Japan adopted ultra-low interest rate policies, eventually giving birth to the notorious "bubble economy" in Japan in the late 1980s. Then, from the end of 1991, the burst of the bubble destroyed the balance sheets of Japanese companies, leading to a prolonged stagnation of the Japanese economy for over thirty years - from 1990 to 2024, the annual growth rate of Japan's GDP was only 0.8%.

In summary, the Plaza Accord and its subsequent effects have caused a heavy blow to Japan's economy that it has not recovered from to this day. And the US successfully forced its biggest economic competitor to bear the pressure generated internally by the US economy - this completely destroyed Japan's economy.

Figure 23

4.5 The Dollar's Performance After the Signing of the Plaza Accord for Four Decades

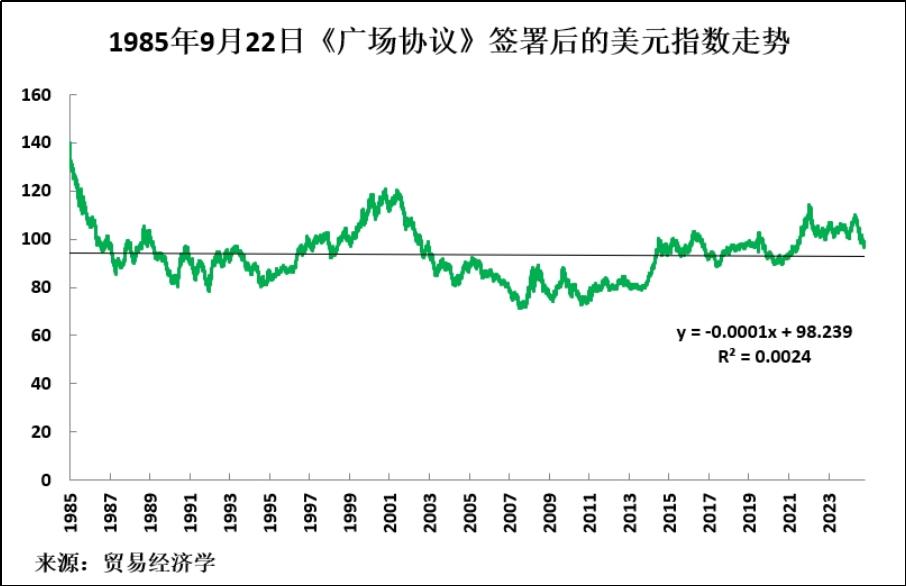

After the Plaza Accord caused devastating damage to the US's competitors and in the following period, the long-term trend of the dollar exchange rate remained relatively stable for nearly 40 years, meaning that it did not show a long-term upward or downward trend, although there were significant short-term fluctuations (which is very favorable for currency speculators!). That is to say, in the past 40 years, although there were a lot of short-term fluctuations, the fluctuations in the dollar exchange rate were relatively limited compared to the large declines or rises in the 1970s or during Reagan's administration (see Figure 24).

Returning to the present, since the outbreak of the pandemic, the dollar has remained relatively strong, although there have been fluctuations within the trading range. As shown in Figure 13 above, the dollar index increased from 96.5 on January 31, 2022, to 98.5 on July 18, 2025. Therefore, although the dollar exchange rate has declined rapidly since Trump took office, it has not caused the dollar to break through its normal trading range formed over the past 40 years.

Overall, during this 40-year period, the dollar exchange rate has remained relatively stable in the long term, with only short-term fluctuations, which has allowed the US international balance of payments deficit to continue to rise to a huge level. Therefore, for people like Milin, the conclusion is obvious, and Trump also faces a choice: whether to try to significantly reduce or eliminate the US international balance of payments deficit through a depreciation of the dollar?

Figure 24

Five. Trump's Choice and Its Impact on China

5.1 Whether Trump Can Implement His Policies Mainly Depends on Political Factors

Finally, the above process clearly shows that whether Trump can implement his policies mainly depends on political factors, not purely economic factors.

From a purely economic perspective, there is no mystery to how to implement policies to significantly reduce or eliminate the US international balance of payments deficit. This can indeed be achieved through a combination of tariff measures and dollar depreciation - the latter can be achieved through "conventional" means, such as rate cuts; if this is still not enough, and if the Trump administration is determined to achieve dollar depreciation, it can adopt more radical measures proposed by Milin, such as taxing foreign purchases of US Treasury bonds, or using tariff threats as a means to compel other countries to take domestic economic policies that raise the exchange rate of their currencies against the dollar, similar to the Plaza Accord, to try to force other countries to implement policies that raise the exchange rate of their currencies against the dollar.

If Trump really succeeds in significantly reducing the US trade/balance of payments deficit, this will constitute a true "Reagan reversal" - that is, a reversal of the economic policy route that has been in place in the US for over four decades. Trump will achieve a historic transformation in the US's relationship with the world economy.

However, as mentioned above, if it is to be done without causing a serious slowdown in the US economic growth, it is necessary to shift US resources from consumption to investment - specifically, to significantly reduce the proportion of US household consumption in the economy. Given the current slowdown in the US economic growth, this will mean a direct impact on the standard of living of the US people.

5.2 Trump's Approval Rating Has Fallen, Is He Willing to Risk a Return to the Political Turmoil of the 1970s?

Therefore, whether Trump succeeds is not just an economic issue, but whether he can implement the economic "Reagan reversal" policy without completely undermining the political stability that Reagan built, or whether Trump implements the tariff and dollar depreciation policies and is willing to risk a return to the political turmoil of the 1970s.

Therefore, the key indicator for determining whether Trump's policies can succeed is not the short-term market fluctuations that are still under control, but the decisive factors that affect the long-term economic growth of the US - the net fixed capital formation as a percentage of GDP, and the political consequences of the possible increase in investment by reducing the proportion of US household consumption.

Given that the tariff and dollar depreciation policies essentially constitute a