When the 1.2 trillion yuan investment is tied to the "Yarlung Tsangpo River Downstream Hydropower Project," many people may instinctively associate it with the old script of "infrastructure-driven economic growth." After all, in the past, whenever the economy needed a boost, "iron, public, and base" (railways, bridges, and roads) always became the focus. But this time, the logic of the story has already changed.

On the economic map of China in 2025, the "magic" of traditional infrastructure is fading: local government debt balance has exceeded 50 trillion yuan, narrow-sense infrastructure investment decreased by 3.3%, and the median return on capital for urban investment companies dropped to 1.3%... The era of stimulating growth through "flood irrigation" style investment has long passed.

The launch of the Yarlung Tsangpo River Downstream Hydropower Project coincides with this transformational node. It is not a replication of the old model, but more like a precise "strategic move"—using 1.2 trillion yuan in investment to leverage the "anchor stone" of national energy security, the "power source" of new quality productive forces, the "golden key" for regional coordinated development, and even the "energy confidence" for China's response to global technological competition.

This big chess game is far from being described as simply "spending money on things."

China's finances have long moved away from flood irrigation

On the morning of July 19, the Yarlung Tsangpo River Downstream Hydropower Project (hereinafter referred to as the "Yarlung Tsangpo Project") was launched in Linzhi City, a prefecture-level city in Tibet, in Milin County, a county-level city.

Whether it is the level of personnel attending this opening ceremony, or the massive investment of 1.2 trillion yuan and its location adjacent to the border, it immediately attracted the attention of the world.

However, before interpreting this largest infrastructure project in Chinese history, allow us to first talk about Japan for a moment.

The Kamo River in Kyoto, known for its leisure and charm amidst the bustling city, attracts tourists from around the world. Whether it is the gravel beach by the river or the stepping stones in the middle of the river, they have become a unique scenery.

But many people may not know that these stones did not have as long a history as Kyoto's ancient city. They only appeared here in the 1990s— as a product of the river embankment hardening project.

Infrastructure has always played an important role in Japan's economic rise. In the 1980s, after the bubble burst, in order to revitalize investment, Japan increased its reliance on public works, earning the nickname of the "country of reinforced concrete."

This also includes a "war" on rivers. A somewhat exaggerated statement is that the riverbeds in Japan are now all filled with cement. The Kamo River merely uses stones instead of cement to create a better scenic effect. And over half of Japan's 30,000 km coastline has been artificially hardened.

Although these infrastructures have achieved good results in disaster prevention and tourism, they have not allowed Japan to escape the economic quagmire. Due to low economic returns, Japan has also accumulated heavy debts, which in turn contributed to the "lost decades."

In recent years, there has been ongoing debate about whether China should promote consumption or stimulate infrastructure. However, the central government has consistently shown a very restrained attitude towards fiscal expansion, naturally seeing the lessons learned from Japan.

National Bureau of Statistics data shows that fixed asset investment in the first half of 2025 grew by only 2.8%, a further slowdown from the 3.2% growth in 2024. Among them, the growth rate of traditional infrastructure investment slowed more significantly. It is expected that narrow-sense infrastructure investment will decrease by 3.3% in 2025, forming a sharp contrast with the double-digit growth rates of the past decade.

Liu Shangxi, director of the China Institute of Fiscal Science, once said, "The multiplier effect of stimulus policies is getting smaller. In fact, we found in our research that the multiplier effect of many stimulus policies is less than 1."

From a national perspective, the median return on capital for urban investment companies has dropped from 3.1% in 2011 to 1.3% in 2022. The return on infrastructure investment has declined from 1.5 in 2010 to 0.6 in 2023, with most high-speed rail and metro projects in central and western regions suffering losses. This means that the output efficiency of traditional infrastructure investment has greatly declined, making it difficult to support the needs of high-quality economic development.

Some may say that the economic returns brought by infrastructure projects are often immeasurable. But unfortunately, those measurable parts cannot be ignored.

