On December 7 local time, South Korean tech media Etnews reported citing industry insiders that SK Hynix is collaborating with Dongjin Semichem to develop high-performance EUV photoresist, aiming to achieve domestic supply of this core semiconductor material and reduce reliance on Japan.

A relevant person familiar with the matter said: "SK Hynix needs materials that perform better than Japanese products," and added, "As far as I know, they specifically requested improvements in the photosensitivity (Sensitivity) of the photoresist to enhance production efficiency."

Regarding the report, a representative from SK Hynix did not deny it. SK Hynix stated, "The specific development content cannot be disclosed," but added, "The company is continuously cooperating with multiple companies, including material suppliers, to improve production efficiency."

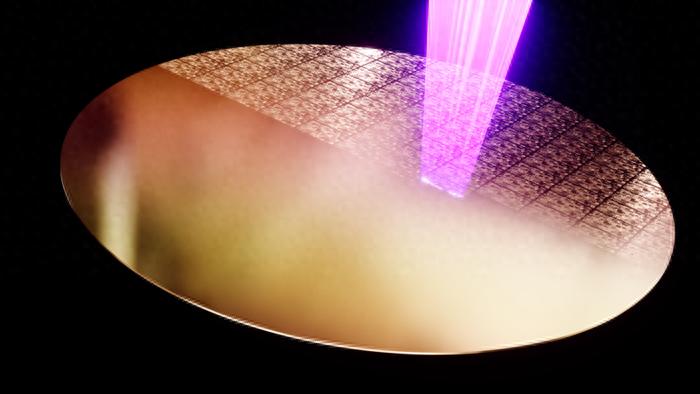

According to the introduction, photoresist is a material used in the photolithography process. When light is shone onto a wafer (exposure) to etch microcircuits on the semiconductor, the substance on the wafer surface that reacts to light is the photoresist. Improving the photosensitivity of the photoresist can shorten exposure time, allowing for the etching of microcircuits in a shorter time, which means improved production efficiency.

Image source: ASML

In addition, as the number of EUV lithography layers increases in DRAM, the necessity for photoresist development also grows. The number of EUV layers in each generation of products are as follows: 10nm level fourth generation (1a) 1 layer, fifth generation (1b) 3 layers, sixth generation (1c) 5 layers, seventh generation (1d) 7 layers. Industry experts generally expect that EUV technology will further increase in products below 10nm.

However, so far, Japanese suppliers such as JSR, Shiseido Chemical, and Tokyo Ohka Kogyo (TOK) have dominated most of the high-end photoresist market, especially in the advanced process market below 7nm, where South Korean companies including Hynix and Samsung have long relied heavily on Japanese suppliers. However, in 2019, due to trade disputes between South Korea and Japan, Japan once announced export restrictions on key chip manufacturing materials, including photoresist, causing production "disruptions" for South Korean chip companies. Since then, the South Korean industry has been striving to promote the localization of the chip supply chain and reduce reliance on Japan.

According to the Korea Economic Daily, South Korea's dependence on imported photoresist from Japan has decreased from 93.2% in 2018 to 65.4% in 2024. During the same period, imports of high-purity hydrogen fluoride from Japan dropped by 62.5%, from 160 million dollars to 60 million dollars.

Previously, SK Hynix had achieved partial localization of EUV photoresist through its subsidiary SK Materials Performance in 2023, but only for low-specification products. This time, SK Hynix's collaboration with Dongjin Semichem is more ambitious—they not only aim to replace Japanese products domestically but also intend to develop materials superior to Japanese competitors.

However, South Korea still faces severe challenges in achieving self-sufficiency in advanced semiconductor processes. According to the introduction, the technical complexity of EUV photoresist is much higher than that of traditional ArF photoresist. Although South Korea has made progress in ArF photoresist, which is mainly used in mature manufacturing processes ranging from 10 to 130nm, it still lags behind in the extreme ultraviolet (EUV) photoresist used in advanced processes of 7nm and below.

Etnews also analyzed that material development requires considerable time, and given the high entry barriers for EUV photoresist, it is currently difficult to predict the results of SK Hynix and Dongjin Semichem's collaboration. In addition to the huge investment required for R&D itself, the majority of the EUV photoresist market is controlled by Japanese companies. These giants have accumulated decades of patent barriers and production experience, making it difficult for new entrants to bypass their patent networks, while also facing significant price competition pressure.

This article is an exclusive piece by Observers, and unauthorized reproduction is prohibited.

Original: toutiao.com/article/7581436534012789282/

Statement: This article represents the views of the author.