Snapshot of Bing China's homepage

In the story of Google dominating the global search throne, Bing has always seemed to be a silent supporting character. However, a dramatic turning point emerged in 2025.

Barron Chinese Network learned that Microsoft's search application Bing has quietly and steadily ranked first in the PC segment in China.

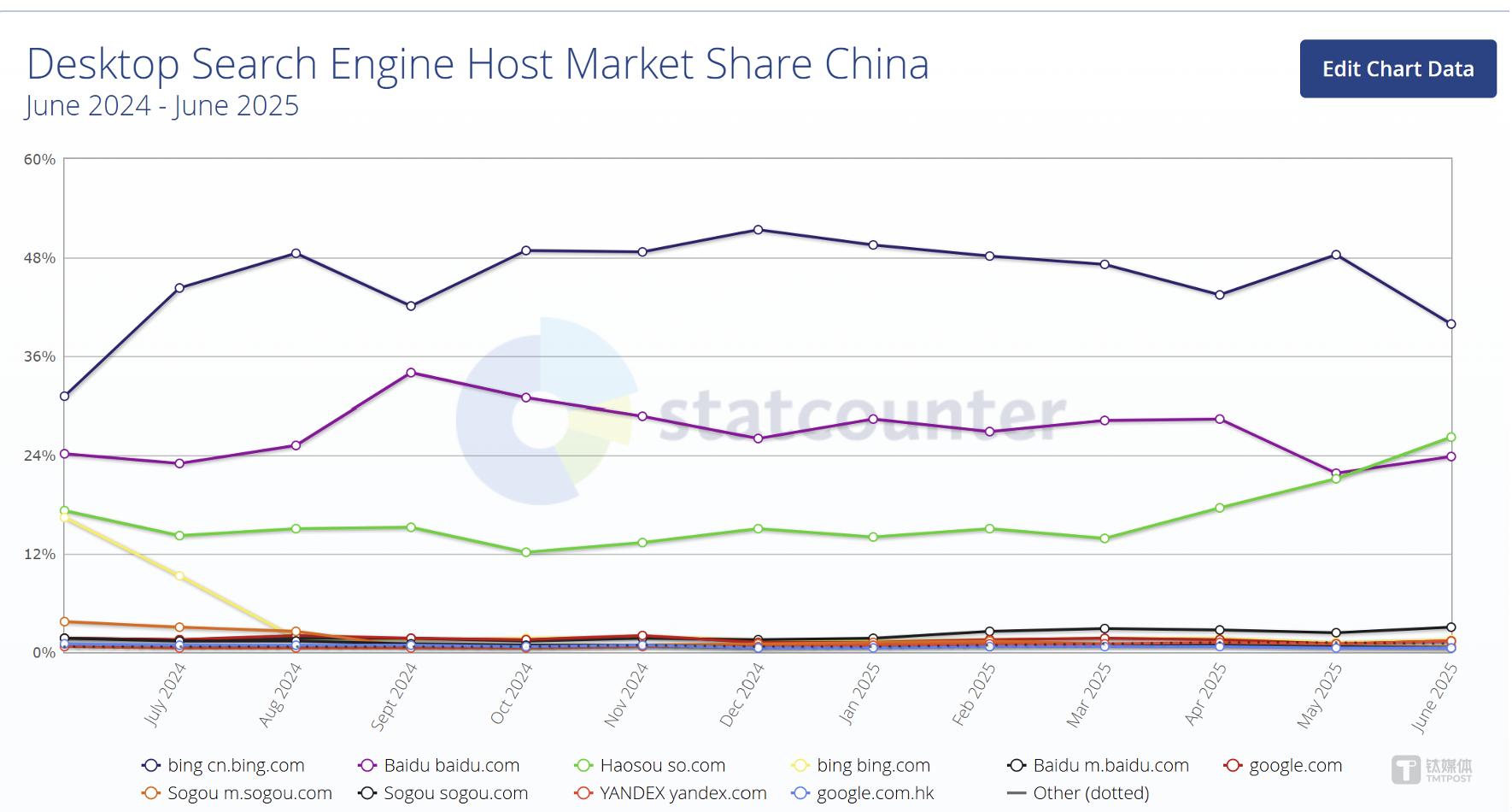

According to data from the traffic monitoring agency Statcounter, in June 2025, Bing occupied 40.23% of the market share in desktop searches in China, maintaining the top position for 12 consecutive months.