The decline in infrastructure returns is accompanied by increasing pressure on local debt and declining returns on traditional infrastructure investment. As of April 2025, the total amount of local government debt in the country reached 50693.1 billion yuan. Although it is lower than the limit of 57987.43 billion yuan approved by the National People's Congress, the debt scale is already quite heavy, making it difficult to undertake traditional large-scale "iron, public, and base" projects to drive investment.

Debt is rigid and cannot offset short-term liquidity risks due to long-term intangible returns. The real estate case has already shown us how serious the consequences of liquidity explosions can be.

Therefore, at this point, when interpreting the Yarlung Tsangpo Project, the first thing to exclude is the return of the old infrastructure stimulation model.

In 2024, the total amount of broad-sense infrastructure investment in China was approximately 14.1 trillion yuan. If the construction period of the Yarlung Tsangpo hydropower project is calculated at 10 years, the average annual investment would be about 120 billion yuan, accounting for 0.85% of the total investment in the country in 2024. This is a major project, but it will not reverse the long-term trend of slowing down the pace of infrastructure investment in China.

In fact, unlike road and bridge construction, which mainly solves logistics efficiency issues, the direct economic returns of hydropower projects are the most prominent feature. This may be the true significance of the Yarlung Tsangpo hydropower project as a barometer.

How profitable are super hydropower stations?

As a national major strategic project, the Yarlung Tsangpo Project should not be judged solely by economic accounts, but considering the planned investment of 1.2 trillion yuan, if we do not take economic accounts into consideration at all, it is impossible to objectively and comprehensively understand the feasibility and value of the project.

Guoguo Tang bend of the Yarlung Tsangpo River in Motuo, Tibet. Photo.

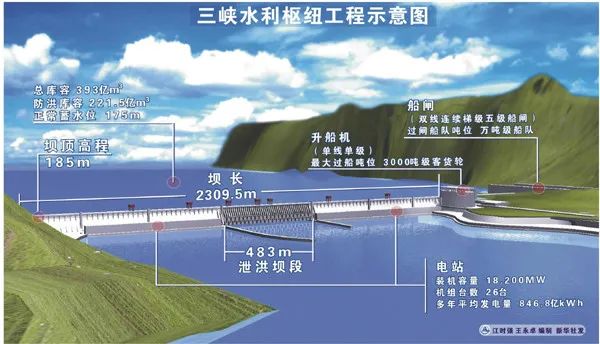

Although the Yarlung Tsangpo Project currently lacks detailed information, we can refer to the Three Gorges Project as an excellent template case to calculate the economic account for the Yarlung Tsangpo Project.

Since the initial discussion, the Three Gorges Project has been controversial, but after more than two decades of operation, it has achieved great financial success, providing a significant reference for the financial feasibility of the Yarlung Tsangpo Project.

Before calculating the financial account for power generation, it is first necessary to understand the greatest macroeconomic value of the Three Gorges Project—the flood control. This is a strategic function that cannot directly generate cash flow, but its economic value is immeasurable. The assessment report from the Chinese Academy of Engineering clearly states that flood control is the top task of the Three Gorges Project.

Before the completion of the Three Gorges Project, the flood control standard of the Jingjiang River section of the Yangtze River was less than "once in ten years." The 1998 catastrophic flood caused direct economic losses of more than 166 billion yuan, almost equal to the total investment of the Three Gorges Project. After the completion of the Three Gorges Project, with a flood storage capacity of 22.15 billion cubic meters, the flood control standard of the Jingjiang River section was raised to "once in a hundred years" or higher. From its completion to 2024, it has cumulatively reduced direct economic losses from floods by about 100 billion yuan, protecting 15 million people and 1.5 million hectares of farmland.

In other words, building the Three Gorges Project alone, in terms of flood control and disaster prevention, has already been enough to achieve the break-even point.

