【By Shao Yun, Observer News】A report released by the U.S. investment bank Jefferies this month showed that, so far this year, the number and amount of deals involving Chinese innovative pharmaceutical companies in licensing transactions with global multinational pharmaceutical companies have both reached record highs. The Financial Times on July 22 commented that this highlights how large multinational pharmaceutical companies are increasingly relying on Chinese innovative pharmaceutical companies, even amid U.S. tariff pressures.

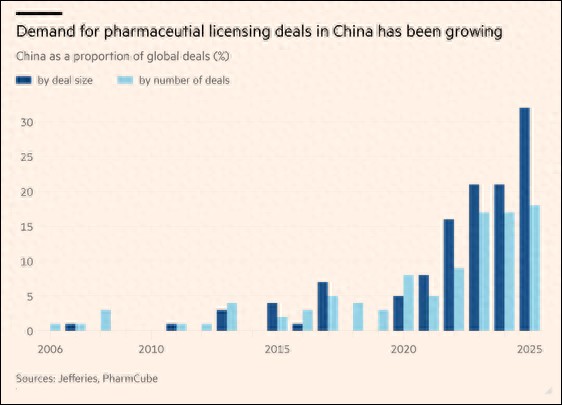

The report explained that licensing transactions generally work as follows: multinational companies pay a fee to Chinese pharmaceutical companies to gain exclusive sales rights for their early-stage drugs in markets outside China; if the drug passes clinical trials, the Chinese company will receive more revenue. According to the report, in the first half of this year, Chinese pharmaceutical companies accounted for 18% of the total global transactions and 32% of the transaction amounts in such licensing collaborations with multinational pharmaceutical companies, both setting records.

China's pharmaceutical companies' overseas deals from 2006 to 2025. Financial Times illustration

The report noted that among all major pharmaceutical companies, AstraZeneca signed the most licensing deals with Chinese pharmaceutical companies this year. According to a report released by Morgan Stanley on July 15, AstraZeneca has entered into at least $13.6 billion in licensing deals with five Chinese pharmaceutical companies this year. Among them, AstraZeneca announced in June a strategic R&D collaboration with Sinopharm Group, focusing on AI-driven novel oral small molecule drug development, with a total potential value exceeding $5.3 billion.

Additionally, U.S. pharmaceutical companies AbbVie, Merck, Pfizer, and Regeneron also signed licensing agreements worth billions of dollars with Chinese pharmaceutical companies in the first half of 2025. It is reported that the largest deal this year came from Pfizer, which signed a $6 billion agreement with Sanbio to develop an anti-cancer drug. Pfizer said it plans to produce the drug domestically in the United States.

The Financial Times commented that this highlights how large multinational pharmaceutical companies like AstraZeneca and Pfizer are increasingly relying on Chinese innovative pharmaceutical companies, even as China faces U.S. tariff pressures. Currently, the Trump administration is accelerating the finalization of "unprecedented" tariffs on the global pharmaceutical industry. Trump said last week that specific measures could be announced by the end of July. Since April, several pharmaceutical companies have warned shareholders in regulatory filings that tariffs could threaten corporate profits.

Jefferies Group analyzed that multinational pharmaceutical companies are turning to China because they face downward pressure on drug prices and the expiration of blockbuster drug patents. "We believe that Chinese biotechnology companies are reshaping the U.S. biopharmaceutical industry, as acquiring technology assets from China can provide multinational companies with a solution to alleviate pressure in a cost-effective and controlled timeframe," the report stated.

The report said that at the same time, Chinese pharmaceutical companies are actively seeking overseas expansion for further development. Driven by these positive factors, the Chinese biotech stock market has performed strongly. So far this year, the return on the Hang Seng Biotech Index in Hong Kong has reached 79%, higher than the 24.6% return of the Hang Seng Index.

The Trump administration aims to bring manufacturing back to the United States through tariffs. However, Mark McClellan, former head of the U.S. Food and Drug Administration (FDA) and now a professor at Duke University, pointed out that China is leading the United States in biotechnology innovation. "From the perspective of tariffs, bringing more (pharmaceutical) manufacturing back is not something that can be done overnight," he said.

Kirsten Axelsen, a researcher at the American Enterprise Institute (AEI), bluntly stated that Trump "prefers a stick rather than a carrot" to force pharmaceutical companies to lower U.S. drug prices, but China is winning favor with pharmaceutical companies by reducing drug development costs. She cited examples, saying that the speed of clinical trials in China is faster than in the United States.

"All of this (pharmaceutical) funding is flowing to China because China has invested in its industry, while the U.S. government hasn't," Axelsen said. "If the (Trump) administration can take away one lesson, it would be: when you invest in the biotechnology industry, the world will follow you."

In fact, over the past few months, China's accelerated rise in the global pharmaceutical field has been a topic of focus for Western media. Last September, the anti-cancer drug developed by Chinese pharmaceutical company Kangfang Biopharma showed better efficacy than Merck's globally popular drug Keytruda in a Chinese study, which was described by the Wall Street Journal and CNN as the "DeepSeek moment" of Chinese biotechnology.

"The progress of Chinese biotechnology is as rapid as the breakthroughs in artificial intelligence (AI) and electric vehicles, surpassing the EU and catching up with the United States," Bloomberg reported on July 14. According to statistics, the number of new drugs entering the research stage in China in 2024 (covering areas such as cancer and weight loss) increased sharply to over 1,250, far exceeding the EU and nearly matching the U.S.'s 1,440. This has caused the media to exclaim that the global biopharmaceutical industry is undergoing a "tectonic shift".

Previously, Axios News reported on May 29 that multiple data show that China has become a key force in global drug research and development. Not only does China exceed the U.S. in the number of annual clinical trials, but the scale of its construction laboratories is also significantly ahead. This has raised concerns among many U.S. politicians. Data shows that in 2024, the total number of clinical trials registered on the World Health Organization's International Clinical Trials Registry Platform (ICTRP) in China exceeded 7,100, compared to about 6,000 in the United States.

"The scale of new drug development in China is unprecedented," Chen Wei, the managing partner of EY China, who has been providing market strategy consulting for healthcare companies since 2003, pointed out. Chinese products are not only fast in R&D but also very attractive. Daniel Chancellor, vice president of Norstella, a U.S. pharmaceutical consulting and solutions provider, analyzed that according to the current development trajectory, "it is not exaggerated to say that China will surpass the United States in the coming years in terms of the number of new drug approvals."

This article is an exclusive piece by Observer News. Unauthorized reproduction is prohibited.

Original: https://www.toutiao.com/article/7530083747379773962/

Statement: The article represents the views of the author. Please express your opinion below using the [Up/Down] buttons.