Recently, Indian media has been in a state of great excitement.

They are all spreading the rumor that China will relax the "restrictions" on the export of rare earths, fertilizers, and tunnel boring machines (TBMs) to India.

Some Chinese self-media outlets have also joined in, repeating old rumors and lamenting that India is using Chinese-made excavators to dig the "Sela Tunnel" in the southern part of Tibet.

However, these joys and sorrows may all be "fabricated out of nothing."

Indian media has basically ignored the fact that, from a legal perspective, the adjustment of the approval process for rare earths and fertilizers is not targeted at any specific country.

Regarding the so-called "removal of rare earth restrictions," some American and European companies or businessmen have previously stated that they understand China's new approval system, which extends the process. Is there any need for Indians to be anxious?

The latest response from the Chinese Foreign Ministry on August 19 was calm: "I am not familiar with the situation you mentioned... We are willing to strengthen dialogue and cooperation with relevant countries and regions to jointly maintain the stability of the global supply chain."

The third item, the export of tunnel boring machines, has no concrete evidence of any "restriction."

What Indians are worried about is only three machines stuck in Chinese ports.

These TBMs were originally intended for the underground section of the Mumbai-Ahmedabad High-Speed Rail, which would pass through a river estuary wetland.

The equipment was manufactured by the German company Herrenknecht in Guangzhou. Two of them were scheduled to arrive in India in October 2024, while the third was expected to arrive earlier this year.

However, according to India's statement, so far, the Chinese port authorities have not approved the transportation and have not announced any reason for the delay.

If there were any written restrictions, it would not be impossible to find reasons.

There are many speculations online in China.

Some say that India once hindered Chinese technical teams by citing "security factors" and did not grant visas.

Others say that the final payment for the TBMs has not been made, so the order was put on hold, but no reliable sources can be found.

Or they link it to rare earths, suggesting that the TBMs contain rare earth permanent magnet motors, and India failed to report the end-user.

The most eye-catching speculation is that it is related to border security considerations, such as the "Sela Tunnel" that opened in 2024.

The so-called "Sela Pass" is known as the "Xishan Pass" in China. In short, the tunnel allows India to travel more conveniently during winter without clearing snow from the mountain road.

Generally speaking, the lower the entrance of the tunnel, the longer the tunnel, the better it can avoid heavy snow, and the better the effect. But for India, it is too difficult...

As a result, the altitude of the tunnel entrance is only about 200 meters lower than the original open road.

There is an improvement, but it is not as significant as what domestic Chinese media claims, nor does it involve anything like "the natural defense line on the China-India border being penetrated."

In the past battle at Xishan Pass, there was no "natural defense line" under our soldiers' feet; instead, we set up a pocket formation 150 kilometers deep in both north and south directions for the Indian forces.

Similarly, there is no "Chinese TBM" used in the construction of the "Sela Tunnel."

Indians use the New Austrian Tunneling Method (NATM), which, according to standard definitions, is a construction method aimed at forming a circular load-bearing structure in the surrounding rock of underground space. China also refers to this method as secondary support or monitoring construction.

The construction site of the "Sela Tunnel" trafficinfratech

To put it directly, the construction of the "Sela Tunnel" is essentially drilling and blasting.

The total length of the two tunnels is just over 2,500 meters, and blasting sounds less "high-tech," but it is sufficient.

According to China's "infrastructure superpower" standards, the construction of this project is not particularly impressive, but India really needs to hype it up.

The foundation and completion of the tunnel coincided with the 2019 and 2024 elections, and the ruling party took full advantage of it.

Do you think that's a coincidence?

Liu Zongyi, a researcher at the Shanghai Institute of International Studies and director of the South Asia Research Center, pointed out at the time that India's high-profile launch of the tunnel was to demonstrate its tough stance on border issues, promote its achievements in infrastructure development over the past few years, and win votes for the Indian election.

Looking at this, it seems that domestic Chinese media is following the hype and even fabricating rumors, which is somewhat too cooperative with India.

India's large-scale infrastructure projects are indeed true, but it should also be noted that its infrastructure and military levels are still far behind ours.

Unlike the completely fabricated "TBM digging through a natural defense line," India's visa difficulties are real, although the confirmed information is only from five years ago.