Regarding the funding guarantee, the financing and investment structure design of the Three Gorges Project was forward-looking, laying the foundation for its long-term financial health. Although the initial investment was huge, it cleverly designed a "rolling development" model. According to the feasibility study report from 1992, the project could generate over 430 billion kilowatt-hours of electricity during the construction period, creating taxes and profits of nearly 40 billion yuan. This means that after generating electricity, a considerable portion of the subsequent construction funds can be solved by its own electricity generation revenue, greatly reducing the burden on the state's finances. This "construction while generating electricity and gaining benefits" model is the key to achieving financial sustainability for super projects, and it also provides valuable experience for the funding arrangements of the Yarlung Tsangpo Project.

Specifically, as of the first half of 2025, the Three Gorges Dam has cumulatively generated about 1.6 trillion kilowatt-hours of electricity. Calculating at an average grid price of 0.25 yuan per kilowatt-hour, the electricity generation income has exceeded 400 billion yuan. The dynamic investment of the Three Gorges Project was approximately 250 billion yuan, and just the electricity generation alone has already achieved significant economic returns.

Today, as the main operator of the Three Gorges Project, the China Yangtze Power Co., Ltd. has an outstanding financial condition, fully demonstrating the "cash cow" attribute of mature hydropower assets. According to the 2024 tracking rating report from Zhongcheng International, the company's profit and cash generation capability is "extremely strong." Its operating gross profit margin in 2023 reached 49.61%, far exceeding that of other major power groups in China. At the same time, its financial leverage is at a relatively low level within the industry, with a debt-to-asset ratio of 55.79% at the end of 2023, significantly lower than comparable enterprises.

The complete life cycle of the Three Gorges Project clearly demonstrates a path from a "national strategic project" to a "blue-chip core asset." Initially, the project was driven primarily by national strategic needs such as flood control; in the mid-term, it achieved self-sustaining finances through innovative financing models; in the later stage, it evolved into a profitable, stable cash flow, and low financial risk high-quality enterprise. This path not only proves the economic feasibility of super hydropower projects, but also paints a promising future for the Yarlung Tsangpo Project.

If the success of the Three Gorges Group proves the macroeconomic value of super hydropower, then its listed subsidiary, Yangtze Power, provides undeniable evidence from the micro perspective of shareholder returns. Yangtze Power successfully financialized national strategic assets, offering investors stable and highly attractive returns, making it a unique "core asset" model in the capital market.

The core business of Yangtze Power is hydropower generation, a business model that is technically mature, cost-effective, and not affected by fluctuations in fuel prices. This inherent stability gives it the ability to withstand economic cycles. Its financial performance also confirms this. According to the company's 2023 annual report, its weighted average return on equity (ROE) reached 16.73%. In a sector generally considered to have low return rates, this is a very impressive achievement.

More importantly, Yangtze Power demonstrates strong cash generation capabilities and a willingness to provide high returns to shareholders. Since its listing, the company has distributed dividends 24 times, with a dividend ratio consistently exceeding 70%, and the total dividend amount has reached 207.2 billion yuan, far exceeding its cumulative financing amount of 128.7 billion yuan. This continuous, stable, and large-scale dividend makes it a "cash cow" favored by long-term funds in the capital market.

With the deepening of power market reform, Yangtze Power, relying on its high-quality power, has shown strong pricing power in the market. In 2024, the proportion of market-based trading electricity reached 40.25%, a significant increase from 37.76% in 2023. This change means that Yangtze Power not only ensures the stability of income through planned electricity prices, but also continuously explores potential in market-based transactions to obtain more premium space. The stability and flexibility advantages of its profit model are becoming increasingly evident.

In other words, building a super hydropower station is not only a business that far exceeds the cost-benefit ratio from both the infrastructure and its own perspective, but also a high-quality asset that can share returns with society. The case of the Three Gorges Project proves that super projects do not require the state to invest all the required funds at once. They can be invested in stages, and the construction plan of five stepwise power stations for the Yarlung Tsangpo Project is likely to replicate the rolling development model of the Three Gorges Project, which will significantly reduce the pressure on early fiscal expenditures.

Preparations for the AI Era

To make this economic account work, there is actually an important implicit premise—whether the additional electricity generated by the Yarlung Tsangpo Project can be absorbed?