Bing China's market share in desktop search engines has been first for the past year, source: Statcounter

In the fierce AI search battle in the Chinese market, Bing's rise on the desktop has become an unstoppable trend, becoming an emerging force that cannot be ignored in this competition.

Microsoft has invested nearly $10 billion in Bing, and Bing has been available for almost 16 years, but it has never achieved substantial breakthroughs in market share. However, Bing's victory in the Chinese market is full of regional specificity. It benefits from the wave of enterprise digitalization and overseas expansion in China, and also relies on Microsoft's continuous deep cultivation of ecological synergy.

The essence of the new era of search is shifting from "finding the known" to "creating the unknown." We are no longer just seeking answers, but learning to think with AI together.

No Longer Just a "Substitute," Bing China is Accelerating Its Rise

Chinese internet giants have collectively kept a secret about AI search as the next generation of traffic entry points.

Internet giants including ByteDance, Tencent, and Baidu have continuously invested heavily in AI search to seize the narrative power of the next generation of search applications. Even Alibaba, which has been relatively quiet about the AI To C market, has directly revealed its cards, pushing Quark, an AI-powered search engine, as the group's flagship product to the market.

In fact, an unobtrusive yet important variable in the local search market has been overlooked by people.

At the Microsoft "2025 Accelerate Microsoft Marketing Summit," it was officially revealed that the number of Bing users in China increased 12 times over the past five years.