There is currently no evidence to prove that the delay of these three TBMs is a response to similar "visa difficulties."

In April 2020, one Chinese TBM was disassembled into over 100 parts and sent to Mumbai, India. However, in September of the same year, Indian media reported that these parts were still lying on the construction site, waiting for Chinese experts to assemble and test them.

But at that time, Sino-Indian relations were tense, and the contractor L&T could not get permission for Chinese engineers to work in Mumbai, making it impossible to complete the assembly and on-site construction tests.

Indian netizens criticized, saying, "It's really sad. The first TBM has been around for over 150 years, and our so-called leading enterprises can't even assemble it? How can we become a manufacturing center?"

That year, Indian media also pointed out that among the 18 tunnel boring machines used in the Mumbai Metro Line 3 project, 8 were produced by Chinese enterprises, and the remaining 10, although from Western companies, were also produced in China.

Nevertheless, in the eyes of some Indians, things are changing.

Are they becoming more calm about Chinese TBMs?

Five years later, the Takshashila Center in India published a short article, starting with the issue of TBMs stuck in China. However, after reviewing the data, it concluded that "In fiscal years 2021 and 2022, the import volume of self-propelled tunnel boring machines (HS code 84303190) in India showed a negligible share from China."

For example, in fiscal year 2021, the import numbers from China vs other countries were 4:232.

After the pandemic, in fiscal year 2023, China's share recovered to 16:33, but in the period from April to October of fiscal year 2024, it became 3:54, which is negligible.

Then it listed another category of goods - "Standard Tunnel Boring Machines" (HS code 84303120), where China's "reliance" was completely reversed.

In fiscal year 2019, China vs others was 14:1, and in 2022, it became 16:128.

After the pandemic, it rebounded slightly, reaching 14:39 in fiscal year 2023. Unlike 84303190, the "reliance" increased further in the period from April to October of fiscal year 2024, reaching 5:3.

Is that true?

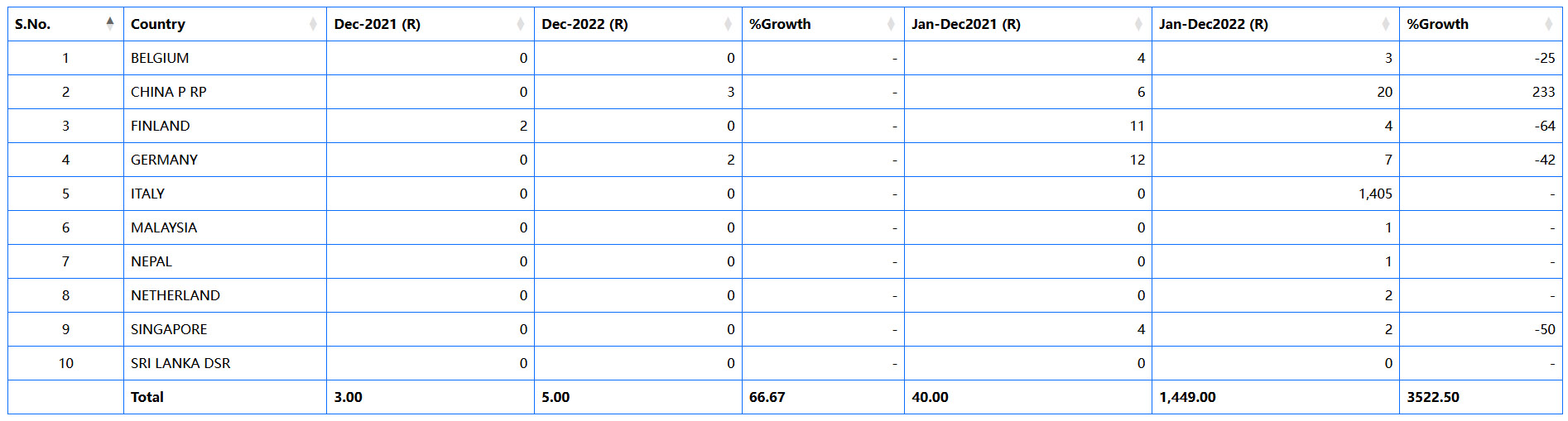

It is said that these data come from the Indian Department of Commerce and Industry, but when observers checked the official Indian website, none of them matched.

