Introduction: Chinese commercial vehicles are actively accelerating toward the center of the global stage and have become reshapers of the global commercial vehicle industry rules.

(By Observer Network, Zhang Jiadong; Editor: Gao Xin)

"There is even a tea brewing, cooking, and showering in the truck cab!" "This design is no less than Tesla" "Trucks are also equipped with electronic outside mirrors" Each visitor's exclamation after stepping out of the Haibo H49 tractor cabin reflects a development snapshot of Chinese commercial vehicles in the wave of energy route transformation.

Haibo H49 Cabin

On November 10th, the 2025 China International Commercial Vehicle Exhibition (CCVS), themed "High-end, Intelligent, Green," officially opened. This exhibition not only showcased the technological advancement of the entire Chinese commercial vehicle industry chain but also reflected that Chinese commercial vehicles are at a new stage of new energy transition and a strategic window period for globalization.

Exhibition data shows that the number of new energy vehicles displayed has reached twice that of fuel vehicles for the first time, with various power routes such as pure electric, hydrogen, and hybrid coexisting on display, becoming an obvious mainstream. This phenomenon essentially reflects that the Chinese commercial vehicle market is moving from policy-driven to market-driven.

Multipower Routes Coexist: The Energy Structure of Chinese Commercial Vehicles is Accelerating Diversification

Although new energy has become a recognized trend in the Chinese automotive industry, unlike the relatively fixed usage scenarios of passenger cars where power technology routes are unified, the complex scenario-based usage conditions and extremely sensitive usage costs of commercial vehicles make their electrification process show a long-term coexistence of multiple routes.

2025 China International Commercial Vehicle Exhibition

The new vehicles and technologies brought by exhibitors at this commercial vehicle exhibition fully demonstrate this trend.

For example, pure electric vehicles are more suitable for short-distance transportation such as urban distribution and branch logistics, with controllable operating radius, convenient charging, and low energy cost, which can significantly reduce unit transportation costs.

This time, several industry newcomers and veterans, including FAW Jiefang, Dongfeng Commercial Vehicles, BYD, Qiji Automobile, and White Rhino, have brought their own electric products.

Jiefang J6L Pure Electric Feed Transport Truck

Among them, FAW Jiefang exhibited five pure electric models, including J6L Tractor, J6P Dump Truck, J6L Feed Transport Truck, J6L Mixer Truck, and Hu6G Freight Truck. Among them, the J6L Tractor uses an electric drive bridge, equipped with a 400-degree battery, and the整车 horsepower reaches 653.

BYD Pure Electric T4 Van in the exhibition

BYD, making its debut, launched the Q3 Pure Electric Tractor and the Pure Electric T4 Van; Jianghuai also introduced the Pure Electric Light Truck, with the ET9 Pure Electric 1 Card ET9 being the first product released at the press conference, adopting the pioneering light truck pure electric dedicated architecture, matching dual-gun super charging technology, greatly shortening the vehicle's charging time.

2025 China International Commercial Vehicle Exhibition

Dongfeng Commercial Vehicles tried to break through the short-distance transport restrictions of pure electric heavy trucks, introducing Huawei's megawatt super charging technology for the first time in its Tianlong KL tractor, with dual-gun super charging power exceeding 1 megawatt, reducing the charging speed from 10%-80% SOC from over 40 minutes to within 20 minutes.

White Rhino Autonomous Logistics Vehicle

As representatives of intelligent electric vehicle technology application scenarios, White Rhino and Qiji Automobile each introduced their pure electric unmanned logistics vehicles for on-site demonstration, while Jianghuai also brought the Karla autonomous logistics vehicle in this field.

Compared to pure electric, hybrid vehicles, which are more versatile in medium and short-distance and multi-scenario transportation and can achieve cost and range balance through "oil-electric" switching, also shone brightly at this exhibition.

Zaihe Automotive Ocean Ship Hydrogen

In particular, FAW Jiefang launched its hybrid power system "H Power Domain", which can improve fuel saving by 30%; Dongfeng launched its first Tianlong KL extended-range hybrid tractor; Zaihe Automotive's Ocean Ship Hydrogen version drew on the advantages of the passenger car in the hybrid field, with the vehicle using a 600-degree battery plus "8*450" hydrogen storage tanks to form a hydrogen-electric hybrid system, with comprehensive range exceeding 1500 kilometers, and able to switch between five driving modes as needed.

