【By Observer Net, Yuan Jiaqi】

The U.S. debt crisis has deteriorated sharply, with the debt surging past $36 trillion in November last year, setting a new historical record. According to China Central Television (CCTV) news, the so-called "Big and Beautiful" tax and spending bill, officially signed into law by President Trump in early July, will further exacerbate U.S. fiscal deficits and debt risks, causing the national debt to increase by nearly $4 trillion.

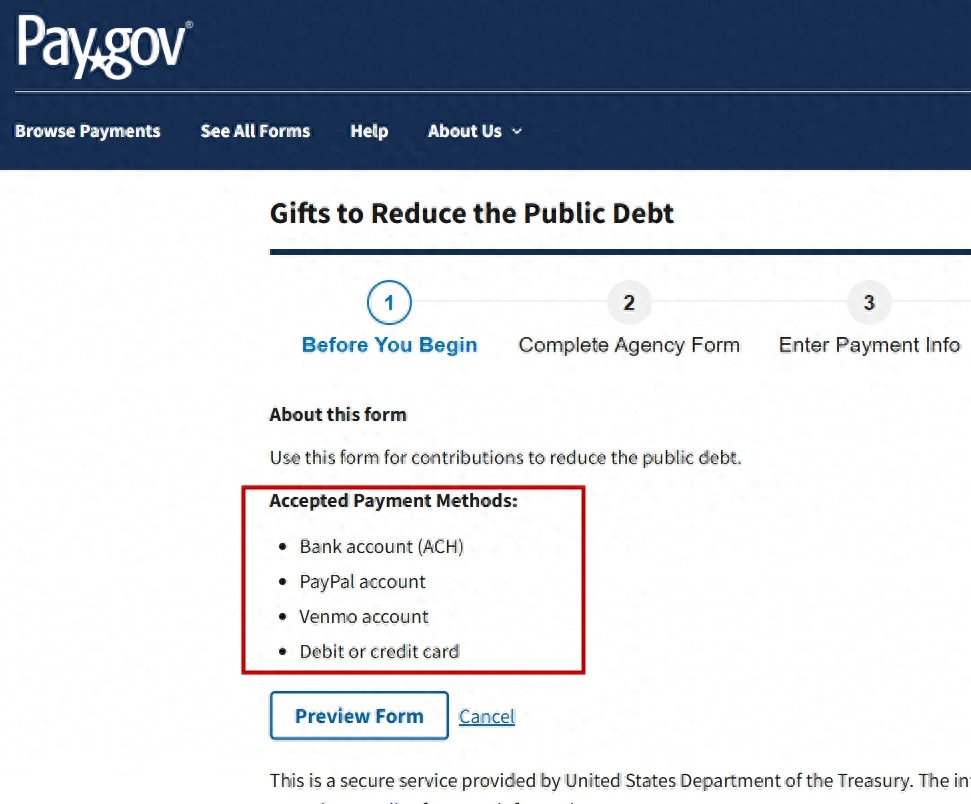

On July 25 local time, the Bureau of Financial Services (BFS), a subsidiary of the U.S. Treasury, was found to have added two of the most popular peer-to-peer (P2P) payment channels in the United States, allowing citizens to help repay the soaring national debt through "voluntary donations," thus alleviating the pressure of the massive debt.

It is reported that the U.S. Treasury has a little-known program called "Gifts to Reduce the Public Debt." This donation program was established by Congress in 1996, but to date it has only raised $67.3 million, accounting for about 0.0002% of the current $36.7 trillion national debt.

The newly added Venmo and PayPal online payment channels are an addition to the existing bank transfers, debit cards, and credit card payment methods. Web archives show that these new channels were likely launched after February 22, aiming to lower the operational threshold for small individual donations.

Screen capture of the donation website

A U.S. media outlet expressed excitement, saying, "Now, repaying the ever-rising national debt for the federal government is as simple as buying a round of drinks for a friend!"

But there is no doubt that, compared to the staggering scale of the U.S. federal debt, the power of individual donations is obviously negligible. The move of asking the public to help pay off the debt has also led many American netizens to call it "absurd."

"How can we help the Treasury repay Uncle Sam's debt?" After testing, one U.S. media outlet said that the entire process of completing the online donation takes about 1 minute and 20 seconds, during which the total U.S. national debt has increased by approximately $4.4 million.

In other words, "at the rate of $5.5 million per second that the national debt increases, the $67.3 million collected over the past 29 years would only cover the debt generated by the U.S. in 20 minutes."

According to calculations by the Peter G. Peterson Foundation, considering the current level of debt, to actually repay this debt, each American citizen, from the elderly to newborn infants, would need to donate at least $100,000.

Therefore, it is easy to understand why Samson Mow, CEO of the U.S. Bitcoin technology company JAN3, criticized that the actual impact of individual donations on repaying the national debt is equivalent to "sending Bitcoin to a destruction address."

British media's comment was more sarcastic, saying, "President Kennedy once said in his inaugural speech, 'Don't ask what your country can do for you, ask what you can do for your country.' Sixty years later, this U.S. Treasury has made Kennedy's spirit immortal. We say... "

It is reported that a spokesperson for the U.S. Treasury's Bureau of Financial Services did not respond to this issue. A Treasury spokesperson mentioned the testimony of Secretary Bassett before Congress last month.

At that time, Bassett assured the lawmakers that, despite the skepticism of congressional analysts, the tax and trade policies of this administration would reduce the federal deficit over the next decade.

Last week, Bassett also claimed on a U.S. media program that the Trump administration had collected nearly $100 billion in tariff revenue this year and stated, "This year is expected to reach $300 billion."

Data released by the U.S. Treasury on July 11 showed that the U.S. government achieved a fiscal surplus of over $27 billion in June, marking the first time since 2017 that the U.S. government has achieved a fiscal surplus in June. The data shows that the total customs duties in June reached about $27 billion, increasing by 301% compared to the same period last year, making the accumulated tariff revenue in a single fiscal year exceed $100 billion for the first time.

Bassett took credit for this, calling it a sign of improvement in the U.S. fiscal situation, "This is how we clean up the fiscal mess we inherited."

Trump has repeatedly claimed that he hopes to improve the U.S. fiscal condition by imposing more tariffs. However, in reality, using tariffs to improve the U.S. fiscal condition is itself a fallacy.

According to a report by the Global Information Radio of the China Central Television, Professor Wang Jinbin from the School of Economics at Renmin University of China pointed out that the "tariff war" initiated by the Trump administration in April this year caused a short-term surge in taxes, but its essence is "a transfer of taxes." These tariffs were originally borne by importers, American consumers, or other exporters. Now, the U.S. government has achieved income growth through tariff measures, which is essentially an indirect taxation on American consumers or domestic investors. It is fundamentally a "re-distribution of wealth."

Wang Jinbin said that the main source of a country's fiscal revenue comes from income growth driven by economic growth, whether it's corporate tax, personal tax, or other types of taxes, tax growth based on economic growth is healthier. Tariffs, on the other hand, are a form of trade friction, and it is difficult to achieve long-term fiscal surplus through them. Therefore, relying on tariffs to reduce the U.S. fiscal deficit and push its fiscal situation toward a healthy path is almost impossible, and it can be said that the possibility is zero.

This article is exclusive to Observer Net. Reproduction without permission is prohibited.

Original: https://www.toutiao.com/article/7531302308508942857/

Statement: This article represents the views of the author and others. Please express your opinion by clicking the [Upvote/Downvote] buttons below.