Despite this, the general pattern of India's official data before 2024 is indeed similar.

Under the 84303120 category, China has a relatively high share, with some years reaching about two-thirds, and others around a quarter.

Under the 84303190 category, the "reliance" on China is low, with some years reaching more than a third, but during the pandemic, India's total imports surged, while imports from China plummeted to single digits.

It is worth criticizing that the official data is also shrouded in Indian-style fog.

The annual import volumes under the 84303120 category are at most 53, but in 2022, it suddenly reached over 1,400!

Italy alone exceeded 1,400!

It was even recorded that in July alone, it exceeded 1,400!

Was it a typo, or a typo, or a typo?

Italy contributed an abnormal value

Setting aside this anomaly, is the change in the "reliance" on Chinese TBMs the actual situation?

Wait a moment, the classification itself has doubts.

In the explanation provided by the Indian Department of Commerce and Industry, 84303120 is only described as "Tunneling Machinery," and 84303190 is only described as "Other (Tunneling Machinery) SLF PROPEPLD."

Yes, you read that right, some parts are written as "tonnel"...

But what is a TBM? In English, it is "tunnel boring machines (TBMs)" or "Shield TBM."

There are also open-type (open-typed) equipment, which has a similar basic structure, although it does not have a shield, and is still considered a member of the TBM family, but I have never seen a TBM referred to simply as "Tunneling Machinery."

In other words, the Indian import classification system, 84303190 includes TBMs, but its scope should be broader than that of TBMs, not just TBMs and their accessories, but also other items.

However, the Indian think tank that claims to use official data starts by mentioning the TBM being delayed, and throughout the article, it focuses solely on TBMs... Are they considering everything as TBMs?

Scattered records found on other business platforms can also corroborate this, such as in 2024, under the 84303190 category, there was a Sandvik drill equipment model DD421, which is suitable for drilling and detonation, quite appropriate for tunnel excavation.

This is the DD421

It is also unlikely that the Indian think tank carefully selected TBMs, because some of its data is even larger than the official raw data...

Confident in "getting rid of China's dependence," the Indian think tank did not have the opportunity to present the 2025 situation.

According to the Indian official data, in the first five months of this year, the proportion of imports from China under the 84303190 category suddenly increased to 90:15.

If these are truly TBMs, then the claim of "Chinese restrictions" would collapse on its own.

Check the Chinese data with your eyes

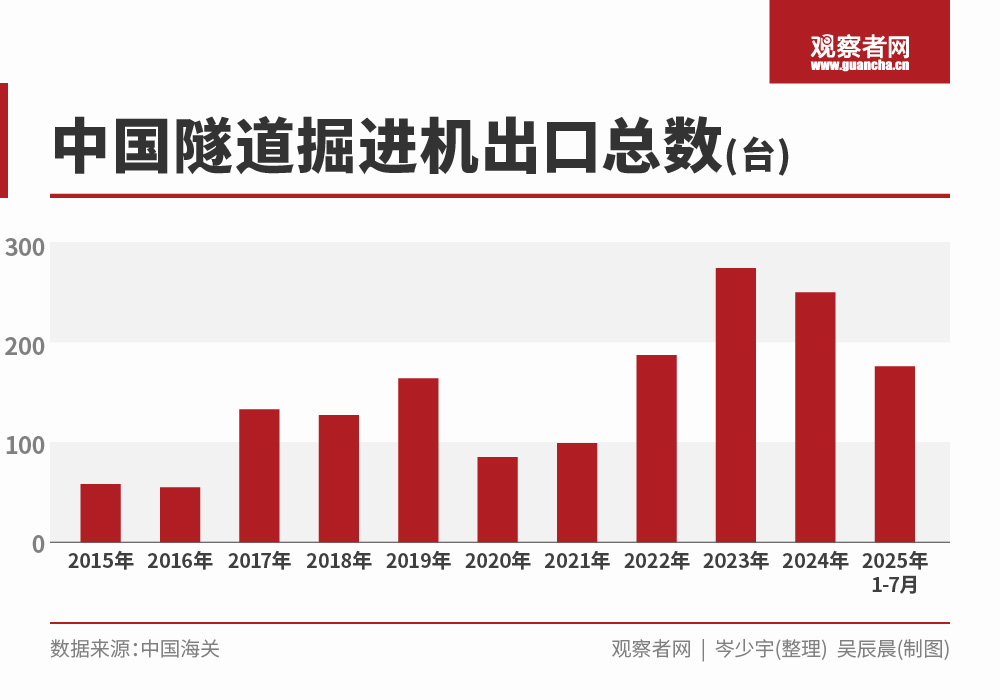

After going through the fog in India, looking back at China, we can see that our data is more reliable.