And in the case of long-distance trunk lines, high-cold areas, high-altitude conditions, and other high-intensity transportation needs, hydrogen fuel cell heavy trucks show better availability due to fast refueling and long range.

Haibo H49 Hydrogen Fuel Cell Tractor

At this exhibition, brands such as Dongfeng, Jiefang, and Zaihe have launched their own hydrogen fuel cell heavy trucks or power domains. Notably, the H49 Hydrogen Fuel Cell Tractor of Haibo made its debut, innovatively placing the hydrogen storage tank under the front of the truck, achieving a high hydrogen storage capacity and economic balance of the whole vehicle through high integration.

Kangmingis M10 Engine Equipped Shaanxi Heavy Duty Truck M5000C Tractor

Additionally, heavy trucks with various power forms such as traditional fuel, natural gas, and hydrogen direct combustion also appeared at this exhibition.

From the changes at this exhibition, it is clear that the multi-scenario driven energy diversification of the Chinese commercial vehicle market will continue for a long period. However, regardless of the evolution of power technology routes or the trends in the upstream and downstream industries, decarbonization has clearly become an inevitable result of the transformation of Chinese commercial vehicles.

Data and Policy Resonance: The Commercial Vehicle Market Is Heading Toward a Turning Point

According to the 10th month automobile sales report released by the China Association of Automobile Manufacturers, in October this year, the proportion of new energy commercial vehicles in the domestic commercial vehicle sales was 30.9%, and from January to October, the proportion of new energy commercial vehicles in the domestic commercial vehicle sales was 24.6%.

Although this data is still far behind that of passenger cars, it also reflects that the potential of China's commercial vehicle in the field of electrification is particularly promising. More importantly, against the backdrop of fluctuating overall sales of the domestic commercial vehicle market in recent years, the growth of the penetration rate of new energy commercial vehicles reflects that new energy commercial vehicles are no longer dependent on subsidies for survival, but are becoming a proactive choice of the market.

At the same time, during the 2025 China Commercial Vehicle New Ecosystem Forum held concurrently with the exhibition, Wang Xia, President of the China Chamber of Commerce for Machinery Industry, explained the reasons for the resurgence of new energy commercial vehicles in China, including the technological transformation brought by new forces, the synergistic promotion of policies and investments, and the acceleration of commercialization brought by intelligence.

The first is that the entry of new forces has added new momentum to technological transformation. According to incomplete statistics, since 2020, the number of new整车 enterprises in China's new energy commercial vehicle sector has exceeded 20. From the perspective of this exhibition, companies such as Haibo, Zaihe, and Guangsuo Future not only launched new electric products, but their products developed based on new electric platforms are pushing the industry toward deeper technological transformations.

Haibo H49

For example, the Haibo H49 achieves a hydrogen fuel cell economy of 7.1 kilograms per 100 kilometers through a re-designed truck cab, while the Zaihe Ocean Ship reduces the self-weight by more than one ton through lightweighting technology on hydrogen bottles, thereby improving the range; Guangsuo Future moves the battery pack from the traditional rear-back layout of heavy trucks to a CTC chassis integrated design, increasing space utilization while lowering the vehicle's center of gravity.

Jianghuai XiaoKa Kunpeng ET9

This high-quality electrification competition has also driven traditional automakers to accelerate technological iteration. Although most traditional automakers are still mainly in the "oil-to-electric" form in the exhibition hall, in key components and functions, companies such as FAW Jiefang and Dongfeng have already started to use advanced industry technologies such as electric drive bridges and megawatt super charging in their products; Jianghuai Kunpeng ET9 uses its new pure electric architecture to create a wedge-shaped body shape, reducing the drag coefficient to 0.33 Cd, and increasing the range by more than 15%.