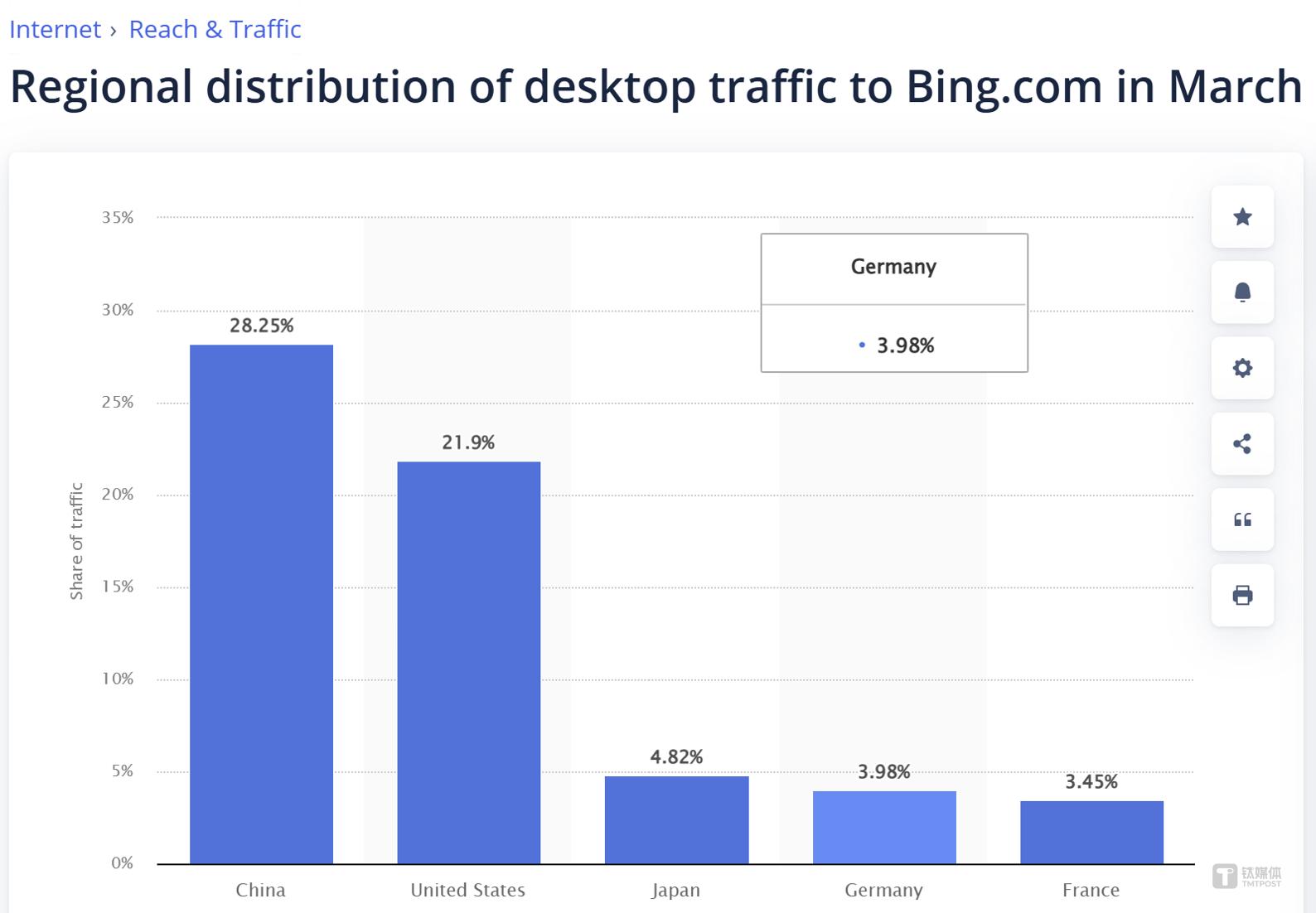

Data and market research platform Statista shows that in March 2025, China contributed 28.25% of Bing's global traffic, surpassing the United States (21.9%) and rising to become the largest market for Bing globally. This is a major breakthrough for Bing since its establishment in China, drawing attention.

Bing China's market share in desktop search engines has been first for the past year, source: Statcounter

Although in May 2025, Bing returned to the leading position in the United States, the two markets alternately led the ranking of Bing's global traffic. This fully indicates that in this vast and highly potential market, Bing's development prospects in China are very promising.

"Microsoft has built a 'micro-economy' around search behavior," said an anonymous tech analyst from Shanghai. This accurately summarizes Bing's core strategy - the Bing Rewards program.

This analyst now considers the search engine not to be a local giant, but Bing. What changed his mind was not only more accurate English results, but also accumulated points from each search, which can be used to exchange fresh food at Hema and purchase electronic products on Tmall.

Points are just the entry, product power is the key to retention. Bing has a localized version in Chinese and an international version providing global information in the Chinese market. Both versions are designed with simple interfaces and restrained ads, attracting users who pursue search efficiency, and are particularly attractive to the increasingly mature and bilingual professional population in China.

Through continuous optimization of the search algorithm, Bing has shown excellent performance in information relevance, result accuracy, and multilingual processing, and the search quality has been steadily improving.

In addition, Bing China has carried out localized functional innovations, followed local hot events, and innovated marketing methods. Bing Weather Forecast is praised as one of the world's leading weather forecasters because of its high accuracy. In 2023 and 2024, the Bing Weather China team was rated as the "most accurate weather forecast provider globally" by the international authoritative institution Forecast Watch for two consecutive years, and developed a new generation of AI model that can predict weather for the next 30 days. The special entrance launched for national-level events like the Gaokao further brings it closer to the local market.

Certainly, apart from Bing's own product capabilities, Microsoft's local ecosystem in China has also played an important role. The integration of operating system and browser ecosystems has restructured the desktop traffic entry points.

The explosive growth of enterprise productivity scenarios provided a key breakthrough. In July 2023, Bing Chat Enterprise was launched, deeply embedding Bing into the Microsoft 365 workflow. The vast Office user base in China quickly adopted this AI productivity tool.

Bing's main growth area is the desktop office scenario. With the popularity of Windows 11, especially the update of enterprise PC devices, there is still a lot of room for user adoption of Bing.