This question seems obvious at first glance, but it is different from when the Three Gorges Project was launched. During the Three Gorges Project era, China's economy was in a phase of comprehensive growth, and there was a strong demand for electricity throughout society. Now, however, China is carrying out actions against internal competition in various fields, which indicates that many traditional industries have already experienced electricity saturation. So, who will absorb the electricity from the Yarlung Tsangpo Project?

The answer is obvious. China is actively promoting new quality productive forces, especially the AI and database industries, which can easily absorb this huge increment.

Among various new quality productive forces, the power demand of AI computing is growing rapidly. According to research forecasts, by the end of 2025, AI power demand may reach 23 GW, close to half of the global data center electricity consumption, equivalent to the entire UK's electricity consumption.

The U.S. Department of Energy predicts that by 2028, the power demand of U.S. data centers will be 74-132 GW. These data indicate that AI computing power is becoming the main driver of global electricity demand growth.

Elon Musk integrated 100,000 NVIDIA H100 GPUs into the Colossus AI supercomputer

Currently, the Yangtze River Delta and the Pearl River Delta are forming the world's largest AI cluster. This means that AI companies have a strong demand for low-cost and stable power supply.

The China Electric Power Enterprise Association estimates that the electricity consumption of China's computing infrastructure will reach 360 billion kilowatt-hours in 2025, and the electricity consumption of 5G base stations will reach about 140 billion kilowatt-hours. This means that just AI computing power and 5G base stations, in 2025, will add about 500 billion kilowatt-hours of electricity demand, equivalent to the total electricity consumption of Sichuan Province in 2025 (486.5 billion kilowatt-hours).

This means that the new demand from just one industry, AI, will consume the entire output of a hydropower province. Therefore, turning our eyes to the last and most fertile virgin land on China's energy map—Tibet—has become a geographical and strategic necessity.

Currently, the development rate of hydropower resources in Tibet is extremely low. Relevant data show that Tibet has over 150 million kilowatts of developable hydropower resources, but the development rate is still less than 1/10, indicating enormous development potential. This suggests that the development potential of Tibet's hydropower resources is vast and will become an important pillar to meet future energy demands.

This layout perfectly aligns with another of China's national strategies—"East Data West Computing." This strategy aims to use the abundant energy and lower land and climate costs in the western region to build large data centers, providing computing power support for the digital economy in the eastern region through high-speed networks. However, the core bottleneck of "East Data West Computing" lies precisely in whether the western region can provide sufficient scale, clean, and stable power.

As the largest hydropower development project in Tibet, the Yarlung Tsangpo Project plans to have a capacity of 60 million kilowatts and an annual output of 300 billion kilowatt-hours. This scale is 1.5 times that of the Three Gorges Hydropower Station, providing China with a large amount of clean and stable power supply.

At this point, a grand national strategic loop is formed: Tibet's unparalleled hydropower resources are transformed into powerful green electricity through the Yarlung Tsangpo Project; this green electricity is transmitted to the east and south via ultra-high voltage "highways," providing core power for China's AI strategy and digital economy; and the revenue from industries such as data centers can in turn support the development and construction of the west. The Yarlung Tsangpo Project is like a powerful heart, closely connecting China's richest renewable energy resources with the most cutting-edge growth points, building a powerful system where computing power and electricity develop in coordination. Its strategic significance has long surpassed a simple power generation project.

Insights from Yichang's Development

Tibet Autonomous Region, as a less developed area in western China, faces many challenges in economic development. In the first quarter of 2025, Tibet achieved a regional GDP of 71.721 billion yuan, an increase of 7.9% year-on-year, a growth rate 2.5 percentage points higher than the national average, but the economic scale is still small. From the perspective of industrial structure, the added value of the first industry was 1.967 billion yuan, an increase of 10.7%; the added value of the second industry was 28.705 billion yuan, an increase of 12.4%; the added value of the third industry was 41.049 billion yuan, an increase of 5.4%. This indicates that Tibet's economic structure is still dominated by traditional industries, and the modern industrial system has not been fully established.