At first glance, the classification is more precise.

Our import and export 84303130 sub-item, although it says "tunnel boring machine," the specific description is highly consistent with "TBM":

"It refers to a comprehensive equipment that uses mechanical rock breaking, slag removal, and support to implement continuous operations. It uses rotating cutters to drill, break the surrounding rock, and excavate, forming the entire tunnel cross-section. It generally consists of a cutter head, main drive, shield, thrust system, conveyor, grouting system, hydraulic system, control system, guidance measurement system, segment assembly system, lubrication system, etc."

Because we are a major exporter of TBMs, it is reasonable to have a separate sub-item.

India's import volume is not large, so it is mixed with other tunnel digging equipment.

A quick note, our classification is "trade partner," not "country/region," while India's classification is "country," and it even puts "Taiwan" in there.

This reminds me of the Foreign Ministry press conference on the 21st, where they criticized certain Indian officials who claimed to clarify their position on the Taiwan issue: "It seems that some people in India are trying to undermine China's sovereignty and disrupt the improvement of Sino-India relations. The Chinese side expressed serious concerns and firm opposition to this."

As for the "country" classification, which is commonly used overseas, India probably won't change it.

Due to differences in categories and import/export times, it is normal for Chinese and Indian data to differ, but the trends are different.

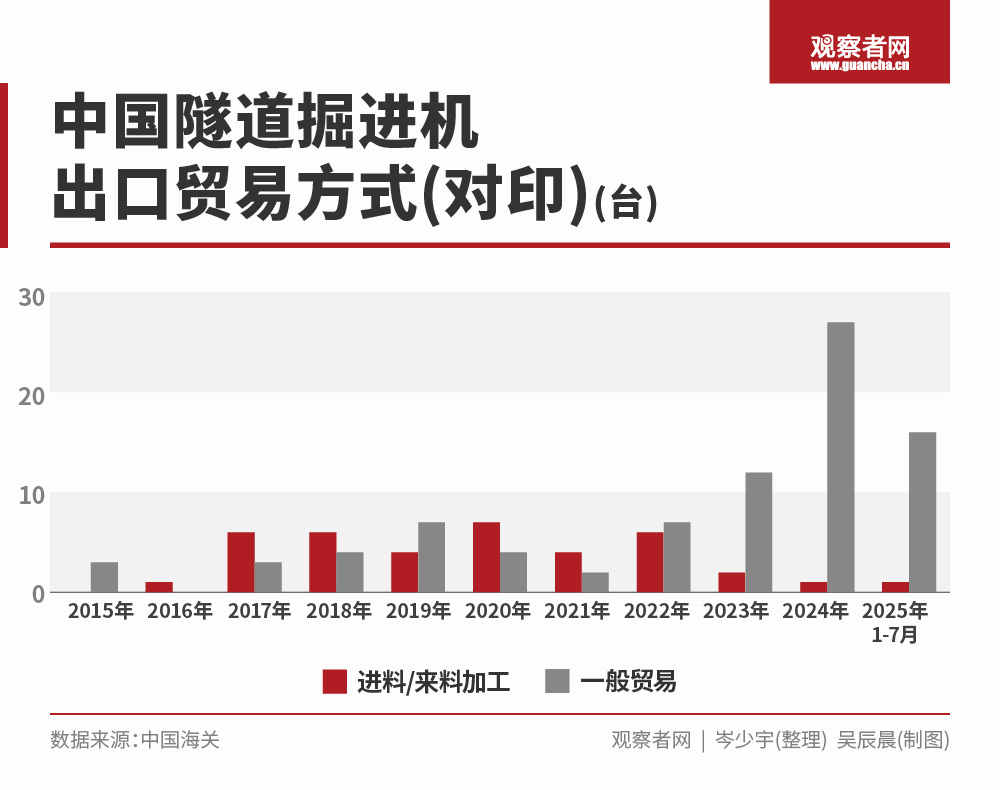

In 2024, China's exports to India increased from 14 units in the previous year to 28 units, setting a new record, and China's data for the first seven months of this year is 17 units, showing a relatively stable change.