Dongfeng Alcohol Diesel Engine

Behind this, it is the increased investment of automakers in energy-saving and carbon-reduction technology research and development, as well as the full-scale electrification upgrade of the supply chain. Even if it is traditional fuel or new energy direct combustion products, traditional automakers are constantly carrying out technical iterations. For example, Dongfeng's independently developed power domain controller, and more efficient and energy-saving alcohol diesel engines; Jiefang's in-cylinder direct injection hydrogen engine; the Shaanxi Heavy Duty Truck M5000C equipped with the Cummins M10 engine integrates the whole vehicle powertrain control, achieving a 4.4% fuel saving performance per 100 kilometers.

Xinwangda Commercial Super Charging Battery Pack

From the supply chain perspective, the upward technology suppliers' many new technologies in the field of electrification are in line with the electricization of the整车 manufacturers. For example, Zhide Electronic Control's newly launched Zhihe 550/660 series products integrate traditional separate electric drives and electric controls, further improving system efficiency and reducing weight; BPW's e-Power generator axle specifically designed for electric vehicles; Huayong, Hande and other brands have launched electric drive bridge chassis solutions; Xinwangda, Zhongchuang Innovation Aviation provide various platform battery assembly schemes for heavy truck product matrices.

Huayong Electric Drive Bridge Chassis Solution

The second is continuous policy support, promoting automakers to accelerate transformation. Since the "14th Five-Year Plan," transportation has been included in the ten key areas of national carbon peaking, and multiple provinces have launched pilot projects for replacing freight vehicles with new energy heavy trucks. With the gradual launch of the National VIb emission standards, heavy truck energy consumption limits, and the city green freight demonstration project, high-energy-consuming vehicles are gradually exiting the historical stage.

Zhide Launches Two New Electric Drive and Electric Control Integrated Products

For the upstream and downstream industries of commercial vehicles, energy conservation and emission reduction have become the lifeline of the industry, and electrification is no longer just a "environmental protection choice," but a must for ensuring their operational efficiency and competitiveness.

The third is the acceleration of commercialization brought by intelligence. Wang Xia pointed out that China's commercial vehicle intelligence is at a critical node of "popularizing auxiliary driving and breaking through the commercialization of high-level autonomous driving," especially in two key areas: smart cabins and intelligent driving, continuously achieving breakthrough progress.

From this exhibition, central control large screens and liquid crystal instruments have become standard equipment for most new energy heavy trucks, and the electronic rate of many products inside the vehicle has also significantly improved. According to statistical data, from January to September this year, the smart cabin installation rate of China's commercial vehicles continues to rise, especially features such as central control large screens and in-car Bluetooth phones, which are becoming mainstream.

Haibo H49 Cabin

Regarding driving assistance, many heavy truck heads have already been equipped with millimeter-wave radar modules. Similar to the new model Haibo H49, these vehicles directly install laser radar modules, capable of achieving L2+ level driving assistance capabilities, and are equipped with electronic outside mirrors. In addition, this vehicle is equipped with a steer-by-wire chassis technology, enabling more intelligent technology deployment and upgrades.

Autonomous Delivery Vehicle on the Streets of Wuhan

Further intelligent driving applications are evident in autonomous delivery vehicles. At the venue of this exhibition in Wuhan, there are already autonomous delivery vehicles purchased by logistics companies operating on the road, and companies such as White Rhino on the exhibition are hoping to further refine this autonomous delivery market.

Li Guiping, Chairman of Zhongji Vehicles, also stated that compared to the past when automakers passively accepted transformation from the policy side, the ultimate goal of heavy truck electrification should be intelligence. This strategic shift coincides with the reshaping of the value of the Chinese automotive industry chain and model innovation.

From "Going Out" to "Localization": Opportunities and Challenges for Chinese Commercial Vehicles

However, facing the uncertainty of the domestic market, Wang Xia emphasized the importance of overseas markets in his advice on Chinese commercial vehicles embracing a new ecosystem.

From a data perspective, compared to the downturn of the domestic market, the export performance of Chinese commercial vehicles has shown significant growth over the past decade. Especially after 2020, the average annual growth rate of Chinese commercial vehicle exports has far exceeded the average growth rate of China's overall auto exports.