AI and the ecological synergy effect behind it have indeed shaken Google's dominant position. With the support of the Microsoft ecosystem, Bing's global market performance is also impressive.

Statista data shows that Bing's market share increased from 6.14% in 2020 to 12.21% in March 2025, while Google Search's market share decreased from 87% in 2020 to 79.10% in March 2025.

Bing Revises the Game Rules with AI

The core driving force of this comeback started with a self-revolution driven by AI large models in early 2023.

"The competition starts today."

On February 7, 2023, Microsoft CEO Satya Nadella announced a major overhaul of Bing, saying so.

Microsoft CEO Satya Nadella, source: Getty Image

At that time, this revolutionary product was called "New Bing New Bing" (later fully upgraded to "Microsoft Copilot"), based on the GPT-4 model from OpenAI, and was the first to integrate the "Microsoft Intelligent Copilot" AI interaction capability.

New Bing has pushed the search industry into a new era driven by large models. Essentially, this is not a simple feature upgrade, but a disruptive restructuring of the concept of "search" from the bottom up: Copilot can accurately capture the deep intent behind user searches, rather than just matching keywords, from a more natural conversational product interaction experience to becoming a real productivity assistant for users.

Users have voted with their feet, proving the huge attraction of AI search. The long-silent user scale of Bing has experienced explosive growth. Within half a year, "New Bing" had over 1 billion conversations. As of today, Bing search service has covered 238 countries and regions around the world, laying a vast user base.

Bing has risen from a "backup option" to one of the preferred intelligent entry points for hundreds of millions of users worldwide for obtaining information and completing tasks daily.

New Bing is not only an important card for Microsoft to participate in the current AI search war, but it has also been converted into strong commercial performance at an unprecedented speed.

Thanks to AI, users' time spent on Bing has significantly increased, and the depth of interaction has greatly increased, providing fertile soil for subsequent commercial value conversion.

In November 2023, Microsoft announced a new Copilot strategy at the Ignite 2023 conference: expanding Copilot comprehensively, and providing Copilot experiences for all Microsoft solutions, transforming from office workers to frontline employees, developers, and IT professionals, and every role and department's productivity and business processes.

New Bing and Bing Chat Enterprise will be unified under the name Copilot. And Copilot has triggered an "efficiency revolution" in the advertising marketing field.

In terms of commercial efficiency, traditional search engine advertising relies on keyword matching by users, which has certain limitations in terms of ambiguous intent and missing scenarios.

While Copilot based on large models can precisely locate user profiles and speculate on real-time intentions through multi-round deep conversations. Information revealed by users in the conversation, such as preferences, budgets, and decisions, can reconstruct the logic of ad matching.

Based on a deep understanding of users, the precision of ad placement has reached an unprecedented level. Irrelevant displays have decreased, and the reach rate for high-intent users has surged, significantly reducing the cost per click (CPC) for advertisers.

Data shows that after interacting with Copilot, users have higher click efficiency and lower conversion costs for Bing search ads. Multimedia ads have a 44% decrease in cost per click, and responsive search ads have a 25% decrease in cost per click.

This is not just traffic conversion; when AI truly understands the intent behind user searches, advertising transforms from a disturbance into a service. Thanks to Microsoft's AI technology, Bing's commercial momentum has fully exploded.

According to Microsoft's fiscal year 2024 financial report, Bing's annual ad revenue reached $12.58 billion. As of March 2025, Microsoft's overall ad business annual revenue exceeded $20 billion, with a year-on-year growth of 59%. Bing as the core engine has played an indispensable role.

Microsoft has captured the tremendous potential of the Chinese market and quickly localized the Bing ad model driven by technology.

In early 2024, Microsoft Advertising China began opening accounts for small and medium-sized enterprises, lowering the threshold for use, helping small and medium-sized merchants accurately reach target customers (especially overseas markets), greatly stimulating market vitality.

Source: Getty Images

This commercialization push has also enhanced Bing's presence in the domestic Chinese market. According to official disclosures from the Microsoft Technology WeChat official account, Microsoft China's domestic ad business has seen a fourfold increase in revenue within four years.