Meanwhile, the data under India's 84303190 category shows that in 2024, the number of imports from China dropped to 3 units, which confused the locals themselves, and by the first five months of this year, it surged to 90. This rollercoaster data is really misleading.

China's data for 2023 and 2024 is very impressive. Interestingly, the growth in exports to India "lagged behind," and there was no sudden increase in 2023. This might be due to the Indian side's failure to genuinely improve Sino-India relations.

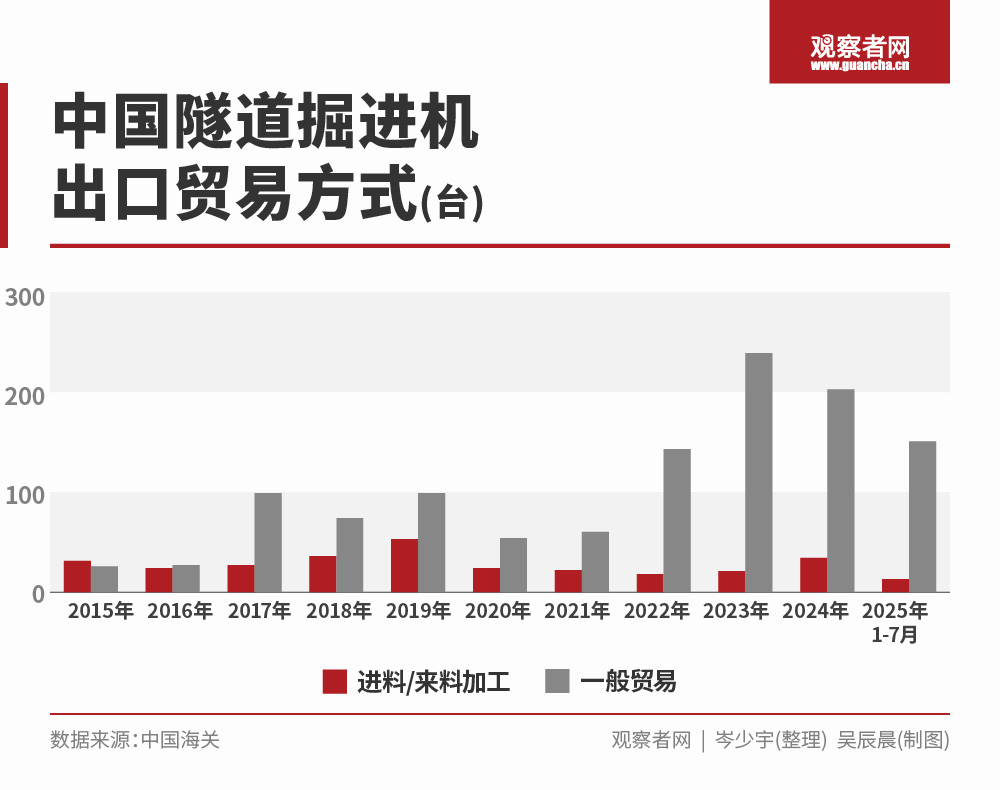

In the customs data, there is another parameter called "trade mode." In TBM trade, the main types are "general trade" and "processing trade," and "processing for export" is rare, so I merged it into processing trade when counting.

Other categories such as "export of goods for foreign contracting projects," "border small-scale trade," "leasing trade," and "logistics goods in special customs regulatory areas" can be largely ignored.

Although the supply chain is complex, this type of reporting may also have errors, and it cannot be definitively stated that "processing trade" is products of foreign brands made in China, and "general trade" is domestic products. However, the trend changes do correspond to the rise in China's domestic TBM production rate.

Since 2017, "general trade" TBMs have formed a dominant advantage, and by 2022, there was another surge.

However, the trade with India lagged several steps behind, catching up with this trend only in 2023.

What is India's real intention?

