Text by Nie Sen, former engineer at Nokia and Ericsson, creator of military and technological science content

The Simgando mine has started supplying iron ore to China. This is a project in China's African strategy that now affects iron ore exports from Australia, thousands of miles away, causing the once-proud and dominant Australian mining giants to bow down, completely reversing China's previous passive position in mineral procurement.

It was here that China began to become the true protagonist on the steel stage. At the same time, this also means that the battle over iron ore pricing between China and Australia leaves Australia no hope for a comeback.

In the past October, China successfully forced BHP Group, an Australian company, to accept Chinese conditions and complete the China-Australia iron ore negotiations:

Firstly, BHP Group gave up its request to increase long-term prices by 15% in 2025. China succeeded in lowering the price, defending its own interests;

Secondly, BHP Group accepted the condition of paying part of the iron ore purchases in RMB.

This move completely reversed the long-standing "buyer market without voice" passive situation, proving the success of China's strategy of "defining rules with strength," and opening a breakthrough for the internationalization of the RMB in the commodity sector.

The "secret weapon" used by China to pressure Australia was on September 30, when the China Mineral Resources Group required major steel mills and traders across the country to suspend purchasing any Australian BHP iron ore priced in US dollars. Initially, BHP Group was "stubborn," but it gave in a week later.

In this game, the reason why China's strategy was so successful and why Australia surrendered so quickly was mainly because the Simandou iron ore project in Guinea started production and began transporting high-quality iron ore to China, giving China the confidence to negotiate with Australia.

Many foreign media have evaluated that the Simandou iron ore project will "disrupt" the global iron ore market. The scale of Simandou is astonishing, estimated to have at least 3 billion tons of reserves, making it the largest undeveloped iron ore deposit in the world, and the quality of the iron ore is extremely high, with an average iron content of over 60%, belonging to the highest grade globally.

The project was originally explored and developed by Rio Tinto, a mining group headquartered in the UK. Rio Tinto, together with Brazil's Vale and Australia's BHP Group, are known as the three major iron ore giants, dominating global iron ore production and trade. There were intense disputes between Rio Tinto and BHP Group over the ownership of the Simandou iron ore. After the involvement of Chinese companies, the situation changed.

Now, Rio Tinto only owns a quarter of the shares in the Simandou mine, and is the only representative of Western countries. Chinese companies, however, own most of the shares in the Simandou project, and even the largest shareholder of Rio Tinto has become its joint venture partner, China Aluminum Company. It can be said that Chinese companies have already taken control of the ownership of the Simandou iron ore mine.

In this game, China reached a triple-win situation with the UK and the Guinean government.

The total investment in the Simandou iron ore project is as high as 23 billion US dollars. After its operation, it is expected to make Guinea the second-largest African country in terms of mineral exports, increasing Guinea's GDP by more than a quarter. At the same time, China will also gain control over the pricing power of the global iron ore market, reshaping the global iron ore landscape.

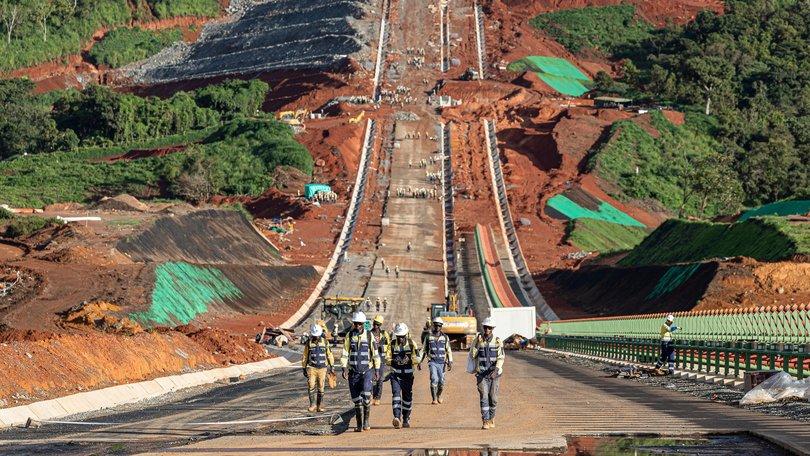

China has already built a dedicated heavy-haul railway for the ore in Guinea, constructed port facilities, and the first heavy-haul train has already departed on October 20. By the end of this year, the first cargo ship loaded with Simandou iron ore will arrive in China.

Bloomberg recently commented that the operation of the Simandou iron ore project allows China to transform a weak link in its supply chain into a strategic advantage, continuing China's leading position in the exploration and refining of resources such as copper, cobalt, and lithium in Africa.

Since 1996, when China's crude steel production exceeded 100 million tons and became the world's largest crude steel producer, it has remained the top country in global steel production and consumption for 28 consecutive years. In recent years, China's crude steel production has continuously exceeded 1 billion tons, even surpassing the combined output of all other countries in the world.

The reason for China's massive steel production, apart from a small amount of exports, is mainly for domestic construction use. In recent decades, China has carried out the largest-scale infrastructure construction in the world, and the shipbuilding industry, which uses a lot of steel, has occupied about half of the global market.

China has relatively few domestic iron ores with low grades, so it relies mostly on imports, which has led to long-term "extortion" by iron ore suppliers like BHP Group, resulting in generally low profit margins in China's steel industry.

Now the market situation has changed, and China's steel industry is about to enter a new era of prosperity.

Another major confidence for China's successful negotiation with BHP Group is that China's demand for iron ore will gradually decrease in the long term.

It should be noted that the main reasons why developed countries have much lower crude steel production and iron ore demand compared to China are as follows:

First, the infrastructure construction of developed countries has been basically completed, and the per capita steel stock has reached around 10 tons, no longer having the need for large-scale infrastructure construction and consuming large amounts of steel;

Second, a large part of the raw materials for the steel industry in developed countries come from recycled scrap steel.

According to statistics from China's steel industry, in 2023, China's social steel stock was approximately 1.28 billion tons, and the per capita steel stock was about 8.9 tons, close to the level of developed countries.

However, China's urbanization rate, per capita road mileage, and per capita railway mileage are still significantly lower than those of developed countries, which means that China will carry out large-scale infrastructure construction for at least the next ten years, and the per capita steel stock may exceed the current average level of developed countries. Additionally, the shipbuilding industry will remain an advantageous industry for China for a long time, and the majority of the steel accumulated in China has not yet reached the recycling period.

Therefore, in the short term, China's demand for iron ore remains very high, and even if the demand decreases, it will be slow. However, in the long run, China will reach the level of developed countries, and the demand for iron ore will inevitably decline significantly. Under this long-term expectation, the global iron ore prices are unlikely to surge sharply.

In today's increasingly fierce Sino-US rivalry, China's control over the pricing and control of key mineral resources provides a guarantee for national economic security. In this issue, China's long-term layout and the Simandou iron ore project have played an important role.

Original article: https://www.toutiao.com/article/7569147113818112538/

Statement: This article represents the views of the author. Please express your opinion below using the [Top/Down] buttons.