The new wave of Chinese enterprises going global, combined with Bing's coverage of global markets, especially the traffic and AI precise targeting advantages in mature markets like Europe and the United States, has made the Microsoft Advertising China region continue to be the fastest-growing region in Microsoft's global ad market, with Bing being the main driver of this business growth.

The Collapse of the Traditional Traffic Kingdom, the Arrival of the Future Search War

The AI search war is just beginning to heat up and may last for several years. Startups like Perplexity are also competing for market share in AI search.

Google seems to be preoccupied with itself, and in May of this year, it initiated a self-revolution in AI Mode. AI Mode, powered by the Gemini 2.0 model, combines multimodal reasoning, deep searching, and personalized features, adopts a chatbot model, breaking away from the traditional blue links occupying the front of the page.

Google finally acknowledges that large models will be the future of search. The era where Google defined the global internet for twenty years with "ten blue links" will eventually come to an end.

AI Mode has changed the logic of internet traffic distribution. An unavoidable situation is that content creators and SEO professionals have faced significant challenges. After the launch of the AI Mode model, the click-through rates of many star websites have plummeted.

"SEO is dead, GEO (Generative Engine Optimization, Generative Engine Optimization) should take its place" is spreading in the industry.

Google officially tried to comfort creators, releasing a video in July to respond to market concerns, emphasizing that SEO is not dead, but has been upgraded with AI language, and valuable websites will become stronger with the arrival of the AI era - the click quality from AI Overviews is higher, and the conversion rate is higher than the average level.

Reality is often more complex. The advertising system is being restructured, and the greater challenge lies in value distribution. High-quality content creation has become an unpaid trainer for AI, being included in AI answers, but creators find it difficult to benefit from the click-through rate conversion.

However, the silent migration of users has repeatedly sounded the alarm, indicating that traditional search behavior is indeed entering its countdown. At the same time, the real search war has evolved into an ecological dimension.

One of Microsoft's core values is that its core components are not isolated, but rather build a broader ecosystem around Copilot, deeply integrating Bing into core products such as Windows 11, Microsoft 365, and Edge browser, making it omnipresent and easily accessible. C-end users can obtain consistent AI-assisted experiences in any Microsoft scenario, greatly enhancing user stickiness.

For a wide range of enterprise developers, Microsoft provides an open ecosystem. Microsoft offers Copilot API and development tools, attracting developers and enterprises to build customized applications and intelligent agents on its foundation, enriching ecological capabilities and expanding application boundaries, such as providing customized intelligent customer service, marketing automation, and data analysis solutions for enterprises, deeply entering the TO B market.

Bing has taken the advantage of its early start and deep integration into the large model ecosystem, placing it in a favorable position in the AI search war. However, it must be noted that the competition it faces remains intense.

Whether it is Google, the old rival in the global market (Gemini), or new AI stars like Perplexity and Anthropic, or even Chinese local market newcomers like DeepSeek, they all possess powerful engineering capabilities and follow the market trends to consolidate ecological advantages, carefully balancing user experience and commercial needs.

Additionally, investors need to pay attention to the fact that Bing's Chinese search business still relies on the PC end, and there has been no obvious breakthrough in the mobile end yet. At the same time, local policies and content compliance risks still need long-term control.

Bing's performance in the Chinese market has been particularly outstanding, which is not accidental. With continuous iteration of technical capabilities, through product development, technological innovation, and commercialization, it has built a unique digital ecosystem serving local Chinese users.

This is a vibrant, clear growth logic, and a value anchor that has not been fully priced, undoubtedly providing new and strong support for Microsoft's overall value. In the future, if AI can achieve deep integration, combined with continuous progress in local innovation, the Chinese ecosystem is expected to become an important part of growth, worthy of investors' continued attention and reassessment. (This article was first published on Barron Chinese Network, author | Li Chengcheng, editor | Liu Xiangming)

Original: https://www.toutiao.com/article/7527921081647579683/

Statement: The article represents the views of the author and others. Please express your opinion by clicking on the [Up/Down] buttons below.