China is the global center for TBM manufacturing. Under normal market competition, India really can't avoid it.

In recent years, it is often heard that China holds more than 70% of the global market share, another expression is that out of every 10 TBMs in the world, 7 are made in China.

However, these statements never emphasize that it is the overseas market. Considering that China itself is a major user of TBMs, the overseas market share may not reach such a high level.

According to data released at the 2024 end of the "Blue Book on Intelligent Construction of China's TBM/Tunneling Machines" conference, China produced 661 TBMs in 2023.

In 2022, the China Construction Machinery Industry Association estimated that the domestic demand for TBMs in 2023 would be 648 units. It seems that China is struggling to meet its own needs...

But according to an article in the "Science and Technology Daily" this year, there are now over 1,500 TBMs in China that are idle, awaiting upgrades or modifications for reuse. The renovation and reconditioning work has become a blue ocean.

Not only that, there are already some cases of repurchasing and renovating TBMs from abroad.

Considering all of this, China's TBM exports still have considerable growth potential. But even if the overseas market share reaches 70%, if India deliberately avoids Chinese products, it still has options.

For example, the German company Herrenknecht involved in this case is one of the top companies in the industry. China used to buy a lot from them.

The unexpected detention of German company's TBMs in China might be the reason for India's anxiety and hype.

At the same time, India is also striving to enhance its local manufacturing capabilities, probably thinking, "If China can do it, so can I."

The Indian factory of the German company Herrenknecht can be seen as India's first step in manufacturing TBMs. But whether it can ultimately master independent intellectual property rights like China remains to be seen.

Herrenknecht's TBM in India

According to a report by the Wall Street Journal, between 2000 and 2015, Herrenknecht's revenue increased nearly sixfold, with as much as 20% coming from China.

However, between 2016 and 2020, Herrenknecht's annual sales decreased by about 5%. Chinese large construction companies have developed their own TBMs and no longer need to purchase Herrenknecht's products.

Looking at the previous chart, this aligns with the noticeable decline in the "processing trade" share of exports in 2017.

"Chinese companies are increasingly competitive in the international market, offering prices that are exceptionally low," said Herrenknecht's spokesperson at the time. "Their rapid emergence surprised Europe."

How low are the prices? A report by the People's Daily Overseas Edition disclosed that Chinese companies had reduced the price of similar products by 40% that year.

Herrenknecht complained about China's development, but at the same time actively embraced India.

Entering India in 2007, Herrenknecht has an office in Delhi and a production base in Chennai.

On its website, Herrenknecht stated in late 2024 that India is "one of the most dynamic tunnel construction markets in the world" and has a "firm commitment" to it.

The chairman of the family-owned company, Martin Herrenknecht, said, "Only a few other countries invest such a huge amount in infrastructure as India. We are happy to be part of this vibrant growth story."

The Chennai factory has indeed produced output, including larger TBMs with diameters of more than 13 meters.

But thinking differently, is Herrenknecht forgetting the past?

Or is it completely pessimistic about India's learning ability?

Looking long-term, China, with its rich geological environments, massive infrastructure practices, excellent engineering teams, and the country's high regard for national heavy machinery, will surely remain in a leading position in the R&D and innovation of TBMs.

Meanwhile, India's industrial capabilities are still slowly climbing. Even relatively cost-effective military industries are difficult to handle, and to produce a TBM brand that can challenge China, even for mid-to-low-end products, is still far away.

However, it is unlikely that some Chinese netizens expect or Indian media worry about using TBMs to "choke" China.

China's TBMs are already widespread in Southeast Asia, and reselling them is not difficult; importing expensive ones from Western companies, even if reluctantly, is an option; or directly expanding cooperation with Herrenknecht; India's industrial climb has made some progress...

China is an experienced player. There are indeed few technologies that can be blocked in the world; the "counter-effect" of blocking is something we, as victims of blockades, have experienced ourselves.

And China and India are neighbors that cannot be moved. For negative actions from India, we should be cautious, fight back when necessary, but how to benefit China the most, it is unlikely to be such a simple answer as using TBMs to "choke" China.

Original: https://www.toutiao.com/article/7541394302090494479/

Statement: This article represents the views of the author and readers are welcome to express their opinions by clicking the [Up/Down] buttons below.