India suddenly stopped buying Russian oil, and after this originally stable supply chain broke down, a large amount of Russian oil floated at sea. China promptly extended a helping hand to Russia, purchasing these oils at historically low prices.

According to the China Energy News on January 23, citing the report from Indian Standard, after the United States imposed sanctions on Russian oil companies and Lukoil, India reduced its purchase of Russian oil. By December 2025, India had dropped to third place in the list of Russian crude oil buyers, behind Turkey.

(Due to the sanctions, 13 million barrels of Urals crude oil are stuck at sea)

According to Bloomberg on the 22nd, due to the reduction in demand for Urals crude oil from India, the amount of floating storage of Russian oil at sea has surged, reaching 13 million barrels, setting a record high over the past decade, with severe inventory buildup.

Floating storage refers to storing oil in super tankers used for transportation, but not leaving the port, serving as temporary warehouses. This process involves economic judgments related to the oil market, such as transportation costs. If shipping out would result in losses, it stays in the port waiting for the market price to recover. It also requires estimating transport policies during the oil transportation cycle and assessing risks. At the same time, the decline in crude oil quality will also affect the price.

Therefore, once there is a sharp increase in floating storage, it means that the current oil market is oversupplied, the quality of crude oil has declined, and the rent costs of ports and transportation are also concerns for sellers.

Moreover, Urals crude oil mainly takes the western route of transportation, such as transporting by land to the Baltic Sea and Northern Europe, through pipelines to Eastern and Central Europe, and via Black Sea shipping to more places.

The main route for Russian oil to be transported to India starts from the Baltic Sea and Black Sea, passes through the Suez Canal into the Red Sea, then through the Indian Ocean to reach India, or goes around the Cape of Good Hope in Africa to reach India.

Therefore, when India reduced its purchase of Russian oil, more than half of the Urals crude oil remained in the Arabian Sea, and due to the sanctions, these oils faced serious sales problems.

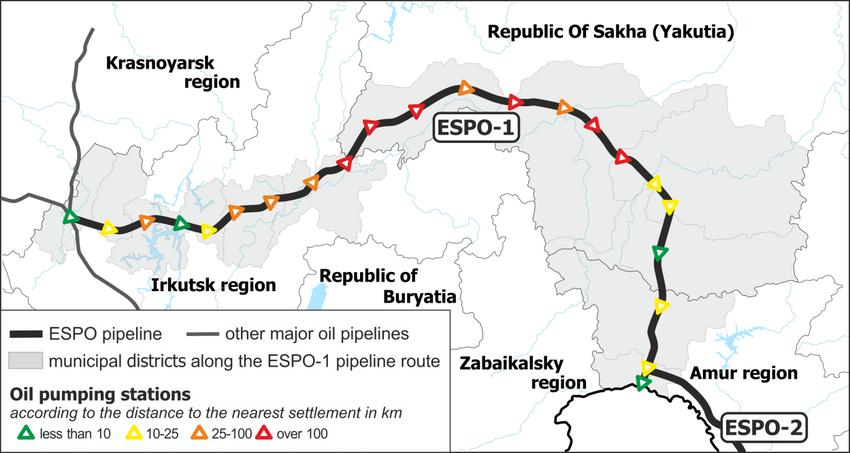

(The East Siberia-Pacific Ocean pipeline is the main route for China's import of Russian oil)

At this time, China increased the import volume of Urals crude oil, which can greatly resolve the problem of oil accumulation. According to data from Kpler, currently, China imports 400,000 barrels of Urals crude oil per day, setting a historical record.

Since China imports oil from Russia mainly through another major oil transportation line of Russia—the East Siberia-Pacific Ocean pipeline—Urals crude oil is not the main type of crude oil exported to China originally. Therefore, China's decision to import large quantities of Urals oil clearly indicates that it is extending a helping hand to Russia.

Russia reciprocated, lowering the price of Urals crude oil to a historical low, which shows great sincerity for China. Moreover, China can settle the transaction in RMB, helping Russia avoid the risk of frozen income.

Russia's crisis was thus resolved. Without China's help, the loss would have been immeasurable.

In fact, the Indian government wants to stop buying Russian oil, but the actual demand of Indian companies is not entirely within the control of the Indian government's will.

Russia is India's largest oil supplier. After the outbreak of the Ukraine-Russia conflict, the share of oil import sources for India underwent significant fluctuations, with Russia replacing the shares previously held by Saudi Arabia and Iraq, taking up 40%. Even after the sanctions were issued, India still rushed to import before the sanctions took effect, although the share decreased sharply, Russia remained India's largest oil supplier.

The current situation has severely affected India. India's industrial base is weak, and its output efficiency is extremely low. The demand for basic energy is huge, and complying with Western sanctions cannot change the reality.

Therefore, the market expects that India will try every means to seek Russian oil again.

(Reliance Industries is the largest Indian corporate buyer of Russian oil)

According to Kpler, several new crude oil exporters have emerged in Russia, and these new companies may be acting as shadow intermediaries to circumvent the restrictions imposed on two previously sanctioned oil companies. This move indicates that Russia is reorganizing its oil sales enterprises and should soon form a new supply chain. This is a measure taken by Russia to cope with international sanctions.

At the same time, this is also an opportunity for India to seize.

As expected, shortly after the "shadow intermediaries" news came out, India showed signals of wanting to continue purchasing oil from Russia. According to a news report on January 21, Reliance Industries plans to continue receiving unsanctioned Russian crude oil in February and March. Reliance Industries is the largest private group in India and the second-largest globally, as well as the largest corporate buyer of Russian oil in India.

In December 2025, Reliance Industries stopped receiving Russian oil due to Western sanctions. According to relevant sources, Reliance Industries changed its position so quickly, probably realizing the harshness of the reality. Even under the pressure of Western sanctions, it would find ways to get Russian oil again.

However, facing such an unpredictable customer as India, Russia may not have a good attitude in the future, let alone the special discount offered by China.

Original article: toutiao.com/article/7599470086704955919/

Statement: This article represents the views of the author.