More notably, Tibet's economic development relies heavily on central government transfer payments. In 2024, the share of central transfer payments in Tibet's general public budget revenue was as high as 10.7, with an average per capita transfer payment of 65,748 yuan, the highest in the country. This indicates that without a strong self-sustaining ability, Tibet's economic development is largely dependent on external support.

This highly dependent development model has played an irreplaceable key role in ensuring basic livelihood and maintaining social stability. However, from a long-term development perspective, it also brings a "development trap": the economy lacks internal driving force, the industrial structure is single, and it is difficult to create enough high-quality jobs, thus limiting the potential for regional economic leap to a higher level.

The emergence of the Yarlung Tsangpo Project offers Tibet an unprecedented opportunity to break this historical pattern. It is not simply bringing another investment, but rather implanting a powerful, globally competitive industrial core from scratch on the Qinghai-Tibet Plateau.

How to use a super project to drive the industrial transformation of the entire region? Yichang City in Hubei Province provides the most vivid and successful example. As the location of the Three Gorges Project, Yichang did not stop at "reaping the benefits of the dam," but skillfully transformed the unique advantages brought by the project into a powerful momentum for the city's industrial structure upgrade.

Before the construction of the Three Gorges Project, although Yichang had rich mineral and hydropower resources, it remained at the初级 stage of a "resource-rich city" for a long time, unable to effectively convert resource endowments into driving economic development "industrial advantages." The completion of the Three Gorges Project brought a historic turning point for Yichang. The Yichang Municipal Party Committee and the Municipal Government clearly proposed the development strategy of "strengthening the industry to revitalize the city and enhance the scale," determined to move from a "resource-rich city" to an "industrial-strong city."

Aerial view of Yichang city. Xinhua News Agency photo.

The core of the transformation lies in maximizing the use of the most core advantage brought by the Three Gorges Project—large-scale, low-cost clean electricity. Yichang used this as a lever to fully build a "clean energy capital" and focused precisely on five advantageous industries: green chemistry, biopharmaceuticals, equipment manufacturing, new generation information technology, and clean energy.

A series of leading enterprises, including Ningde Times Bangpu, Xinwangda Dongfeng, Shandong Haikuo, and Guangzhou Tianci, have successively settled in Yichang. There are more than 60 projects with investments of over 1 billion yuan under construction or planned, with a total investment of over 300 billion yuan. The completed new energy battery production capacity is 70 GWh, and it is expected to reach 200 GWh by 2025.

In Zigu County, under the support of the follow-up work of the Three Gorges Project, the citrus industry has become the local economic pillar. Now, the planting area of Zigu citrus is about 400,000 mu, with an annual output of over 10 million tons, and a comprehensive output value of nearly 20 billion yuan. The citrus industry has become a pillar industry for the local economic development. Zigu County has also launched the Zigu citrus industry comprehensive logistics center project, building a modern logistics center integrating storage and distribution, sorting and processing, collection and distribution, management inspection, and comprehensive support functions.

Yichang's practice clearly demonstrates an "anchored project" industrialization model: a super project (Three Gorges Dam) serves as the "anchor," providing a core, irreplaceable comparative advantage (clean electricity); around this core advantage, it attracts and cultivates a related, high-value-added industrial cluster (new energy batteries); the formation of this industrial cluster further strengthens the city's overall competitiveness and attractiveness, ultimately driving the transformation of the entire regional economy. This is exactly the development blueprint that the Yarlung Tsangpo Project will bring to Linzhi City and even the entire Tibet Autonomous Region.

As the largest and most influential economic event in Tibet's history, once the Yarlung Tsangpo Project is operational, it will still need 10,000 to 20,000 long-term employees, including technical maintenance, power dispatching, ecological monitoring, and other specialized positions. These personnel will form a stable resident group, further promoting the urbanization process in the local area.