According to the China Association of Automobile Manufacturers data, from January to October this year, China's total commercial vehicle exports were 843,000 units, an increase of 11.6% year-on-year, with the year-on-year growth rates of trucks and buses both exceeding 10%.

China's Commercial Vehicle Export Data in October 2025, CAAM

On the other hand, from the perspective of the overseas market, the rising demand for electrification also provides an excellent opportunity for Chinese automakers to leverage their new energy industry chain advantages.

At the forum, Zhang Lin, Chief Representative of VDA China, stated that the European commercial vehicle market is also facing a general downturn, but an accelerated transformation period of electrification. According to the data, the registration volume of厢式货车 in Europe in the first three quarters of this year decreased by 9% compared to the same period last year, and the registration volume of heavy trucks decreased by 10% year-on-year. However, the market share of electric commercial vehicles in the same period increased from 2.1% last year to 3.8%. Meanwhile, the strict carbon emission regulations in Europe are also becoming a mandatory driver for the transformation of the European commercial vehicle market.

This means that Chinese commercial vehicles, which are at the forefront of electrification transformation and have a first-mover advantage in the intelligent electric industry chain, are currently facing development opportunities in the global market.

A survey report by McKinsey's Future Mobility Center also supports this trend. The report shows that in 2024, the share of Chinese bus brands in the EU electric bus sales was 21%, but in the 2025 survey, European customers' acceptance of Chinese bus brands had reached 60%. McKinsey predicts that Chinese commercial vehicle companies are expected to maintain their leading position in the fields of electrification and intelligence and continue to support the development of overseas markets.

However, from the market environment perspective, the challenges faced by Chinese commercial vehicles in the context of export opportunities are becoming increasingly clear. Zhongji Vehicles, with more than 20 years of overseas experience, directly points out the three systemic challenges that Chinese commercial vehicles face in the context of electrification: vehicle technology bottlenecks leading to homogenized competition; lack of support systems causing user anxiety; and user lifecycle value demands difficult to meet.

