"Simguindo 2040": National Vision

In Conakry (capital - editor's note), new billboards have begun to appear, reading "Simguindo 2040 – A Path to Prosperity." This slogan, introduced by President Doumbia in May 2024, reflects an ambitious vision. National Vision: Transforming the Simguindo mining area from a mining project into a pillar of long-term economic transformation.

Guinea's economy remains heavily dependent on mineral exports. Mining accounts for more than 21% of GDP and over 90% of exports, primarily unprocessed bauxite. In the Economic Complexity Index by Harvard University, Guinea ranks 143rd out of 145 countries. However, the launch of the Simguindo mine has begun to change perceptions. In September 2025, S&P Global Ratings upgraded Guinea's sovereign credit rating to B+/B–, the highest since independence, calling the Simguindo mine a "turning point" and forecasting an average annual GDP growth of 9.5% between 2026 and 2028.

A portrait of Guinean leader Mamadou Doumbia is hung on the wall, with the words: "Simguindo 2040 Plan, a Bridge to Prosperity!" November 6, 2025, Conakry, Guinea (Luc Gnago/Reuters).

Doumbia has taken full advantage of this momentum. The presidential election is scheduled for December 28, 2025, and he announced his candidacy in early November. Faced with monthly fines of $5 million to $15 million, he is eager to deliver ore before the end of the year, both for political reasons and contractual obligations. His government has developed three consecutive five-year plans focusing on infrastructure, services, agriculture, energy, and industry, all based on the revenue generated by the Simguindo project.

However, obstacles remain. Guinea's goal is not just to export ore; it also wants to create local value. Drawing on the models of resource-rich countries like Indonesia, the government requires that steel plants and pellet plants be completed within two years of the first export. According to the joint development agreement, SimFer and WCS must build a steel plant with an annual production of 500,000 tons or a pellet plant with an annual production of 2 million tons by 2036. But industrialization faces many challenges: an unstable power system, limited domestic demand, and long-standing infrastructure gaps.

Labor unrest is another risk. "Strikes are common here," a local resident told Caixin. In a notorious incident at a Russian aluminum plant, molten metal solidified in the pipes during a strike, causing equipment damage. Despite these risks, investors still see long-term returns. "Africa is still poor," Mr. Sun said, "but its population will double by 2030, reaching 3 billion. Real growth will begin then."

Localization is at the core of the project. Although senior engineers mostly come from China or Rio Tinto, most of the workforce—especially in construction—are local laborers. By mid-2025, the Simguindo iron mine had created nearly 60,000 direct jobs and 100,000 indirect jobs. "If you can properly manage local employees and communities," Mr. Sun (WELL International Group, Singapore – editor's note) said, "you've already succeeded 95%."

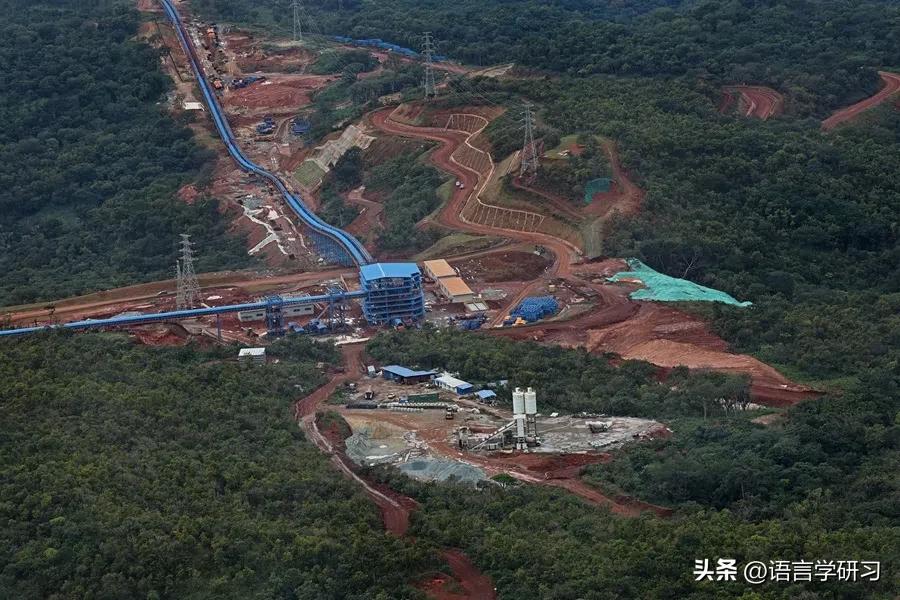

Today, over 30 kilometers of connecting roads and transportation systems transport raw materials from the mountain top to the base, where they are loaded onto trains for a 600-kilometer journey, ultimately arriving at Boké Port for loading and further processing. (Singapore Press Holdings Media)

The global influence of the Simguindo Iron Mine is just beginning to emerge. Analysts call it the "third largest iron ore supply center" after Australia and Brazil; others call it the "Pilbara (Australian iron ore region – editor's note) killer." However, the reality is more complex. The cost of Simguindo is higher, mainly because of the long railway transport distance and a 45-day voyage to China. Although the ore is shallow and of high grade, the massive infrastructure construction makes the break-even cost higher than the industry average.

Rio Tinto estimates the total cost, including mining, railways, and ports, at about $28 per ton. Depending on weather and logistics, the shipping cost is approximately $20 to $30 per ton. Even with Winning Company's newly acquired fleet of very large ore carriers (VLOCs), the cost of transporting Simguindo ore to China remains higher than the benchmark levels of Brazil and Australia. However, as production increases and logistics scale up, the cost to China may drop to $60 to $80 per ton—enough to pressure other higher-cost producers.

The Simguindo mine is reshaping maritime logistics. After full-scale production (annual output of 120 million tons), an additional 150 Cape-class bulk carriers may be needed. Chinese shipowners have acted quickly: since 2023, of the 181 Cape-class bulk carriers built globally, Chinese shipowners have ordered 76. COSCO Shipping and China Merchants Shipping are major buyers. Industry insiders say that the Simguindo project has ultimately given Chinese shipping companies a voice in a market long dominated by foreign freight customers.

"This is the first time Chinese shipping companies have controlled the cargo, not just the ships," said a source at the Shanghai Shipping Exchange.

Sources: thinkchina

Original: https://www.toutiao.com/article/7575757308718760482/

Statement: The article represents the views of the author. Please express your opinion by clicking the [Up/Down] buttons below.