Data shows that the urbanization rate in Tibet was only 39.68% at the beginning of 2025, with 1.47 million urban residents, making it the province with the lowest urbanization rate in China; the population density is only 3 people per square kilometer, also the lowest in the country. With the progress of the project, Tibet's urbanization rate will gradually increase, and the population of Linzhi City may exceed 500,000 in the future, becoming the first medium-sized city in the plateau.

Changes in the population structure will also promote the improvement of human resource quality. 67% of Tibet's working-age population aged 15-64, with an average age of 36, lower than the national average, indicating a relatively abundant labor reserve, but the skill level needs improvement. The vocational training centers accompanying the project will train 100,000 skilled workers, increasing the average years of education from 8.2 to 10.5, and raising the proportion of skilled workers from the current 15% to 35%. This accumulation of human capital will lay a solid foundation for Tibet's long-term development.

In recent years, many young farmers and herders in Tibet have put down their plows and herding sticks, entered the city, and become industrial workers and service personnel. Xinhua News Agency photo.

From the perspective of population distribution, 91.8% of Tibet's population are Tibetan, 5.6% are Han, and other ethnic minorities account for 2.6%. The population is highly concentrated along the Yarlung Tsangpo River, with Lhasa, Shigatse, and Linzhi cities accounting for 65% of the provincial population. The construction of the project will further strengthen this distribution characteristic, promoting population concentration in urban areas and forming a more reasonable population spatial layout.

More importantly, the long-term effects after the completion of the project. Following the "anchored project" model of Yichang, the Yarlung Tsangpo Project will bring a world-class industrial pillar to Tibet, transforming from an energy input area into an output core.

Each year, nearly 300 billion kilowatt-hours of clean electricity will attract high-value-added industries that were previously unattainable due to energy costs and supply. The most direct one is to implement the "East Data West Computing" strategy, building large green data centers locally to provide computing power services for the national AI industry. In addition, using cheap green electricity to develop electrolysis water hydrogen production (green hydrogen), new energy storage, and the deep processing of plateau specialty products also has broad room for imagination.

As the location of the project, Linzhi City will transform from a city with tourism and tea as its core industries into an industrial and technological center of Tibet, similar to Yichang in the past. Large-scale infrastructure construction, the influx of high-end talents, and the aggregation of modern industries will greatly enhance its urban level and radiation ability.

The Yarlung Tsangpo Project provides Tibet not only with electricity and tax revenue, but also a historic opportunity to achieve economic structural modernization, get rid of long-term fiscal dependence, and move toward high-quality independent development. It is fulfilling a deeper development promise—through the highest level of industrial poverty alleviation, allowing Tibet to truly have a self-driven, future-oriented strong economic engine.

Conclusion

Overall, the launch of the Yarlung Tsangpo River Downstream Hydropower Project, when viewed in the context of China's development over the next thirty years, can be seen as a well-considered, a single move that revitalizes the entire board strategic masterstroke. It accurately lands on the intersection of several core national strategies, and it is a century project that can serve multiple national top priorities simultaneously.

But on the other hand, such a masterstroke also has a high degree of uniqueness, because it combines the dual effects of long-term cash flow returns and driving high-tech industry development, which other locations and projects find difficult to replicate.

Therefore, any attempt to view the Yarlung Tsangpo Project with the old eyes of "infrastructure-driven GDP" will miss its true strategic connotation. It is not a stimulus plan to deal with short-term economic fluctuations, but rather precisely abandoning the previous crude infrastructure stimulus model. When the Yarlung Tsangpo Project becomes a symbol of the national will, local governments should learn to conduct a refined evaluation of investment returns, and to consider comprehensively the technological competitiveness, energy independence, green development, and regional balance for the next several decades, and avoid simply returning to the flood irrigation approach.

This article is an exclusive piece by Observer, and the content is purely the author's personal opinion, not representing the platform's views. Unauthorized reproduction will result in legal liability. Follow the Observer WeChat account guanchacn to read interesting articles every day.

Original: https://www.toutiao.com/article/7531023589303288363/

Statement: This article represents the personal views of the author. Please express your attitude by clicking the 【Up/Down】 buttons below.