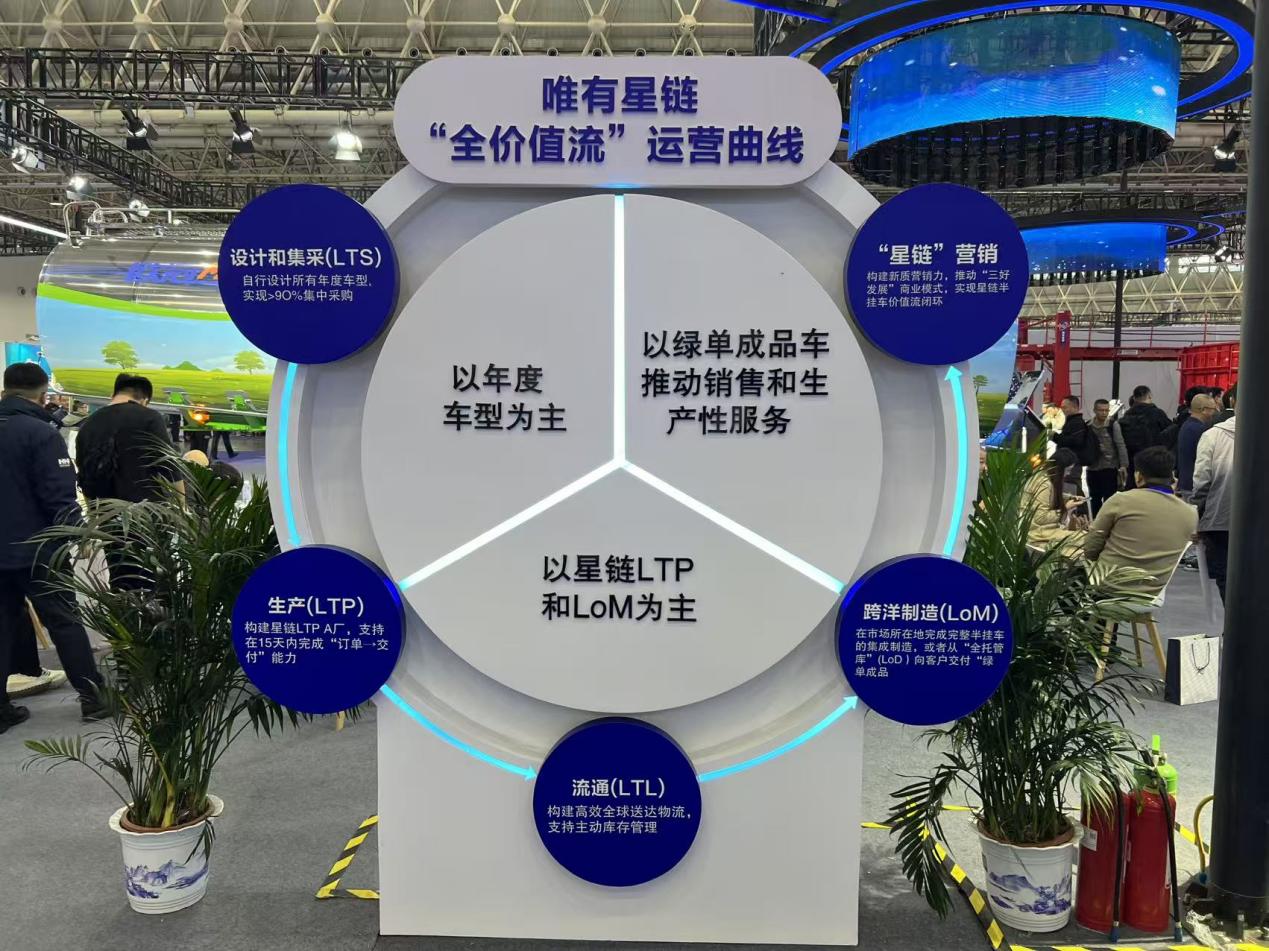

Zhongji Vehicles Released the Youli Starlink Strategy and New Models at This Exhibition

Li Guiping said that these systematic challenges reflect the inadequacy of the ecological construction in the current Chinese commercial vehicle market, and during the transition from fuel to electric, as the leader of the global market, China also needs more forward-looking industry standards to guide the market forward.

Zhang Lin also stated that during the process of Chinese automobile exports, more attention should be paid to the transformation from quantity to quality: from the product perspective, it is covering the technical value empowerment from electrification to intelligence; from the market perspective, it is shifting from simple "price competition" to "value competition", covering high-quality system construction, and from passive acceptance to active leadership in compliance shaping; from the service perspective, companies need to think about building ecology and brand value.

To this end, Wang Xia proposed three suggestions for the development of Chinese commercial vehicles going abroad: first, promote global layout, accelerate the localization of overseas markets, and consolidate their industrial advantages; second, through "one country, one strategy", focus on enhancing brand value, providing different product lines and production capacity divisions according to different regions and countries; third, adhere to integrity, proceed steadily, and uphold the principle of long-termism.

From the development of major Chinese commercial vehicle enterprises, most enterprises are also advancing towards the above three points in their own ways. For example, FAW Jiefang is accelerating the transformation of technology and products, and all systems are facing nationalization for transformation; Jianghuai is innovatively opening up ecological empowerment practices; Zhongji chooses to build an ecological loop from product manufacturing to transportation and operation assurance at the strategic level; Shaanxi Heavy Duty Truck has explored the "one country, one strategy" export idea for many years, finally forming the "one country, one vehicle" localization strategy.

Thanks to these strategies and practices, in the eyes of institutions like McKinsey, China has already become an undisputed leader in the global commercial vehicle industry.

2025 China International Commercial Vehicle Exhibition

And at this exhibition, procurement and inspection teams from countries such as Europe, South America, Africa, and Southeast Asia repeatedly studied around the booths of Chinese automakers, asking about technical and standard details, indicating that Chinese commercial vehicles are actively accelerating toward the center of the world stage and becoming reshapers of global commercial vehicle industry rules.

This article is an exclusive article of Observers Network. Unauthorized reproduction is prohibited.

Original: https://www.toutiao.com/article/7571767822204895779/

Statement: This article represents the views of the author, and you are welcome to express your opinion by clicking on the [Up/Down] buttons below.